Navigate Cross-Border Tax and Accounting with Confidence

As your SME expands internationally, every new entity, invoice, and transaction can trigger unexpected tax obligations - from indirect taxes like VAT and GST to direct tax filings and transfer pricing. Without a clear structure, finance teams risk compliance gaps, inefficiencies, and audit exposure. This guide offers a 7-step framework to bring order to the chaos - mapping out practical actions to simplify cross-border tax, align internal processes, and support sustainable international growth.

Step 1: Map Your Entity Footprint and Value Flows

Before exploring cross-border tax solutions, start with a clear operational map. Poor visibility into legal entities and value flows is a major risk factor for compliance gaps.

- List each legal entity with registration numbers and local tax years. Misaligned fiscal years can delay reporting and complicate consolidation.

- Diagram money, goods, and data flows between group companies - especially in e-commerce. Include countries, incoterms, and payment currencies.

- Flag potential permanent establishments (PEs) - warehouses or remote employees may trigger unexpected tax liabilities.

- Log intercompany transactions early to support future transfer pricing compliance.

According to a Eurobarometer study, nearly 30% of SMEs cite unclear rules and compliance complexity as major hurdles when expanding cross-border.

Cross-Border Tax and Accounting Guide

This cross-border tax and accounting guide helps SMEs manage VAT/GST, direct taxes, and multi-country reporting with clarity and control. Use a simple heat map to visualize exposure - red for two or more taxes, orange for one, green for exempt. For a practical breakdown, check the VAT Compliance Checklist for Startups and Small Businesses.

Step 2: Nail Indirect Taxes Early (VAT, GST, Sales Tax)

Indirect taxes shift fast- and ignoring them can lead to major compliance issues. Centralizing your VAT/GST processes early is essential for effective cross-border tax & accounting.

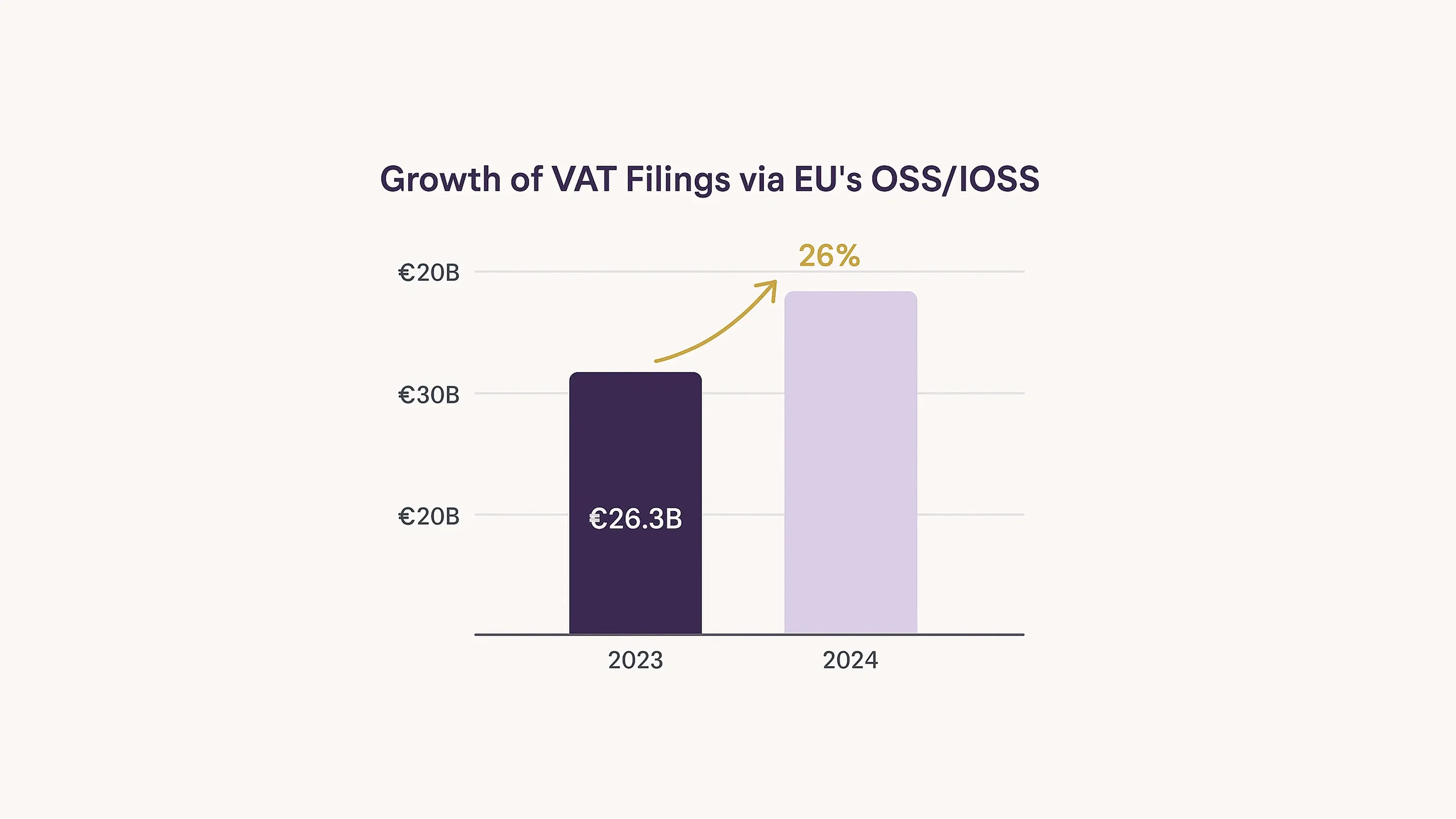

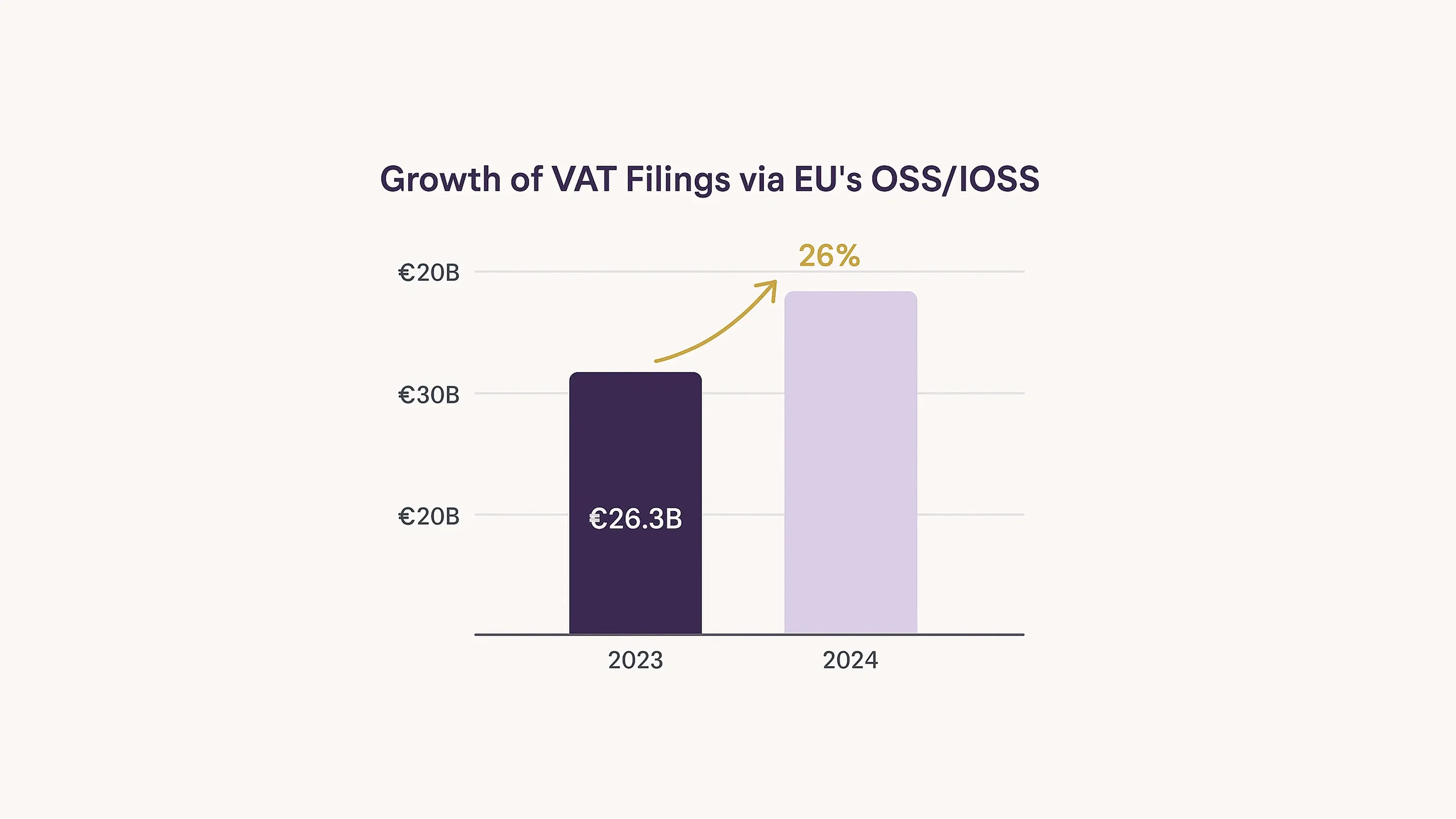

- Rapid growth in VAT filings: In 2023, businesses declared €26.3 billion in VAT via the EU’s OSS/IOSS schemes. This figure jumped to €33 billion in 2024 - a 26% increase, per the European Commission’s official report.

- OSS/IOSS is scaling fast: By mid-2024, over 170,000 traders had registered across schemes, including 153,550 in Union OSS - up 16% from 2023 European Commission.

- Even small sales count: A £1 parcel shipped from the UK to France may trigger French VAT if thresholds are crossed.

- Pro tip: Use tax-inclusive pricing to reduce cart abandonment and post-sale disputes on consumer platforms.

For SME-friendly registration strategies and simplified reporting tools, explore the EU VAT rules for small businesses. For strategies on indirect tax registration and staying compliant as an SME, read the EU – Simplified Reporting Under Domestic and Cross-Border SME Scheme.

Troubleshooting common VAT errors

- Wrong currency conversion: lock FX rates on invoice date.

- Mixed VAT rates in one order: split the invoice lines for clarity.

- Import VAT paid twice: reconcile customs broker statements against IOSS filings monthly.

To learn more about OSS and IOSS processes, see the One-Stop Shop Schemes – Brief Overview.

Step 3: Harmonise Direct Tax Reporting Calendars

Direct tax deadlines vary widely across jurisdictions - from March to December - creating serious challenges for international reporting. For effective cross-border tax & accounting, aligning calendars is key.

- Build a unified calendar tracking local filing deadlines and internal draft review dates across all entities.

- Align fiscal year-ends where allowed, to simplify consolidation and reduce audit adjustments.

- Automate reminders to prevent late filings that can trigger penalties or loss of simplified regimes.

- Leverage cross-border tax solutions to centralize deadline tracking and ensure compliance across jurisdictions.

As the OECD notes, inconsistent tax periods and reporting cycles increase the risk of misstatements and delays in global tax reporting.

Example-Spain subsidiary inside a UK group

Spain allows a 12-month fiscal year that doesn't have to follow the calendar year. A UK group with a December year-end may choose a March year-end for its Spanish subsidiary, but this can delay consolidation and require additional adjustments. Under IFRS, reporting gaps of up to three months are permitted, but they still increase reconciliation workload.

Step 4: Consolidate Transfer Pricing and Intercompany Charges

Tax authorities closely examine cross-border intercompany transactions, making consistent documentation essential for compliance.

- Follow the OECD’s master file/local file framework to meet global transfer pricing standards.

- Refresh comparables every 12–24 months to avoid using outdated benchmarks that raise audit flags.

- Use consistent FX rates for royalties, management fees, and internal loans to reduce translation issues.

- These steps are vital in any effective Cross-border tax and accounting guide to reduce audit risk and maintain policy alignment.

For expert guidance on aligning your policies and minimising audit risk, try VAT Consulting for International Businesses.

Margin Variance Check

If your EBIT margins diverge substantially from comparable benchmarks, it may trigger tax authority scrutiny. It’s prudent to compile a defense file or consider pricing adjustments before year-end to mitigate risk.

Step 5: Automate Data Collection and Reconciliation

Manual spreadsheets struggle with multi-country complexity. To strengthen your cross-border tax & accounting framework:

- Integrate your systems: Link ERP, e-commerce platforms, and bank feeds with a tax engine to centralize data and reduce errors.

- Schedule frequent reconciliations, ideally nightly, so anomalies emerge while transactions are still fresh.

- Maintain complete digital audit trails - line-level data is required for compliance with EU SAF-T and France’s FEC standards.

For more on automating VAT compliance, consult industry-respected resources like Tax Technology Tools – VAT Compliance Automation.

Choosing tools

When evaluating cross-border tax solutions, prioritize platforms that support multi-currency and multi-language ledgers, automatically maintain tax rate libraries, and integrate with your existing systems. Opting for a subscription-based solution is often more cost-effective and scalable than building and maintaining custom tax tables in-house.

Step 6: Leverage Cross-border Tax Solutions and Experts

Even the most advanced tax technology should be complemented by professional expertise. OECD guidance stresses the importance of qualified tax professionals in ensuring compliance across jurisdictions.

- Engage reputable global or local tax advisory firms - professional advisers can handle complex cross-border tasks, such as acting as an IOSS intermediary or managing Canadian NRI registrations, where in-depth local knowledge is essential.

- Consider fixed-fee agreements - while not mandated, fixed-fee packages can improve budget predictability and are a common practice among multinational SMEs.

- Review service agreements regularly - OECD highlights that periodic evaluation of service provider performance helps ensure value and compliance, though it does not set a specific review frequency. Many businesses choose quarterly or semi-annual reviews to align with transaction volume changes.

Step 7: Monitor Regulatory Change and Information Exchange

According to the OECD’s Automatic Exchange of Information 2024 report, 134 million financial accounts are now automatically exchanged across 111 jurisdictions (OECD AEOI). This unprecedented transparency means tax authorities can quickly identify inconsistencies in cross-border reporting.

How to stay compliant:

- Subscribe to tax authority updates in your key markets.

- Record all auditor requests - they often signal upcoming rule changes.

- Conduct bi-annual compliance checks, testing sample transactions against current rules.

- Track e-invoicing and digital reporting requirements to avoid last-minute compliance gaps.

Stay ahead of worldwide compliance changes and digital reporting obligations in Global Trend – Electronic Invoicing and Digital Tax Reporting.

Prepare for pillar-two and e-invoicing

Pillar Two’s 15% minimum tax and expanding e-invoicing in countries like Italy, France, and Poland will raise data demands - update your ledgers now to stay compliant.

Conclusion

Cross-border tax & accounting isn’t a guessing game. Map your flows, secure indirect taxes, align reporting calendars, document transfer pricing, automate data work, work with the right experts, and stay ahead of regulatory changes. Follow these seven steps, and you’ll spend less time racing deadlines - and more time driving your SME toward confident, profitable international growth.