Overview

We begin by demystifying the term “VAT ID” and showing how it ties to Value Added Tax in more than 160 jurisdictions. From there, we break down common formats, explain the legal importance of correct numbers, then walk step by step through online verification tools such as the EU’s multilingual VIES service and the UK database. You will see real examples, quick bullet checklists, and practical tips on what to do if a number fails validation.

By the end, you will have a reliable routine to screen every supplier or customer before the invoice is posted.

VAT ID meaning: more than just an invoice label

Every business that surpasses the local registration threshold for Value Added Tax receives a unique identification code. Known interchangeably as a VAT number, VAT ID, or VAT registration number, it serves three purposes:

-

Tracks the collection of tax on each sale and purchase.

-

Signals to customers and tax authorities that the business is authorised to charge VAT.

-

Enables zero-rating of intra-community supplies within the EU and the swift recovery of input tax.

Without a valid code, an invoice is “non-compliant”, which means the buyer cannot deduct the VAT and the seller risks fines. One manufacturing exporter in Germany lost €40,000 in input tax after a routine audit because it had printed an unregistered supplier’s number on forty invoices. A five-second online check could have prevented the loss.

So, the VAT ID is not an optional formality; it is the linchpin that connects transactions to national revenue systems.

Anatomy of VAT numbers: country codes and check digits

Different countries design their numbers differently, yet most share a pattern: a two-letter ISO country prefix followed by 8 to 12 alphanumeric characters. Understanding those patterns speeds up error spotting.

-

EU Member States: Prefix with the ISO code, for example FR999999999, ESX9999999X.

-

United Kingdom (post-Brexit): No prefix used domestically, but “GB” appears in cross-border trade. All UK VAT numbers contain exactly nine digits as confirmed by HMRC’s internal manual.

-

Norway: 9 digits plus “MVA” suffix, e.g., 123456789MVA.

-

Australia: Australian Business Number, 11 digits where the first two are checksum digits.

Most jurisdictions build a check digit algorithm into the last or first digits. If you type an incorrect digit during data entry, free validation tools will instantly detect the mismatch.

The variety of formats can feel tedious, yet a quick visual preview often catches errors before they propagate. For instance, if a supplier in Poland sends “PL1234567”, you immediately know something is off because Polish IDs are 10 digits long.

At this point, you can already spot obvious typos, yet you still need confirmation from an official database. That brings us to verification.

Why verifying VAT numbers matters

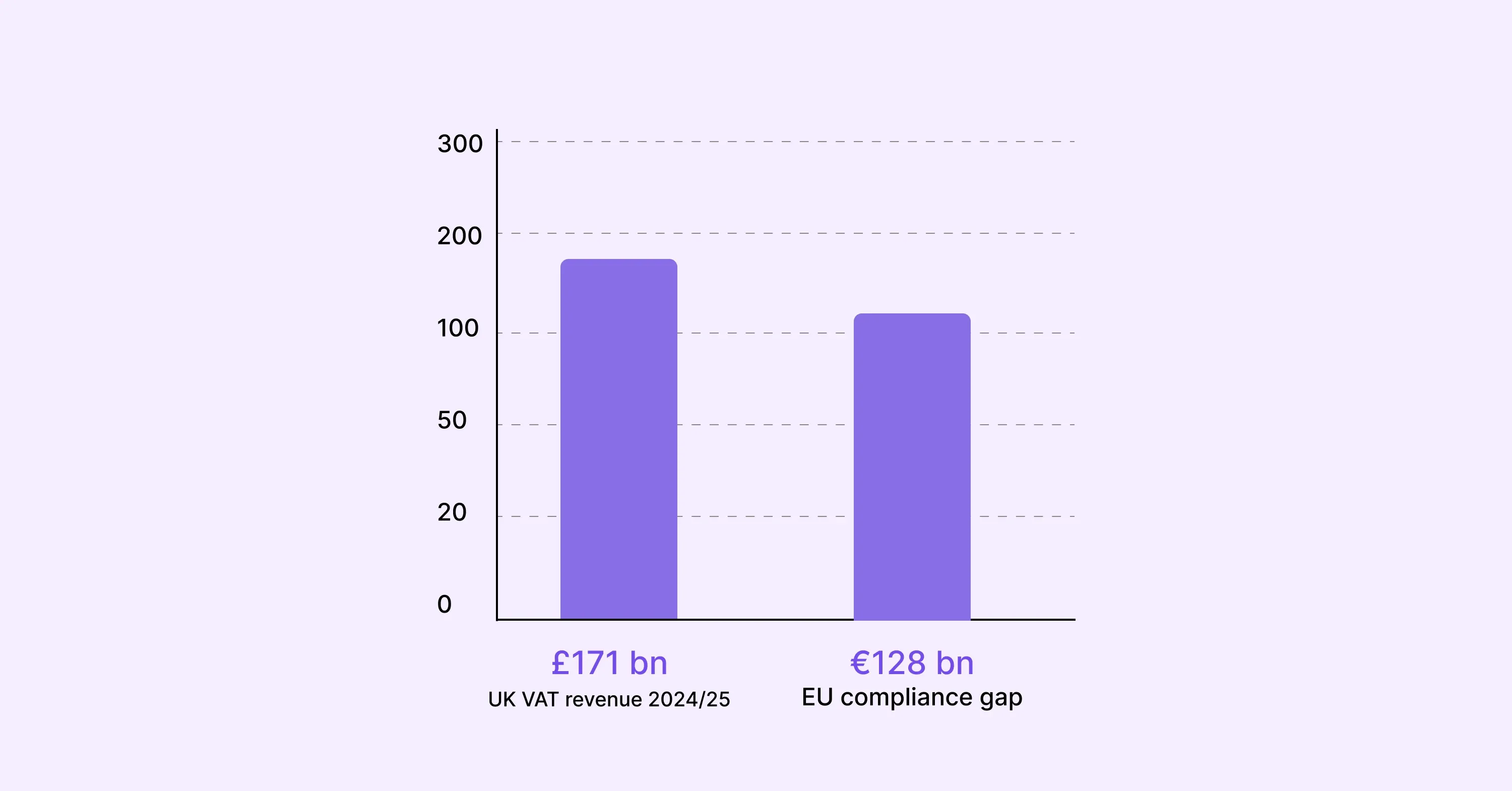

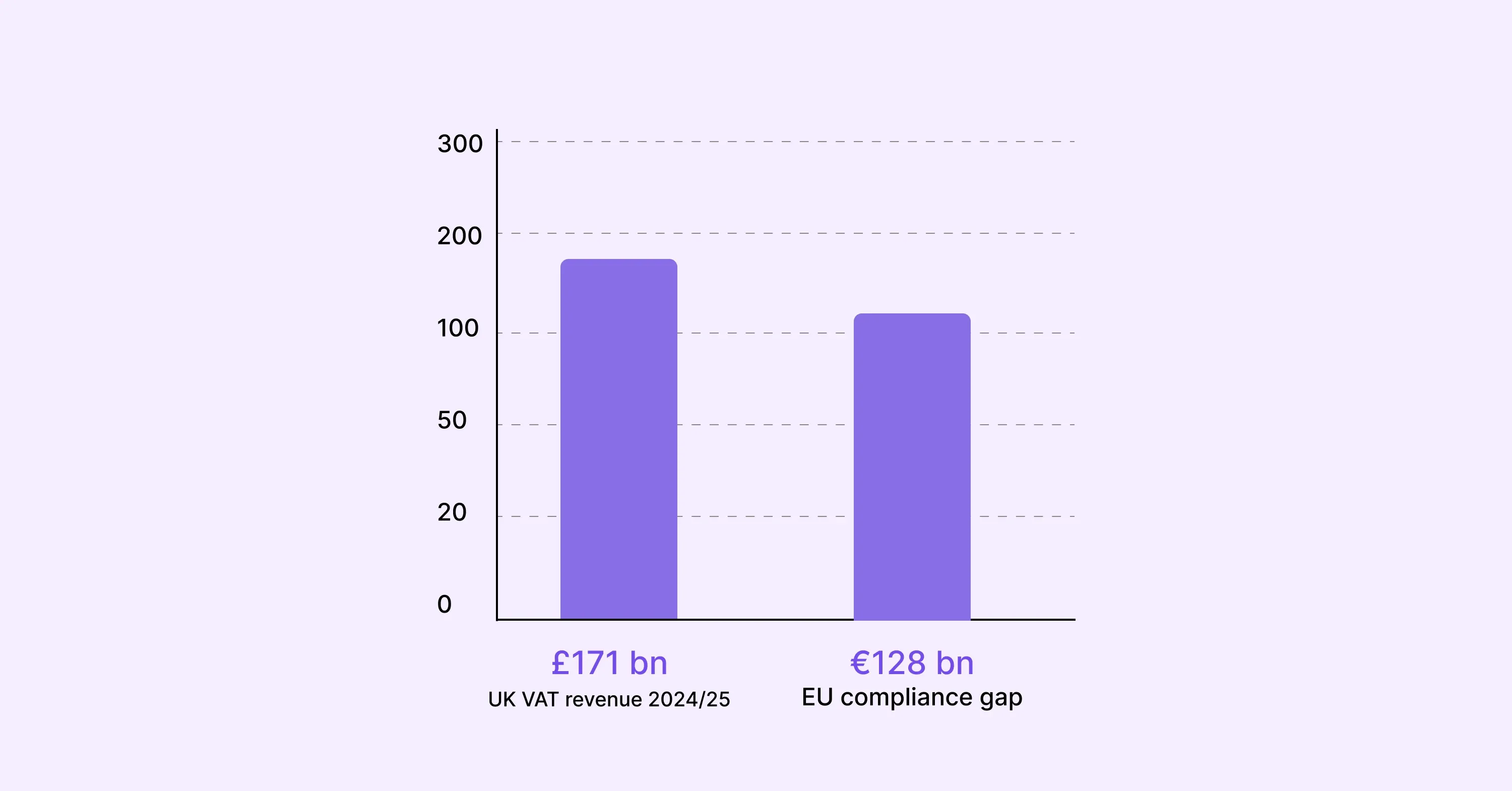

Mistakes cost money. In the UK alone, businesses remitted £171.0 billion in VAT during 2024/25, and 2.33 million entities were registered. Auditors focus on whether each invoice number on record belongs to a live taxpayer. If you claim input tax on an invalid number, you shoulder the liability.

The stakes go beyond refunds:

-

Charge the wrong VAT rate and you may owe arrears plus interest.

-

Ship goods cross-border under the wrong VAT ID and customs may detain the cargo.

-

Repeat errors can bring reputational damage with suppliers and clients.

Europe’s challenge is even larger. VAT represents 7.2 % of EU GDP and 15.7 % of government revenue, yet an estimated €128 billion compliance gap persists. Tax authorities are tightening electronic reporting and increasing penalties, making real-time verification a front-line defense for businesses.

If you're looking for a detailed breakdown of intra-EU compliance rules and how cross-border VAT issues affect your business, see How does Intra-Community VAT work in the EU? A simple guide.

So, verifying each number is not red tape; it is risk management that safeguards margins and credibility.

How to check VAT number online

You have three main routes: the EU’s VIES portal, national databases, and specialist compliance providers that integrate multiple registries.

Using the EU VIES service

The VAT Information Exchange System (VIES) connects the national databases of all 27 EU Member States and Northern Ireland. The interface is available in all 23 official EU languages, making it accessible for multilingual finance teams.

To verify a number:

-

Navigate to the VIES webpage.

-

Select the Member State from the dropdown.

-

Enter the VAT number without spaces or dashes.

-

Click “Verify”.

-

Save or print the confirmation page for your audit file.

If the result reads “No, invalid VAT number”, double-check the format and repeat. Some Member States update their local databases only once a day. A second attempt after 24 hours sometimes turns an “invalid” result into “valid”.

For a clear, action-driven walkthrough, see How to Perform an EU VAT ID Check (VIES Guide).

Real-world example

A Dutch wholesaler receives an order from a new Romanian retailer. Before shipping, the wholesaler runs the retailer’s number through VIES. The system reports “valid”, so the wholesaler zero-rates the invoice and ships same day, confident the intra-community supply meets EU rules.

National databases outside the EU

VIES covers only EU registrations. For other jurisdictions, you must use local portals.

-

United Kingdom: HMRC’s “Check a UK VAT number” tool. Enter any 9-digit code or GB-prefixed number. It returns status, business name, and registration address.

-

Norway: The Brønnøysund Register Centre (Brreg) allows lookups of nine-digit Org.nr followed by “MVA”.

-

Australia: The Australian Business Register provides real-time ABN and GST status.

When a database allows name matching, always compare the returned legal name with the supplier’s invoice. Discrepancies can signal fraud, such as the classic “clone firm” scam that uses a real VAT number with a fake trading name.

For Brexit-specific VAT compliance shifts, see End of Brexit Transition: 6 Main Changes for International Sellers.

Integrated compliance platforms

Large sellers trading across dozens of countries often automate checks through API connections to VIES, HMRC, and similar registries. Providers such as 1stopVAT wrap these lookups with human review and ongoing monitoring, flagging numbers that become invalid later in the year. For businesses processing hundreds of invoices a day, that blend of automation and specialist oversight reduces manual workload without sacrificing accuracy.

For practical solutions and how automation simplifies compliance, check out Tax Technology Tools – VAT Compliance Automation.

At the end of the day, whether you click manually or rely on an API, the responsibility to prove that you validated the number stays with the taxpayer. Always capture a time-stamped record.

What if a VAT number fails verification?

An “invalid” result does not always mean fraud. Follow a short troubleshooting ladder before rejecting the transaction:

-

Check for obvious typos: swapped digits, stray spaces, or missing country prefix.

-

Confirm the supplier’s legal name and address via a public registry.

-

Email or call the supplier asking for a copy of their VAT certificate.

-

Repeat the online check 24 hours later in case of database lag.

-

If still invalid and the supplier is EU based, request a corrected invoice before payment; if outside the EU, consult a local adviser.

If the supplier insists the number is correct yet it still fails, you must decide whether to withhold the transaction or charge VAT as if selling to an unregistered entity. Document every step, because auditors will ask.

If your business faces complex issues or recurring errors, consider consulting VAT Compliance & Consultancy: Why Expert Advice Matters for guidance on working with professionals.

What Is a VAT Number and Why It Matters

A VAT number, or VAT ID, is the unique registration code that tax authorities assign to a business authorised to charge and reclaim Value Added Tax. It usually starts with a country prefix followed by 8–12 digits or letters, and every cross-border invoice must show a valid number that can be confirmed through official databases such as the EU’s VIES or national lookup tools.

Conclusion

A valid VAT number is the passport that lets goods and services travel across borders without friction. Learning each country’s format, taking two minutes to run online checks, and keeping evidence on file can prevent costly disputes and audits. Tools like VIES for EU numbers, HMRC’s lookup for UK codes, and integrated services from firms such as 1stopVAT make the task straightforward. For further step-by-step instructions, you can see How to Verify a VAT Number: A Simple Guide. With a disciplined verification routine, you can invoice confidently, recover the VAT you are owed, and keep regulators satisfied.