VAT registration

VAT registration services

Behind every successful e-commerce business is a reliable infrastructure, including accounting and tax. In this tricky field, there are plenty of traps to avoid, from problems with tax authorities to your trading account getting suspended because you aren’t tax compliant.

We help you with all aspects of VAT and sales tax, from tax consultancy to complex solutions.

Need a personal consultation?

Book your time and we’ll address all your questions and concerns.

Get in touch for your Free consultation!How we can help you?

Value added tax (VAT), sales tax, and goods and services tax (GST) registration anywhere in the world.

Your VAT registration needs to follow local rules, which can be tricky to understand. E-commerce’s almost limitless popularity has made this easier, and lots of countries have made online registering for VAT possible, but procedures and rules differ from country to country.

Depending on customer type and the product you sell, this can get complicated very quickly and raise doubts on how to register for VAT. We help you keep track of all the necessary registrations, VAT register summaries and offer services tracking distance selling thresholds around the world.

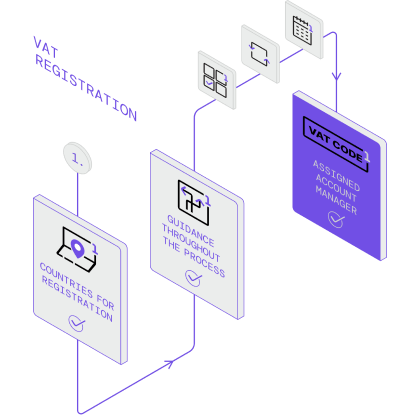

VAT Registration

How it works?

1. Consultancy and identification of the countries for registration.

2. Assigned onboarding manager who will lead you through the entire registration process:

2.1. You will receive the questionnaire and mandatory documents’ list for successful VAT registration.

2.2. You will receive constant updates about the registration process and status.

2.3. Once the VAT code is received, you will get all the details related to filing frequency, filing deadlines, first reporting period, etc.

3. You will be assigned an account manager who will be the key contact regarding VAT returns filing, taxation consultancy, etc.

Making online

VAT Registration easier

Ultimately, handling all of these tax-related tasks themselves is cost-inefficient for companies. Tracking your sales for tax compliance, searching for the appropriate tax representatives in each country is a hazardous, time consuming, and an insecure way of staying tax compliant worldwide. These, coupled with language barriers that hinder understanding and communication, are the main reasons why international businesses choose tax partners. A majority of countries nowadays have possibility to register for VAT online, therefore registrations can be executed very quickly. Once they is completed it is easy to find company in any VAT register check.

Other services

VAT registration is the first step towards VAT compliance. See how we can help you further.

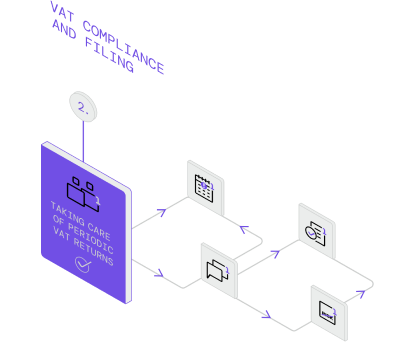

VAT Compliance and Filing

What it is?

Stay tax compliant across all your markets. It is becoming common practise to check if your partners are a VAT registered company and if you are reliable to start business with.

Beyond your registrations, you also need to navigate the local reporting requirements and systems to stay compliant. And this matters, since your business can be suspended if your filing is due or not VAT registered at all.

International businesses that surpass the VAT threshold in a specific country must register for VAT in that country and apply certain rate of VAT to the prices of their goods and services. This threshold is comprised of the total value of all taxable sales made throughout the tax year, however sales that are exempt from tax don’t count towards it.

How we can help you?

There are plenty of VAT registration check sites, however we take care of all checks and compliance. We are flexible and offer VAT and sales tax reporting based either on the data you submit to us in the form of files, or by using our own integrated solutions to automate the process.

We guarantee compliance in every market you hire us for.

Backing you up is a team of VAT/GST compliance experts that make sure you stay compliant as you lead your business into new markets. We do all the necessary tax paperwork, file the returns, register for VAT, check vat registration (if any) and distribute payments accordingly.

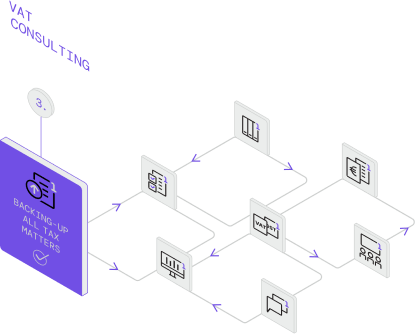

VAT Consulting

What it is?

VAT and GST are charged on most transactions all over the world. Depending on the region and the state, different tax rules & regulations are enforced, but as these legislations are subject to perpetual changes, staying VAT compliant has become increasingly challenging and time-consuming. Failing to do so often leads to penalties and other serious issues that significantly hinder the growth of companies.

Ensuring that your business complies with VAT regulations is vital because it can be quite complicated and challenging to meet all the necessary VAT requirements.

How we can help you?

Discover the best strategies for managing your VAT/GST set-up by consulting with our team of experts. Tax laws can be complex and ever-evolving, making it crucial to seek professional advice when entering new markets, modifying your current tax structure, or improving your operational procedures.

We provide complimentary consultation on VAT registration. Our experienced consultants will guide you through the process, ensuring you understand your obligations and providing insights on optimizing your VAT/GST practices.