The gist of it

In 2023 alone, 17 % of VAT applicants were rejected or withdrew. This number encouraged us to prepare an action-oriented checklist to secure your EU VAT number.

Want to dive deeper into fast EU entry? Here are more expert tips

Today you’ll learn:

-

Why VAT registration is non-negotiable for cross-border sellers

-

What is covered by “fast-track” or priority tax registration

-

Which EU countries offer expedited processing

-

Eligibility rules, paperwork, costs, and timelines

-

The pros and cons of using VAT consultants like as 1stopVAT

-

A printable step-by-step checklist for your team.

Fast-track VAT registration is an accelerated filing route offered by certain EU tax authorities or specialist agents that simplifies a conventional four-to-twelve-week process into as little as five working days by pre-validating documents, leveraging local portals, and monitoring every stage to receive VAT ID sooner and start trading legally.

1. Confirm why your business needs VAT registration

Not registering VAT is beyond a compliance risk; it may deter product movement. HMRC delays have “hindered business expansion and stopped new businesses from trading.

Leverage this quick check:

If at least one point applies, prioritize VAT as a critical point.

Want to dive deeper into global scenarios? Here is our Sales Tax Registration and Compliance Guide for Global Sellers.

2. Understand what a fast-track application really means

“Fast-track” is beyond a universal legal term, entailing:

-

Dedicated online queues in countries like Ireland and the Netherlands

-

Pre-approved documentation packs agreed with tax offices

-

A paid premium service offered by authorities (in a few cases) or by agents (in many cases)

-

Parallel filing of Economic Operator Registration and Identification (EORI).

Ask whether the shorter timeline covers the entire process: receiving the VAT number, certificate, and access to e-filing portals.

Here we’ve listed core advantages of fiscal representation.

Red flags to watch out for

- Promises of instant approval without document checks

- Agents that advertise one-day numbers but deliver only a temporary application ID

- Lack of after-care for the first VAT return.

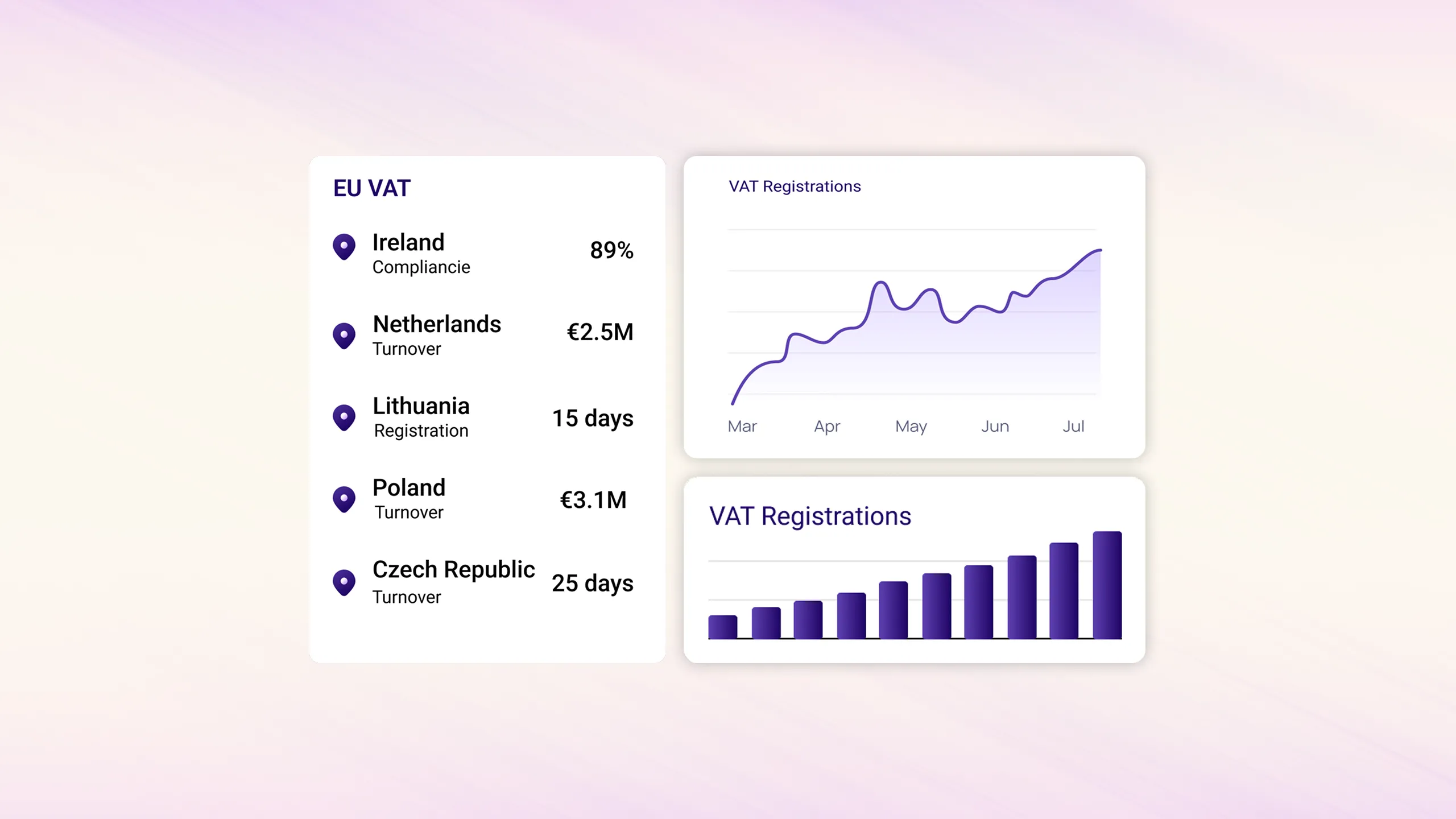

3. Pick EU countries with priority tax registration windows

Not every EU member state will fast-track you equally, so be sure to match your supply chain with the friendliest jurisdictions:

-

Ireland: express route, typical issue in 5–7 working days for importers

-

Netherlands: early provisional number while documents are validated

-

Lithuania and Estonia: digital-first portals support same-week numbers

-

Poland: limited slots, but agents can queue-jump by filing through KSeF pre-clearance

-

Czech Republic: offers accelerated processing for non-resident sellers using OSS/IOSS

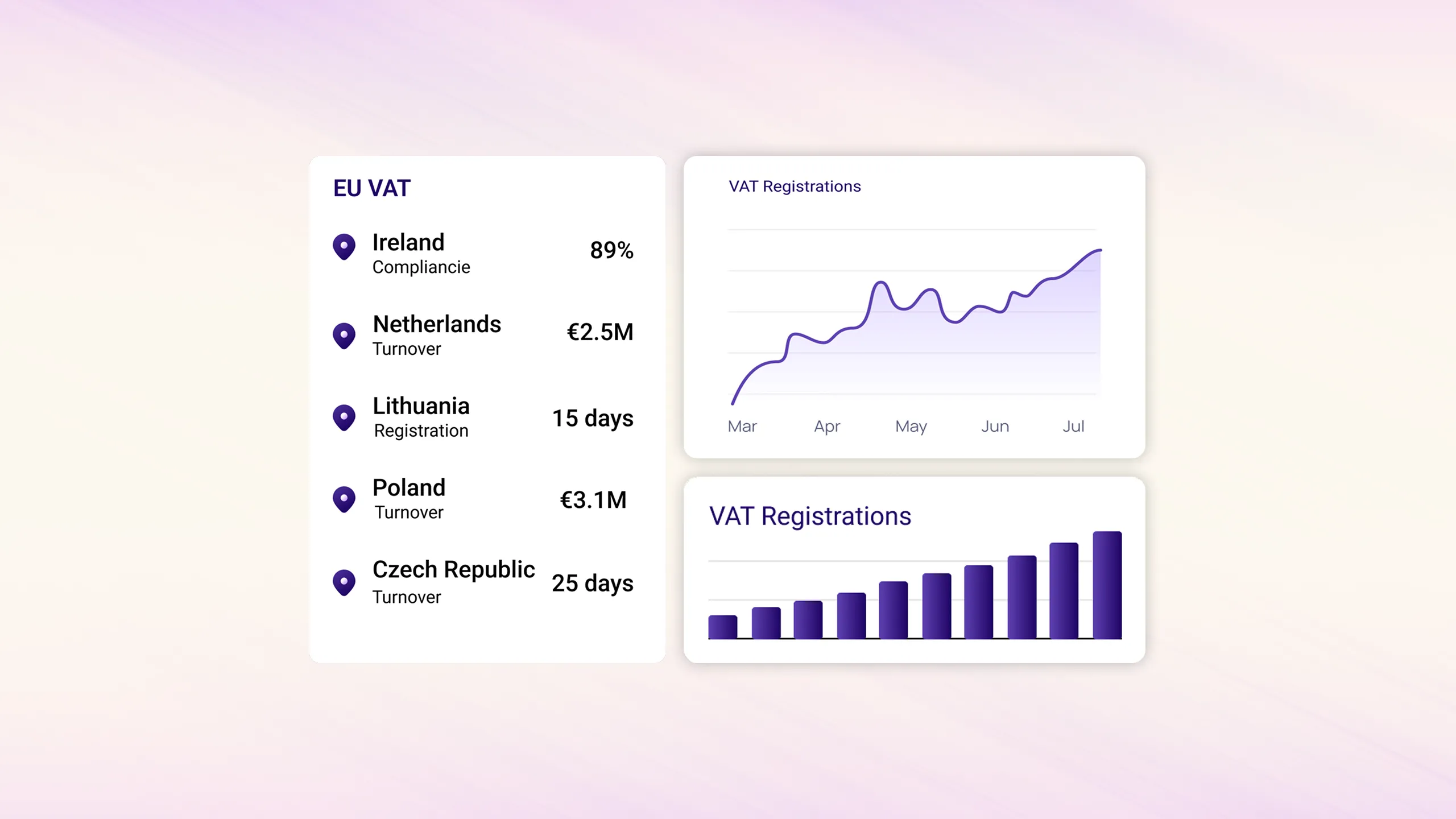

More than €33 billion in VAT was collected through the EU’s OSS in 2024, and 170 000+ businesses are already enrolled.

Choosing the country that meshes with OSS will slash your workload, so make sure to check out the latest trends and policy updates.

4. Check your eligibility for a priority tax registration

Tax offices will only expedite clean, complete files, so make sure you can tick these boxes:

-

A registered business address (commercial, not a virtual mailbox)

-

Up-to-date articles of association translated into the local language

-

No outstanding tax debts in your home country

-

A bank account in the EU or UK for refund purposes

-

A documented business model: invoices, contracts, projected turnover

-

Fail one item and you slide to the slow lane.

5. Gather the required documents in a single pack

A watertight file will week-long queries:

-

Certificate of incorporation

-

Articles of association or bylaws

-

Directors’ passports and proof of address

-

Bank statement (within three months)

-

Power of attorney for your local agent

-

Contracts or invoices proving taxable activity

-

Warehouse lease or 3PL agreement

-

Previous VAT numbers and deregistration letters if applicable.

Scan each item at 300 dpi, label the files in English and the local language, and keep the total size below the portal limit (often 10 MB).

Cross-border challenges and VAT registration hurdles in the UK faced by foreign entities

6. Map realistic timelines and costs

The European Commission levies a non-resident VAT registration one-time cost of about €1 200.

Fast-track options add a premium but can still be cheaper than lost sales.

Usual timeline breakdown:

-

1–2 days: data gathering and translations

-

1 day: portal account creation

-

3–7 days: tax office processing for fast-track

-

1 day: communication of VAT ID.

Even an “express” path rarely beats five calendar days, so manage internal expectations.

Budget line items

-

Government fees (some states, €50–€300)

-

Notarisation and apostille of documents

-

Fiscal representative annual retainer

-

Fast-track agency fee (varies, €400–€900).

7. Decide whether to use a professional service

Handling the filing yourself saves fees but risks delay. The cost of one missed launch weekend can dwarf agency charges.

Comparative advantages of working with VAT consultants:

-

Pre-checked documentation and translation services

-

Direct API links with tax portals for priority slots

-

Real-time status updates, avoiding “black hole” weeks

-

Automatic onboarding to OSS/IOSS when needed

-

Single point of contact for multi-country projects.

8. A step-by-step checklist to submit and follow up

Missing a follow-up email is a primary reason why applications stall, so be sure to set alerts in your project management tool.

- Assign an internal owner (CFO, finance manager, or tax manager).

- Select the target country based on the warehouse and sales flow.

- Download the latest VAT registration form and guidance notes.

- Compile notarised corporate documents and translations.

- Register for the online tax portal and secure login credentials.

- Upload documents and complete data fields.

- Pay any registration or courier fees immediately.

- Track submissions daily and answer queries within 24 hours.

- Receive VAT ID, confirm activation on the EU VIES database.

- Update invoices, ERP, marketplaces, and shipping labels with the new number.

- Enrol in OSS/IOSS if B2C cross-border sales exceed thresholds.

- Schedule the first VAT return and compliance calendar.

Conclusion

Fast-track VAT registration is a practical way to sidestep bottlenecks, safeguard launch dates, and keep your revenue flowing. By choosing the right jurisdiction, preparing documents meticulously, and answering tax office questions quickly, finance teams will secure your VAT ID in days. Get your fast EU VAT number with ‘1stopVAT’ fast-track registration