Why Cross-Border Compliance Matters More Than Ever

Regulators across the globe keep raising the stakes. Businesses in the EU alone spend €204 billion per year on tax compliance, and those costs jumped 114% between 2014 and 2019. Small and medium-sized enterprises feel the pain most, burning roughly 2.5% of turnover on tax tasks compared to 0.7 % for large groups.

The EU’s One-Stop Shop (OSS) schemes help, yet they still require expertise. From mid-2021 to 2024, traders declared €88.05 billion in VAT under OSS/IOSS, proving how quickly digital sellers face multi-country filings.

What does this mean for you?

- Missing a local deadline can trigger late-filing fines that erase margins.

- Collecting the wrong rate can spark retroactive assessments and interest charges.

- Failing to appoint an IOSS intermediary blocks low-value imports into the EU.

The takeaway: global sales need global compliance muscle. For a deeper dive on why VAT compliance is mission-critical and how to structure your approach from registration to reporting, see this practical VAT services for US companies: How to Stay Compliant When Selling Internationally.

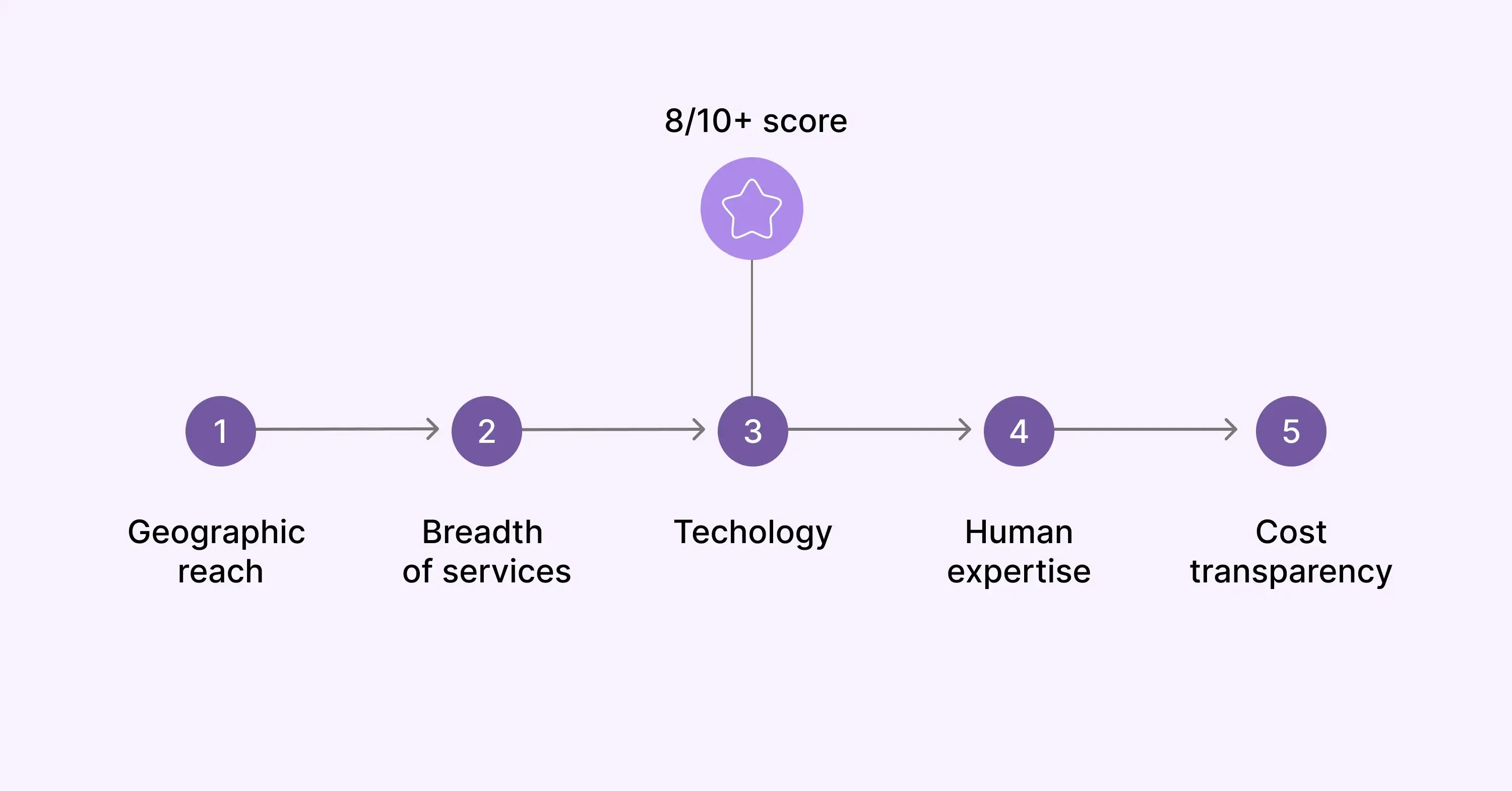

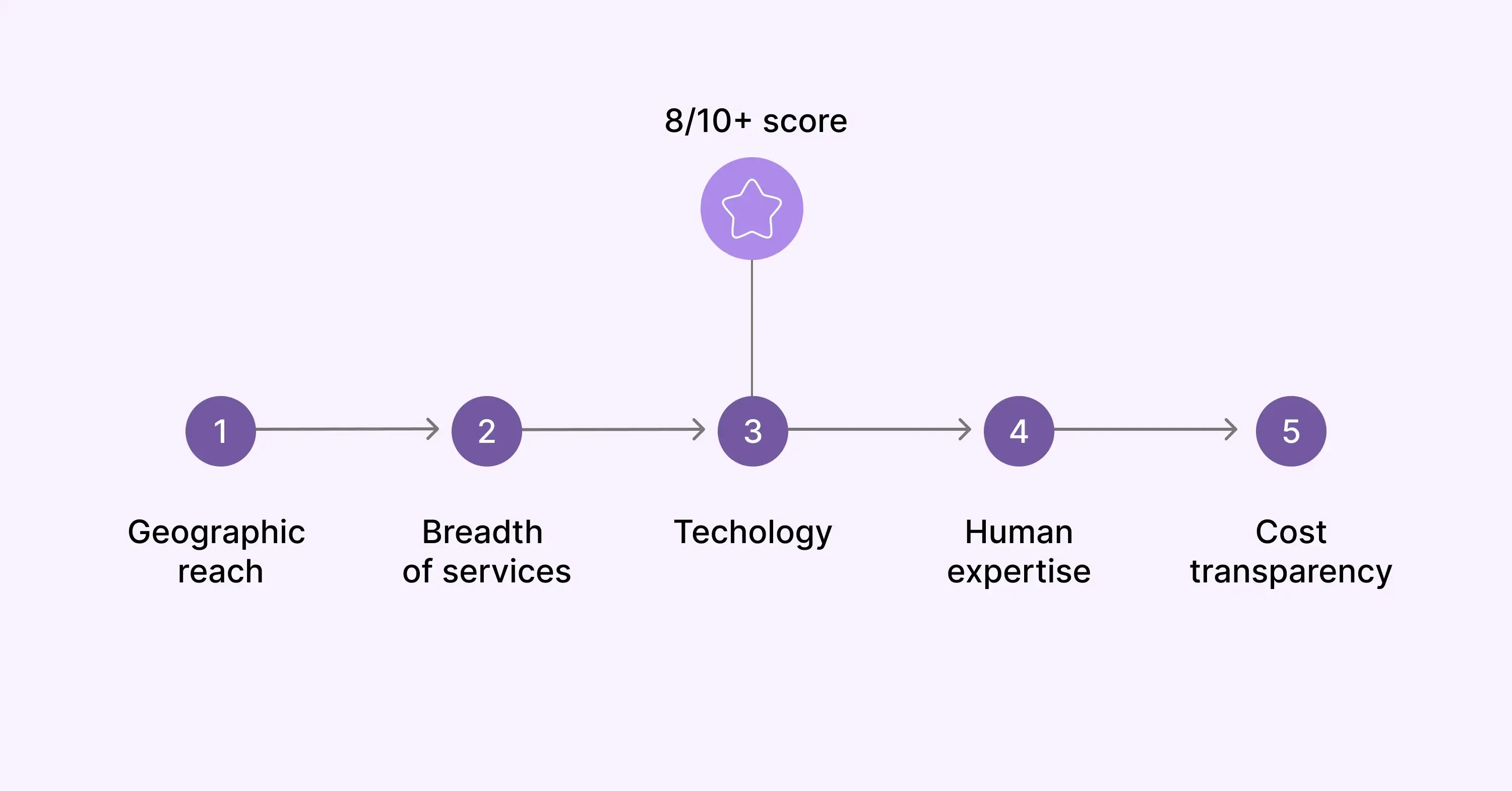

How We Picked the Best Cross-Border Tax Compliance Firms

Choosing outsourced tax help is a high-stakes call. We evaluated dozens of providers on five weighted criteria:

- Geographic reach: Can they cover 50, 75, or 100+ countries?

- Breadth of services: Registration, ongoing filings, audit defence, consultancy.

- Technology: Secure portals that simplify data transfer without pushing “automation only.”

- Human expertise: Certified tax pros with local language skills.

- Cost transparency: Flat fees, clear onboarding timelines, and no surprise “change-order” invoices.

Only firms scoring 8+ out of 10 on each category made the final list.

Ending this section, remember that a shiny platform means little without seasoned advisers who pick up the phone. Next, meet the specialists who blend both. For those managing mixed direct and indirect tax issues, consulting a guide on cross-border tax planning for global growth can clarify potential pitfalls and compliance strategies as you scale internationally.

Top 7 Global VAT Experts

Below are seven providers that consistently deliver cross-border peace of mind. For quick scanning, each H3 outlines coverage, flagship services, and a standout strength.

1. 1stopVAT

Acting as a single point of contact, 1stopVAT’s 40-plus certified specialists manage VAT registration, filing, and consulting in 100+ countries. Clients appreciate the mix of automated tools and hands-on guidance, letting them scale quickly while staying compliant.

- Flagship: Union OSS and IOSS registrations with ongoing filings.

- Standout: Fast onboarding for e-commerce sellers that need multi-country VAT numbers yesterday.

Their balanced approach of tech plus people helps mid-sized brands avoid the spreadsheet chaos that accompanies rapid expansion.

2. Deloitte Indirect Tax

Deloitte’s global network covers virtually every jurisdiction and blends VAT, GST, and customs services. Multinationals lean on their local teams for complex rulings or dispute resolution.

- Flagship: End-to-end VAT life-cycle outsourcing.

- Standout: Integrated customs and supply-chain consulting for importers.

3. PwC Global Tax Compliance

PwC offers centralised VAT governance combined with country-specific filing support. Their MyTaxPortal gives CFOs a real-time view of obligations across entities.

- Flagship: Co-sourcing models that embed PwC staff in-house.

- Standout: Industry-focused teams for SaaS, manufacturing, and retail.

4. KPMG Trade & Customs

KPMG blends technology platforms with regional VAT centres of excellence. Their VAT Alert service flags legislative changes in minutes.

- Flagship: Continuous transaction controls (CTC) readiness assessments.

- Standout: Strong presence in Latin America’s fast-changing e-invoice landscape.

5. EY Global Indirect Tax

EY maintains more than 3 000 indirect-tax professionals worldwide. Their Indirect Tax Tracker maps real-time rate changes and filing deadlines.

- Flagship: Managed services combining VAT, GST, and sales tax.

- Standout: Robust analytics that spot anomalies before auditors do.

6. TMF Group

TMF specialises in corporate secretarial and accounting along with VAT. Their on-the-ground presence in 80+ jurisdictions helps companies with limited local substance meet tax and corporate law requirements.

- Flagship: VAT compliance plus statutory bookkeeping.

- Standout: Ability to act as fiscal representative where required.

7. Ryan Global VAT

Known for audit defence, Ryan helps businesses reclaim overpaid VAT and negotiate assessments. Their team frequently litigates contentious cases.

- Flagship: VAT recovery and controversy services.

- Standout: Success-based fee structures that align incentives.

Choosing among them boils down to fit: size, industry, and desired service depth. Shortlist two or three, request proposals, and compare scope and pricing apples to apples. For a broader consideration of advisory versus in-house approaches, the VAT Compliance & Consultancy: Why Expert Advice Matters article provides a concrete comparison and explores core services.

How Great Providers Keep You Penalty-Free

Even the best cross-border tax compliance firms cannot change the rules, but they can keep you a step ahead. Here is how:

- Mapping obligations: A matrix of registrations, thresholds, and invoice rules for every destination.

- Data sanity checks: Reconciling ERP figures to returns reduces audit surprises.

- Deadline discipline: Calendar tools plus human reminders beat last-minute scrambles.

- Audit advocacy: Experienced negotiators speak the tax authority’s language, literally and figuratively.

A strong adviser also interprets policy shifts. The EU expects the BEFIT rules could trim compliance costs by up to 65%, but only if companies adjust their processes promptly. Your chosen firm should translate legislative jargon into clear action steps. If you need a comprehensive view of compliance automation and its benefits, see Tax Technology Tools – VAT Compliance Automation.

Wrapping up, remember that compliance is not a set-and-forget project. Regular health checks keep yesterday’s solution aligned with tomorrow’s law. Businesses looking for ongoing assurance should review the Aligning Cross-Border Tax and Accounting Practices for SMEs resource for seven structured steps to effective compliance.

Practical Guidance for Multi-Country Operations

Managing taxes across borders is less daunting when broken into repeatable actions.

- Centralise data: One source of truth for sales, returns, and tax rates.

- Segment markets: Group countries by similar rules (e.g., EU VAT vs. Gulf VAT) for focused workflows.

- Leverage OSS/IOSS: Businesses registered through the schemes can cut red tape by up to 95% on intra-EU distance sales.

- Monitor thresholds: Many jurisdictions apply revenue or shipment counts that trigger registration.

- Budget for audits: Set aside funds and documentation time so audits do not upend daily operations.

A trusted adviser handles filings, yet internal alignment still matters. Finance, logistics, and IT teams should understand tax data requirements to avoid last-minute panics. Plus, for a practical checklist, the Global Sales Tax Solutions & VAT Compliance Guide offers actionable steps and guidance for worldwide sellers.

Finish this section remembering that compliance scales with process discipline. Build good habits early, then let your chosen firm fine-tune the details.

Conclusion

Cross-border growth magnifies compliance challenges, yet the right partner makes multi-country tax a manageable routine. Evaluate geographic reach, expertise, and transparency, then select a firm, like the seven featured above, that aligns with your goals. Stay proactive, keep data clean, and enjoy the confidence that your global VAT obligations are under control.