Article overview

We’ll unpack the real-world cost of VAT mistakes, backed by fresh EU and OECD data. Next, we will provide a side-by-side look at handling VAT on your own versus using professional VAT advisory services. You’ll learn about the consultant’s toolkit: registration, audits, training, and collaboration benefits. Finally, we’ll show you how seasoned advisers soothe the path to global growth and outline the first steps toward a stress-free engagement.

Why VAT compliance is so complex

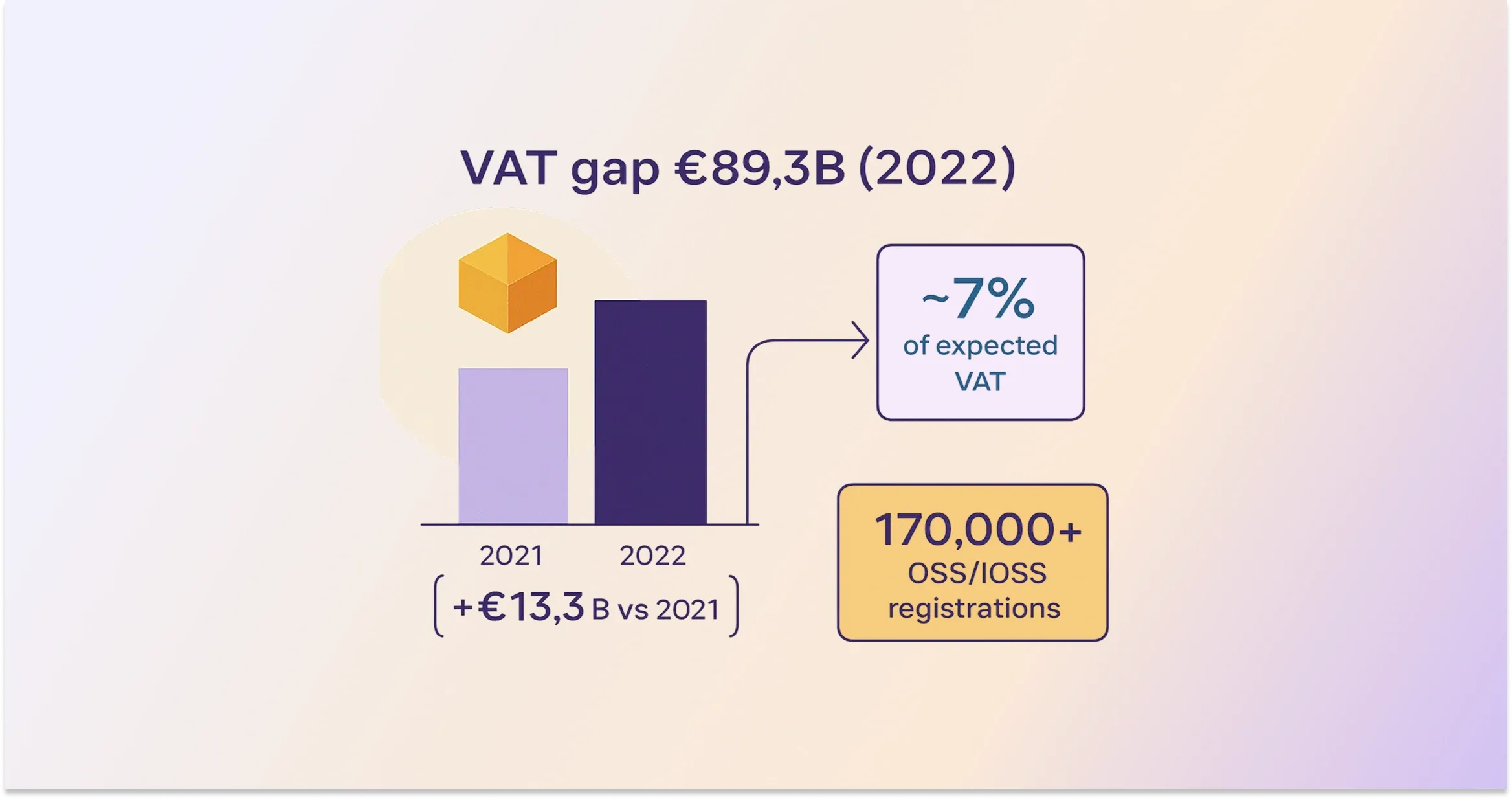

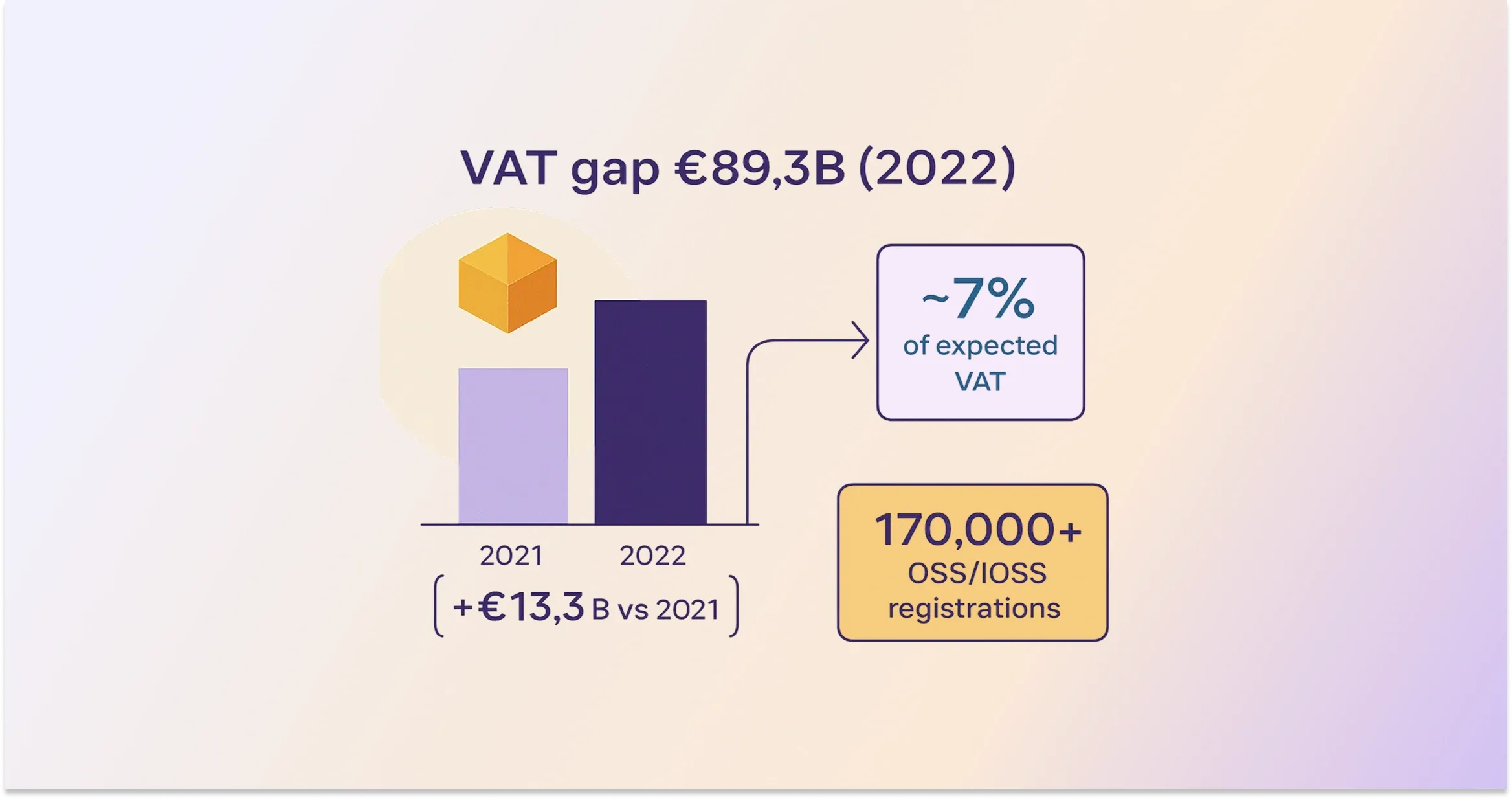

The scope of the problem is clear: in 2022 alone, EU businesses lost a staggering €159 million in VAT penalties. Despite using digital tools, the EU still has a VAT compliance gap, which is the difference between expected and actual VAT revenue. In 2022, the gap constituted 7% due to systematic errors, fraud, and carelessness that led to considerable financial losses.

Why the gap persists:

-

VAT laws are national, while supply chains are global. A single sale can trigger reporting in several countries.

-

Real-time e-invoicing and digital reporting mean errors surface quickly, and penalties follow.

-

Thresholds, reduced rates, and exemptions vary wildly. A zero-rated product in one country may be taxed at 25 % just across the border.

-

Governments keep tightening the net: by the end of 2024, over 170,000 businesses had already registered for the EU’s OSS/IOSS to keep up with new rules.

VAT compliance assumes registrations, accurate invoicing, periodic returns, and timely tax payments to ensure that a business charges, collects, and remits value-added tax as per jurisdiction requirements. Failure to comply leads to penalties, interest, audits, and blocked market access.

Hidden costs of getting it wrong:

-

Late-payment interest compounds monthly.

-

Reputation damage when tax authorities publish defaulters.

-

Seized inventory at customs due to invalid VAT numbers.

-

Lost management time fixing past errors instead of growing revenue.

UK firms offer a cautionary tale: unpaid VAT liabilities averaged £12 billion per month in Q1 2025.

DIY vs professional VAT advisory services

Doing it alone can look cheaper on paper until the first audit letter arrives. Here is a quick comparison.

In-house or DIY approach:

-

Requires constant monitoring of legislative updates in every target market.

-

Heavy reliance on generic accounting software that may miss local nuances.

-

Internal staff must juggle compliance with their day-to-day roles.

-

Risk of knowledge gaps when employees leave.

Working with VAT consultants:

-

Access to specialists who handle tax law daily, not occasionally.

-

Pre-defined workflows and checklists cut filing times dramatically.

-

Direct liaison with tax authorities smooths audits and data requests.

-

Scalable support as you enter new markets or product lines.

Want to hire professionals to help you with cross-border VAT recovery scenarios? Check our VAT Consulting for International Businesses.

Cost perspective

Consultants spread their expertise over a vast array of clients, so you pay only for the hours or projects you need.

-

Penalties avoided often exceed the fee, especially when foreign surcharges reach 200 % of the unpaid tax.

-

Predictable retainer models help to forecast cash flow.

Core VAT consultancy services explained

A reputable consultancy is beyond mere form-filling.

Advisory & planning:

-

Map supply chains to determine where you must register.

-

Optimise pricing to keep VAT neutral for B2C and B2B customers.

-

Assess whether voluntary registration has unlocked input credits.

Compliance health checks and audits:

-

Review historical returns to spot under-claimed input VAT.

-

Check invoice wording, currency rounding, and exchange-rate usage.

-

Recommend remedial filings before tax authorities intervene.

Our Global Sales Tax Solutions & VAT Compliance Guide digs deeper into effective global audit strategies.

Training & process design:

-

Tailor workshops for finance teams on local rules and OSS/IOSS workflows.

-

Draft SOPs so staff know when to charge local VAT or reclaim foreign VAT.

-

Embed controls, such as VAT number validation, into ERP systems.

Ongoing filing and representation:

-

Prepare and submit periodic returns, Intrastat, and SAF-T files.

-

Reconcile e-commerce platform data with accounting records.

-

Act as a fiscal representative where the law mandates a local agent.

Technology enablement:

-

Integrate API-driven reporting tools that feed data directly to tax portals.

-

Automate reminders for payment due dates across jurisdictions.

-

Provide dashboard tracking of VAT refunds & reclaims in real time.

Tax Technology Tools – VAT Compliance Automation further explains the role of automation in VAT and indirect tax compliance.

Benefits of partnering with VAT experts

Consumption taxes make a considerable share in national budgets, 29.6 % of total tax revenues in OECD countries. While national governments cannot afford leakage, enforcement pressures will only tighten.

Here’s how VAT consultancy will keep your business safe and profitable:

Peace of mind: VAT consultants will detect gray areas for you

Faster market entry: new VAT numbers and OSS/IOSS registrations are often issued sooner.

Cash-flow boosts: reclaim overlooked input VAT and prevent over-payments.

Audit readiness: structured documentation slashes disruption during inspections.

Competitive edge: customers appreciate precise invoicing and transparent tax treatment.

In the majority of OECD members, VAT accounts for over 20% of government revenue, so compliance is critical.

Supporting international tax compliance during business expansion

Cross-border e-commerce magnifies VAT obligations. The EU’s one-stop-shop schemes collected €33 billion in 2024 alone. For internationally operating sellers, understanding the distinctions between various VAT schemes is vital.

How VAT consultants add value:

-

Translate local rules into plain-English action points.

-

Coordinate warehouse moves or 3PL arrangements so tax registrations follow stock.

-

Calculate the place-of-supply (POS) for digital services, often a headache for SaaS providers.

-

Advise on invoicing currencies to simplify FX gains and losses.

Red flags during global rollout:

-

Import VAT that becomes a sunk cost if you lack a local registration.

-

Distance-selling thresholds breached without realising it.

-

Split payments or real-time reporting in ERPs-unsupported regimes.

Ready to simplify your VAT?

1stopVAT aligns seasoned tax lawyers, chartered accountants, and smart software to keep your filings accurate and timely.

Whether you need a one-off health check or a fully outsourced compliance model, our team will tailor a plan that scales with your global ambitions:

-

Single point of contact covering 30+ jurisdictions.

-

Transparent pricing: no hidden costs.

-

Secure client portal for document exchange and status tracking.

Get a Free Quote

Conclusion

VAT fuels public budgets, so that’s why tax authorities are watching it closely. Potential complexities arise with every new market, product line, and reporting mandate. Professional VAT compliance & consultancy converts that complexity into a manageable routine to save you money, free staff time, and build trust with stakeholders. Evaluate your current processes, compare them with the actionable insights above, and invest in expert advice.