What you will learn

By the end, you will know exactly which member state you must register in, which online portals to use, and how to avoid the errors that cause most applications to be rejected. Along the way we cite real numbers- such as the €33 billion declared through the EU’s OSS schemes in 2024 - and show how the system is getting faster and more digital each year.

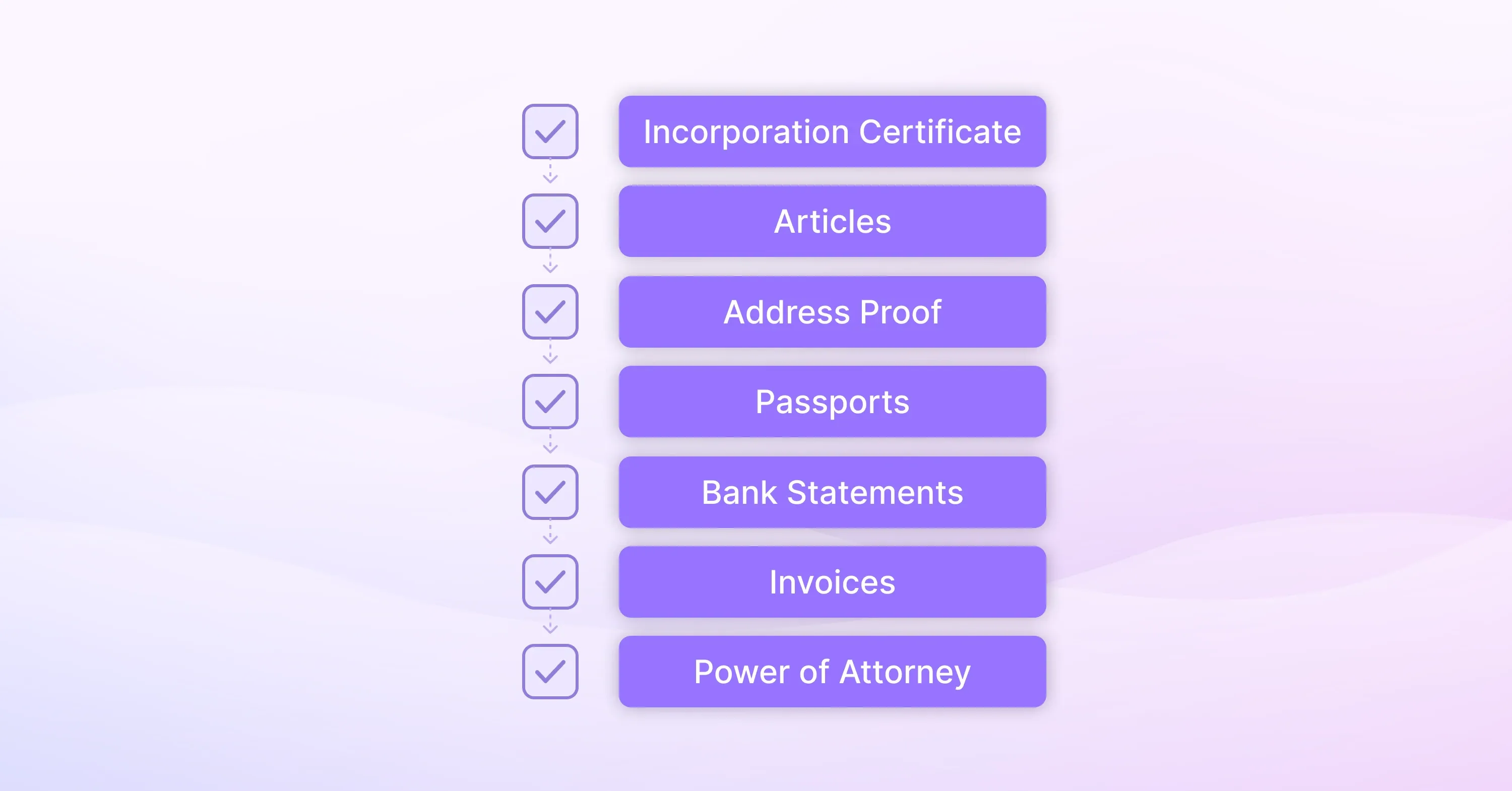

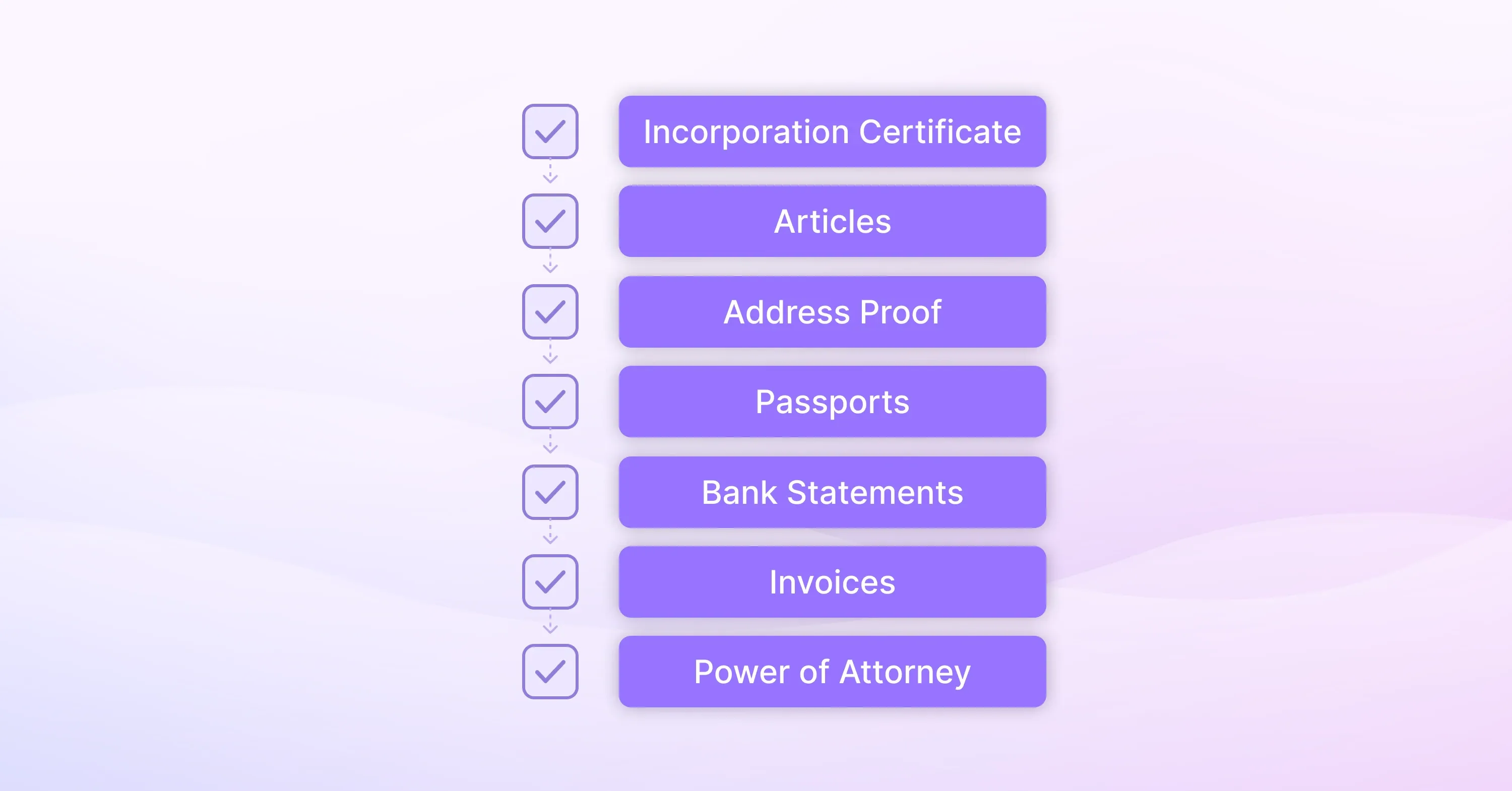

Below is a concise checklist you can bookmark. After that we explore each step in detail and flag the common traps.

EU VAT registration at a glance

EU VAT registration involves seven core actions:

-

Confirm your obligation (thresholds, distance-selling, or non-resident rules).

-

Select your Member State of identification (MSI).

-

Gather legal, banking, and trade documents.

-

Create an account in the national tax portal.

-

Submit the application form and copies of documents.

-

Receive and verify your VAT number.

-

Set up filings, OSS/IOSS where eligible, and keep records for 10 years.

Step 1: Confirm whether you must register

Even before filling out a form, you need absolute clarity on when EU VAT registration is mandatory. The rules vary slightly across member states but share three triggers.

-

Selling goods within a country where you hold stock or have a permanent establishment: immediate registration.

-

Cross-border B2C sales of goods that push the €10,000 EU-wide distance-selling threshold: register either in each destination country or opt for the Union OSS.

-

Providing digital services to EU consumers when you exceed the same €10,000 threshold: register or use the non-Union OSS.

Businesses ignore these limits at their peril. VAT fraud already costs governments tens of billions of euros each year, with compliance pitfalls detailed in the VAT Compliance: How EU Businesses Lost €159M in Penalties article. That pressure fuels stricter audits, so the margin for error is shrinking.

A UK cosmetics brand stored inventory in Poland to speed deliveries. Because stock physically sat in Poland, it had to register for Polish VAT before the first sale, even though projected turnover was only €3.000 per month.

Failing the obligation check is the root cause of many fines. Once you are sure you need a number, you can decide where to file.

The next section bridges from the “if” to the “where”.

Step 2: Choose the right Member State of identification

Your Member State of identification (MSI) determines the portal you use, the language of correspondence, and sometimes the speed of approval. Broadly, you have three scenarios.

-

Established in an EU country: register in your home state for domestic VAT and optionally add Union OSS for cross-border B2C sales.

-

Non-EU seller without EU stock: pick one EU country as your MSI under the non-Union OSS for digital services.

-

Non-EU seller with stock inside the EU: register in each country where goods are stored and, if using warehouses in several countries, consider multiple local numbers plus Union OSS for distance sales.

Why does the choice matter? Because refusal rates differ. Romania, for instance, cut its share of rejected applications from 14.5% in 2016 to just 2.2% in 2019 as highlighted in an EU report on VAT control procedures. Choosing a jurisdiction with clear guidance and user-friendly portals saves weeks. Practical decisions on country and scheme combinations are explored in the Fast-Track VAT Registration: How to Register Quickly and Easily guide.

Conclude the decision by noting each country’s language, required sworn translations, and whether you need a fiscal representative (mandatory in, say, Italy for most non-EU traders). Now you can start the document hunt.

Step 3: Gather the documents the tax office will actually accept

Every member state publishes its own checklist, yet 90 % of the items overlap. Collect them in one sitting to avoid stop-start delays.

-

Certificate of incorporation or trade register extract (issued within the last six months).

-

Articles of association.

-

Proof of business address (utility bill or lease).

-

Passport copies of directors and EU-resident representative if applicable.

-

Bank statement showing IBAN for tax refunds.

-

Sample invoices or contracts proving planned activity.

-

Power of attorney if a tax agent such as 1stopVAT will submit on your behalf.

For an overview of efficient document management and the pitfalls to avoid, browse How to Register for VAT: A Complete Guide.

Use certified translations when the source documents are not in an official EU language of your MSI. Some tax offices accept English, others insist on the local tongue.

Scan every file at 300 dpi, combine multi-page documents into a single PDF, and keep file sizes below 5 MB because many portals reject larger uploads without explanation.

Once the paperwork sits in a single folder, you are ready to set up your online account.

Step 4: Create an account in the national tax portal

Almost every EU country now runs an electronic VAT application system. The layout differs, but the flow is similar.

-

Register a user profile with email and two-factor authentication.

-

Verify identity via electronic ID, mobile app, or one-time code.

-

Select “VAT registration” or the equivalent menu item.

-

Enter company data, ownership, contact details, and expected turnover.

-

Upload the prepared PDFs.

Real-world example: Germany’s ELSTER portal lets non-resident traders apply fully online, yet a paper signature page still must be mailed within 14 days. Missing that step resets the application clock.

By contrast, Estonia’s e-MTA portal accepts qualified e-signatures so the whole process, including activation, can finish in one afternoon.

For businesses looking to prioritize speed, Expedited VAT Registration: Checklist for Fast EU Entry provides actionable tips to skirt common delays.

Conclude this step by double-checking every field. Typos in your business name or wrong NACE code can hold back the file for weeks. Hit submit and note the reference number. The waiting game starts.

Step 5: Track your application and answer follow-up questions

Tax officials often ask for clarifications within 3–10 working days. Respond quickly with concise answers.

-

Always quote the reference number and upload documents in the portal, then send a brief email confirmation.

-

If you need extra time, request it formally; silence can kill the application.

-

Keep a simple log: date, question, response, status.

Speed matters. The EU saw 170 000+ businesses registered under the three OSS portals by end-2024 as shown in commission data on the e-commerce package. With that volume, files that sit dormant often slide to the bottom of the pile.

Once the official stamps your application, the portal will generate your VAT number.

Step 6: Receive, verify, and activate your VAT number

A VAT number is not valid until it appears in the VIES public register. Follow this short post-approval to-do list.

-

Check VIES and save a PDF showing “Valid” status; marketplaces may ask for it.

-

Update invoice templates, e-commerce backend, and EORI records with the number.

-

If you opted for Union OSS or IOSS, activate the scheme inside the same portal - note that over €24 billion flowed through the Union OSS in 2024 alone as the latest statistics confirm.

If you want a strategic overview of the OSS/IOSS process, One-Stop Shop Schemes – Brief Overview breaks down the schemes’ timelines and differences.

Congratulations, you are now officially in the EU VAT system. Compliance starts immediately, so the story is not over.

Step 7: Set up ongoing compliance and avoid common mistakes

VAT registration without follow-up filings is a ticking time bomb. Build your process while the registration email is still fresh.

-

Calendar your filing deadlines: monthly, quarterly, or OSS monthly returns.

-

Reconcile sales, returns, and import VAT in real time rather than once a quarter.

-

Archive digital invoices for at least 10 years; new rules will make cross-border electronic invoicing compulsory by 2030 with full interoperability by 2035 as laid out in the EU Council timeline.

-

Monitor sales thresholds per country if you still operate multiple local numbers.

-

Consider an external specialist. A firm such as 1stopVAT, staffed by 40+ certified tax professionals, acts as a single contact point across more than 100 jurisdictions and keeps you informed when rules shift. For ongoing reporting and compliance, VAT Reporting Made Simple: Best Practices for Businesses offers step-by-step guidance to avoid late filings and errors.

Avoid the classic errors:

-

Relying on marketplace platforms to remit VAT but forgetting that storage still triggers local obligations.

-

Mixing business and personal expenses on the same invoice, which risks deduction refusals.

-

Filing OSS returns without reconciling them against local import VAT paid at the border, causing double taxation.

For a complete list of multi-country pitfalls and how agencies resolve them, see Top EU VAT Registration Agencies: 2025 Guide.

By building a workflow now, you avoid penalties when audits tighten. Union OSS registrations alone jumped 16% in 2024 - an extra 20 941 traders means more data for tax offices to cross-match.

Conclusion

Registering for VAT in the EU is less a paperwork chore and more a seven-step journey that starts with knowing your obligation and ends with disciplined monthly compliance. The system is becoming smoother - total VAT declared through the OSS schemes rose by 26 % in 2024 to €33.1 billion - but that growth also means greater scrutiny. Follow the sequence in this guide, keep accurate records, and you will trade across the EU with confidence instead of fear of the taxman.