Extended Producer Responsibility

EPR services

At 1stopVAT, we understand the growing need for businesses to take responsibility for the environmental impact of their products. Our Extended Producer Responsibility (EPR) service is designed to ease your journey towards compliance with international environmental standards.

What is Extended Producer Responsibility (EPR)?

EPR is a policy approach under which producers are given a significant responsibility – financial and physical – for the treatment or disposal of post-consumer products. Assigning such responsibility could in principle provide incentives to prevent waste at the source, promote product design for the environment, and support the achievement of public recycling and materials management goals.

Who is affected by EPR?

EPR requirements have been in place since 2012. Generally, all companies are expected to adhere to EPR, but it’s only in recent times that Germany, France and Spain have taken steps to ensure that online platforms and other e-commerce sellers fulfill their eco-contribution obligations. If you want to sell products in France, Germany and Spain through marketplaces, it’s crucial to ensure that you comply with the EPR regulations in each of these countries. Marketplaces must be able to prove that everyone who sells to the mentioned countries have been issued with EPR number. Therefore, request proof of compliance with EPR regulations before allowing sellers to list and sell products on their platforms.

EPR regulations are designed to make producers, importers, and retailers responsible for the entire life cycle of their products, including their end-of-life disposal.

Consumers also play a part, as EPR can influence their choices and how they dispose of products. At 1stopVAT we help all these groups understand and follow EPR laws. Working with us means turning the challenge of EPR into an advantage for your business.

EXTENDED PRODUCER RESPONSIBILITY

How it works?

- Consultation – begin with a detailed assessment of your products and the EPR obligations they require.

- Registration & Number Allocation – we will manage your registration process, ensuring you receive your unique EPR number.

- Annual Declarations – our experts will handle the complexities of declaration submissions, tailored to each waste category relevant to your products.

- Continuous Optimization – stay ahead of the curve with our proactive approach to EPR compliance, ensuring you’re always aligned with the latest regulations.

Book a FREE consultation about EPR service!

Other services

See what other services we provide to help you be VAT compliant

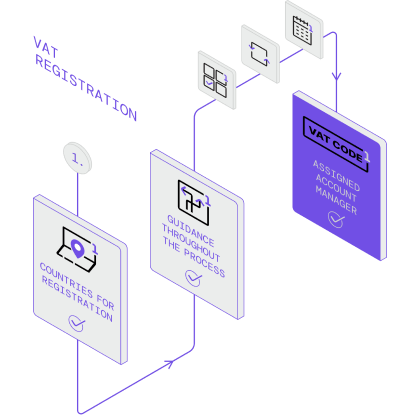

VAT Registration

What it is?

When a business reaches a certain threshold of taxable turnover, as defined by the tax authority in each country, it becomes mandatory for that business to register for VAT. The threshold varies from country to country and is subject to change, so it’s essential to check the specific regulations applicable in jurisdictions that business operates in.

How we can help you?

We specialize in global VAT, sales tax, and GST registration services, ensuring compliance in any jurisdiction. Navigating the complexities of VAT registration can be challenging, especially when dealing with different rules and procedures across different countries. So we’re here for you.

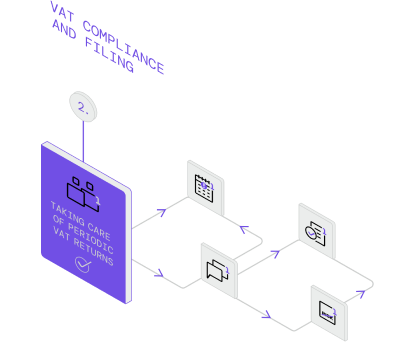

VAT Compliance and Filing

What it is?

Stay tax compliant across all your markets. It is becoming common practise to check if your partners are a VAT registered company and if you are reliable to start business with.

Beyond your registrations, you also need to navigate the local reporting requirements and systems to stay compliant. And this matters, since your business can be suspended if your filing is due or not VAT registered at all.

International businesses that surpass the VAT threshold in a specific country must register for VAT in that country and apply certain rate of VAT to the prices of their goods and services. This threshold is comprised of the total value of all taxable sales made throughout the tax year, however sales that are exempt from tax don’t count towards it.

How we can help you?

There are plenty of VAT registration check sites, however we take care of all checks and compliance. We are flexible and offer VAT and sales tax reporting based either on the data you submit to us in the form of files, or by using our own integrated solutions to automate the process.

We guarantee compliance in every market you hire us for.

Backing you up is a team of VAT/GST compliance experts that make sure you stay compliant as you lead your business into new markets. We do all the necessary tax paperwork, file the returns, register for VAT, check vat registration (if any) and distribute payments accordingly.

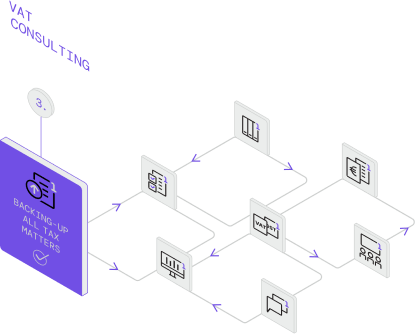

VAT Consulting

What it is?

VAT and GST are charged on most transactions all over the world. Depending on the region and the state, different tax rules & regulations are enforced, but as these legislations are subject to perpetual changes, staying VAT compliant has become increasingly challenging and time-consuming. Failing to do so often leads to penalties and other serious issues that significantly hinder the growth of companies.

Ensuring that your business complies with VAT regulations is vital because it can be quite complicated and challenging to meet all the necessary VAT requirements.

How we can help you?

Discover the best strategies for managing your VAT/GST set-up by consulting with our team of experts. Tax laws can be complex and ever-evolving, making it crucial to seek professional advice when entering new markets, modifying your current tax structure, or improving your operational procedures.

We provide complimentary consultation on VAT registration. Our experienced consultants will guide you through the process, ensuring you understand your obligations and providing insights on optimizing your VAT/GST practices.