Overview

This guide walks you through the full US sales-tax registration journey.

You will learn:

-

How nexus rules decide where you must register

-

Which documents and data each state portal asks for

-

Whether to file on your own or hire a US sales tax registration service

-

Common pitfalls that trigger audits and how to dodge them

-

Ongoing compliance habits that keep you off every revenue department’s radar

By the end, you will understand the entire registration cycle, from the first “Do I have nexus?” moment to the final “Return accepted” confirmation screen.

Step 1: Map Your Nexus Footprint

Sales tax starts with nexus, the legal connection that lets a state tax your sales. If you do not know which states claim you, nothing else matters.

Since the 2018 South Dakota v. Wayfair decision, nexus can arise even when you have no people or property in a state. In fact, Forty-five states and the District of Columbia collect statewide sales taxes and quickly updated their rules for remote sellers.

-

Physical nexus: offices, employees, inventory, trade show visits

-

Economic nexus: revenue or transaction count in the state

-

Marketplace nexus: sales through Amazon, Etsy, or similar platforms

Real-world example: A Minnesota apparel brand kept no stock in California yet shipped $210,000 of orders there last year. Because 25 states define economic nexus solely by a dollar sales threshold, commonly $100,000–$200,000, California counted the brand in even without a single local employee.

For an in-depth exploration of how nexus and sales tax rules impact remote sellers in every state, check out the US Sales Tax Explained: State-by-State Guide. Clarify your nexus map now, and the remaining steps get simpler. This groundwork leads naturally to deadlines, so let’s review those next.

Step 2: Check Each State’s Thresholds and Deadlines

You know where you have nexus, but every state sets its own trigger date and registration timeline. Miss a deadline and late-registration penalties multiply fast.

-

Effective date: the day you cross the stated threshold

-

Registration deadline: usually 30–60 days after that date

-

First return due: could be as soon as the next filing period

-

Special rules: states like Florida require a security bond in rare cases

Remember, five states, Alaska, Delaware, Montana, New Hampshire, and Oregon, do not impose a state-level sales tax, so you can skip them unless local ordinances apply. Staying compliant with these ever-changing rules and tracking deadlines effectively is detailed further in Sales Tax Compliance: Key Steps for Your Business. Wrapping up deadlines clears the path to gathering paperwork.

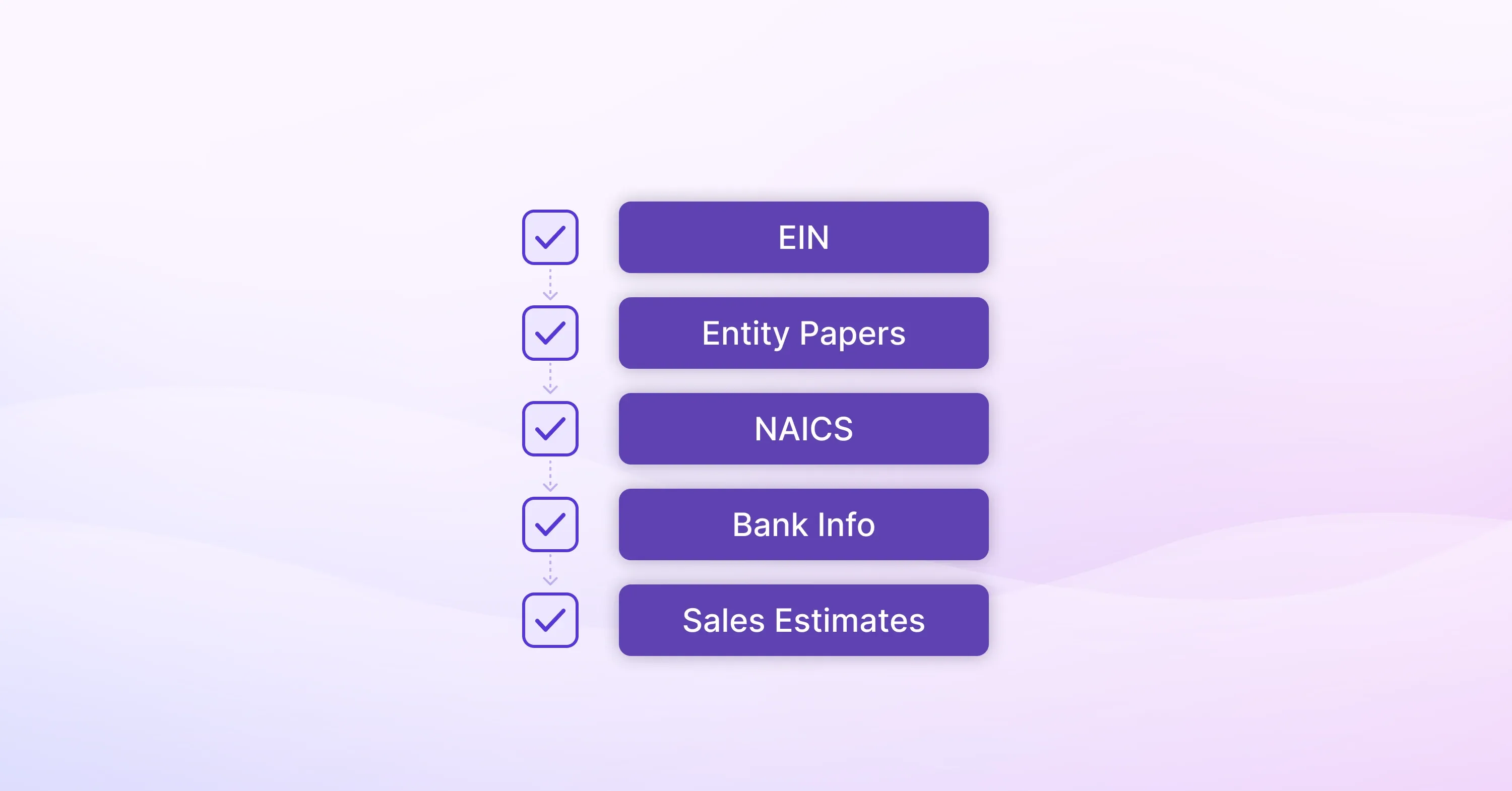

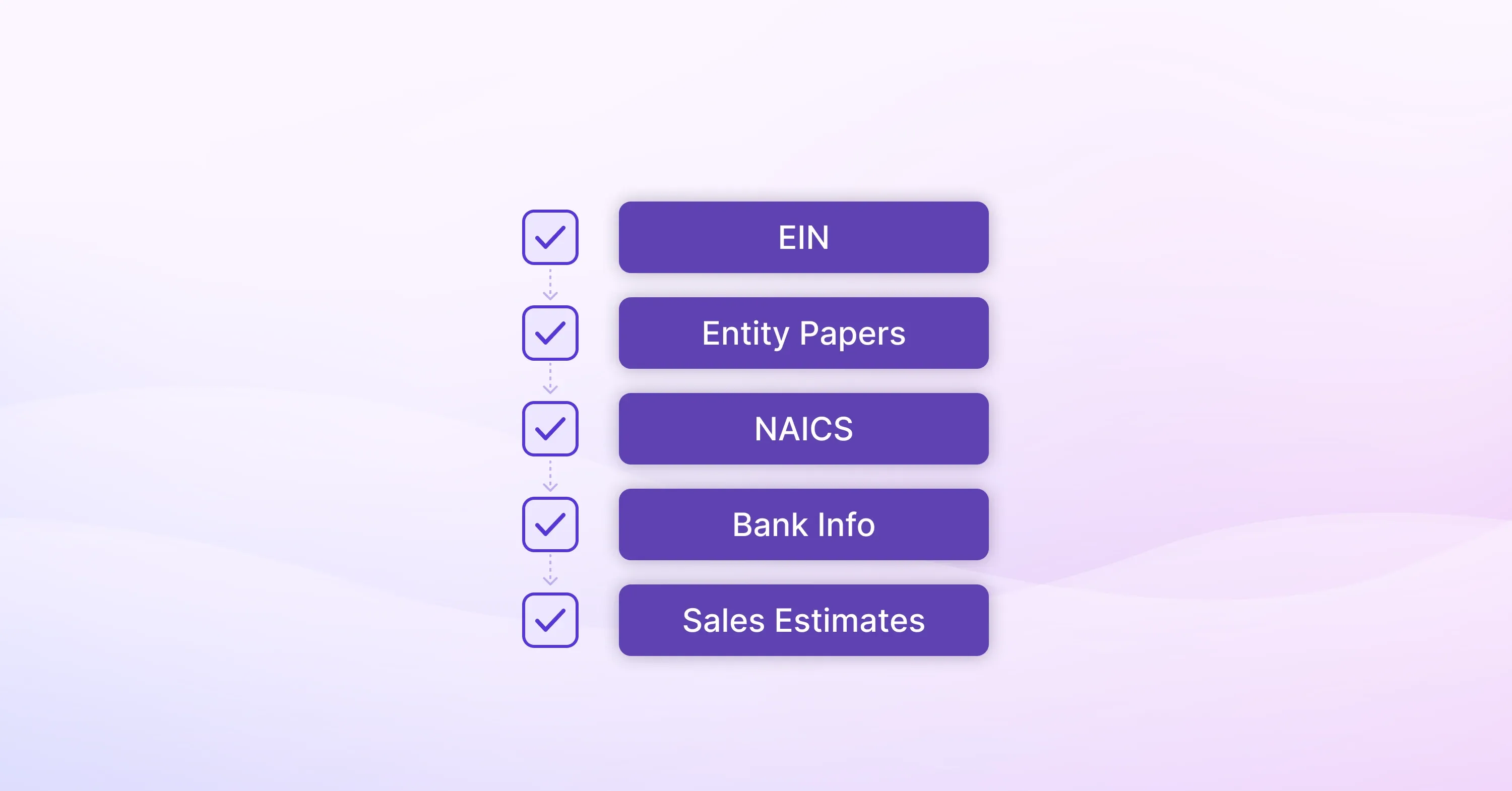

Step 3: Prepare the Documentation State Portals Expect

Registration is mostly data entry, but errors here ripple into every future return.

Set aside an hour to assemble:

-

Federal EIN and SSN for responsible parties

-

Business entity documents (Articles of Incorporation or equivalent)

-

NAICS code, product categories, and marketplace IDs

-

Bank routing and account numbers for ACH debit payments

-

Estimated monthly or annual taxable sales per state

Beginning with a complete folder avoids the frustrating “application rejected” emails that push your start date back.

To see a broader comparison of US and international registration document requirements, read the Sales Tax Registration and Compliance Guide for Global Sellers.

With packets ready, you can move to the actual American tax registration portals.

Step 4: Submit the American Tax Registration Forms Online

Virtually every revenue department now offers a web portal. The flow is similar, yet each form hides unique tripwires such as local surtax opt-ins or separate city returns.

Follow this baseline process:

-

Create username and verify by email

-

Enter business information and ownership details

-

Declare nexus date and projected sales

-

Pick filing frequency (monthly, quarterly, or annual)

-

Review, sign, and submit electronically

Practical tip: Georgia auto-generates your sales-tax ID immediately, while Texas can take up to 10 business days. Knowing these timelines helps you plan product launches. At this point you face a choice: keep submitting registrations yourself or bring in outside help.

Step 5: Choose a US Sales Tax Registration Service or DIY

Filing across several states quickly turns into a part-time job. A specialized US sales tax registration service relieves that load.

-

Expertise: seasoned specialists spot inconsistent nexus answers that trigger audits

-

Efficiency: one intake questionnaire covers every state, saving hours of portal clicks

-

Ongoing help: many services stay on as filing agents

For businesses selling on multiple marketplaces and into the European Union, a global firm such as 1stopVAT, whose 40+ tax consultants already manage VAT and sales-tax accounts in over 100 countries, can consolidate both sides of the Atlantic under one roof.

For practical comparison of top sales tax consulting and compliance providers, including criteria for choosing the right partner, see Top Sales Tax Compliance Firms for Businesses. Whether you hire or continue solo, the next step is setting up collection and remittance.

Step 6: Activate Collection and Remittance in Your Systems

A sales-tax permit only matters if you actually collect the tax.

-

Enable state-specific tax rates in your e-commerce platform or POS

-

Map product tax codes so clothing, software, or groceries are taxed correctly

-

Coordinate with marketplace facilitators to avoid double collection

-

Test a $1 dummy transaction to confirm the right rate applies

If you're looking to optimize or automate sales tax collection in complex multi-state or cross-border commerce, the Global Sales Tax Solutions & VAT Compliance Guide is a helpful read.

Real-world example

A Texas retailer nearly double-collected when Shopify and Amazon both charged tax on the same Houston shipment. A quick channel review fixed the overlap. Once collection works, focus on staying compliant for the long haul.

Step 7: Stay Compliant with Ongoing State Tax Registration USA Requirements

States rely heavily on sales tax. In fact, state retail sales taxes yielded $444.5 billion in fiscal year 2022, accounting for 31.18% of total state tax collections. Because revenue is so critical, auditors watch filings closely.

Maintain these habits:

-

File returns on time even if you had zero sales

-

Reconcile marketplace and direct-site data monthly

-

Monitor legislative changes: thresholds, rate changes, local add-ons

-

Renew permits or business licenses as required (some expire every 1–2 years)

-

Archive confirmation numbers and payment receipts for at least four years

See more ongoing best practices for recordkeeping, reconciliation, and timely filing in Compliance Checks: Ensuring Your Business Meets U.S. Tax Laws.

Following these routines means fewer surprises and easier audits.

US State Sales Tax Registration: Quick Overview

To register for US state sales tax, identify where you have physical or economic nexus, gather your EIN plus entity paperwork, open a state tax portal account, complete the online sales-tax permit application, then activate tax collection in your checkout system and file returns by the assigned due dates.

Conclusion

Registering for US sales tax is less about ticking boxes and more about staying one step ahead of 50 sets of rules. Map your nexus, respect each state’s deadlines, file accurate applications, and keep collection systems tuned. Whether you shoulder the work yourself or lean on a specialist, a clear process turns sales-tax compliance from constant worry into a routine admin task, so you can focus on growing your business.