What you will learn

By the end of this guide, you will know:

- The exact situations that trigger compulsory business VAT registration

- The paperwork and data you need on day one

- How to complete the online application without common errors

- What happens after you click “submit,” including timelines and follow-up duties

- Practical tips to keep your VAT affairs tidy in the months that follow

Let’s get started.

VAT registration in one sentence

To register for VAT, a business confirms it meets or will soon meet its country’s turnover threshold, gathers company and banking details, completes the tax authority’s digital form, then waits for its VAT number before charging VAT on sales and reclaiming it on costs.

Step 1: Confirm whether you must register

Even before opening the tax portal, determine if VAT registration is necessary right now.

- Most EU countries trigger registration once domestic turnover crosses €10,000–€100,000, while the UK sets the limit at £90,000.

- Distance sellers shipping into the EU often register when sales exceed €10,000 across Member States.

- Voluntary registration is allowed below the threshold, which can improve cash flow through input-VAT deductions.

For a deeper dive into compliance triggers and regional nuances, explore the VAT Compliance Checklist for Startups and Small Businesses.

How the VAT gap influences audits

Tax authorities are tightening controls. EU Member States lost €89.3 billion in VAT revenues in 2022 and are keen to close the gap. Businesses that should register but do not are more likely to face retrospective assessments.

When you are certain registration is required or beneficial, move on to preparation.

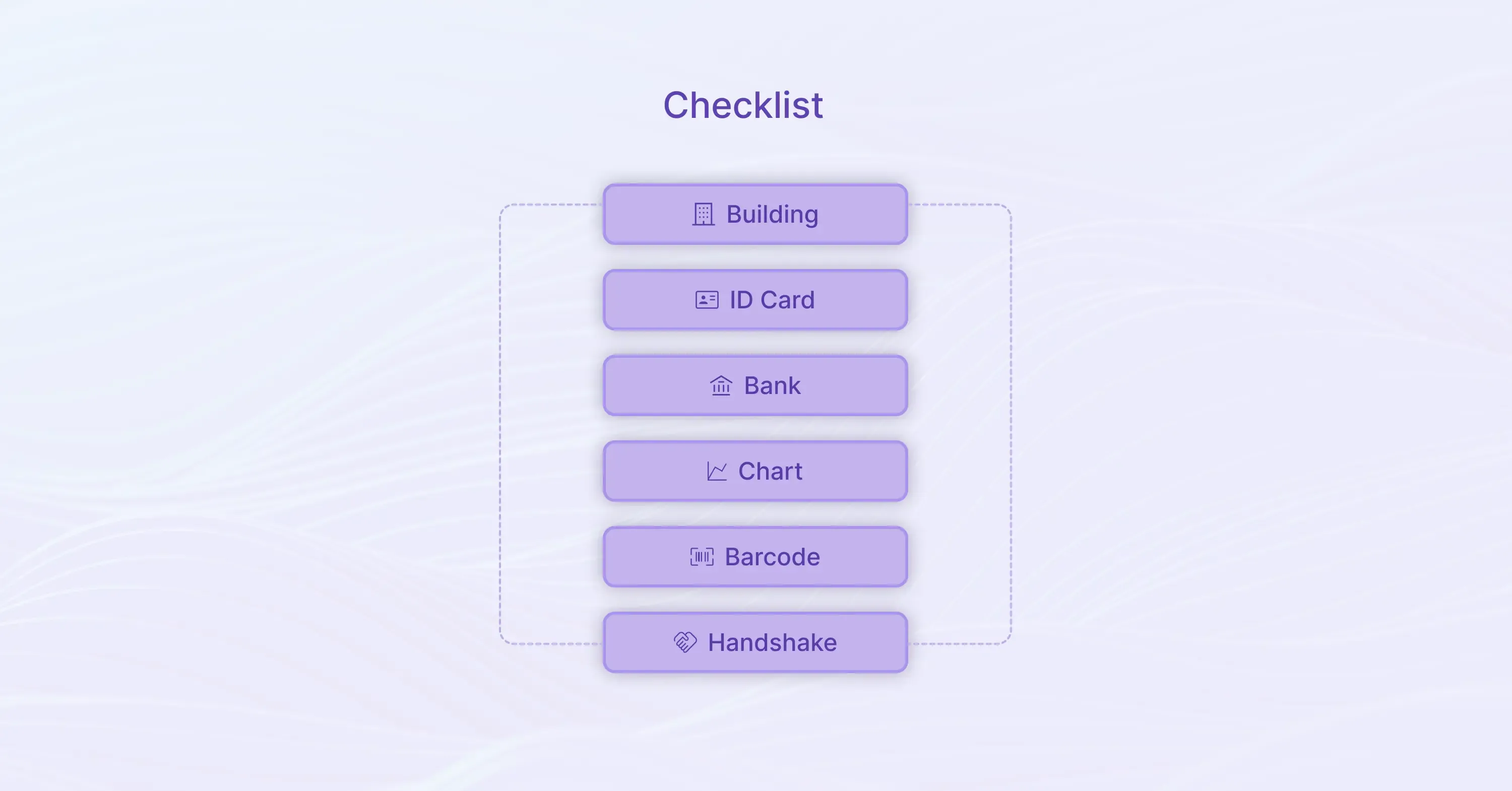

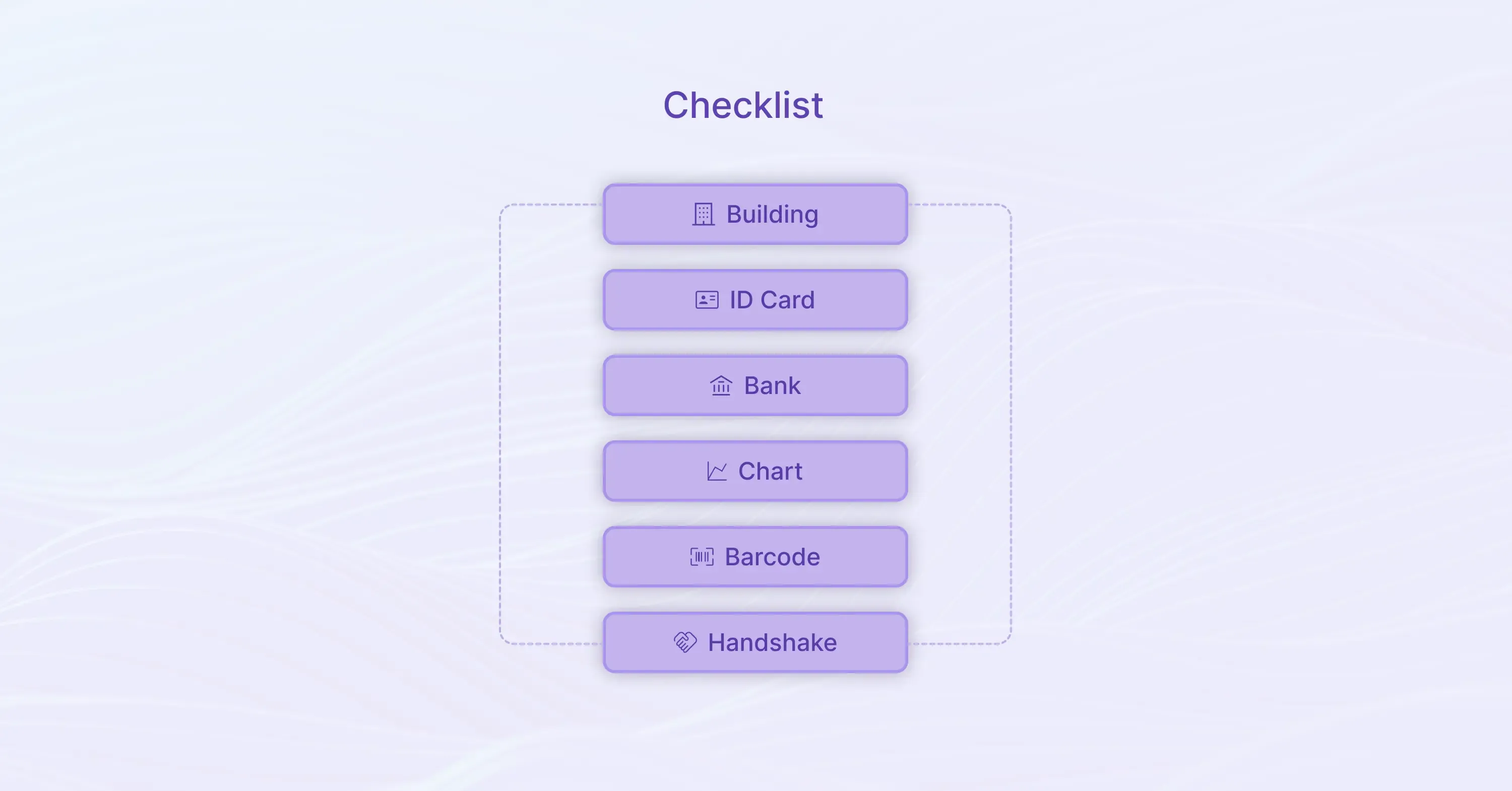

Step 2: Gather your information and documents

Preparation is half the battle. Having every detail at hand speeds up the application and reduces rejection risk.

- Legal entity data: company name, registration number, address

- Responsible officer’s ID: passport or national ID, proof of address

- Bank account details for refunds and payments

- Expected taxable turnover for the next 12 months

- Description of activities and main product or service codes

- Proof of trading: invoices, contracts, or website screenshots

- For cross-border sellers: stock locations, shipping partners, and marketplace agreements

Around 17 % of UK VAT registration applications were unsuccessful in 2023 largely due to missing or inconsistent information. A ten-minute cross-check now can save weeks later.

To ensure all paperwork is in order, see practical examples in Expedited VAT Registration: Checklist for Fast EU Entry.

Step 3: Choose the right scheme and country options

Each jurisdiction offers several VAT schemes. Picking the correct one keeps compliance simpler and bills lower.

- Standard scheme: default for most businesses

- Flat-rate or simplified schemes: pay a fixed percentage, easier bookkeeping but fewer input deductions

- Margin schemes: ideal for second-hand goods and travel

- EU One-Stop Shop (OSS) and Import OSS (IOSS): centralised filing for distance sales and low-value imports

Since their launch, nearly €88 billion in VAT has been collected via OSS/IOSS, highlighting their popularity. As 170,000+ businesses already enrolled, consider OSS/IOSS if you ship across borders - or check out a Brief Overview of One-Stop Shop Schemes for clear, side-by-side differences.

Conclude this step by confirming your chosen scheme inside the tax portal and, if needed, appointing an intermediary for non-EU companies.

Step 4: Complete the online application

Most authorities now process VAT setup assistance online. Sign into the government gateway, then work through the screens.

- Enter legal entity details exactly as shown on the incorporation certificate.

- Declare turnover and expected sales by product type.

- Select your scheme and start date.

- Upload requested documents in JPEG or PDF format.

- Review and submit.

Helpful tip: keep screenshots of each submitted page. If questions arise, you will have proof of the data entered.

Businesses that prefer human guidance often outsource this stage to dedicated VAT registration services such as 1stopVAT, whose team of 40+ certified tax specialists handle the form filling and communication with over 100 tax authorities worldwide.

To avoid common pitfalls - such as wrong document formats, missing translations, or outdated templates - review tips in The obligation to register for VAT: 6 common mistakes.

Once submitted, note the reference number. You will need it for queries.

Step 5: Track the application and receive your VAT number

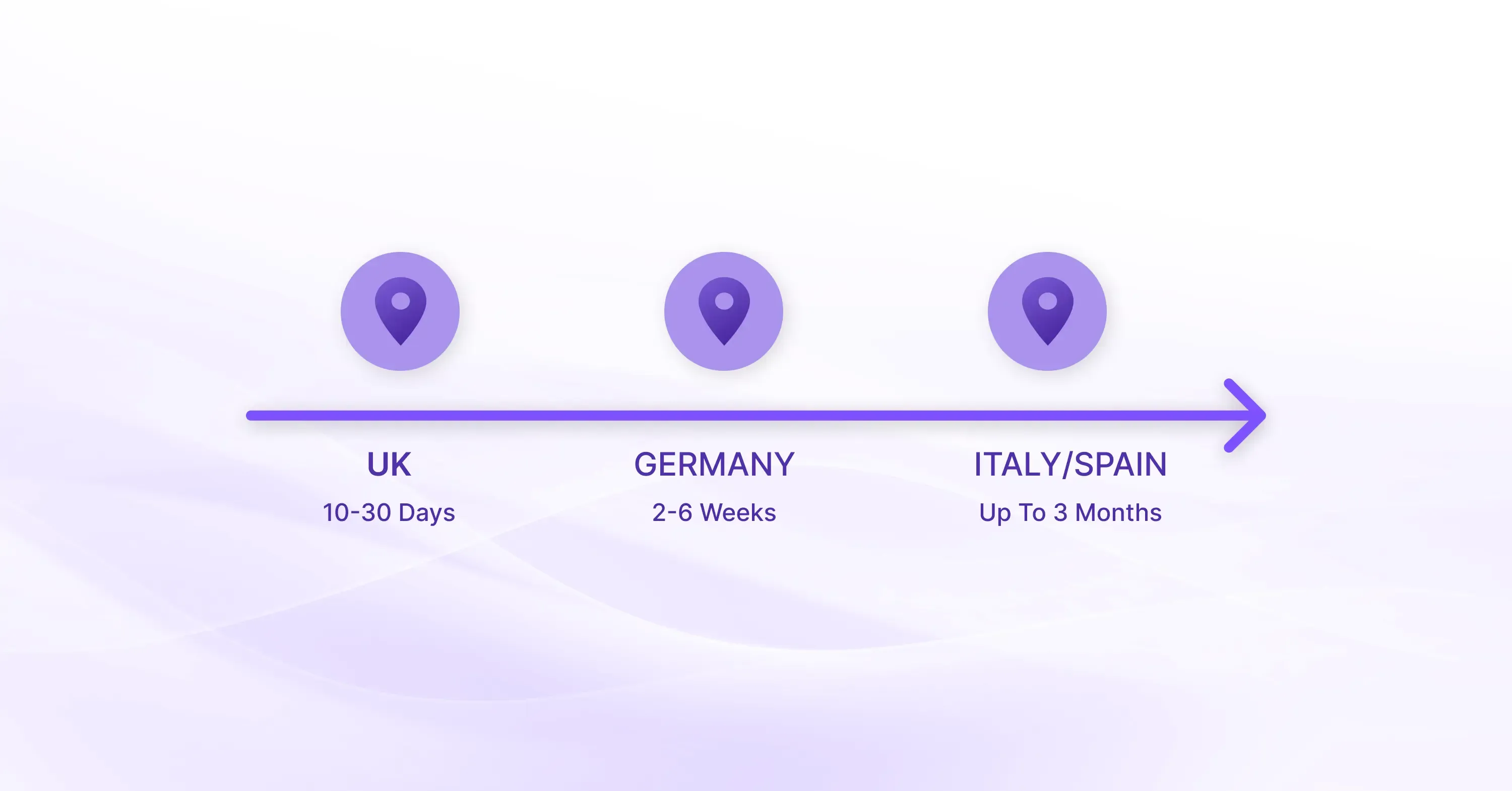

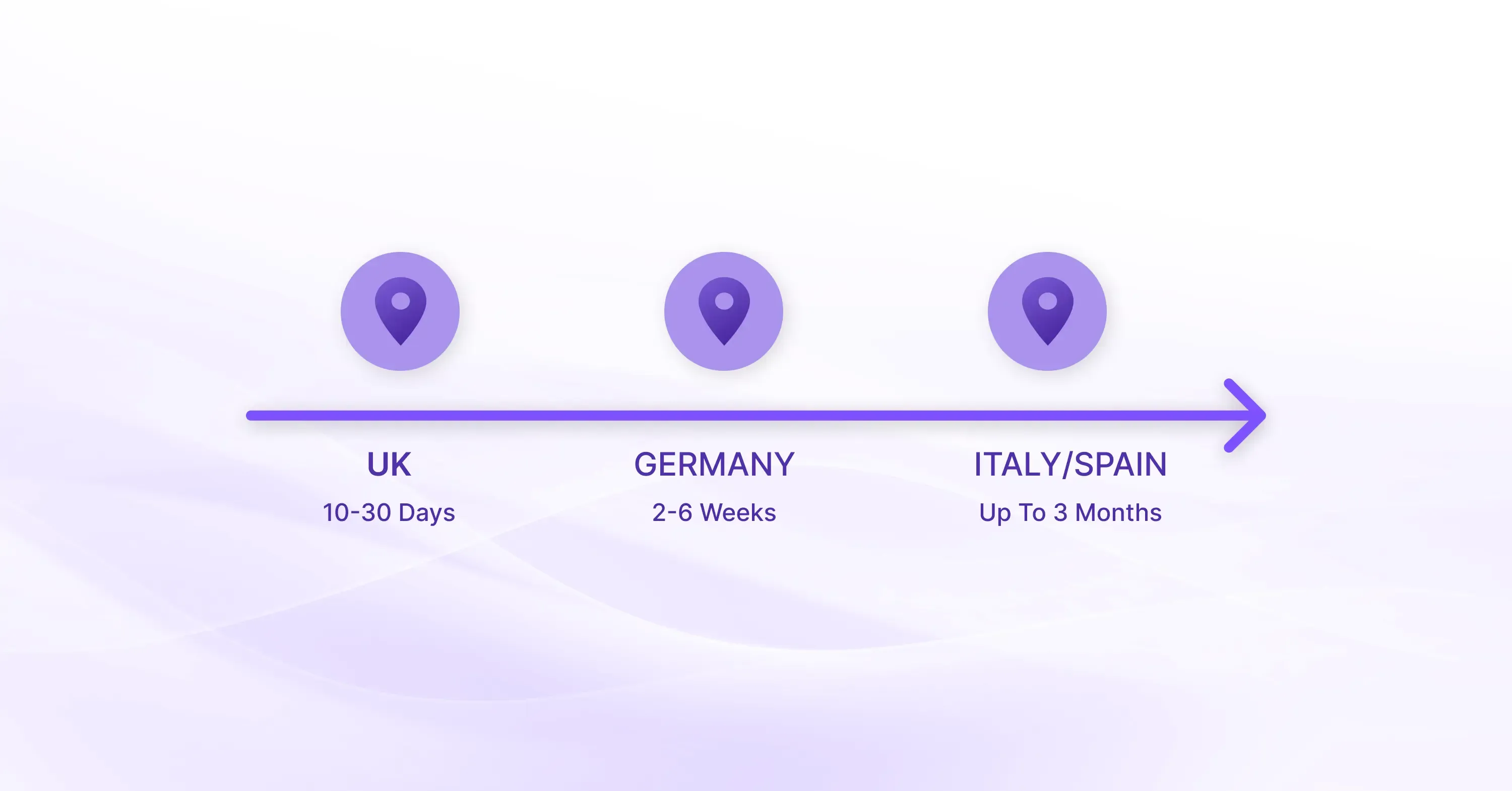

Processing times vary.

- UK: 10–30 working days

- Germany: 2–6 weeks

- Italy and Spain: up to 3 months when additional verification is requested

During this period, you must monitor your email for follow-up questions. Missing a reply deadline can reset the clock.

Provisional VAT and back-dating

If you start charging VAT before the number arrives, state “VAT pending” on invoices. Once approved, you may need to reissue those invoices with the official number and account for the tax on your first return.

When the VAT certificate lands in your inbox, celebrate briefly, then tackle integration.

Step 6: Integrate VAT into your systems

A VAT number is only the beginning. You now need to record, report, and pay it accurately.

- Update invoice templates to include the new VAT number and correct rate lines.

- Set up accounting software with country-specific tax codes.

- Train staff on issuing credit notes and managing zero-rated exports.

- Implement a process to reconcile input VAT on expenses monthly.

- Schedule return deadlines in a shared calendar.

EU one-stop-shop regimes collected €33 billion in VAT during 2024, 26 % more than 2023. The surge underlines how automated portals can simplify multi-country filings, but you still need solid internal records to support each figure.

For an in-depth look at record-keeping, tech tools, and compliance software, check out Tax Technology Tools – VAT Compliance Automation.

Companies selling in 15+ markets often retain ongoing business VAT registration support from firms like 1stopVAT, ensuring data flows smoothly into each quarterly or monthly return.

Step 7: File your first return and stay compliant

The real work happens after registration. Follow these habits:

- Reconcile sales and purchase ledgers monthly.

- Submit VAT returns on time: late filings attract interest and penalties.

- Pay or reclaim VAT by the statutory due date, typically one month and seven days after the period ends in the UK.

- Review threshold positions annually in every country where you trade.

- Monitor legislative changes, especially digital reporting mandates arriving across the EU.

The UK alone recorded £9.5 billion as the VAT gap in 2023–24, so audits are increasingly data driven. Accurate submissions guard against assessments - and real-life cautionary tales are showcased in VAT Compliance: How EU Businesses Lost €159M in Penalties.

Congratulations, you are now fully registered and ready to charge, reclaim, and account for VAT like a pro.

Conclusion

Registering for VAT is a structured process: assess your obligation, prepare documents, pick the right scheme, submit the form, integrate the number into your invoices, and stay on top of filings. Use professional VAT registration services when internal bandwidth is tight, and keep detailed records from day one. With these steps nailed, your business can trade confidently across borders while remaining fully compliant.