Identifying What Counts as a Digital Service

Before worrying about tax rates, you must determine if your product falls under the specific category of "electronic services" defined by tax authorities. This classification triggers specific VAT rules that do not apply to standard consulting or physical goods. Generally, digital services are defined as services supplied over the internet or an electronic network, heavily reliant on information technology, and requiring minimal human intervention.

Common examples of digital services include:

-

Downloadable content such as e-books, PDFs, and stock photography.

-

Streaming media services for music, movies, and online gaming.

-

Software as a Service (SaaS) and cloud-based accounting tools.

-

Web hosting and remote data storage.

-

Online courses that are pre-recorded and automated (live webinars often fall under different rules).

If your product matches these criteria, you likely face specific compliance hurdles. You cannot simply apply your domestic tax rate to every sale. Instead, you must adhere to a complex web of digital VAT rules that vary based on who your customer is and where they live. For a focused breakdown of VAT obligations and digital product definitions in the European Union and beyond, see Digital Services VAT Compliance: What You Need to Know.

Determining Where VAT is Due

Once you confirm you are selling a digital service, the next step is establishing the "place of supply." This legal concept determines which country’s tax rate applies and where that tax must be remitted. For digital goods, the destination principle usually applies, meaning VAT is due in the country where the consumer is located, not where your business is based.

Distinguishing Between B2B and B2C Sales

Your obligations shift dramatically depending on whether you sell to businesses (B2B) or private consumers (B2C).

-

B2B Transactions: In many regions, especially the EU, B2B sales of digital services are subject to the "reverse charge" mechanism. You do not charge VAT; instead, the business customer accounts for the tax in their own periodic returns. You must validate their VAT number to apply this rule (see Reverse Charge VAT for B2B Digital Services Explained).

-

B2C Transactions: When selling to individuals, you are generally responsible for charging, collecting, and remitting the VAT applicable in their country of residence.

This distinction is crucial because VAT accounted for nearly one-fifth of all tax revenue collected in EU member states recently. Governments are aggressive about collecting this revenue, so misclassifying a B2C sale as B2B can lead to significant penalties.

Navigating the EU VAT One-Stop Shop (OSS)

For businesses selling to consumers across the European Union, the administrative burden of registering in up to 27 different countries used to be overwhelming. To address this, the EU introduced the One-Stop Shop (OSS) scheme. This system allows you to register for VAT in just one Member State and use a single quarterly return to report sales made to consumers in all other EU countries.

This electronic service VAT guide would be incomplete without highlighting the success of this simplification. The system has proven effective, as more than €33 billion in VAT was collected in 2024 through the EU's e-commerce VAT systems. Using the OSS means you collect the specific VAT rate of the customer’s country (e.g., 19% in Germany, 27% in Hungary) but pay it all through one portal in your home or registration country.

If you’re navigating OSS options or want best-practice guidance for digital goods, the VAT Compliance for SaaS and Digital Services in the EU guide covers evidence collection, threshold management, and compliant invoicing.

Adoption is growing rapidly because it reduces red tape. By the end of 2024, over 170,000 businesses were registered under the OSS frameworks. If you are a non-EU business, you can use the "Non-Union OSS" to achieve the same result. This consolidation is a massive time-saver compared to managing dozens of local tax registrations.

Managing Global VAT Obligations Outside the EU

While the EU offers a unified framework, the rest of the world operates on a country-by-country basis. Many nations have realized they were missing out on revenue from foreign digital giants and have updated their laws to capture tax on remote sales.

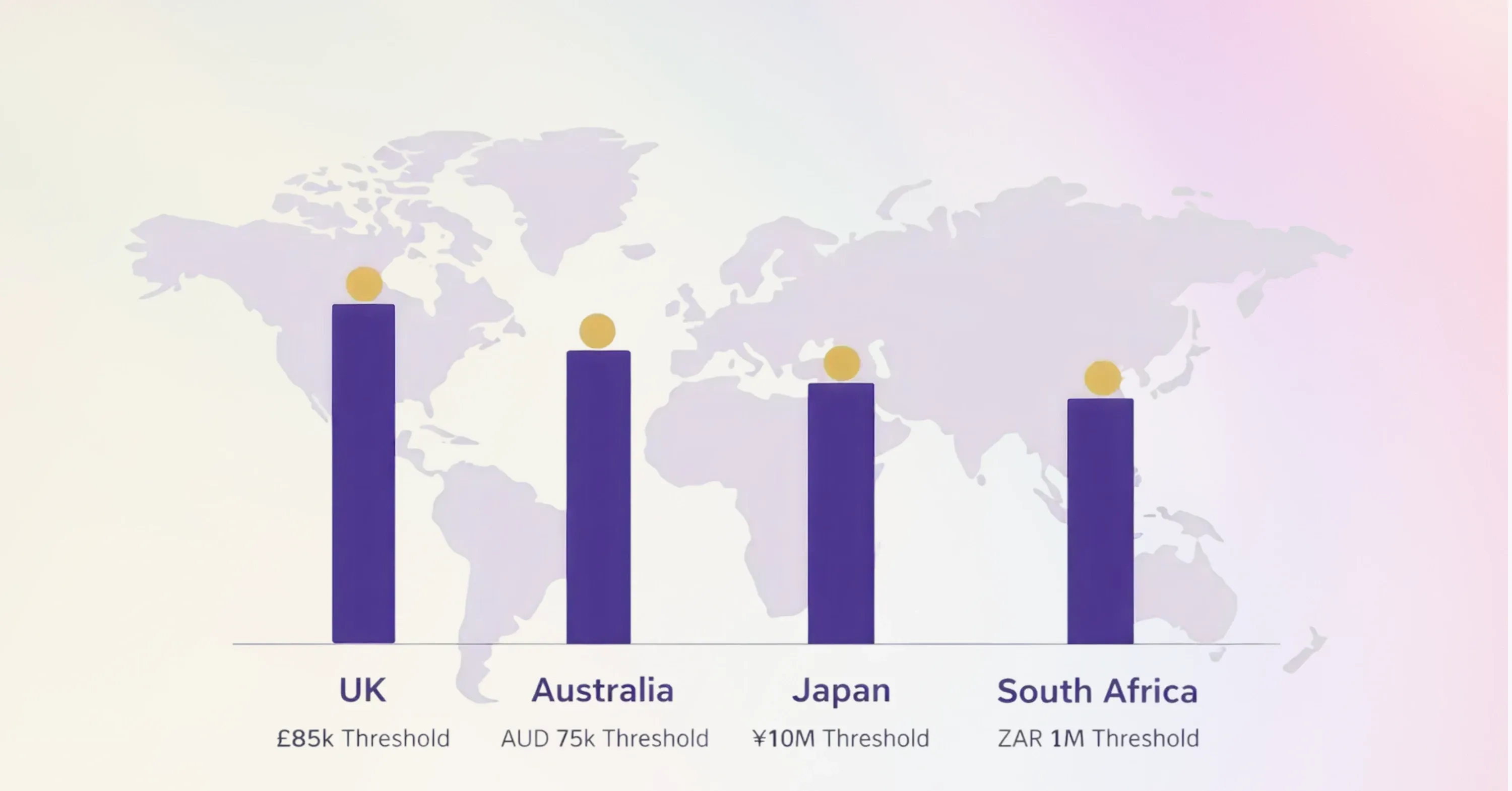

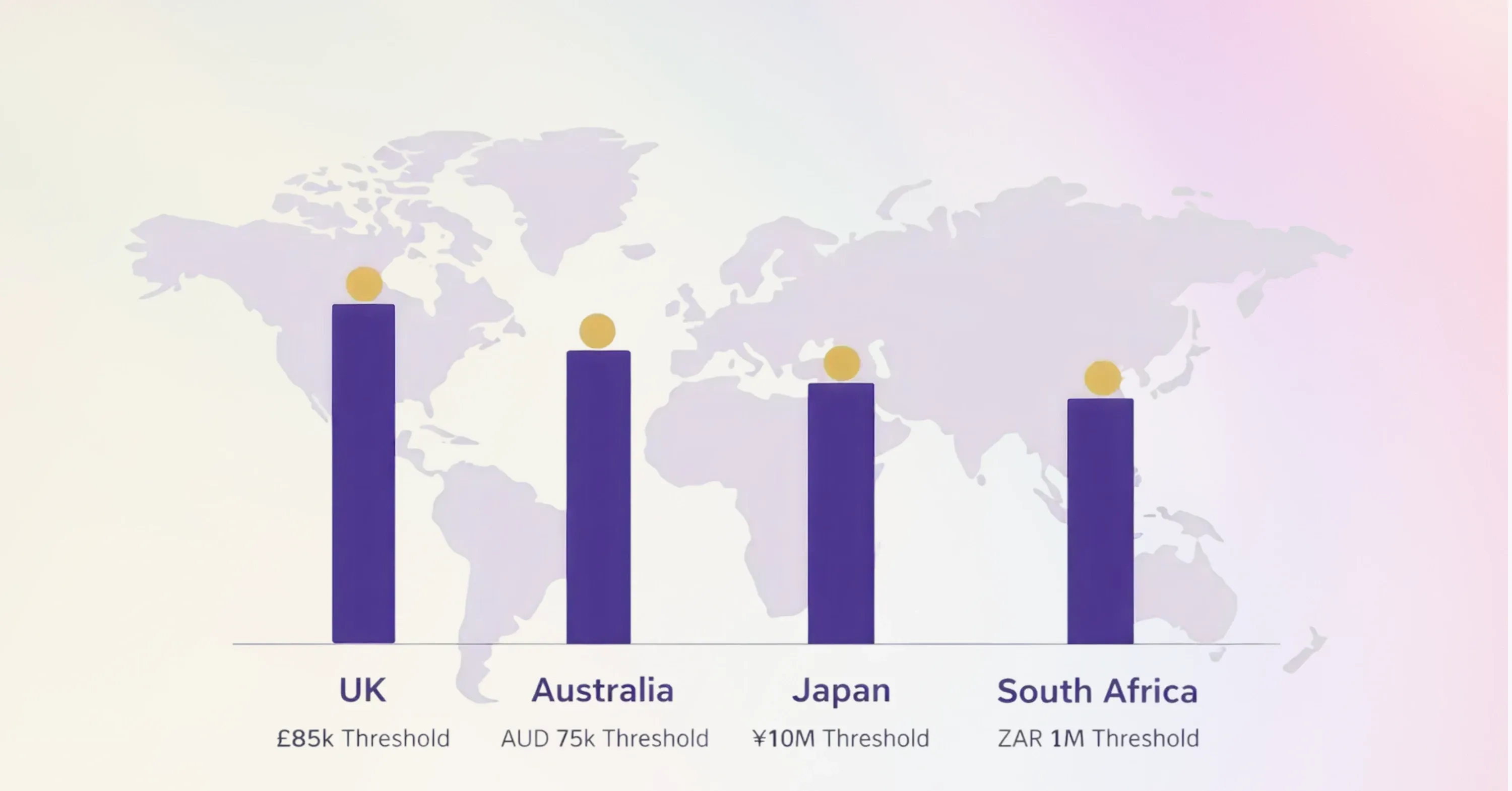

This trend is global. Reports indicate that 27 OECD countries have expanded their VAT regimes on online services to cover imports of low-value goods and digital downloads. Key markets like the UK, Australia, Japan, and South Africa now require foreign sellers to register and charge VAT once they surpass certain sales thresholds.

Navigating these diverse regulations requires careful monitoring:

-

Check Thresholds: Some countries have zero thresholds (register from the first sale), while others offer generous allowances.

-

Local Representation: Some jurisdictions require you to appoint a local fiscal representative to handle your taxes.

For a deeper dive into cross-border complexities and operational tips, refer to Cross-Border Tax Compliance: Tips for Global Businesses.

For companies facing this level of complexity, partnering with a specialized provider can prevent costly errors. 1stopVAT is a global VAT compliance provider that acts as a single point of contact for these obligations. Their team of certified tax specialists can manage registrations and filings across 100+ countries, ensuring you remain compliant as you expand into new territories.

Collecting Evidence of Customer Location

Since the tax rate depends on where the customer lives, you must prove their location to tax authorities. You cannot simply ask the customer "Where are you?" and trust the answer. Most regulations require you to collect two non-conflicting pieces of evidence that verify the customer's location.

Common data points used for location evidence include:

-

IP Address: The geographical location of the device used to make the purchase.

-

Billing Address: The address associated with the payment method (credit card or bank account).

-

Phone Country Code: The prefix of the phone number provided during checkout.

-

Country of the SIM card: Relevant for mobile purchases.

If your billing address data says "France" but the IP address says "USA," you have conflicting evidence. You must resolve this discrepancy before finalizing the tax calculation. Failing to store this data is a common compliance failure. If an audit occurs, the tax authority will ask to see the proof behind your tax decisions.

To understand the full requirements and best documentation techniques - including automation tips and sample evidence logs -see VAT Certificate Verification: Ensuring Compliance.

Preparing for Future Reporting Requirements

VAT compliance is not static; it is moving toward real-time transparency. Governments want to close the "VAT gap" (uncollected tax revenue) and are turning to digital reporting requirements to do it.

The European Union is pushing for modernization. Under reforms agreed in late 2024, VAT reporting obligations for cross-border transactions must be fully digital by 2030. This means the days of uploading PDFs or manual spreadsheets are numbered. Future compliance will require systems that can transmit transaction data electronically and in near real-time.

To discover how these coming changes will affect your operations, including details on new EU e-invoicing mandates, consult EU – Digital Reporting Regime after Parliament Approves Draft Legislation ViDA 2025.

To stay ahead, businesses should audit their current invoicing workflows. Ensure your systems can issue e-invoices and export data in structured formats like XML. Waiting until the deadline approaches creates unnecessary risk.

What is the "Place of Supply"?

Place of Supply is the legal term used to determine which country’s VAT rules apply to a transaction. For digital services sold to consumers (B2C), the place of supply is generally the location of the customer, meaning you must charge the VAT rate of the customer's country. For sales to businesses (B2B), the place of supply is often the business customer's location, typically triggering a reverse-charge mechanism where no VAT is collected by the seller.

Conclusion

Handling VAT for digital services requires a shift in mindset from local to global. By correctly classifying your services, leveraging simplification schemes like the OSS, and maintaining rigorous data on customer locations, you can turn a complex obligation into a manageable process.

Compliance is essential for sustainable growth. As you expand into new markets, keep a close watch on local thresholds and evolving reporting rules. With the right systems and support in place, you can confidently sell to the world without fear of unexpected tax bills.