Overview

This guide walks you through the essentials of U.S. sales tax: where tax applies, how rates differ, what records to keep, and how to submit each state tax filing without stress. You will also learn which sales tax compliance services and software features lighten the administrative load, plus practical tips for retail tax reporting across jurisdictions.

By the end, you will be able to:

- Spot where your business has nexus

- Register in the right states

- Charge and collect accurate tax at checkout

- File on time and stay audit-ready

Let’s start with the foundation.

Understand the Basics of U.S. Sales Tax

Sales tax is a consumption tax that states, counties, and cities levy on the retail sale of tangible personal property and, increasingly, digital goods and services. Unlike federal taxes, it is administered at the state level, which means 45 states and thousands of local authorities all set their own rules.

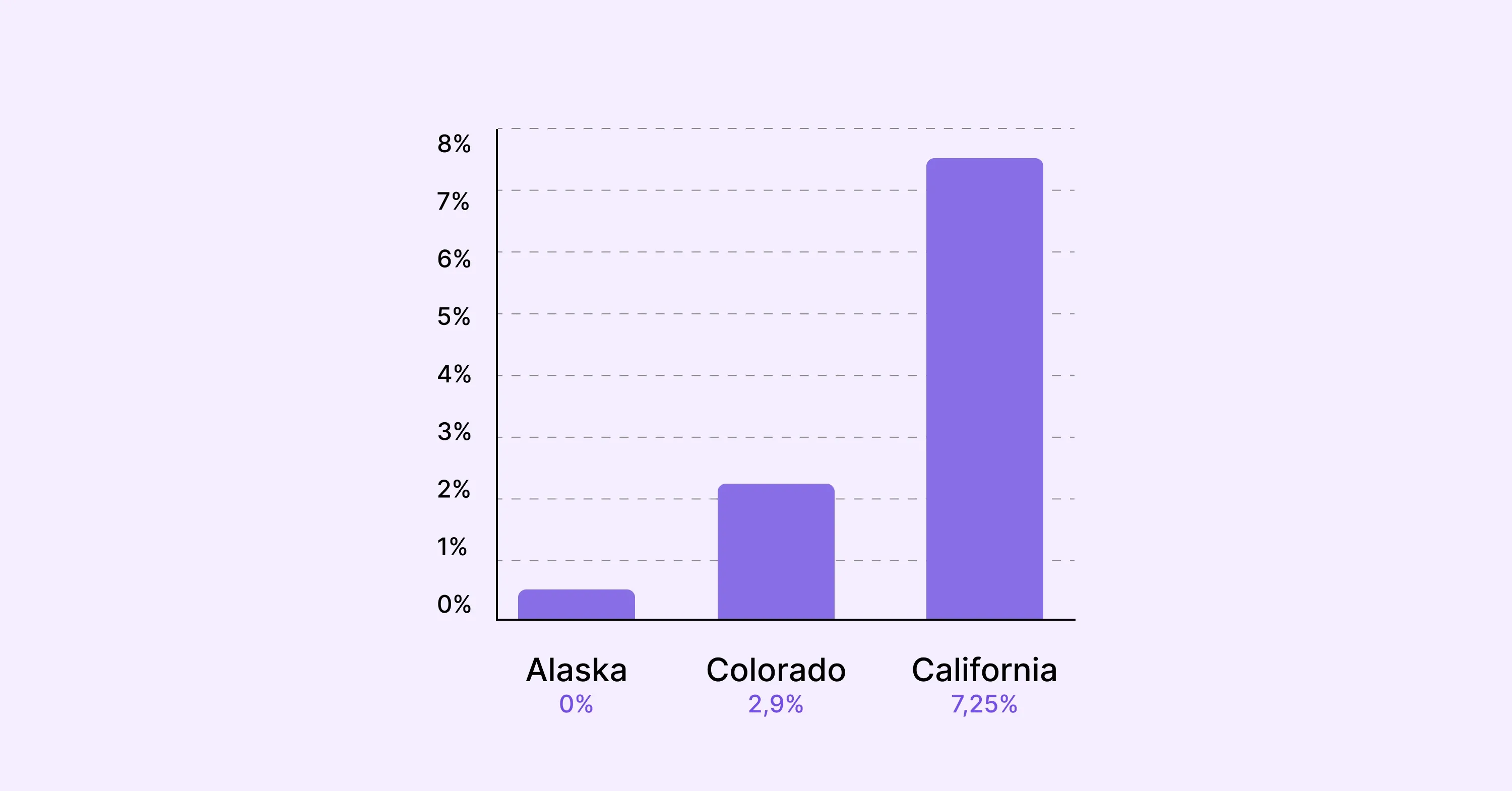

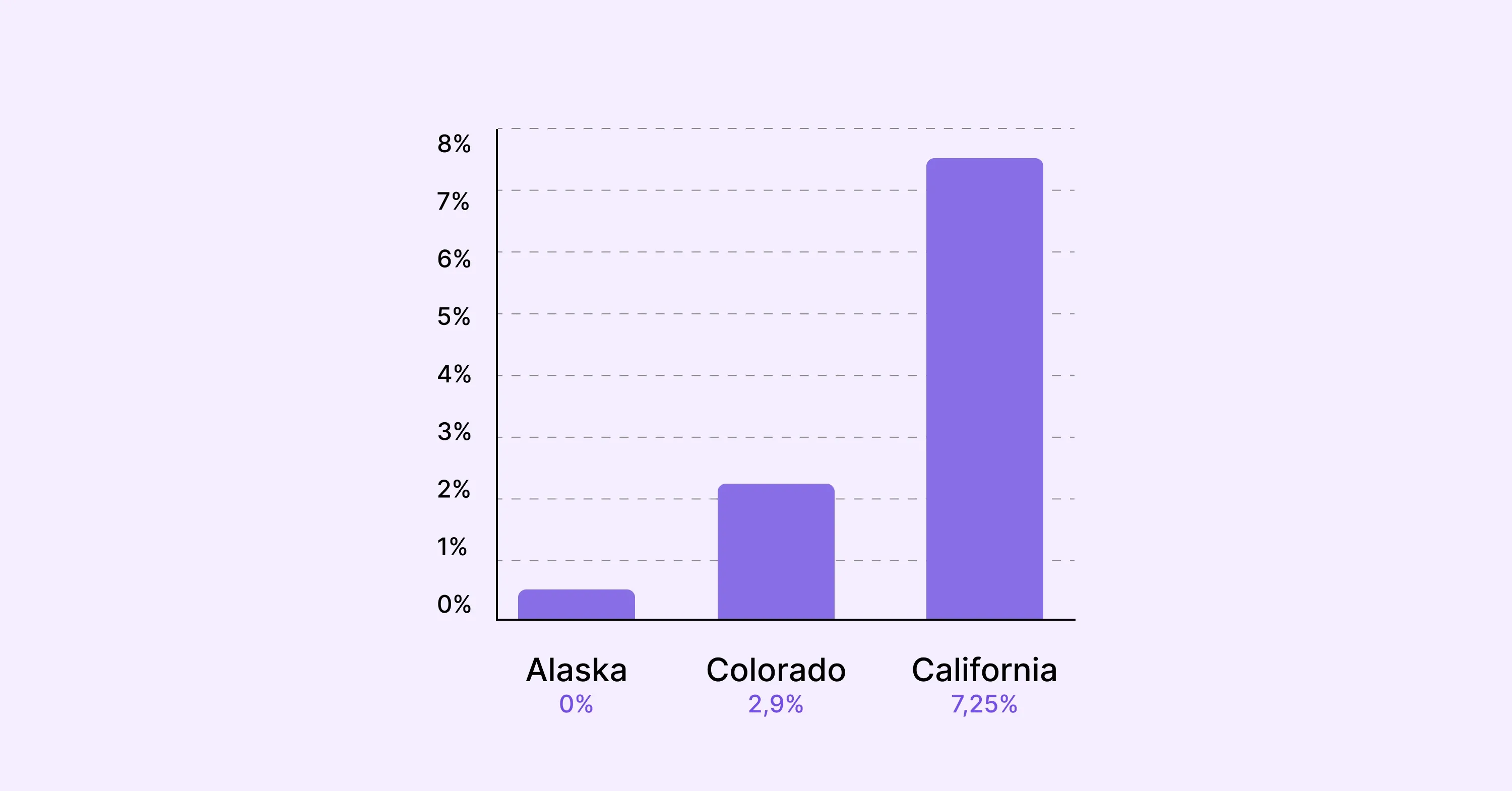

- State rates range from 0 % (Alaska) to more than 7%.

- Local surcharges can push the combined rate above 10% in some jurisdictions.

- Exemptions vary: groceries, prescription drugs, and manufacturing equipment are common carve-outs.

Grasping these fundamentals helps you avoid over- or under-collecting tax and prevents customer dissatisfaction.

Keeping this knowledge updated is not a one-time task. Laws change every legislative session, so plan a quarterly review of the rules that affect your catalog. For deeper insights into global compliance strategies, explore the Global Sales Tax Solutions & VAT Compliance Guide.

Determine Nexus and Registration Requirements

Nexus is the connection that obligates you to collect and remit sales tax. Two categories exist: physical nexus and economic nexus.

- Physical nexus: Owning or leasing property, storing inventory in a warehouse, or having employees or independent contractors in a state.

- Economic nexus: Exceeding a sales or transaction threshold, usually $100,000 in annual revenue or 200 transactions, though each state sets its own levels.

How to confirm nexus

- List all locations where you have offices, inventory, affiliates, or employees.

- Pull sales data for the last twelve months by state.

- Compare each total to the state’s economic threshold.

- Document any marketplace facilitator rules that may shift collection duties to the platform.

Missing nexus is the top trigger for late registration penalties. Create a living spreadsheet that flags thresholds at 80% so you can register before you hit the limit.

Once nexus exists, register for a sales tax permit before you begin charging customers. Filing without a permit is illegal in most jurisdictions. For further reading on how nexus rules apply to remote and multi-state sellers, see Economic Nexus.

Collect the Right Tax at Checkout

After registration, you must begin calculating and collecting tax on every taxable sale.

Set the stage by classifying each SKU:

- Taxable

- Exempt

- Partially exempt (e.g., clothing over a certain price point in New York)

Rate calculation options

- Manual lookup: Feasible if you sell in one state with a handful of rates.

- Built-in ecommerce engine: Shopify, WooCommerce, and similar platforms provide table-based rates but may require manual updates.

- Integrated sales tax compliance services: API-driven tools pull rates in real time based on ZIP+4 and product taxability codes.

Even a single drop-shipment can cross multiple rate boundaries, so test transactions in a sandbox first. Store the tax line as a discrete field in your ERP or accounting software to simplify reconciliation later. For advice on product classification and common digital product pitfalls, review Navigating SaaS Taxation: Key Facts for Businesses.

Keep Accurate Records for Retail Tax Reporting

Sales tax returns summarize gross sales, taxable sales, tax collected, and exemptions. If your data is messy, you will spend hours reconciling each period.

Build a record-keeping routine that captures:

- Order number

- Ship-to state and ZIP code

- Taxability code

- Tax amount collected

- Exemption certificates (if any)

For certificates, use secure digital storage with expiration reminders. Auditors frequently ask for these documents, and losing them can turn exempt sales into taxable sales.

This discipline pays off during retail tax reporting, reducing adjustments and cutting the time you spend per return. If your reporting crosses borders, it may help to refer to Aligning Cross-Border Tax and Accounting Practices for SMEs.

Meet State Tax Filing Deadlines

Every state assigns filing frequencies - monthly, quarterly, or annually - based on your sales volume. Missing a deadline can trigger late fees of 5-25 % of the tax due, plus interest.

Practical deadline tactics

- Create a master calendar with color-coded due dates.

- Schedule reminders at least one week before each deadline.

- Reconcile sales for the period on the first business day after month-end.

- Submit the return and payment at least 24 hours before the portal deadline to buffer for bank errors.

Several states, such as Florida and Illinois, offer small discounts for early electronic filing. Grabbing these credits helps offset compliance costs. For more detail on digital filing and reporting trends, see Global Trend – Electronic Invoicing and Digital Tax Reporting.

Use Tools and Sales Tax Compliance Services Wisely

Handling compliance in-house makes sense when sales are simple. Once multi-state sales, product-specific exemptions, or frequent filing schedules appear, third-party solutions pay for themselves in reduced labor and audit risk.

Reputable sales tax compliance services typically include:

- Nexus monitoring across all 50 states

- Permit registration and renewals

- Rate calculation APIs

- Return preparation and filing

- Audit support

A global perspective matters too. In the European Union, member states lost €61 billion in VAT revenues in 2021, prompting mandatory e-invoicing reforms. The same pressure to modernize is rising in several U.S. states, so selecting a partner that tracks worldwide changes can future-proof your process.

If you also sell abroad, consult a specialist like 1stopVAT, whose 40+ tax professionals manage VAT registration and filing in 100+ countries, giving you a single, knowledgeable point of contact. To understand the broader impact of automation and consultancy in tax compliance, explore VAT Compliance & Consultancy: Why Expert Advice Matters.

Monitor Legislative Changes and Stay Audit-Ready

Compliance is never static. Over the next decade, the EU’s plan to make digital reporting obligations fully electronic by 2030 signals where U.S. rules may head.

To stay ahead:

- Subscribe to each state’s tax bulletin.

- Attend webinars hosted by departments of revenue.

- Review pending legislation every quarter.

- Update your system table of rates and product codes within 30 days of change.

Audits often begin with a notice asking for the last three to four years of returns and supporting data. Keeping accurate records, reconciled filings, and current certificates shortens the audit timeline and reduces the chance of assessments.

At the end of each fiscal year, perform an internal mock audit. Match reported figures to source documents, confirm exemption certificates, and adjust any process gaps. For more details on staying ahead of U.S. audit challenges, see US – Challenges for Remote Vendors.

Sales tax compliance

Sales tax compliance services are third-party firms or software platforms that handle the end-to-end process of determining nexus, registering for permits, calculating accurate tax at checkout, filing state returns, remitting payments, and providing audit support, allowing businesses to stay compliant in every jurisdiction where they sell.

Conclusion

Staying compliant with U.S. sales tax hinges on five actions: knowing where you have nexus, registering promptly, collecting the correct rates, keeping airtight records, and filing on or before the deadline. Reliable tools and knowledgeable sales tax compliance services lift much of the burden, letting you focus on growth while the tax side stays accurate and audit-ready.