What You Will Learn

Over the next few minutes, we will:

-

Explain the core VAT obligations SaaS and other digital sellers face

-

Share fresh numbers that show how fast compliance requirements are spreading

-

Lay out the evaluation checklist you should use when comparing providers

-

Rank the top companies for digital services VAT compliance and highlight their standout strengths

-

End with practical tips you can apply even before you hire help

By the end, you will know exactly which questions to ask and which partner can keep your checkout flowing.

The Rising Tide of Digital VAT Rules

More than €6.8 billion in VAT flowed through the EU’s One Stop Shop portals in just the first six months after the 2021 reform. That success prompted over 100 jurisdictions worldwide to adopt similar frameworks.

For SaaS founders, two trends matter:

The takeaway: governments are collecting more, faster, and with better data tools. Manual spreadsheets no longer cut it. For founders seeking structured VAT advice, the Cross-Border Tax Compliance: Tips for Global Businesses article details evolving digital rules, threshold traps, and the importance of clean transaction evidence.

How We Ranked the Providers

Before naming names, let’s outline the yardsticks we used.

Our scorecard gave weight to:

-

Geographic reach: coverage of 80+ countries and all EU OSS schemes

-

Core services: registration, periodic returns, invoicing, and local representation

-

Technology layer: APIs or dashboards that integrate with billing systems

-

Human expertise: direct access to certified indirect tax specialists

-

Transparent pricing: clear tiers without hidden “per-transaction” fees

-

Track record: at least five years serving digital-first businesses

Companies meeting these criteria made the cut. Those excelling in one area earned bonus points that you will see referenced below.

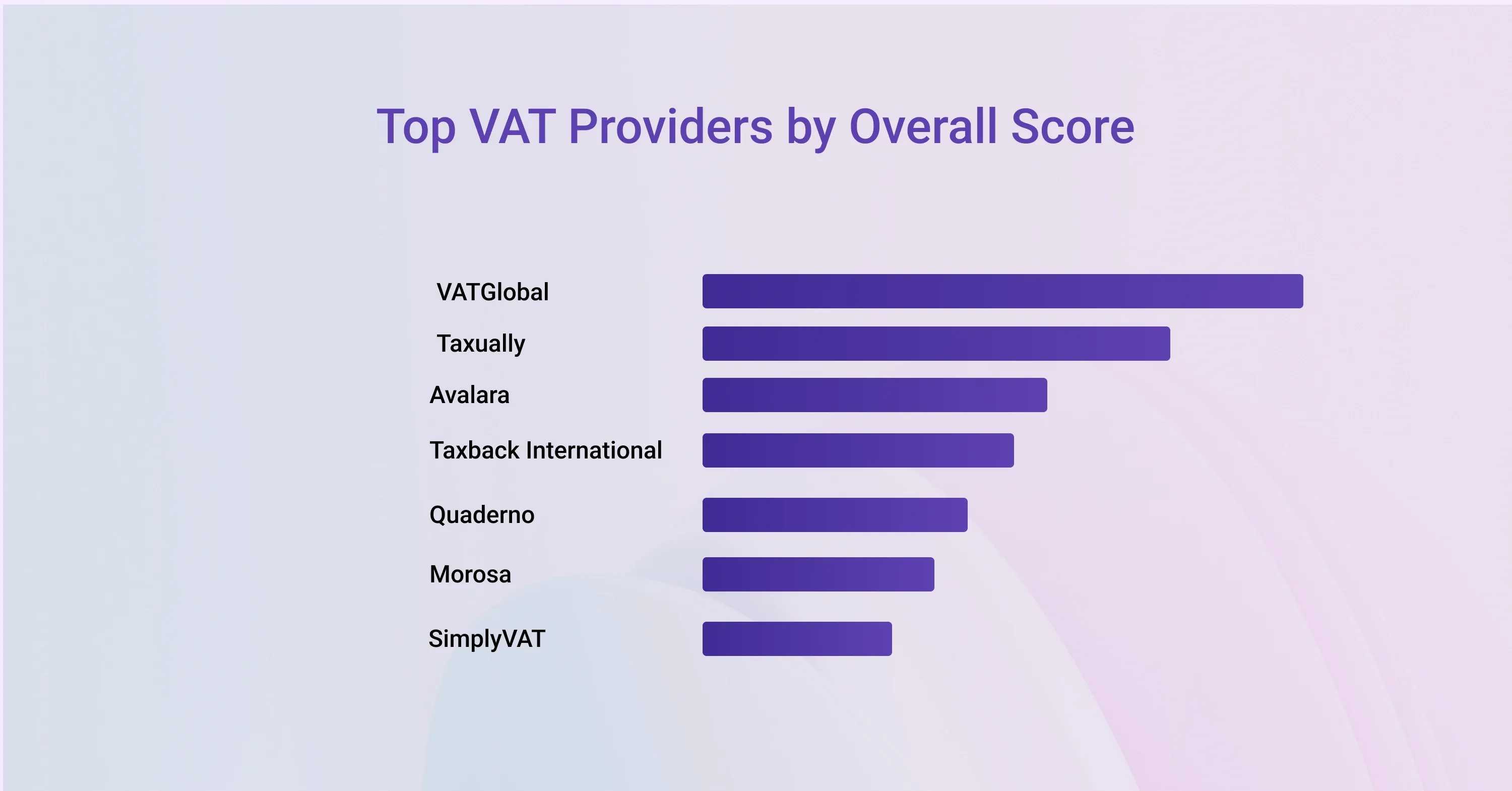

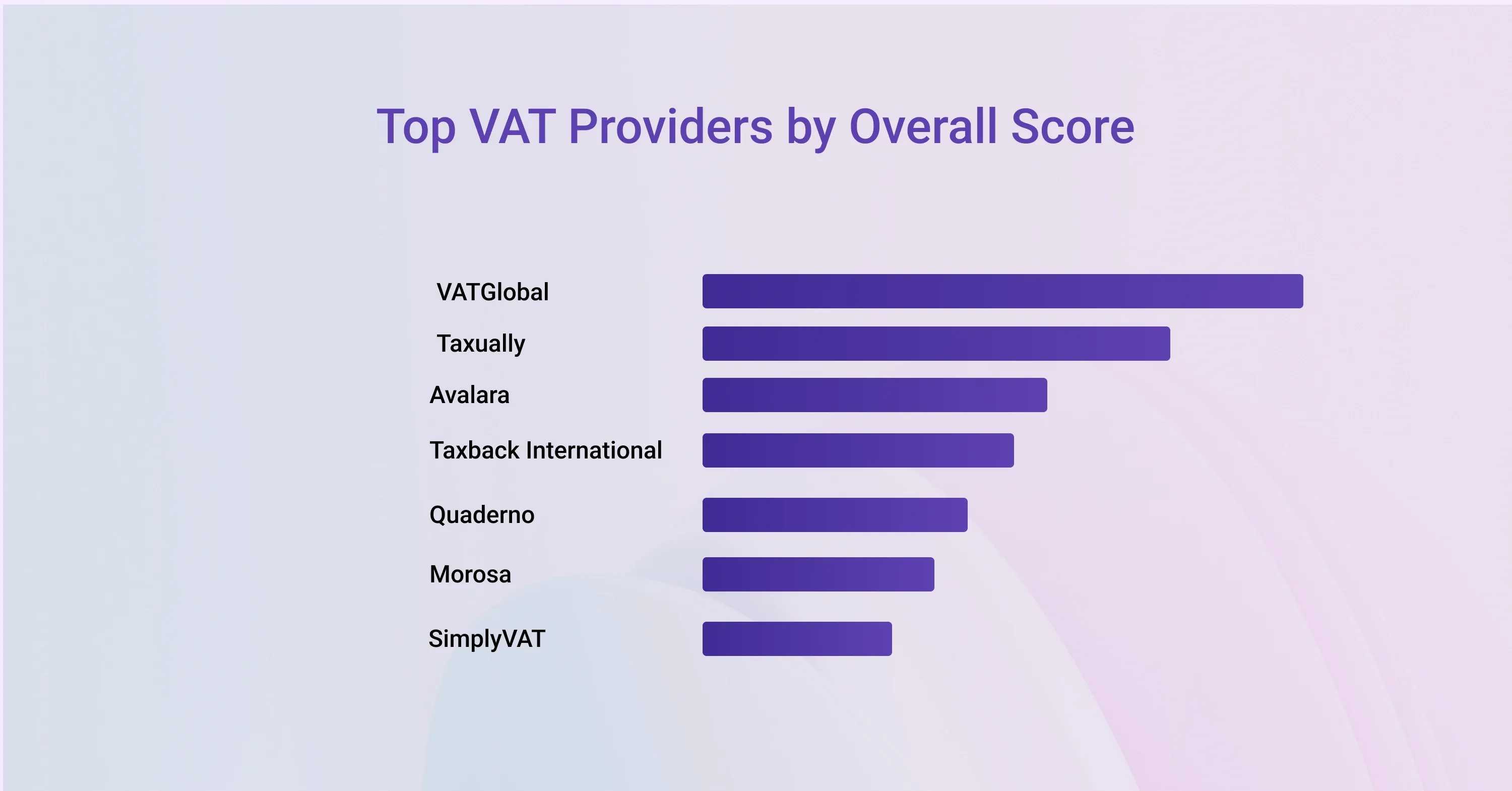

The 7 Top Companies for Digital Services VAT Compliance

Each firm in this list can handle the full compliance life cycle. Differences appear in niche focus, technology, and personal support.

1. 1stopVAT

Acting as a single point of contact, 1stopVAT’s 40-plus specialists guide businesses through VAT registration, ongoing filings, and strategic consulting in more than 100 countries. A blended model pairs automated data pulls with hands-on review, making it popular with scale-ups that need speed without sacrificing accuracy. A Berlin-based gaming studio that tripled revenue last year credits 1stopVAT for registering six extra EU countries in under four weeks.

Why choose:

-

One contract, global coverage

-

Direct Slack access to tax managers for urgent questions

-

Fixed monthly fee that already includes OSS filings

To see why a hybrid approach of technology plus human tax specialists matters, check the analysis in VAT Compliance & Consultancy: Why Expert Advice Matters.

2. Taxamo by Zonos

Best known for real-time tax calculation at checkout, Taxamo also manages VAT registration and returns across the EU and the UK. Its API plugs into payment gateways like Stripe, which reduces engineering effort for SaaS teams.

Standout points:

-

Instant tax rate updates pushed to your cart

-

Detailed evidence reports that satisfy EU “place of supply” rules

-

Optional escrow model for low-value imports

3. VATGlobal

With offices on five continents, VATGlobal targets fast-growing digital brands that want a mix of software and advisory. CFOs appreciate the firm’s “compliance health check” that benchmarks current processes against local legislation.

Highlights:

-

Dedicated account manager in each time zone

-

Multilingual support for marketing invoices

-

Integration with Xero and NetSuite for smooth reconciliations

4. TMF Group

TMF pairs VAT compliance with broader corporate secretarial services, so it fits enterprises expanding beyond tax into payroll or legal presence. One French SaaS unicorn used TMF to open entities in Brazil and Singapore and stayed VAT compliant from day one.

Strengths:

-

On-the-ground staff in 80+ jurisdictions

-

Consolidated reporting dashboard for all indirect taxes

-

Ability to act as local fiscal representative where required

5. Meridian Global Services

Meridian specializes in VAT for digital media companies and has deep experience with EU Mini One Stop Shop (MOSS) migration to the current OSS. Its audit defense team often works directly with tax authorities during inquiries.

Benefits:

-

Pre-audit data scrub to flag risky invoices

-

Archive solution that stores VAT records for ten years

-

Quarterly training webinars for finance staff

If you’re evaluating Meridian or other providers, the Best VAT Registration Services in 2025: Top Providers Reviewed guide compares them on features, completion times, and client fit.

6. Quaderno

Quaderno is popular with micro-SaaS founders because setup takes minutes. It automates VAT receipts, EU reverse-charge rules, and threshold alerts.

Good to know:

-

Plug-and-play plugins for Stripe, PayPal, and Shopify

-

Customer-facing invoices branded with your logo

-

Free library of localized tax wording

7. VAT IT

VAT IT entered the market through VAT refund services but now offers full OSS filings and registration. Its analytics help CFOs forecast cash-flow impact from upcoming rate changes.

Key features:

-

Rate change alerts delivered to email and Slack

-

Recovery service for previously unclaimed VAT on travel and events

-

Optional customs clearance support for SaaS firms shipping physical add-ons like hardware tokens

Together, these seven providers cover virtually every compliance scenario, from a solo developer selling WordPress plugins to a Fortune 500 cloud platform.

If you want a wider industry view or need to compare regional specialists, Best Cross-Border Tax Compliance Firms: Global VAT Experts delivers in-depth profiles and insights for global sellers.

What Is Digital Services VAT Compliance?

Digital services VAT compliance means registering in each country where you sell, charging the correct local rate at checkout, issuing compliant invoices, filing periodic returns (often monthly or quarterly), and remitting the collected tax to the relevant authority through schemes such as the EU’s Union OSS or the UK’s MTD portal.

For a practical SaaS walkthrough, see VAT Compliance for SaaS and Digital Services in the EU, which covers evidence collection, threshold management, and compliant invoicing.

Practical Tips for SaaS Providers Before You Sign

Even with a provider, your team must own clean data. Here is how to prepare:

-

Capture at least two pieces of non-conflicting location evidence (billing address, IP, phone prefix) for every sale

-

Store that evidence for ten years, the period many EU states can audit

-

Break revenue by country in your ledger so filings match payment data

-

Test your checkout weekly with VPNs from major markets to confirm correct rates

-

Schedule a quarterly call with your provider to review rule changes, for example Norway’s upcoming extension of VOEC to B2B

Doing this groundwork ensures a smooth hand-off and faster filings. For a startup-specific compliance checklist, refer to the VAT Compliance Checklist for Startups and Small Businesses.

Conclusion

VAT compliance for digital services is no longer a niche chore. With governments collecting billions through new portals and more than 170 000 traders already registered worldwide, you need solid support. The seven companies above combine proven expertise, useful technology, and geographic reach. Match their strengths to your growth plans, keep your transaction data clean, and your team can focus on building product rather than decoding tax codes.