What you will learn

In the next few minutes you will:

- Meet seven reputable providers that specialize in EU VAT registration and ongoing compliance.

- Compare country coverage, service bundles, and price points.

- Follow a practical five-step timeline that shows exactly how businesses register, from data collection to the first VAT return.

- Find quick answers to common questions such as “Do I need a fiscal representative?” and “How long does the process take?”

By the end, you will know which agency model fits your growth plans and budget.

7 best agencies for EU VAT registration

Choosing an agency is easier when you see their strengths side by side. The firms below focus on EU VAT rather than general accounting, which means you get niche expertise and local language support if the tax office calls.

1. 1stopVAT

Acting as a single point of contact, 1stopVAT combines automated tools with a 40-plus team of certified specialists to handle registrations, filings, and ad-hoc consulting in 100+ countries.

- Services: EU VAT number acquisition, OSS/IOSS, fiscal representation, audit help

- Country coverage: All 27 EU member states, plus the UK, Norway, and Switzerland

- Pricing: Registration packages start at €490 per country; monthly compliance from €120

The integrated service is handy for sellers running multichannel operations across Europe and beyond.

2. TMF Group

- Services: VAT registration, representation, bookkeeping, payroll

- Country coverage: 80 jurisdictions, with dedicated EU desks

- Pricing: From €650 per registration, tailored quotes for compliance

TMF Group is suitable for enterprises that also need wider corporate administration under one roof.

3. Meridian Global Services

- Services: VAT registrations, cross-border refund claims, indirect tax consultancy

- Country coverage: 40+ EU and non-EU countries

- Pricing: Registration from €600, annual support plans on request

Meridian’s strength lies in complex supply-chain scenarios such as call-off stock and triangulation.

4. SimplyVAT.com

- Services: EU and UK VAT numbers, OSS/IOSS, education webinars

- Country coverage: 29 European countries

- Pricing: Fixed €430 per registration, monthly filings from €109

A good fit for small to midsize e-commerce brands that want clear, package-based fees.

5. Taxback International

- Services: EU VAT registration, reclaim, expense recovery tech

- Country coverage: 130 countries

- Pricing: Quote-based. Transaction fees apply to reclaimed amounts

Its reclaim division can claw back overseas VAT you already paid, boosting cash flow.

6. Marosa

- Services: VAT number applications, distance-selling thresholds monitoring, Intrastat

- Country coverage: Entire EU, plus Norway and the UK

- Pricing: Registration from €525, filings from €95 per return

Marosa publishes helpful compliance calendars and newsletter alerts at no extra cost.

7. Euro VAT Refund

- Services: Registrations, fiscal representation, B2B and B2C refund services

- Country coverage: 40 countries

- Pricing: €500–€700 per registration, success-based refund fees

Well known for handling live events, trade shows, and film productions that require temporary VAT numbers.

Each of these agencies earns its place through proven track records, multilingual teams, and transparent communication. Keep reading to learn how to put them to work.

A growing compliance burden adds urgency to the decision. EU member states lose €61 billion to the VAT Gap every year, so audits are tightening. Having expert support reduces the odds of being part of that statistic.

How to pick the top agency for EU VAT registration

Before you sign a mandate letter, walk through the checklist below. It saves time and prevents costly mismatches later on.

Start by outlining your actual needs. A marketplace seller shipping from one EU warehouse has different risks than a SaaS provider with users in 15 states.

- Service scope

Do you need only the VAT number, or ongoing filings, OSS, and audit help?

- Language and representation

Some tax offices, for example in Italy and France, require a local fiscal rep.

- Technology

Check if the agency offers a client portal for document exchange and deadline alerts.

- Pricing model

Flat fee, transaction-based, or tiered subscription?

- Customer support SLAs

Response times under 24 hours are ideal when you are juggling shipments.

Pull these notes into a simple comparison table. Shortlist two or three agencies and request demo calls. End every call with a written summary of deliverables and timelines to avoid surprises.

Having a clear scoreboard helps you make a confident decision and sets expectations for both parties. For more tips from industry professionals, see VAT services for US companies: How to Stay Compliant When Selling Internationally.

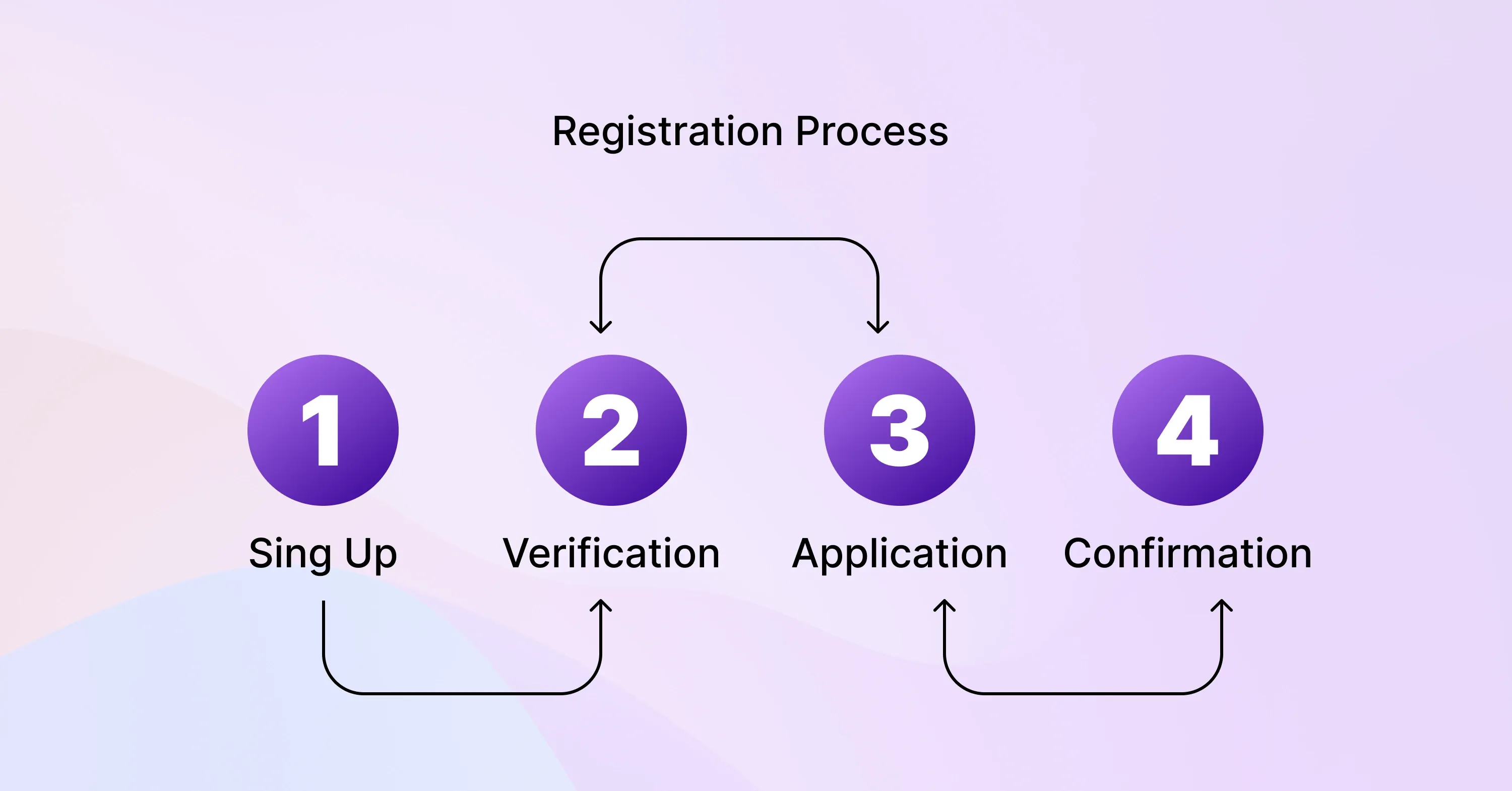

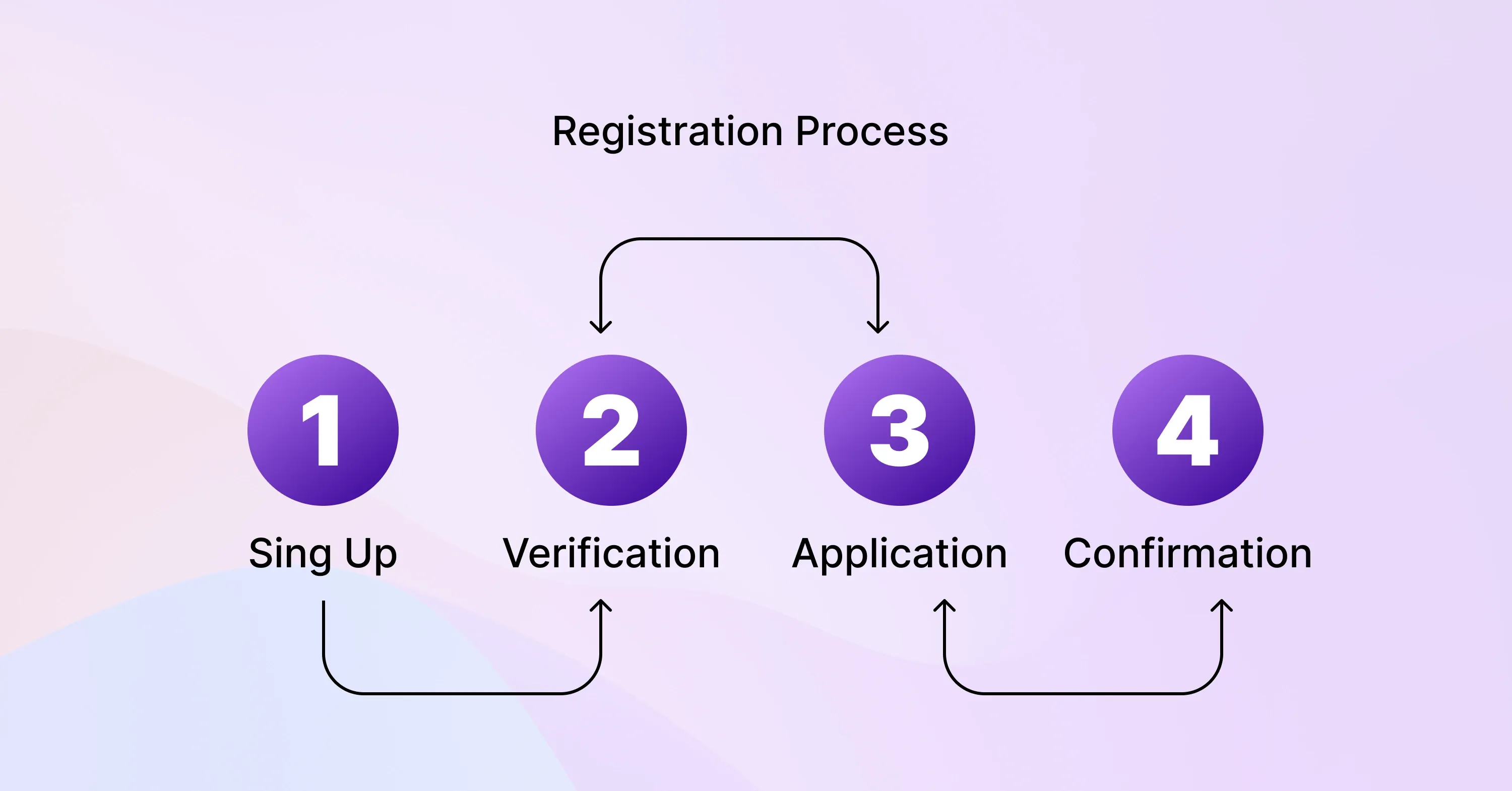

Step-by-step: Registering for EU VAT through an agency

Most providers follow a similar workflow. Knowing the milestones up front lets you plan inventory moves and marketing launches around them.

- Sign a Letter of Engagement

- The document covers legal authority and data-protection rules under GDPR.

- Submit KYC and business docs

- Certificate of incorporation, trade registry extract, director IDs, proof of bank account.

- Agency completes the application

- Forms differ by country. Germany requests an additional Questionnaire USt1A, while Spain asks for a Modelo 036.

- Tax office review

- Processing time ranges from two weeks in Ireland to up to eight weeks in Italy.

- Certificate issuance and activation

- You receive the VAT number, registration certificate, and, if applicable, an OSS login.

For businesses needing to move particularly fast or facing unique hurdles, refer to the Expedited VAT Registration: Checklist for Fast EU Entry, which provides actionable steps for speeding up the process and minimizing delays.

Keep an eye on the calendar. Launch marketing only after the certificate arrives. Selling early risks penalties plus missing invoice data.

The whole process usually runs 4-8 weeks but can stretch to 12 weeks if tax offices request extra translations. Build that buffer into your project plan.

Costs and hidden fees explained

Budget clarity avoids sticker shock down the road. Agencies quote either per country or per bundle.

- One-off registration fee: €400–€700 on average

- Fiscal representation surcharge: 10–20 % on top of the base fee

- Monthly or quarterly filings: €90–€150 per return

- Annual recapitulative statement: €50–€100

- Ad-hoc queries or audit assistance: €120–€250 per hour

Some agencies offer discounts when you register in multiple countries at once. For example, 1stopVAT lowers the per-country fee to €390 if you sign up for five or more jurisdictions together.

Check the small print for translation costs, courier fees, and disbursements that may appear later.

Understanding the cost stack ensures you compare apples to apples when reviewing quotes. If your business is in its early stages or operates internationally, you’ll find concrete VAT cost comparisons and common fee structures in the VAT Compliance Checklist for Startups and Small Businesses.

Common pitfalls and how agencies help you avoid them

Even seasoned finance teams run into surprises. An experienced agency acts as a safety net.

- Missing registration deadlines

Thresholds vary. France triggers at €35,000, but Sweden waits until SEK 99,680. Agencies monitor sales and alert you early.

- Incorrect invoice sequencing

Local rules on numbering differ. Spain demands a chronological series per establishment.

- Late EC Sales Lists

Penalties run up to €1,500 per report in Belgium. An automated calendar and reminder emails keep you punctual.

- Over- or under-declared VAT

Self-revision windows are tight. External checks before submission cut error rates.

For real-life scenarios of how costly slip-ups occur and how to protect yourself, see VAT Compliance: How EU Businesses Lost €159M in Penalties.

Mitigating these pitfalls means smoother cash flow and fewer sleepless nights.

EU VAT Registration Made Simple: What Agencies Do in 5 Steps

EU VAT registration through an agency takes five key steps: sign an engagement letter, provide company documents, let the agency file forms with the tax office, wait for review, then activate the issued VAT number. Total lead time is usually four to eight weeks, with costs starting around €400 per country plus ongoing filing fees.

Conclusion

Picking the right partner for EU VAT registration reduces risk, frees up internal resources, and accelerates your European expansion. Compare service scope, country coverage, and fee structures, then follow the five-step timeline to keep your launch on schedule. With the insights above and the added resources—like VAT Compliance & Consultancy: Why Expert Advice Matters - you are ready to select the agency that matches your cross-border ambitions and budget.