Overview

This guide breaks VAT reporting into practical steps, from confirming where you owe tax to sending the final return.

You will learn:

- Which transactions you must report and how often

- How digital VAT filing tools and VAT reporting services can slash paperwork hours

- The penalties for late or inaccurate submissions

- Hands-on tips that keep audits and cash penalties at bay

Follow along and turn VAT reporting from a headache into a routine task.

Know Your VAT Reporting Obligations

Every VAT journey starts with knowing who you must report to and what figures go onto the return.

EU Member States lost €89.3 billion in VAT revenues in 2022, so tax offices scrutinize filings more than ever. Getting the basics right is non-negotiable.

- Taxable supplies: sales of goods or services where VAT is due

- Reverse-charge purchases: supplies where you, not the seller, account for VAT

- Distance sales: cross-border B2C sales above national thresholds

- Imports: shipments arriving from outside the customs union

If you sell digitally or run marketplaces, remember special regimes like the One Stop Shop (OSS). Over 170,000 businesses registered for OSS and IOSS by the end of 2024, showing how widespread these schemes have become.

For a deep dive on how OSS and IOSS work, see the Overview: What’s the Difference Between EU VAT vs. OSS VAT guide.

In short, map each supply chain leg to the correct VAT rule before you start filling numbers.

Filing Frequency and Deadlines

Most countries ask for:

- Monthly returns when turnover crosses a set limit

- Quarterly returns for small to medium traders

- Annual recap statements such as EC Sales Lists or SAF-T files

Make a calendar that combines all jurisdictions you sell into. Late filings can trigger both fixed fees and a percentage of the VAT due. We will cover penalties in detail later.

Once you list every supply and its matching rule, filing becomes a data exercise rather than detective work.

Collect and Validate Source Data

Accurate VAT returns rely on clean records. Messy data is the number-one cause of corrected filings and interest charges. For a real-world perspective on what poor VAT record-keeping can cost, read VAT Compliance: How EU Businesses Lost €159M in Penalties.

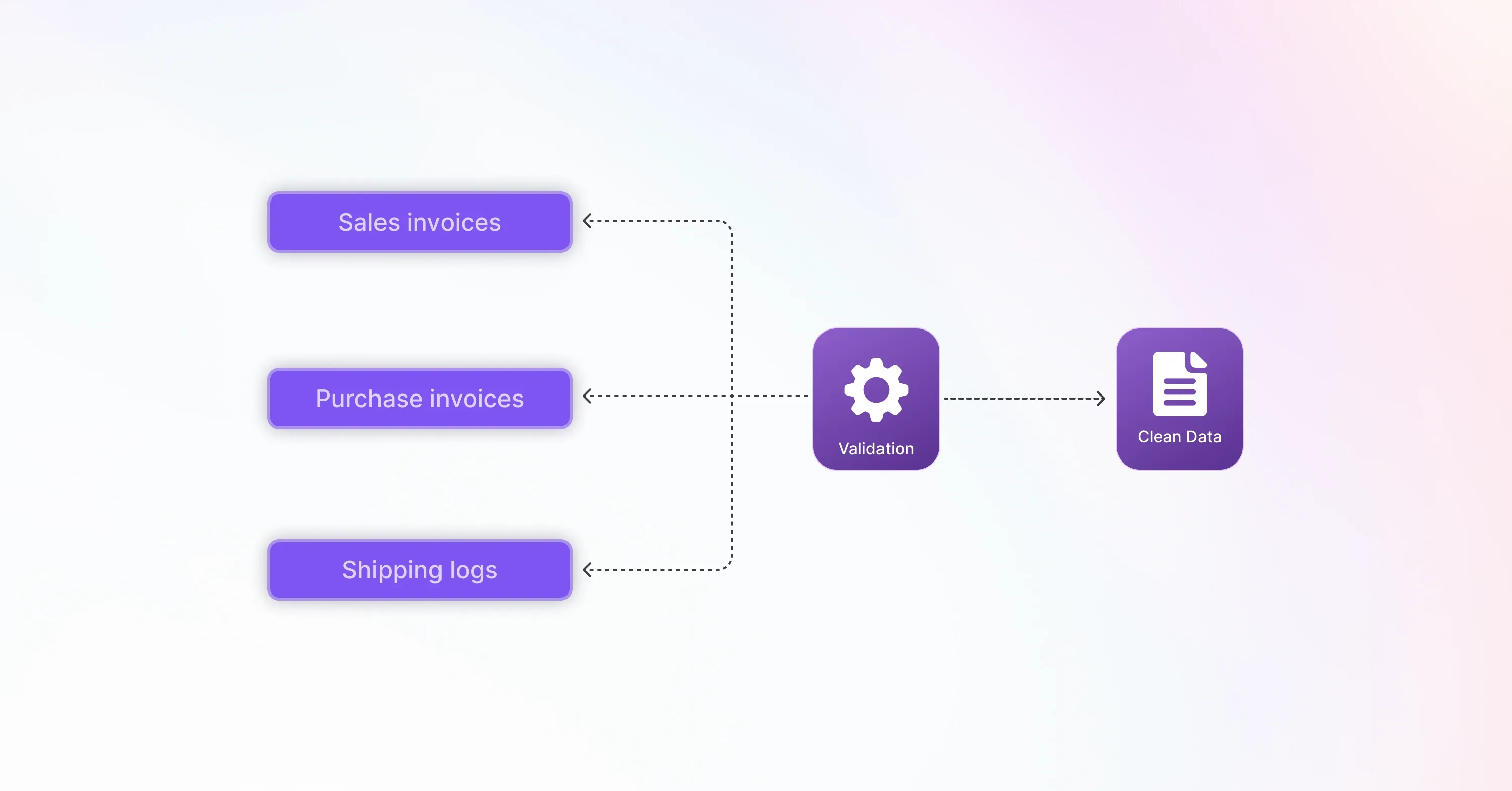

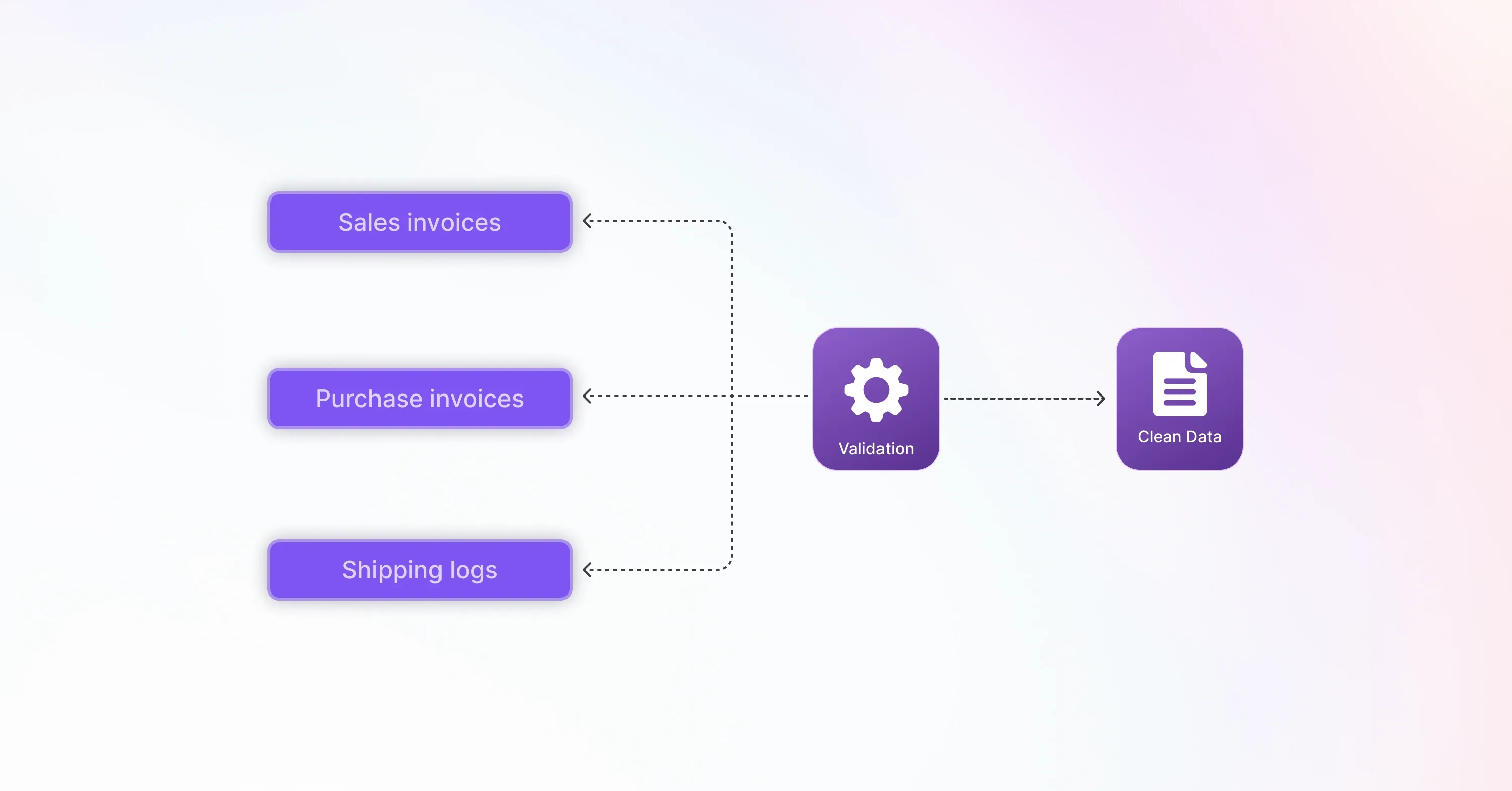

Every VAT transaction leaves a digital footprint. Your goal is to gather these footprints before submission.

- Sales invoices from accounting or e-commerce platforms

- Purchase invoices to reclaim input VAT

- Shipping logs that prove goods left a country

- Exchange rates on the transaction date

Check VAT numbers of B2B customers with the VIES database or local tools. Invalid numbers erase your right to zero-rate intra-EU sales.

A tight data flow today prevents correction letters tomorrow.

Use Digital VAT Filing Tools Wisely

Technology has changed VAT compliance. UK firms that adopted Making Tax Digital software saved an average of 26–40 hours per year on VAT tasks. That time was valued at £603 million to £915 million annually.For practical advice on leveraging digital solutions, explore How to File VAT Returns Online: Streamlining Digital Submission.

Digital tools help you:

- Import transactions directly from ERP or shopping carts

- Run automatic VAT code checks

- Produce country-specific XML or CSV files

- Store an audit trail for five to ten years, depending on the jurisdiction

Still, software is only as good as the configuration. Many companies turn to specialist VAT compliance services to validate the output before hitting “submit.” A provider such as 1stopVAT, with 40+ certified tax specialists across 100+ countries, can review digital data and make the final call.

Let software handle the heavy lifting, while human experts ensure the numbers pass a real-world tax audit.

Selecting the Right Tool

- Confirm it supports all countries you file in

- Check if OSS/IOSS modules are included

- Verify two-factor authentication and encrypted storage

- Ask whether the tool updates tax rates automatically

For more on how automation can streamline your process (and reduce risk of error or penalties), see Tax Technology Tools – VAT Compliance Automation.

The right choice reduces manual tweaks and late-night spreadsheet sessions.

Prepare and File the Return

You now have clean data and a trusted tool. Time to assemble the VAT return.

Steps at a glance:

- Reconcile sales and purchase totals with your general ledger.

- Run plausibility checks: high margins or negative boxes flag errors.

- Generate the draft return and share it with finance or advisors.

- Submit through the local portal or via an API gateway.

- Pay outstanding VAT, ideally at least two days before the due date.

For a step-by-step checklist that ensures nothing gets missed, bookmark Accurately Filling Out a VAT Return.

Keep screenshots or confirmation emails. Some tax offices allow amendments but impose interest from the original due date.

A disciplined filing routine removes last-minute panic and strengthens your compliance story.

Understand Penalties for Non-Compliance

Missing a deadline or under-reporting VAT has real costs. For instance, the EU estimates that proposed digital reforms could help collect up to €18 billion in extra VAT revenue each year, partly by tightening enforcement.

For cautionary tales and practical tips on avoiding and addressing penalties, review the article VAT Compliance Lessons from the €200,000 Mistake.

Common penalties:

- Late filing fees: fixed amounts or percentages per day overdue

- Late payment interest: often the base rate plus 4–8 %

- Incorrect returns: fines of 10–25 % of the VAT under-declared

- Criminal charges: in cases of deliberate fraud, such as Missing Trader schemes that cost the EU €13–€33 billion annually

When you spot an error, file a voluntary disclosure. Many states reduce penalties if you act before the tax office contacts you.

Keep Improving Your VAT Process

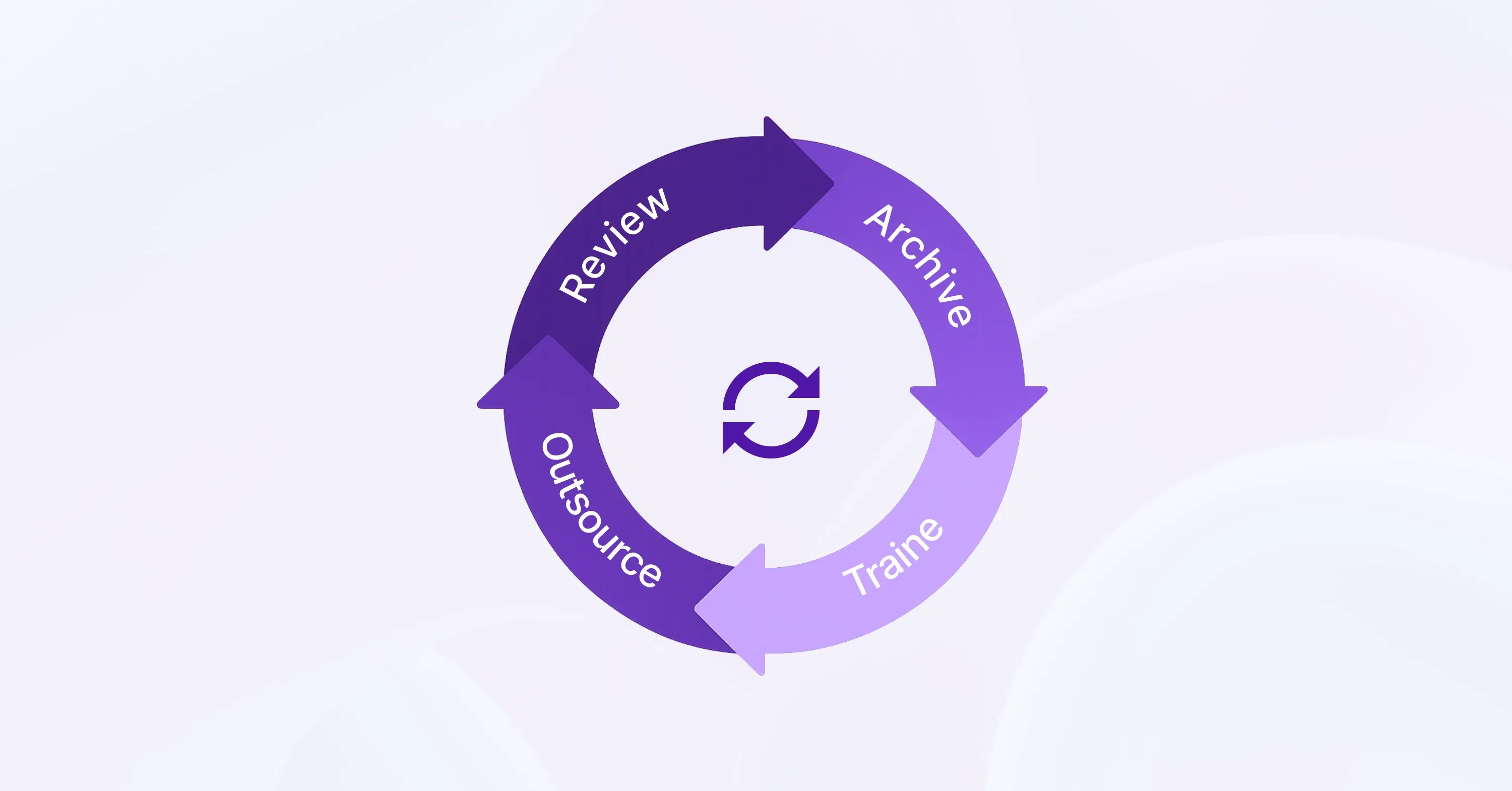

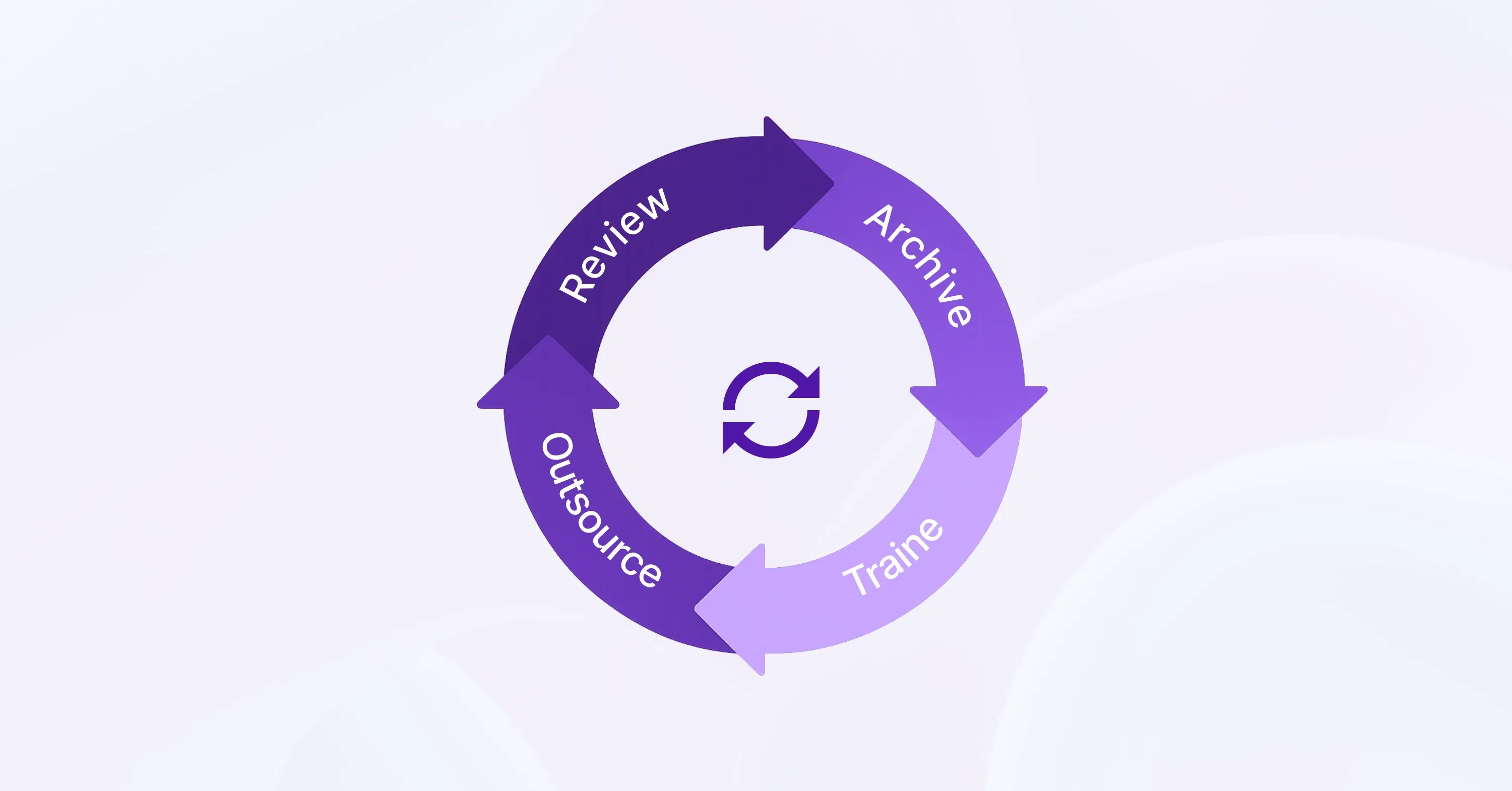

Compliance is not a one-time project. Make VAT reporting smoother each cycle.

- Run quarterly health checks on VAT codes

- Archive documents in searchable folders

- Train staff on new thresholds and regimes

- Review vendor VAT numbers yearly

- Outsource complex markets to a single service partner for continuity

For expert strategies and when to consider external help, see VAT Compliance & Consultancy: Why Expert Advice Matters.

Continuous tuning is how the EU collected more than €33 billion through OSS in 2024, up 26 % from 2023. Businesses that keep pace benefit from the same efficiencies.

Treat VAT as an ongoing business process, not a year-end scramble.

What is VAT reporting?

VAT reporting is the periodic process of collecting sales and purchase data, calculating net tax due, and submitting a structured return to each relevant tax authority by the statutory deadline, often monthly or quarterly, along with payment or refund claims. Many businesses use VAT reporting services to simplify this process, ensure accuracy, and stay compliant across multiple jurisdictions.

Conclusion

VAT reporting does not need to derail your finance team. Clarify obligations, keep data clean, leverage digital tools, and stay mindful of penalties. Whether you handle the work internally or rely on professional VAT reporting services such as 1stopVAT for cross-border filings, the steps above will help you submit accurate returns on time and focus on growing your business.