What You’ll Learn

This guide spells out the entire journey, from selecting the right specialist to handling post-filing notices. You’ll see:

- Types of professionals involved, and how their skills affect accuracy and speed

- Digital intake tools that make collaboration painless

- Key checklists that founders and SMEs can reuse every year

- How multi-country filings differ and why experienced pros matter there

You’ll learn what a first-class engagement looks like and whether outsourcing is worth it for your business.

What are professional tax filing services?

Professional tax filing services are end-to-end engagements where certified accountants or tax advisors collect your financial data, prepare compliant returns, submit them to every relevant authority, and provide follow-up support for audits or notices, often using secure digital portals for real-time collaboration.

Step 1: Match Your Needs to the Right Professional Tax Filing Team

Before entrusting your sensitive financial information to any firm, the crucial first step is to match your specific tax filing needs to the right professional team. This involves a thoughtful assessment of your situation, whether you require basic individual tax preparation, specialized handling of complex business structures, international tax matters, or estate planning.

Choosing blindly is risky. Different professionals focus on different areas, fees, and turnaround speeds.

Key roles you may want to hire:

- Certified Public Accountant (CPA): deep compliance knowledge, ideal for complex or cross-border cases

- Enrolled Agent (EA): licensed federally in the US, cost-effective for domestic returns

- Chartered Tax Adviser or equivalent in the UK/EU: best for multi-country structuring

- Specialized software firms that blend automation with human review

For founders expanding abroad, a team familiar with both domestic and international standards keeps errors low and speeds processing.

Let’s dive deeper into how end-to-end expert support drives risk reduction

Quick checklist:

- Verify licenses and recent continuing education credits.

- Ask how they uphold accuracy: peer review? AI checks? Both?

- Confirm expected speed: draft return within X days of receiving documents.

- Request client references matching your industry size.

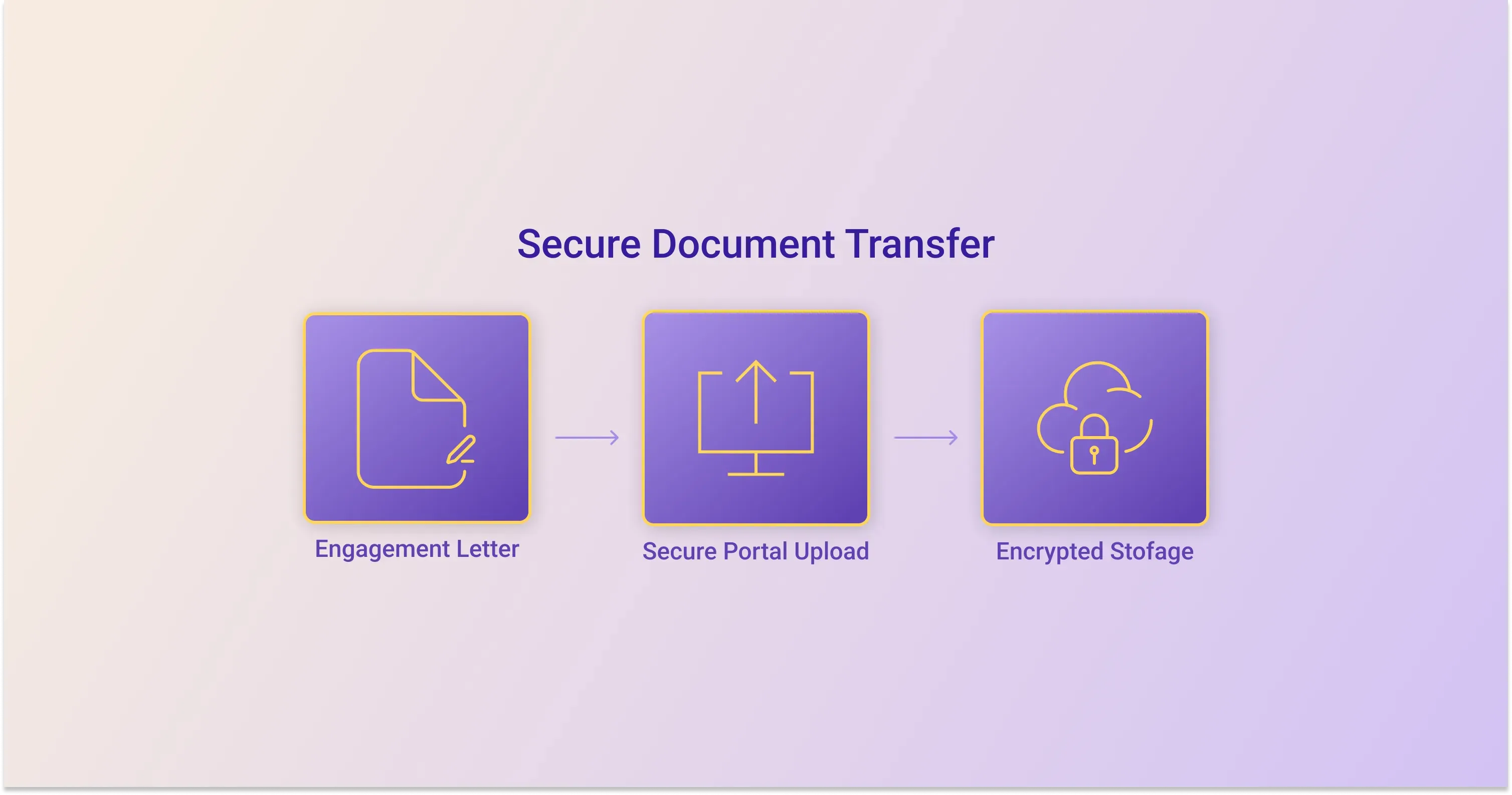

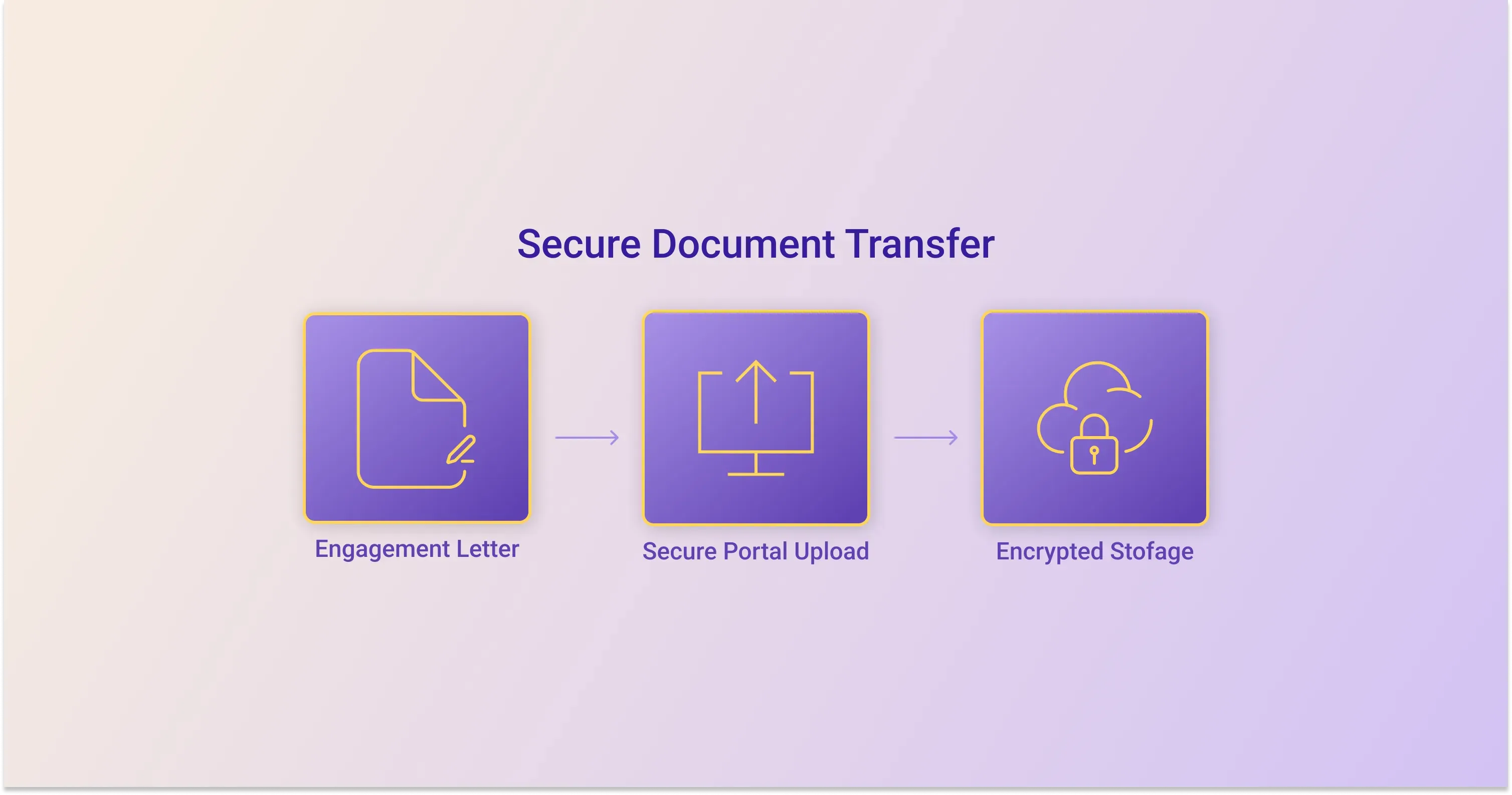

Step 2: Kick-Off Call and Secure Document Transfer

Even before numbers are crunched, data security matters. The second step in working with your chosen professional tax team focuses on launching the engagement and establishing a secure, efficient flow of necessary financial data.

- Sign an engagement letter outlining scope, timelines, and fee structure.

- Receive a link to a secure portal or encrypted drive.

- Upload prior-year returns, trial balance, bank statements, payroll data, and any country-specific forms.

Many firms now embed chatbots inside their portals. A sign of quality: More than 60% of tax administrations now offer virtual digital assistants for taxpayer inquiries, so your advisors should feel comfortable using similar tech to answer quick questions.

Step 3: Data Validation and Initial Review

Accuracy is their reputation. Expect pros to run multiple passes. Once your professional tax team has received all your documents, the crucial next phase is Data Validation and Initial Review. This step ensures the accuracy and completeness of the financial information, laying a solid foundation for error-free tax preparation.

What’s going on behind the scenes

- Software imports your numbers, flags gaps or anomalies.

- Human reviewers cross-check high-risk items, e.g., foreign tax credits or R&D claims.

- You receive a short list of questions to clarify.

Mistakes cost real money. Across Europe, businesses face annual tax compliance costs averaging around 1.9% of their turnover.

Tight validation keeps your share from creeping higher? Here’s our action-driven checklist for your team.

Step 4: Using Online Tax Filing Help for Faster Drafts

In today’s burning tax environment, the key to efficiency lies in empowering the professional team to generate a rapid, accurate first draft of your return by leveraging advanced software and client-side data solutions. This step transforms the labor-intensive process of manual data entry into a high-speed, automated workflow.

Speed boosters

- Auto-sync with bookkeeping apps, so no manual CSV uploads

- Document OCR that captures values from scanned receipts

- Appointment scheduler that shows preparer availability in your time zone

- Digital signature workflows for forms like 8879 or country equivalents

SMEs often run lean, yet they feel compliance pain the most: SMEs spend about 2.5% of turnover on tax compliance, compared to 0.7% for large enterprises.

Online tax filing cuts this overhead. Get our practical advice on streamlining your tax tech stack and digital submission.

Troubleshooting stalls

- Missing API connections: reconnect and push a manual refresh.

- Large file errors: compress PDFs below 15 MB or split uploads.

- Wrong access level: ask admin to grant “edit” rights, not “view only”.

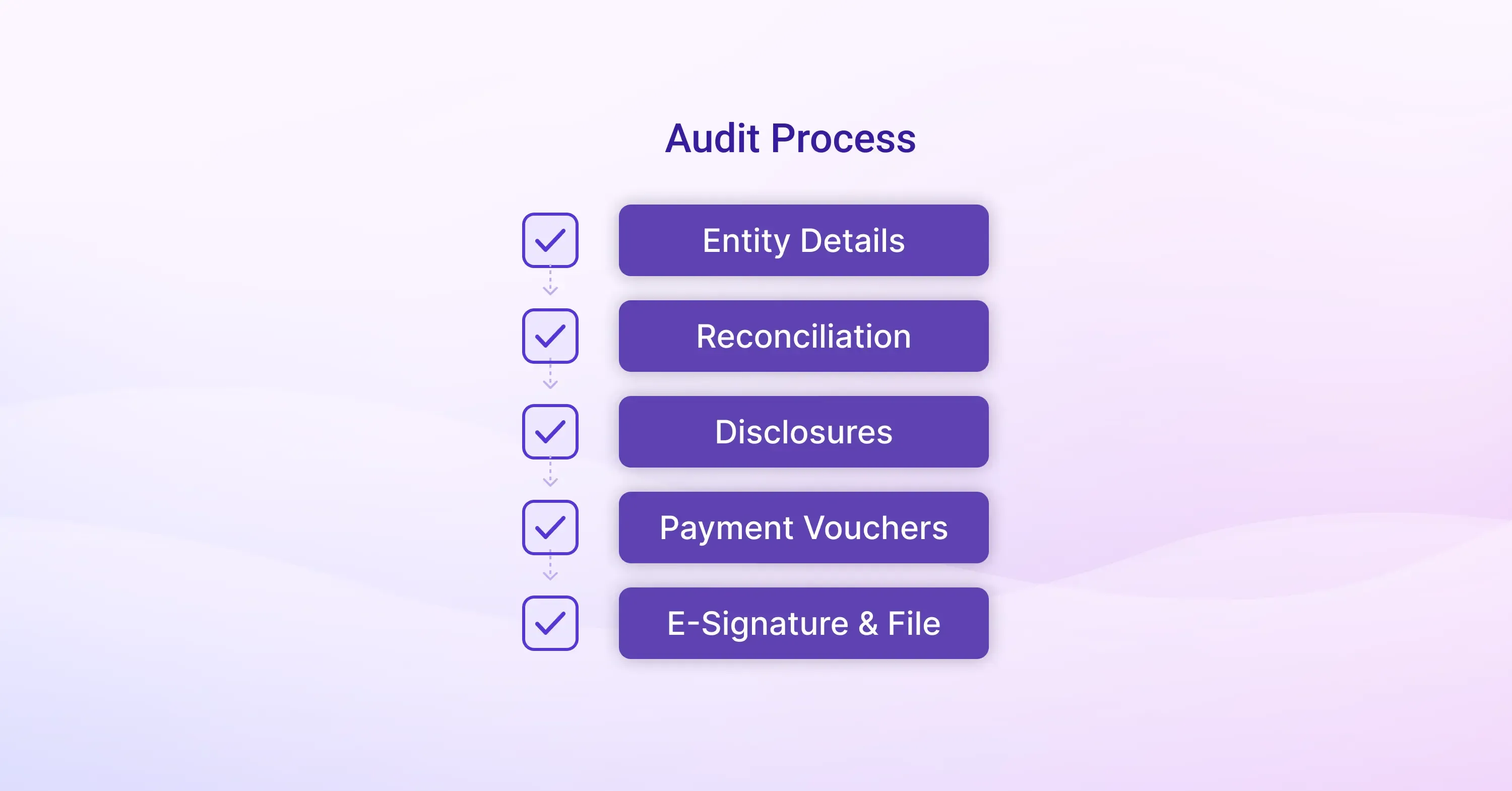

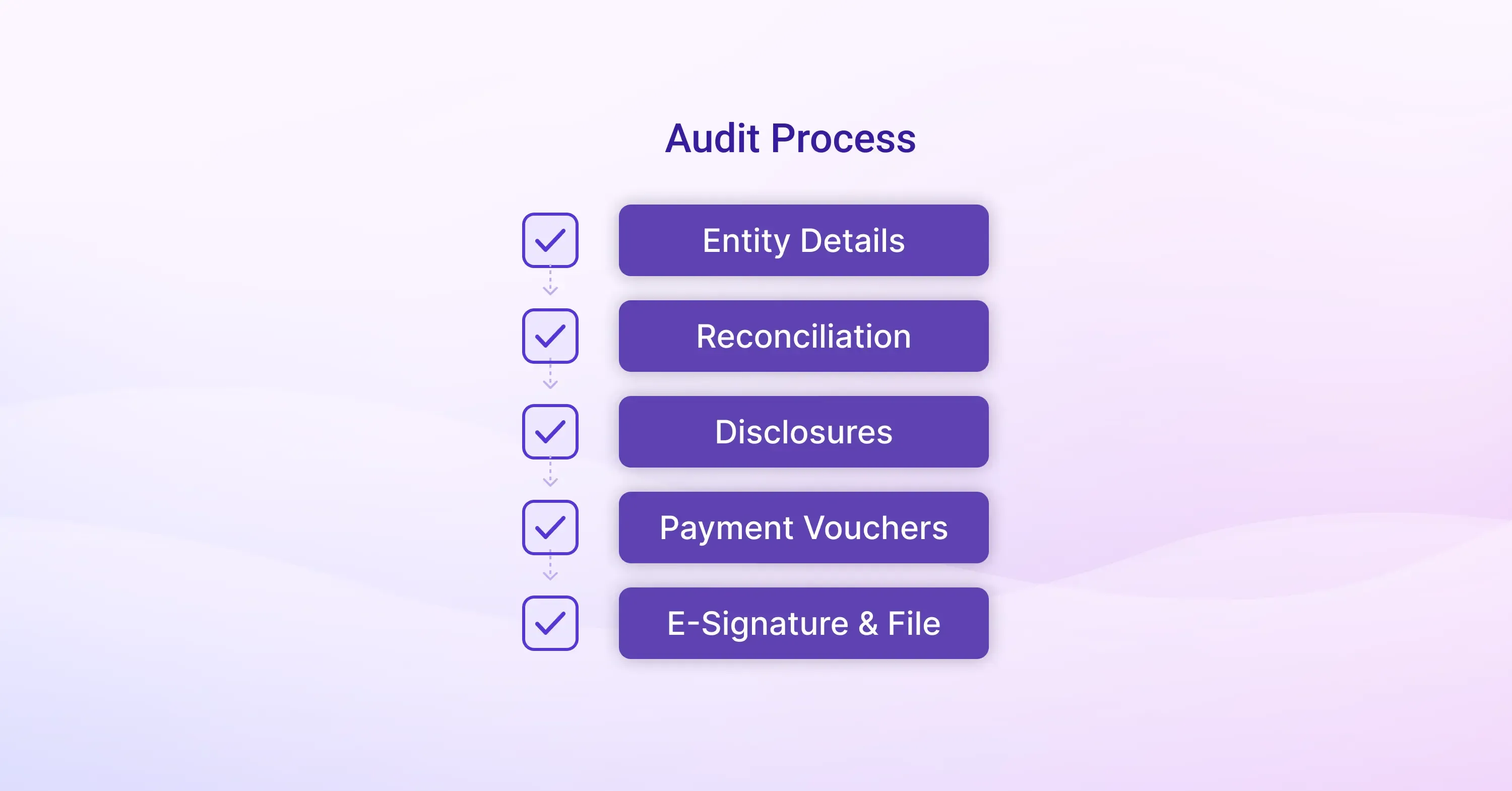

Step 5: Final Review, Sign-Off, and Submission

A second partner review is common on complex engagements. Following the preparation of the accurate draft return, the process moves into its final, most critical stage: Final Review, Sign-Off, and Submission.

This step transitions the completed tax return from a draft document into a legally filed return, ensuring both parties confirm its accuracy before transmitting it to the tax authorities.

Here’s a clear checklist:

- Confirm entity details: legal name, tax ID, address

- Reconcile taxable income to financial statements, attach schedules

- Review any multi-country disclosures (BEPS, DAC7, Form 5471)

- Generate payment vouchers or direct debit instructions

- Obtain your e-signature and file before the statutory deadline

Companies collectively pour €204 billion per year into compliance. A meticulous final review keeps you from adding avoidable interest and penalty fees to that total.

Let’s now dive deeper into effective cross-border strategies

Step 6: Payment, Proof of Filing, and Record Storage

Once the return has been officially submitted and accepted, the final phase focuses on closing out the tax cycle by handling the necessary financial transactions and establishing a robust record-keeping system.

Final diligence transitions the focus from the act of filing to the long-term maintenance of your financial and compliance records, ensuring you are fully prepared for the next tax year and any future inquiries

Once the return is accepted:

- Download official “accepted” acknowledgments. Save both PDF and XML files.

- Schedule any installment payments.

- Archive the workpaper binder. Most firms store records for seven years and share a zipped copy.

Multi-country tip

Store each jurisdiction’s receipt separately. Customs authorities may request proof of tax residency or payments when evaluating GST or VAT refunds.

Step 7: Post-Filing Support and Audit Defense

The final step extends beyond the submission date, covering the crucial period where the return is processed and providing protection against future scrutiny:

- Monitor tax authority inboxes for notices.

- Respond within the statutory window, often 15–30 days.

- Provide additional schedules, recalculations, or appeal letters.

Regimes are growing more digital. 80% of accounting professionals identified Making Tax Digital for Income Tax as the industry’s biggest challenge, and many believe audits will become data-driven.

Here are deeper insights into audit preparedness and the value of an expert partner

Concluson

From choosing the right expert to leveraging lightning-fast portals, each step above aims for two outcomes: accuracy and speed. With growing digital demands and costly compliance burdens, the right partner turns into a smart risk management practice. Quote a deeper understanding of cross-border tax and audit risk management