Trusted by

When your business goes global it’s crucial to comply with Value Added Tax (VAT) regulations. Charging VAT during sales and paying it based on the customer’s location can be complicated. We are here to simplify this process for you!

Services

Check what we can do for you

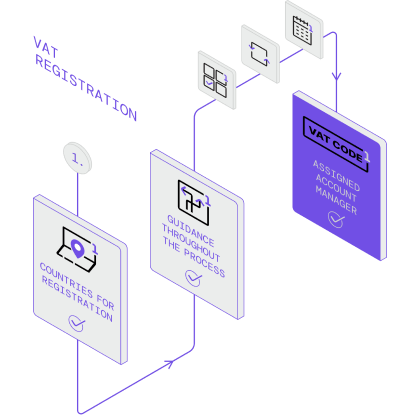

1

VAT registration

With our complete registration services, your business can be registered anywhere in the world, even where this process can be tricky and regulations vary.

2

VAT filing

Once your business obtains a VAT number in a country, it’s important to file periodic VAT returns to remain compliant with local regulations. Our team can ensure on-time reporting and submissions.

3

VAT consulting

Have questions or concerns about VAT compliance? No problem! We’re here to solve any issue, answer any question or back-up your business in any situation when it comes to taxes matters.

Why us?

Dedicated account manager

As our client, you will be assigned to a multilingual account manager who can address all your tax-related inquiries and resolve any issues you may have at any time.

Single point of contact

We serve as single point of contact, simplifying the process and ensuring that your VAT compliance is handled efficiently and effectively within single stop.

Exclusive customer service

We support our clients, ensure fast response time and always go beyond by offering tailored assistance and individual attention.

Certified experts

Our team is combined of more than 40 experts, who can provide wide range of services and are certified members of IVA, AITC and VAT Forum. Currently we have more than 800 clients and knowledge how VAT works in 100 locations.

Register for a FREE consultation

We offer a FREE consultation to better understand your needs. This could result in a simple solution to your taxes issues or lead to a more collaborative working relationship. Let’s find out what’s the best solution for you!

Book a Free consultation

What are the consequences of not being compliant?

How to ensure compliance?

Our clients