Overview

We will unpack the key components of VAT and sales tax in international trade, explain when and where a foreign company must register, and clarify emerging rules for digital services. You will also learn how to synchronize filings across several jurisdictions, keep audit-ready records, and choose outside help when internal capacity runs thin. By the end, you will have a clear blueprint to scale globally, implement global tax solutions, and sleep well during tax season.

Understand VAT and Sales Tax in International Trade

Indirect taxes look similar at first glance but vary widely in scope, rate, and collection mechanics. Getting the basics right avoids cascading errors later.

VAT vs. Sales Tax: A Quick Primer

Value Added Tax applies at every stage of the supply chain, with businesses offsetting input VAT against output VAT. Sales tax, common in the United States, is charged only at the final sale to consumers. Roughly 170+ countries run a VAT system, while fewer than 30 rely primarily on sales tax.

- VAT is destination-based: the tax belongs where the customer consumes the good or service.

- Sales tax is origin-based within the US: the seller collects based on the buyer’s state and local rates.

- Imports are usually taxable, exports often zero-rated, yet documentary proof is essential.

Many firms misapply domestic concepts abroad, leading to double taxation. A strong grasp of these contrasts is the first pillar of international VAT compliance. For a more detailed comparison, see the Sales Tax Registration and Compliance Guide for Global Sellers.

Ending this section, remember: treat each country’s VAT or sales tax as unique, not a copy-paste exercise. Next we explore when you must register.

Registration Requirements for Foreign Sellers

Cross-border transactions often create “taxable presence” long before a legal entity exists in the target country.

Foreign companies must register when they either hold stock locally or cross a revenue threshold. In the EU, registration can trigger at €0 if you store goods in a member state’s warehouse. Meanwhile, Australia and Norway require VAT registration once digital revenue to consumers exceeds AU$75,000 and NOK 50,000 respectively.

Identify thresholds:

- Physical goods: distance-selling limits in the EU, state nexus rules in the US.

- Digital services: often lower or nil thresholds.

Gather documents early: certificate of incorporation, bank letters, passport copies of directors.

Expect variations in processing time:

- Germany, 6–8 weeks

- Singapore, 10 working days

Delay costs money. For example, 55 % of importers reported customs holds due to missing VAT IDs last year. Filing before your first shipment avoids storage surcharges.

In many cases, external advisors streamline multi-country registrations. Firms such as 1stopVAT act as a single point of contact, sparing finance teams from tracking a dozen portals and languages. For benchmark thresholds and compliance checklists, see the VAT Compliance Checklist for Startups and Small Businesses.

Now that you are registered, let’s tackle the complexities of digital services taxation.

Digital Services Taxation and Platform Obligations

Streaming platforms, SaaS vendors, and gaming studios face rules that change faster than product roadmaps. Over 80 jurisdictions now impose VAT or GST on B2C digital supplies.

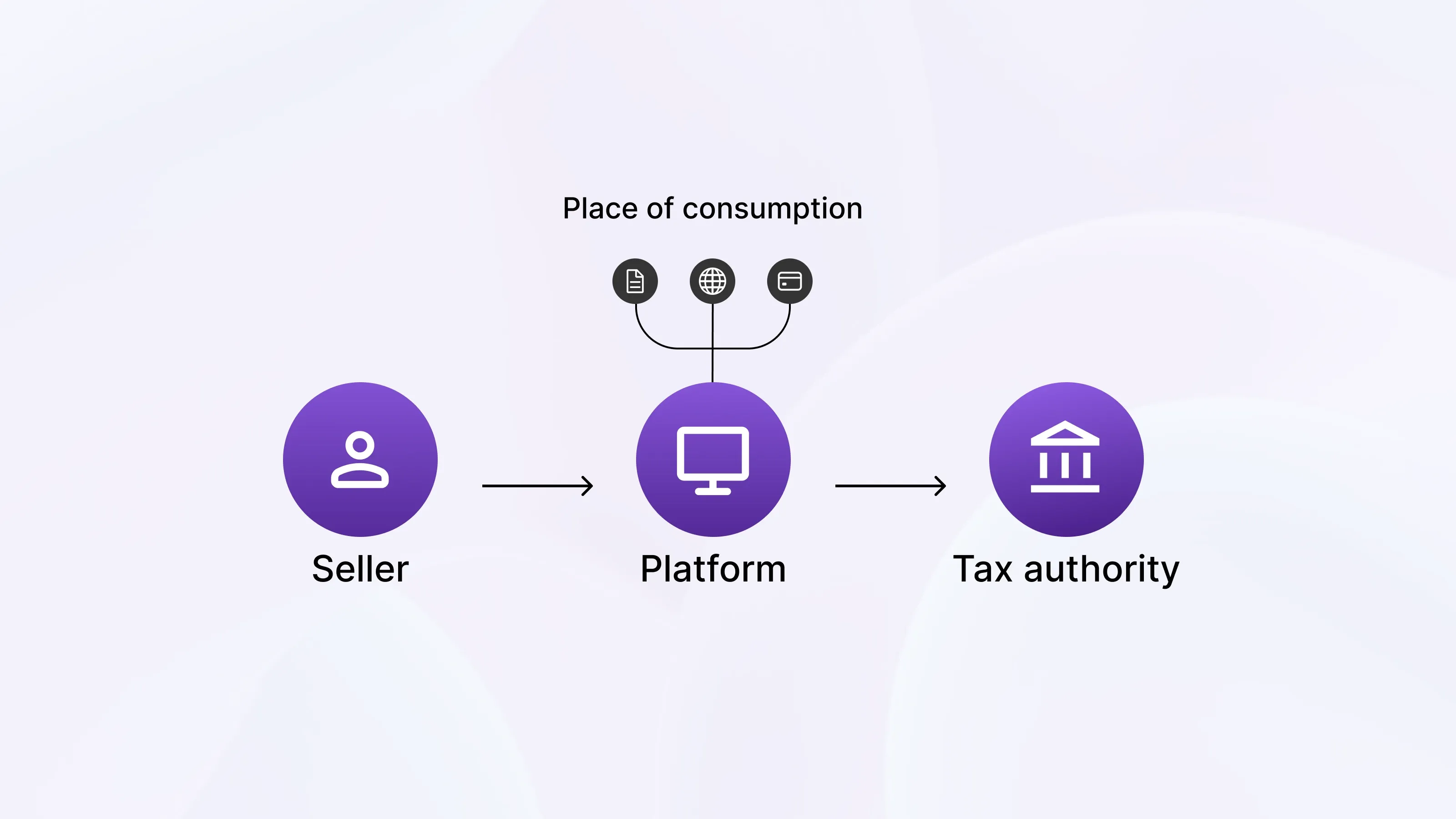

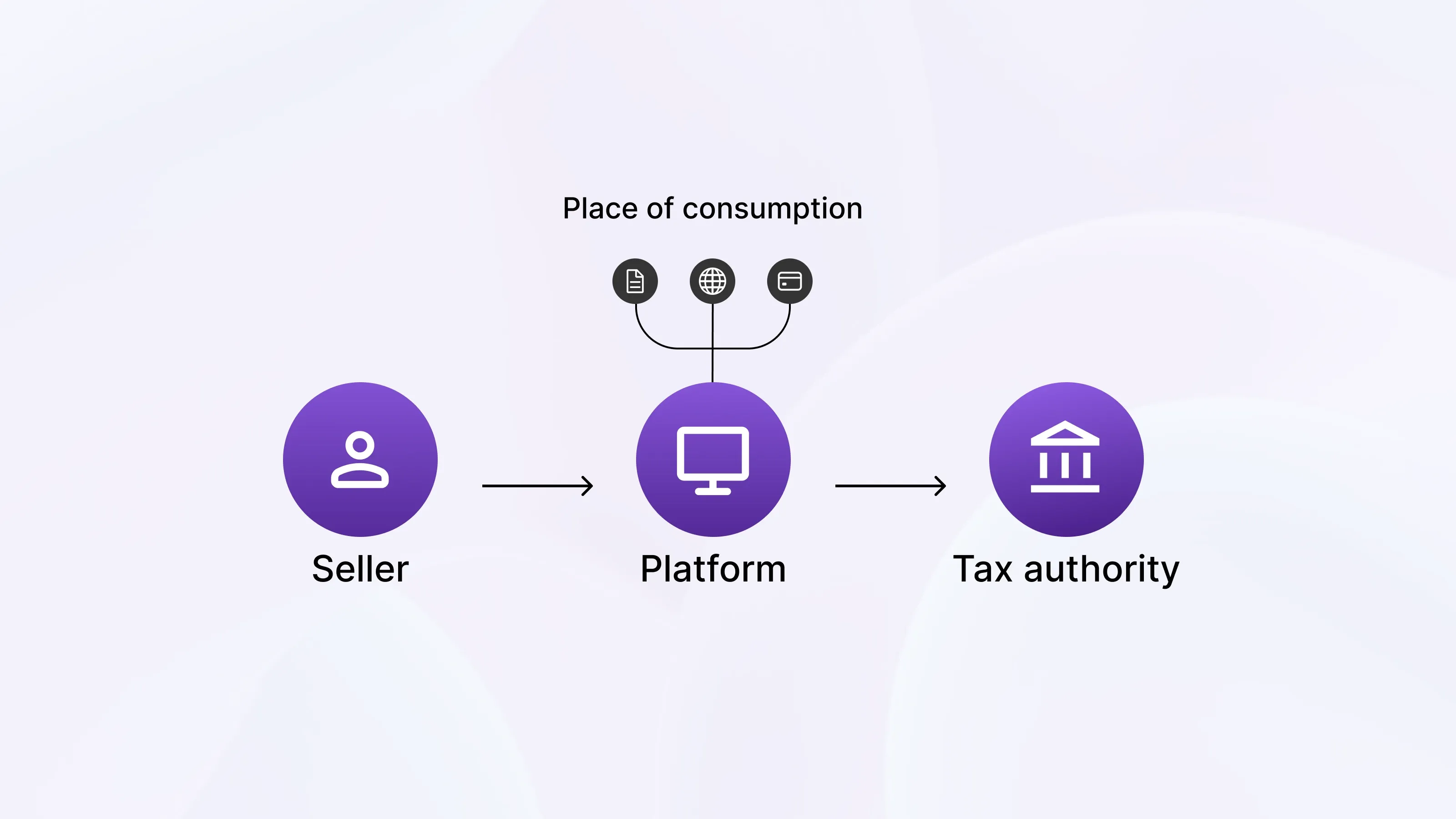

Pinpoint the Place of Consumption

Most regimes apply the “two non-contradictory pieces of evidence” test:

- Billing address

- IP location

- Credit card BIN country

Keep logs for at least five years to defend your position during audits.

Marketplaces as Deemed Suppliers

Several countries have shifted collection duties to online platforms. For instance, the EU’s 2021 e-commerce package moved VAT liability to marketplaces for certain low-value consignments. To dive deeper into what platforms and sellers are responsible for, visit Marketplace VAT Obligations for Online Sellers: What You Need to Know. Sellers may no longer charge VAT themselves but must still issue compliant invoices.

Special Cases: Digital Advertising and User Data

India’s Equalisation Levy and Kenya’s Digital Service Tax target revenue from local users, even when no local entity exists. Such levies sit outside regular VAT schemes, so accountants must book them separately.

Finishing this section, review whether your business model includes any platform or data-driven revenue streams. If yes, expect extra layers of indirect tax.

How to Coordinate Multi-Country Filings

You now collect taxes in multiple currencies, languages, and file formats. Missing a deadline can trigger fines of up to 300 % of the unpaid amount, as Spain’s tax code allows.

A structured calendar is non-negotiable.

- Build a master compliance matrix: country, return type, frequency, due date, extension rules.

- Use local bank accounts where required, but maintain a treasury plan for currency swings.

- Reconcile payments: match VAT on sales, imports, and reverse charges to ledger data.

- Submit EC Sales Lists, Intrastat, or SAF-T files when applicable.

Filing through a Single VAT Return: OSS and IOSS

The EU’s One-Stop Shop (OSS) and Import OSS reduce multiple returns into one. Eligibility:

- B2C sales shipped from a single EU stock point: OSS

- Goods below €150 imported from outside the EU: IOSS

Entering OSS can cut administrative time by 30%, improving working capital, as European Commission impact assessments show. Want to dig into practical OSS/IOSS steps? See VAT Compliance for SaaS and Digital Services in the EU for a stepwise breakdown.

Summary: a living compliance calendar paired with consolidated filing schemes where available keeps costs predictable.

Technology and Human Expertise: Building a Scalable Compliance Framework

Spreadsheets buckle once you add five or more VAT registrations. Yet software alone cannot interpret gray areas or handle regulator queries.

- Choose tools that integrate with ERP and shopping carts, pulling real-time tax data.

- Ensure logic for multiple rates, exemptions, and currency conversions.

- Retain professional oversight: a team of certified tax specialists, similar to 1stopVAT’s 40-plus consultants, validates transactions and manages correspondence with authorities.

- Document processes: who reviews, approves, and submits each return.

The hybrid approach gives you speed without sacrificing nuance. As regulations evolve, human oversight prevents expensive misinterpretations. For insights into tech-driven frameworks, check Tax Technology Tools – VAT Compliance Automation.

Maintaining Audit-Ready Records and Documentation

Tax offices ask for proof, not promises. Keep your house in order long before the audit notice arrives.

- Retain invoices, import declarations, and shipping proofs for 7–10 years, depending on jurisdiction.

- Store data in searchable formats: PDF/A, CSV, or XML.

- Map evidence to each line in the VAT return.

- Conduct periodic internal audits: spot discrepancies in VAT codes, exchange rates, or refund claims.

72% of finance leaders said audits focused on digital services revenue last year. Solid documentation turns an audit from crisis into routine. For a cautionary perspective on potential penalties, see VAT Compliance: How EU Businesses Lost €159M in Penalties.

By now, you have a full compliance cycle, from registration to record-keeping. Let’s crystallize the core idea.

What Are Cross-Border Tax Compliance Services?

Cross-border tax compliance services help businesses register for VAT or sales tax, determine the correct rates, collect and remit taxes in multiple countries, prepare and file returns on schedule, and maintain audit-ready records, ensuring all indirect tax duties are met when selling goods or digital services internationally.

Conclusion

Cross-border trade adds rewarding revenue streams but also layers of tax risk. By understanding indirect tax rules, registering promptly, mastering digital service obligations, coordinating filings, blending technology with human expertise, and safeguarding documentation, you build scalable global tax solutions that adapt to multiple jurisdictions. With the right global tax solutions in place, compliance shifts from a roadblock to a reliable business support system - letting you focus on sustainable growth rather than penalties.