VAT Compliance: Step-by-Step Guide to Tax Compliance

VAT compliance is essential for any business selling goods or services in regions where it applies - especially across the EU and the UAE. The European Commission treats VAT as a major revenue source and enforces strict compliance rules. This guide walks you through everything you need to know: registration thresholds, VAT schemes, record-keeping practices, and strategies to manage international obligations smoothly.

1. Understand the Basics of VAT Compliance

Before zeroing in on small business VAT solutions, it helps to know what VAT really is and why it matters:

-

VAT (Value Added Tax) is a consumption tax applied to the sale of goods and services at each stage of the supply chain.

-

In the European Union, €61 billion in VAT revenue was lost in 2021, according to the European Commission’s 2023 report - a sharp drop from €99 billion in 2020 that highlights the growing impact of compliance efforts.

-

VAT rates vary by country, but most businesses must register once they exceed specific annual revenue thresholds.

Global Perspectives on VAT

-

In Dubai, VAT is applied at 5% on most goods and services.

-

Startups must register if their taxable supplies exceed AED 375,000.

-

Voluntary registration is allowed from AED 187,500.

-

Failure to register may result in a AED 10,000 fine, increasing to AED 20,000 for repeated violations.

Quick Definition

VAT stands for Value Added Tax, a charge at each stage of the supply chain where value is added to a product or service. Businesses collect VAT from customers and remit it to tax authorities. Proper VAT accounting keeps you transparent, helps avoid hefty fines, and ensures you’re charging the correct amount on sales.

2. Check Your Registration Threshold

One of the first “to‑dos” is confirming if your startup is obligated to register for VAT. Thresholds differ across regions:

-

EU: Each member state sets its own VAT registration threshold. However, for cross-border digital services and e-commerce, a unified €10,000 annual threshold applies across the EU. For country-specific thresholds, refer to national tax authority websites or consult the VIES portal.

-

UAE (Dubai): VAT registration is mandatory if your taxable supplies exceed AED 375,000 annually. Voluntary registration is available from AED 187,500.

-

Non‑EU Countries: Each has different rules; you may face thresholds based on sales volumes or business activities.

For example, new rules regarding registration thresholds are being introduced, as detailed in Slovakia - New Rules Concerning VAT Registration Thresholds.

How to Confirm Your Threshold

-

Review official government tax portals.

-

Talk to a local tax consultant.

-

Use official calculators to see if your yearly revenue meets or exceeds the minimum.

Staying within compliance is simpler once you know the exact cutoff. If you do business internationally, check if you need multiple VAT registrations.

3. Select Small Business VAT Solutions Appropriate to Your Situation

Choosing a VAT scheme that suits your startup’s profile is often the next step. Different schemes exist, especially in jurisdictions like the EU and Gulf regions:

-

Standard VAT Scheme: You pay and collect VAT on every transaction; typically used by mid-sized or larger businesses.

-

Flat‑Rate Scheme: Some countries allow smaller businesses to pay a fixed VAT percentage on total turnover, reducing paperwork.

Note: Flat-rate schemes aren’t available in all EU countries, so check local rules before choosing this option.

-

Cash Accounting Scheme: VAT is paid only when payments are received from customers, which helps with cash-flow management.

The European Commission has also proposed changes to simplify VAT for small businesses across the EU - see the official 2024 announcement for details. For a practical breakdown of these schemes and how they apply to your business, explore our guide: EU - Reform of SME Schemes and Simplified VAT Compliance.

Pros and Cons of Each

Standard Scheme

Flat‑Rate Scheme

Cash Accounting Scheme

4. Set Up Solid Record-keeping for Tax Compliance for SMEs

Accurate records are your shield against costly mistakes and audits. VAT compliance requires clear documentation to stay on track and avoid business disruptions. Startups and SMEs can manage their VAT documents using cloud-based solutions or simple spreadsheets, as long as they maintain clear and transparent audit trails.

-

Invoices: Retain digital and physical copies, especially if local rules require them.

-

Receipts: Always keep expense receipts for items you claim input VAT on.

-

VAT Returns: Archive final returns along with supporting documents.

Tech Tools to Boost Efficiency

-

Cloud-based software adoption is steadily increasing among small businesses, with Eurostat reporting that 42.5% of EU enterprises used cloud computing services in 2023.

-

Business tools for automated invoice generation, expense tracking, and real‑time reporting can reduce manual errors.

-

Using tax technology tools for VAT compliance automation can streamline processes and integrate directly with tax authorities - discover practical approaches in Tax Technology Tools - VAT Compliance Automation.

-

Some solutions integrate directly with local tax authority systems, making submission smoother.

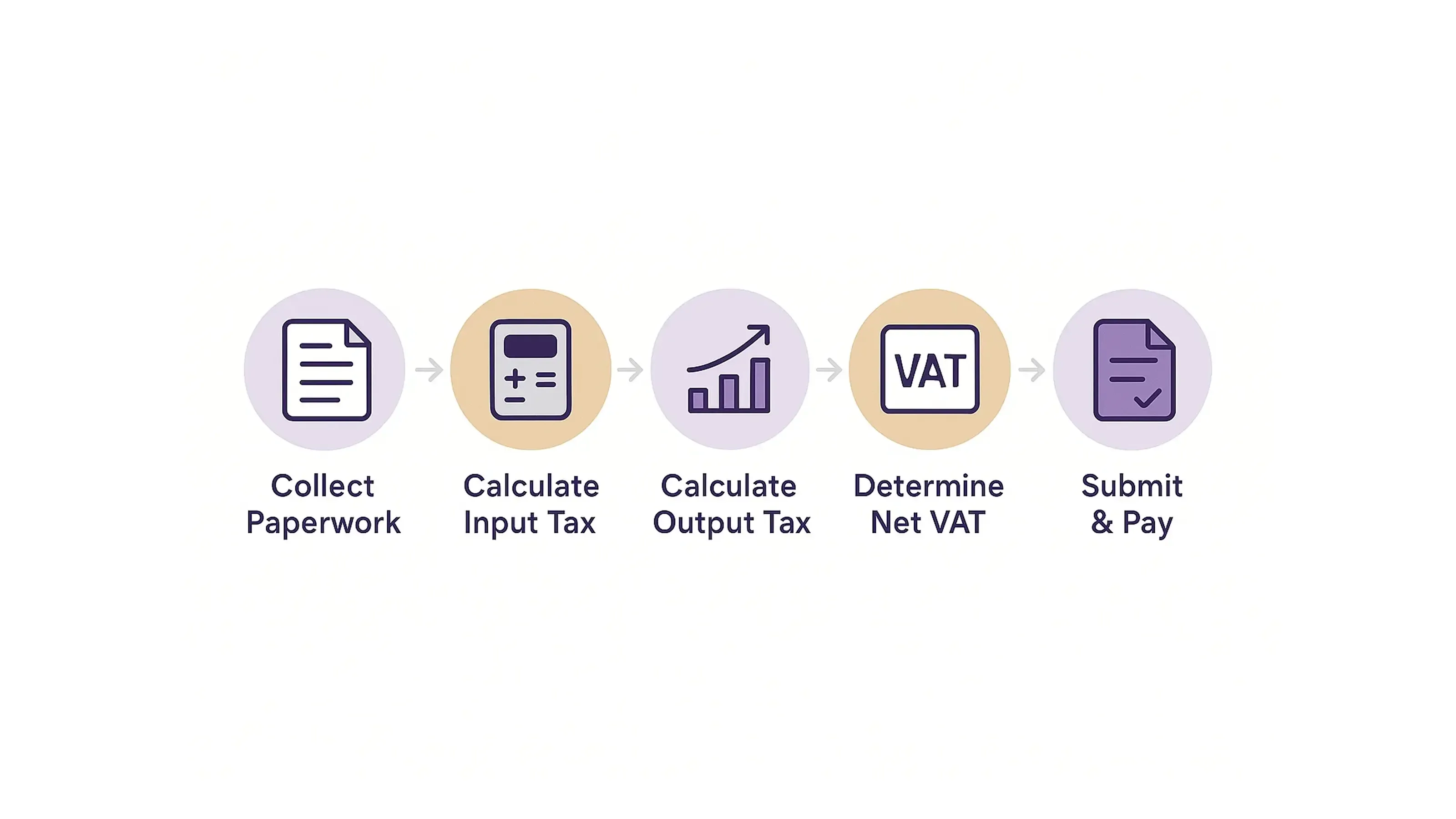

5. Calculate and File VAT Returns on Time

Once you have your VAT registration and record‑keeping in place, you need to submit returns regularly. The frequency (monthly, quarterly, or annually) depends on the region:

- Collect Paperwork: Gather invoices, receipts, credit notes, and any adjustments.

- Calculate Input VAT: Determine how much VAT you paid on purchases related to your business.

- Calculate Output VAT: Sum the VAT you collected from customers.

- Determine Net VAT: Subtract input VAT from output VAT to see your liability or refund.

- Submit & Pay: File your VAT return and pay any balance due before the deadline.

Tip for Timely Filing

-

Set calendar reminders at least a week ahead of each deadline.

-

Assign a team member to monitor approaching due dates.

-

Use direct‑debit features where available to avoid late payments.

6. Manage VAT for International Transactions

If your startup is engaged in cross-border sales, VAT compliance becomes even more complex. International VAT rules can get tricky - you may have to register in multiple jurisdictions, especially if you sell online to EU consumers or operate in a free-trade zone like the United Arab Emirates.

-

EU Cross‑Border Rules: For e‑commerce or digital services, you might use schemes like the One‑Stop‑Shop (OSS) to streamline reporting.

-

Export & Import VAT: Exports may be zero‑rated in some regions, but you may still pay VAT or customs duties when bringing goods in.

-

Dubai Free Zones: Some free zones offer VAT exemptions, but treatment depends on the zone and type of business activity. You may still need to register for VAT if you supply goods or services to mainland UAE.

Common Pitfalls

-

Mixing domestic and international sales in the same ledger entry without proper tagging.

-

Losing track of the correct exchange rates for VAT calculations.

-

Forgetting to file separate returns where required (e.g., multiple EU member states).

-

For tailored advice on such international matters, consider VAT Consulting for International Businesses.

7. Stay Current with Policy Changes

Tax regulations change over time, and local authorities often adjust thresholds, VAT rates, and penalties. In the EU, member states lost around €89 billion in VAT revenue in 2022, according to the European Commission’s latest report - a reminder of how quickly policy landscapes can shift.

-

Track announcements from official tax authorities or reliable newsletters.

-

Maintain contact with professional networks that share regulatory updates.

-

Revisit your compliance processes each year to confirm they still meet the latest rules.

Conclusion

Navigating VAT compliance doesn’t have to be a headache. From confirming your registration threshold and choosing small business VAT solutions to managing returns and staying on top of shifting regulations, careful planning is key. By applying the steps in this checklist, you’ll keep your tax compliance for SMEs running smoothly - allowing you to focus more on growing your business and less on watching the tax clock.