Overview

Compliance checks help U.S.-facing businesses avoid fines, audits and reputational damage by regulators such as the Internal Revenue Service (IRS) and state tax authorities. This guide shows how to treat compliance not as a one-time event but as a continuous discipline - from defining your scope through to staying audit-ready for federal and state requirements.

For deeper insight into expanding into U.S. states while staying compliant, see 1stopVAT’s Sales Tax Consulting Services.

What Are Compliance Checks?

Regulatory compliance checks are systematic internal reviews to ensure a company meets all relevant tax rules - federal, state, and indirect (such as sales/use tax) - as well as any industry‐specific obligations. They validate that transactions are properly documented, tax calculations are correct, and internal controls function as intended in real time.

For example, the IRS defines a compliance check as a review of whether a taxpayer is adhering to recordkeeping and information-reporting requirements.

Step 1 - Define the Scope of Your Compliance Check

Before diving into remediation, map the regulatory environment your business operates in.

Checklist:

- Identify all US states where you have sales, inventory, employees, or fulfilment centres (which may trigger nexus or registration requirements).

- List required filings: federal income tax, state income tax (where applicable), state sales/use tax registration and filings, payroll and withholding returns.

- Account for industry‐specific obligations (e-commerce, digital services, healthcare, or anti-money-laundering rules).

Clarifying scope early helps avoid surprises when a state Department of Revenue or the IRS begins an inquiry.

For a state-by-state breakdown of sales tax nexus and rules, see 1stopVAT’s US Sales Tax Guide: Nexus, State Rules & Rates.

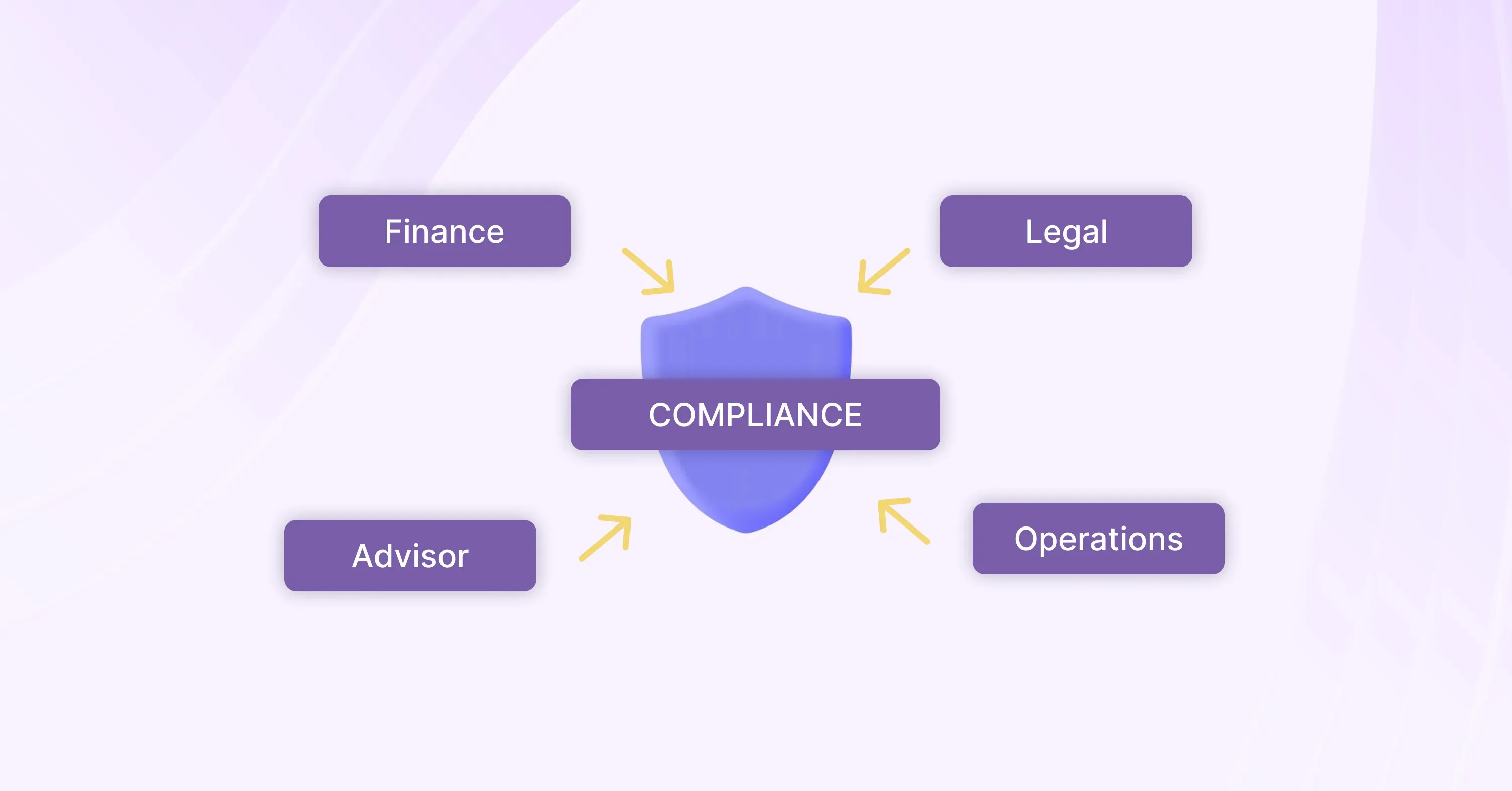

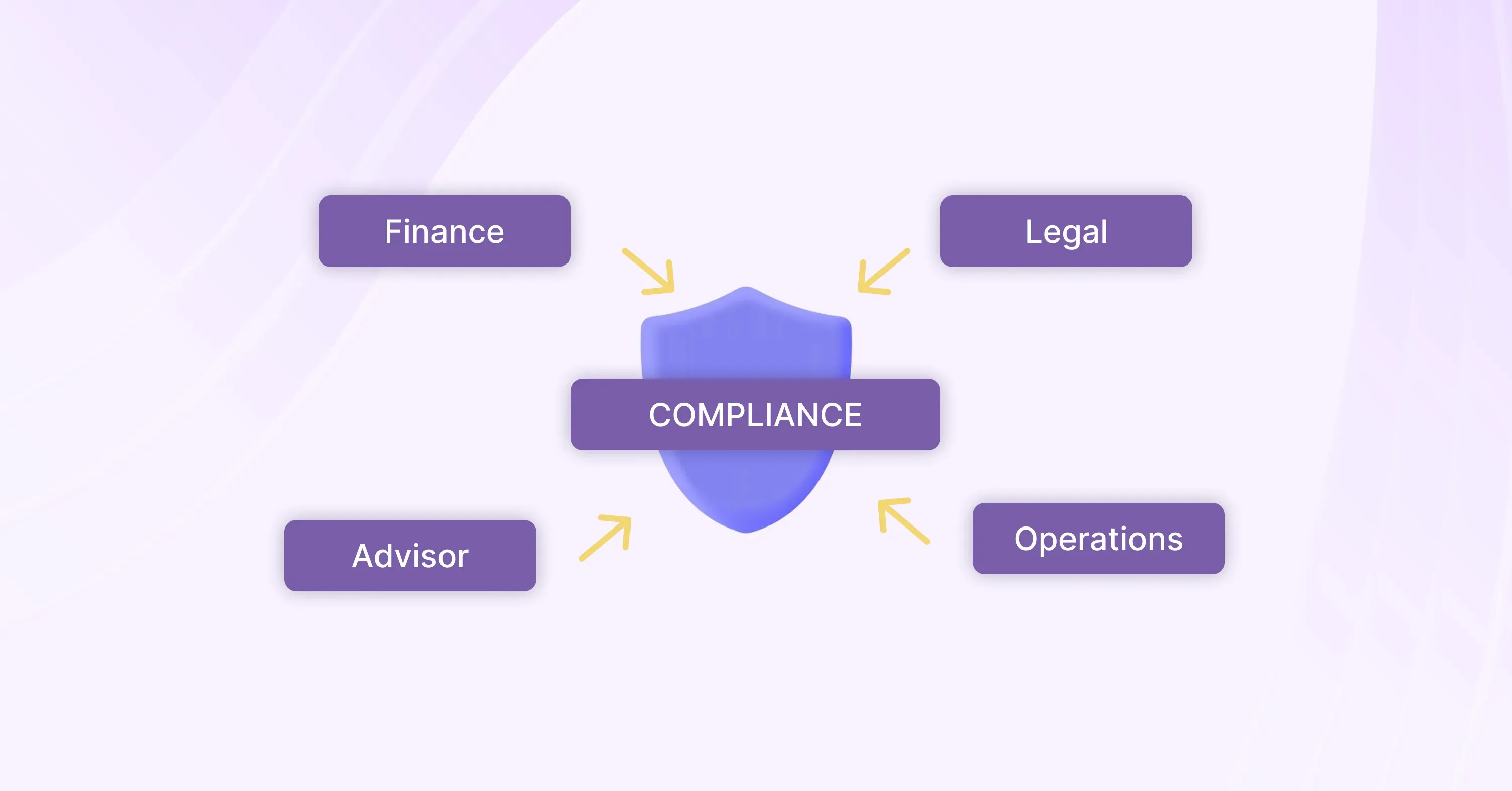

Step 2 - Build a Cross-Functional Compliance Team

US compliance spans multiple disciplines - tax, operations, IT, legal - a single accountant rarely covers all bases.

Key roles:

- CFO / Controller: signs major filings, owns budget risk.

- Legal Counsel: interprets statutes/notices and liaises with regulators.

- Operations Lead: ensures business processes align with policy and documentation.

- IT & Security Lead: controls access, retains audit-trail data, manages tax-system integrity.

- External Advisor / Specialist: brings prior audit experience, multistate insight and best-practice benchmarking.

Kick-off meetings should define meeting cadence, documentation ownership and escalation paths. For more about managing multistate sales tax obligations Sales Tax Consulting Services.

Step 3 - Identify and Prioritise Key Risk Areas

With your team in place, assess which processes and transactions attract the most regulator attention.

High-risk zones include:

- Manual journal entries or large adjustments.

- Cross-state or online sales that may create tax nexus.

- Payroll withholding issues (e.g., contractor vs employee).

- Expense reimbursements or corporate-card misuse.

- Data-protection, document-retention, audit-trail gaps.

Use a simple “heat map” (red = high risk, yellow = moderate, green = well-controlled). For structuring internal controls, the US Government Accountability Office (GAO) “Green Book” offers a foundational framework.

Step 4 - Gather and Validate Documentation

When an audit hits, documentation is your proof - not your story.

Must-have items:

- General ledger, trial balance and detailed journal‐entry backup.

- Bank statements, vendor & customer invoices, fulfilment/shipping documents.

- Filed tax returns, payment confirmations, correspondence with IRS/state DOR.

- Payroll registers, W-2s/1099s, employment/contractor agreements.

- Written policies: revenue recognition, expense approval, data retention, access rights.

Verify: Are totals consistent? Are receipts signed and dated? Are PDFs secure and easily retrievable? The IRS emphasises that they request documents already used to prepare the return.

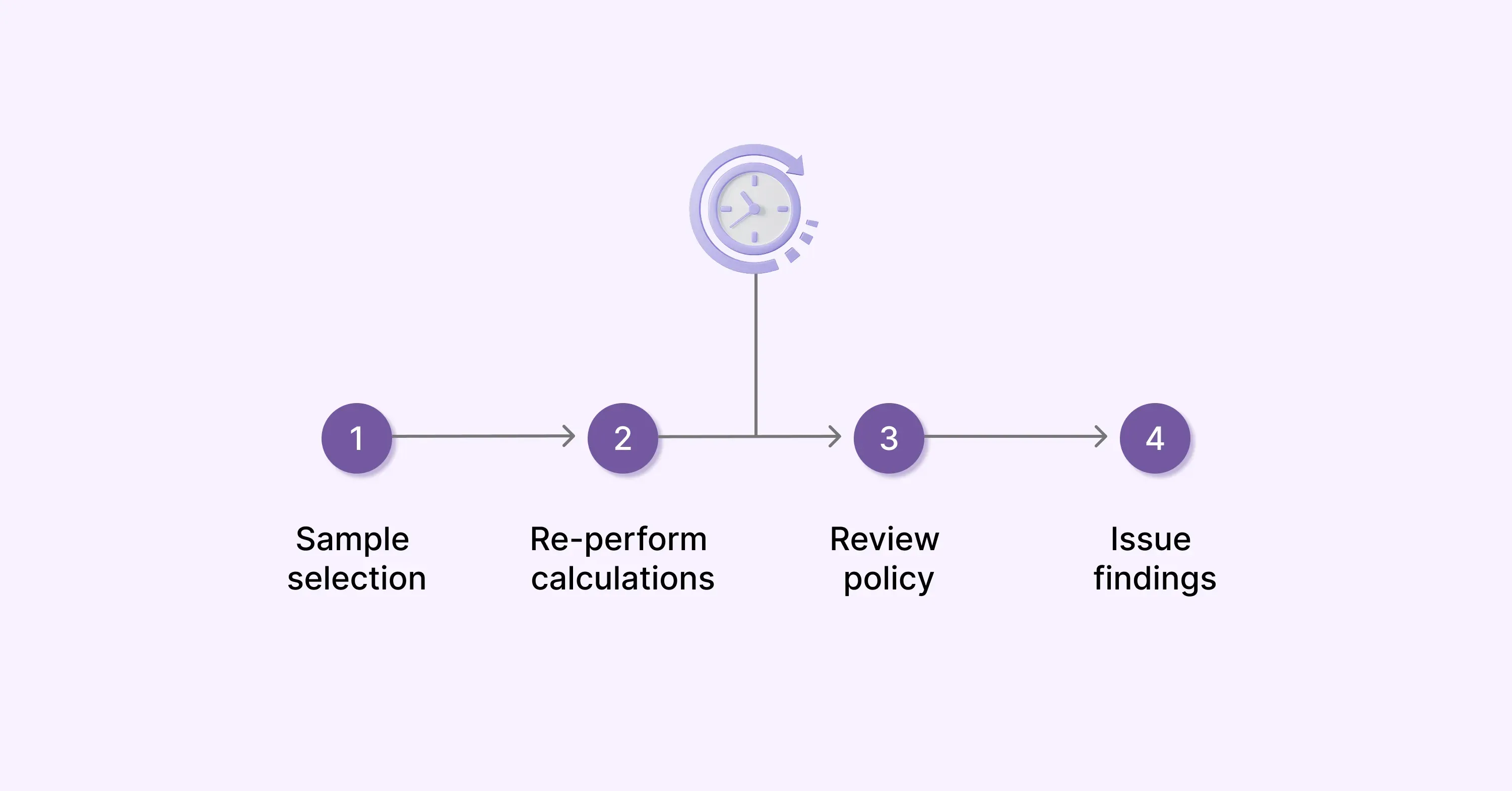

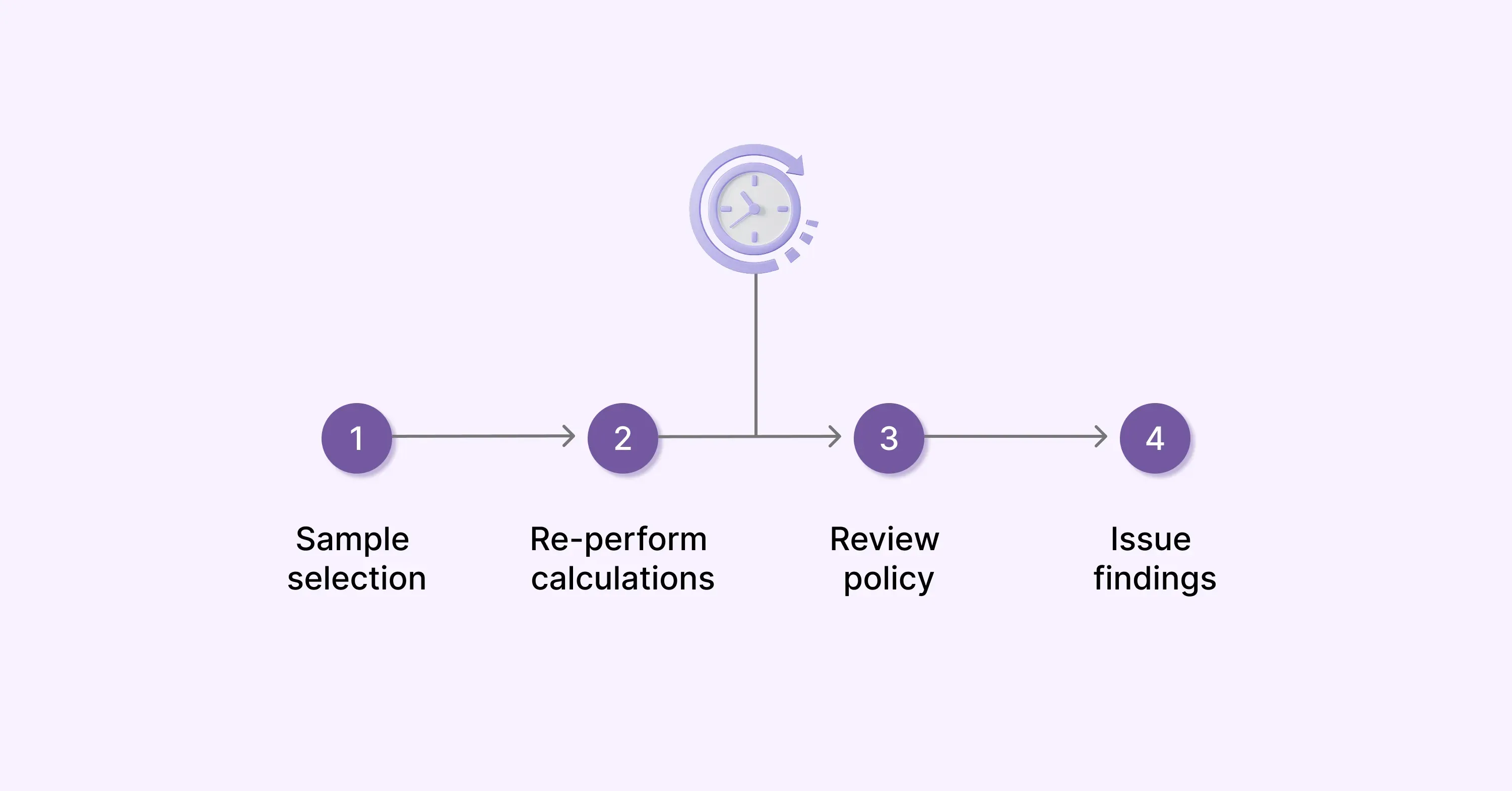

Step 5 - Conduct an Internal Financial Compliance Audit

A financial compliance audit is a focused review covering both financial accuracy and regulatory adherence - ideal before an external review begins.

Testing approach:

- Select ~5% of transactions or use a statistical sampling model.

- Recalculate sales/use tax owed, validate exemptions and correct state rate application.

- Trace invoices through to the financial statements.

- Review approvals, segregation of duties, system-flags.

- Issue a findings-report: assign owners, set deadlines, classify by severity.

Proactive internal audits build confidence in your controls and improve audit‐readiness.

Step 6 - Fix Gaps and Monitor Continuously

Finding issues is only half the job - fixing them promptly builds real compliance strength.

Action steps:

- Assign owners & deadlines for remediation tasks.

- Update policies (tax-registration matrix, data-retention schedule, system-access controls).

- Implement alerts for recurring risks (e.g., new state sales, high refund requests).

- Conduct training and collect annual acknowledgements from staff.

- Run quarterly mini-reviews in addition to your annual full audit.

Authoritative resources to consider:

Ongoing monitoring shifts compliance from reactive to routine - embedding it into your operations.

Step 7 - Prepare for an External Compliance Review

When an external audit begins, time is limited - preparation sets you up to respond effectively.

Be ready to:

- Confirm which tax years, states, and obligations are under review.

- Appoint a single Contact Person as regulator liaison.

- Create a secure “audit binder” or read-only shared folder with requested documentation.

- Track all documents provided and log all questions/answers.

- After the closing meeting, send a summary memo capturing agreements & next steps.

For insight into industry-focused examinations, see the IRS’s Audit Techniques Guides (ATGs).

Conclusion

Compliance checks don’t need to be overwhelming or reactive. By defining your scope, building the right team, mapping risks, maintaining detailed documentation and embedding continuous monitoring, you transform audit-readiness into operational hygiene.

If you’re expanding into the U.S. market, selling across states, or managing global fulfilment models, 1stopVAT’s Sales Tax Consulting Services are designed to simplify your compliance journey.