Global sales tax solutions

Global tax rules can feel overwhelming, especially when you’ve got a business spanning multiple countries. Yet, knowing how to handle VAT, GST, and worldwide sales tax compliance can be the difference between smooth operations and hefty fines. This guide walks you through a practical method of managing taxes across borders using global sales tax solutions, so you can focus on growth instead of guesswork. With cloud-based tax platforms comprising about 70% of the market and on-premises software at 30%, it’s clear that technology offers a streamlined path for international sales tax services. A recent forecast from prnewswire.com suggests the global sales tax software market could reach $17.2 billion by 2033. Below, you’ll find how to get in on that wave.

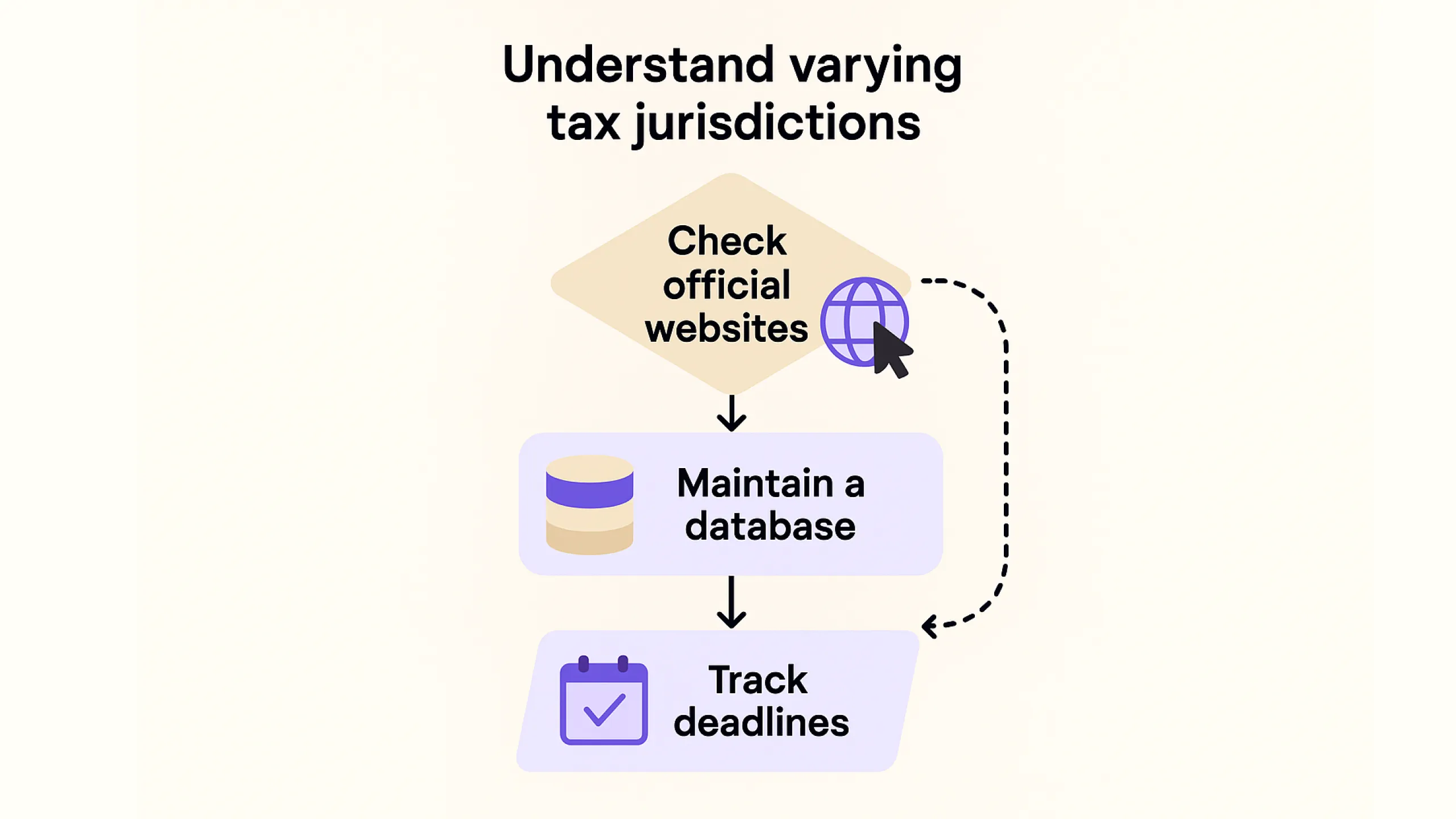

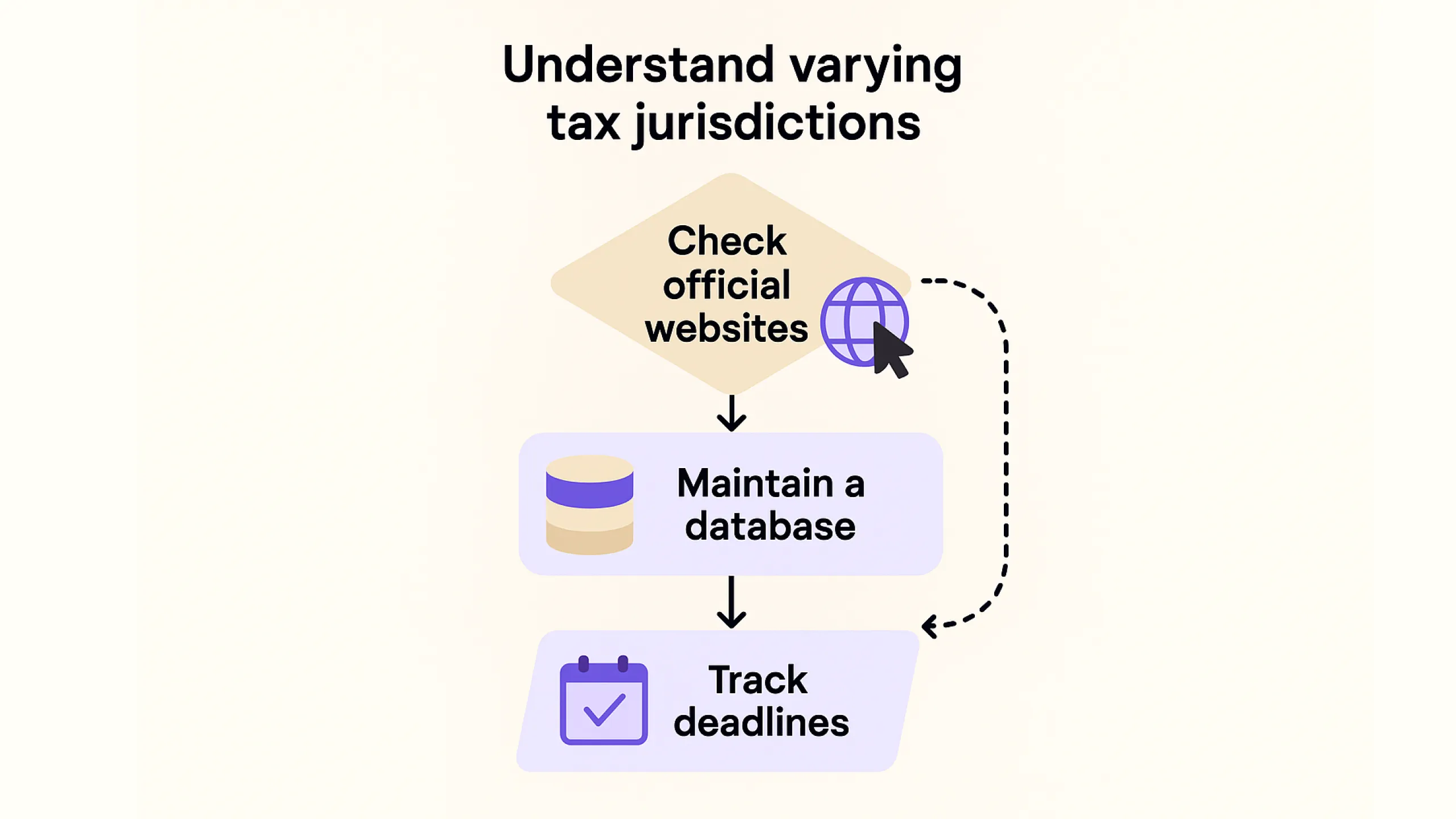

Step 1: Understand Varying Tax Jurisdictions

Worldwide sales tax compliance starts with knowing the rules in each region. Regulations can shift without warning, especially for VAT and GST thresholds or digital services.

That’s why regular checks are vital - they help you avoid non-compliance and stay prepared as you expand into new markets.

- Check official government websites for the latest thresholds and rates (e.g., OECD Tax Policy, EU Taxation and Customs)

- Maintain a spreadsheet or simple database of each location’s requirements

- Track paperwork deadlines to avoid late filing fees or interest charges

As you expand internationally, be mindful of rules related to cross-border sales. If you're planning to sell in North America, check regulatory details like those discussed in Sales Across the US and Canada Border: Do Sales and Duty Taxes apply?

Avoid Surprises by Staying Informed

It helps to sign up for alerts from tax agencies or subscribe to independent tax compliance newsletters and regulatory feeds. Platforms like OECD Tax Updates, EU Taxation News, or reputable accounting networks often share timely updates. That way, you can adjust quickly and stay compliant.

Step 2: Choose the Right Sales Tax Software

Selecting tools under the umbrella of global sales tax solutions simplifies your workflow. According to a 2025 survey from thebusinessresearchcompany.com, the sales tax software market is on track to expand from $9.61 billion in 2024 to $10.68 billion by 2025.

- Compare features such as consistent currency conversions, region-based tax calculations, and real-time tax rate updates

- Look for integration with your existing e-commerce platforms and financial software

- Decide between cloud-based or on-premises solutions, noting that cloud-based systems currently lead with 70% market share

If you want to dig deeper into choosing the right automation options for VAT/sales tax, the overview at Tax Technology Tools – VAT Compliance Automation is a helpful read.

Test-Run Your Choice

Most providers offer free trials. A quick test can reveal whether the interface feels intuitive and if it speeds up or complicates your daily tasks.

Step 3: Set Clear Accounting Processes

Once you’ve chosen robust international sales tax services, outline your accounting workflow. A well-structured process ensures fewer surprises when filing returns.

- Use a universal chart of accounts that matches standard global categories

- Assign a unique code to each location to mark transactions and keep them organized

- Maintain separate files for each region’s tax forms and confirmations

For customized guidance suited to international operations, VAT Consulting for International Businesses offers insights and strategies tailored to your needs.

Train Your Team

Even the best tax solution won’t work unless your team knows how to use it. Set up short training sessions or provide documentation to ensure smooth onboarding and prevent user errors.

Step 4: Classify Products and Services Accurately

Different merchandise categories often have different tax rates. For instance, digital goods might be taxed at one rate, while physical items could be at another.

- Document each product or service category in your system

- Match each category with the local rates in the regions you serve

- Watch out for regional exemptions or zero-rated items

Product classification can be especially critical for digital services. If you provide software or SaaS, explore the nuances in Navigating SaaS Taxation: Key Facts for Businesses.

What Product Classification Means

Product classification tags each item or service with a precise tax category. This helps your software auto-calculate the correct rate, reducing the chance of tax errors.

Step 5: Automate Tax Calculation and Collection

Manual data entry is prone to errors, especially if you sell across many borders. Automation is a lifesaver for any company using international sales tax services.

- Link your e-commerce site directly to your chosen global sales tax solution

- Program the system to update local rate changes instantly

- Customize error alerts whenever a tax mismatch occurs

A Glimpse into Automation Benefits

Automating your calculations can help you meet filing deadlines sooner, prevent costly mistakes, and give you clearer financial visibility. As a bonus, automation often cuts the time you’d spend checking calculations by hand.

Step 6: Prepare and File Returns Timely

Each region has a specific filing schedule - monthly, quarterly, or annually. Delaying returns can pile on late penalties, so promptness is everything.

- Mark each region’s filing deadline on your project calendar

- Check data accuracy in your software before filing

- Set reminders two weeks before each deadline for a final review

For the latest on trends like e-filing and digital tax reporting, see Global Trend – Electronic Invoicing and Digital Tax Reporting or consult official EU or local tax authority sources for detailed regional requirements.

E-Filing vs. Manual Submission

Many zones now prefer electronic submitting, which can save days of waiting. E-filing also creates a digital paper trail for future reference.

Step 7: Monitor Changes and Audit Regularly

For many businesses, the global sales tax solutions industry is expanding rapidly. Different research groups define this market in varying ways - some focus solely on sales tax automation, while others include broader categories like overall tax management solutions. This growth signals continuous shifts in taxation rules and technological developments.

- Schedule quarterly or semiannual audits to confirm your processes are accurate

- Keep track of global regulations issued by bodies like the OECD, the EU Commission, or local authorities

- Adjust your accounting platform’s settings or your product classification whenever rules change

International businesses should be particularly aware of unique compliance challenges when selling remotely. For a U.S. perspective, review US – Challenges for Remote Vendors.

Internal vs. External Audits

In-house reviews catch small issues early, while external audits can provide a thorough evaluation. Combining both approaches helps protect your business from compliance gaps, especially as international regulations evolve.

Conclusion

Managing multiple tax jurisdictions can be simpler with a steady plan. By choosing capable global sales tax solutions, mapping out your workflow clearly, and staying informed on worldwide sales tax compliance, you can ease the stress of cross-border selling. The world of international sales tax services continues to expand, and smart tools are there to make your next filing experience much smoother. While this article explores the software options available for tax compliance, many growing businesses prefer to leave the complexity to trusted experts. At 1stopVAT, we help you stay compliant without setting up or managing tax software.

Discover how our expert-led indirect tax services can support your expansion.