Carbon Border Adjustment Mechanism

CBAM services

In a world actively combating climate change, the European Union’s Carbon Border Adjustment Mechanism (CBAM) represents a crucial change in environmental policy. As we step towards a greener future, your business needs a trusted partner to adapt and excel in this evolving landscape. Our specialized CBAM services are designed to help you navigate these changes with confidence and efficiency.

Who needs CBAM services?

CBAM impacts all importers of specific commodities from third countries into the EU. These include sectors like iron and steel, aluminum, cement, electrical energy, hydrogen, fertilizers, and various downstream products. If your business operates within these fields, staying ahead of CBAM regulations is crucial for uninterrupted trade and profitability.

Timeline and implementation

The CBAM will roll out in phases, starting with a transitional period from 1 October 2023 to 31 December 2025. This initial phase is a learning curve for businesses, focusing on data reporting without financial adjustments. However, non-compliance, such as failing to submit quarterly reports, can lead to penalties. The definitive phase begins on 1 January 2026, progressively increasing the coverage of embedded emissions and phasing out free allocations under the EU Emissions Trading System (EU ETS). By 2034, 100% of embedded emissions will be subject to CBAM certificates.

CARBON BORDER ADJUSTMENT MECHANISM

Our services

- Customized reporting solutions – we provide reporting assistance to ensure accurate and timely data submission, safeguarding you from potential penalties.

- Strategic advisory – our experts offer insightful consultations to help your business adapt its operations and strategies in line with CBAM requirements.

- Financial impact analysis – we assess the financial implications of CBAM on your business, helping you plan and budget effectively for the future.

- Compliance assurance – stay compliant with our continuous monitoring and updates on developing CBAM regulations and requirements.

Why choose us?

Connecting with us brings a committed advocate to your side for CBAM compliance. Our expertise in environmental policy and EU regulations, combined with a deep understanding of the impacted sectors, positions us uniquely to offer incomparable guidance and support.

Book a FREE consultation about CBAM service!

Embrace change, secure success – your

CBAM strategy starts here.

Other services

See what other services we provide to help you be VAT compliant

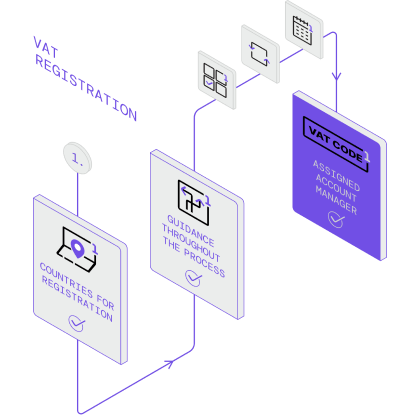

VAT Registration

What it is?

When a business reaches a certain threshold of taxable turnover, as defined by the tax authority in each country, it becomes mandatory for that business to register for VAT. The threshold varies from country to country and is subject to change, so it’s essential to check the specific regulations applicable in jurisdictions that business operates in.

How we can help you?

We specialize in global VAT, sales tax, and GST registration services, ensuring compliance in any jurisdiction. Navigating the complexities of VAT registration can be challenging, especially when dealing with different rules and procedures across different countries. So we’re here for you.

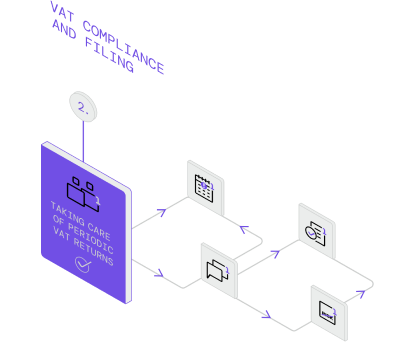

VAT Compliance and Filing

What it is?

Stay tax compliant across all your markets. It is becoming common practise to check if your partners are a VAT registered company and if you are reliable to start business with.

Beyond your registrations, you also need to navigate the local reporting requirements and systems to stay compliant. And this matters, since your business can be suspended if your filing is due or not VAT registered at all.

International businesses that surpass the VAT threshold in a specific country must register for VAT in that country and apply certain rate of VAT to the prices of their goods and services. This threshold is comprised of the total value of all taxable sales made throughout the tax year, however sales that are exempt from tax don’t count towards it.

How we can help you?

There are plenty of VAT registration check sites, however we take care of all checks and compliance. We are flexible and offer VAT and sales tax reporting based either on the data you submit to us in the form of files, or by using our own integrated solutions to automate the process.

We guarantee compliance in every market you hire us for.

Backing you up is a team of VAT/GST compliance experts that make sure you stay compliant as you lead your business into new markets. We do all the necessary tax paperwork, file the returns, register for VAT, check vat registration (if any) and distribute payments accordingly.

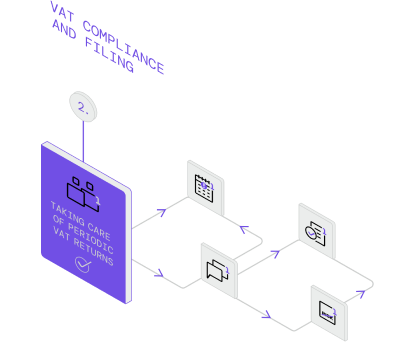

VAT Consulting

What it is?

Stay tax compliant across all your markets. It is becoming common practise to check if your partners are a VAT registered company and if you are reliable to start business with.

Beyond your registrations, you also need to navigate the local reporting requirements and systems to stay compliant. And this matters, since your business can be suspended if your filing is due or not VAT registered at all.

International businesses that surpass the VAT threshold in a specific country must register for VAT in that country and apply certain rate of VAT to the prices of their goods and services. This threshold is comprised of the total value of all taxable sales made throughout the tax year, however sales that are exempt from tax don’t count towards it.

How we can help you?

There are plenty of VAT registration check sites, however we take care of all checks and compliance. We are flexible and offer VAT and sales tax reporting based either on the data you submit to us in the form of files, or by using our own integrated solutions to automate the process.

We guarantee compliance in every market you hire us for.

Backing you up is a team of VAT/GST compliance experts that make sure you stay compliant as you lead your business into new markets. We do all the necessary tax paperwork, file the returns, register for VAT, check vat registration (if any) and distribute payments accordingly.