What you will learn

This guide:

- Explains why outsourcing registration often beats doing it yourself

- Shows the rating criteria we used: cost, speed, expertise, geographic reach, and help desk quality

- Pits four provider types against each other, including a government portal, an online marketplace, a local accountant, and a global consultancy such as 1stopVAT

- Ends with a practical checklist you can print or bookmark

Let us jump in.

Why entrepreneurs outsource tax registration anyway

More than 60% of tax transactions are now completed online, which means registration looks simple on paper. Reality bites when forms bounce back, business models cross borders, or you must prove identity a second time.

More than 60% of tax transactions are now completed online, which means registration looks simple on paper. Reality bites when forms bounce back, business models cross borders, or you must prove identity a second time.

Key pain points that push founders to outside help:

When a service can register you faster than you would alone, the fee often pays for itself.

For a detailed look at how expert advice can reduce costly missteps and help with compliance, see VAT Compliance & Consultancy: Why Expert Advice Matters.

Closing thought for this section: outsourcing is not mandatory, but the data shows that mistakes and opportunity costs make outside help attractive.

How we rated the providers

Before we stack services side by side, here are the scorecards we used.

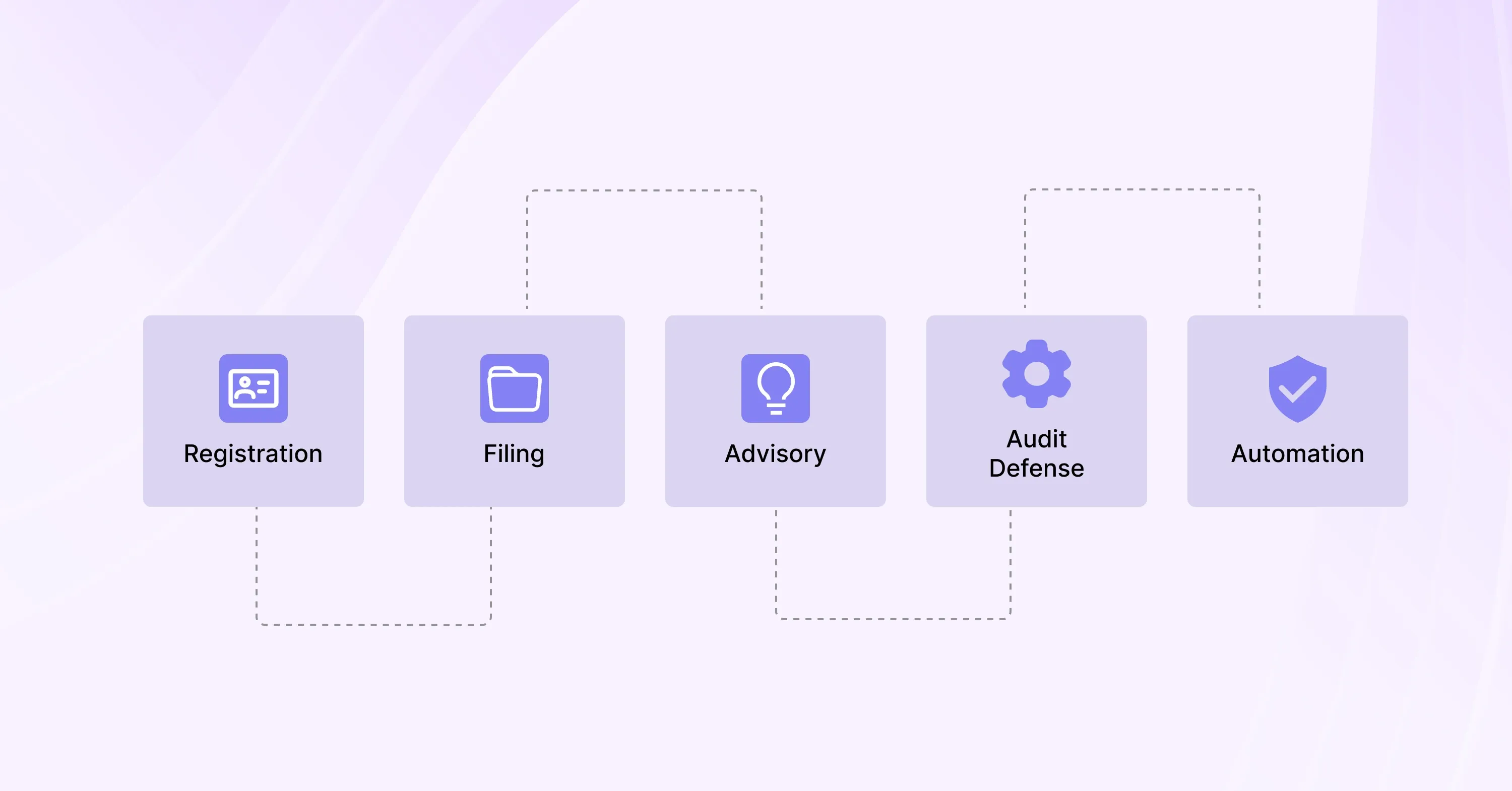

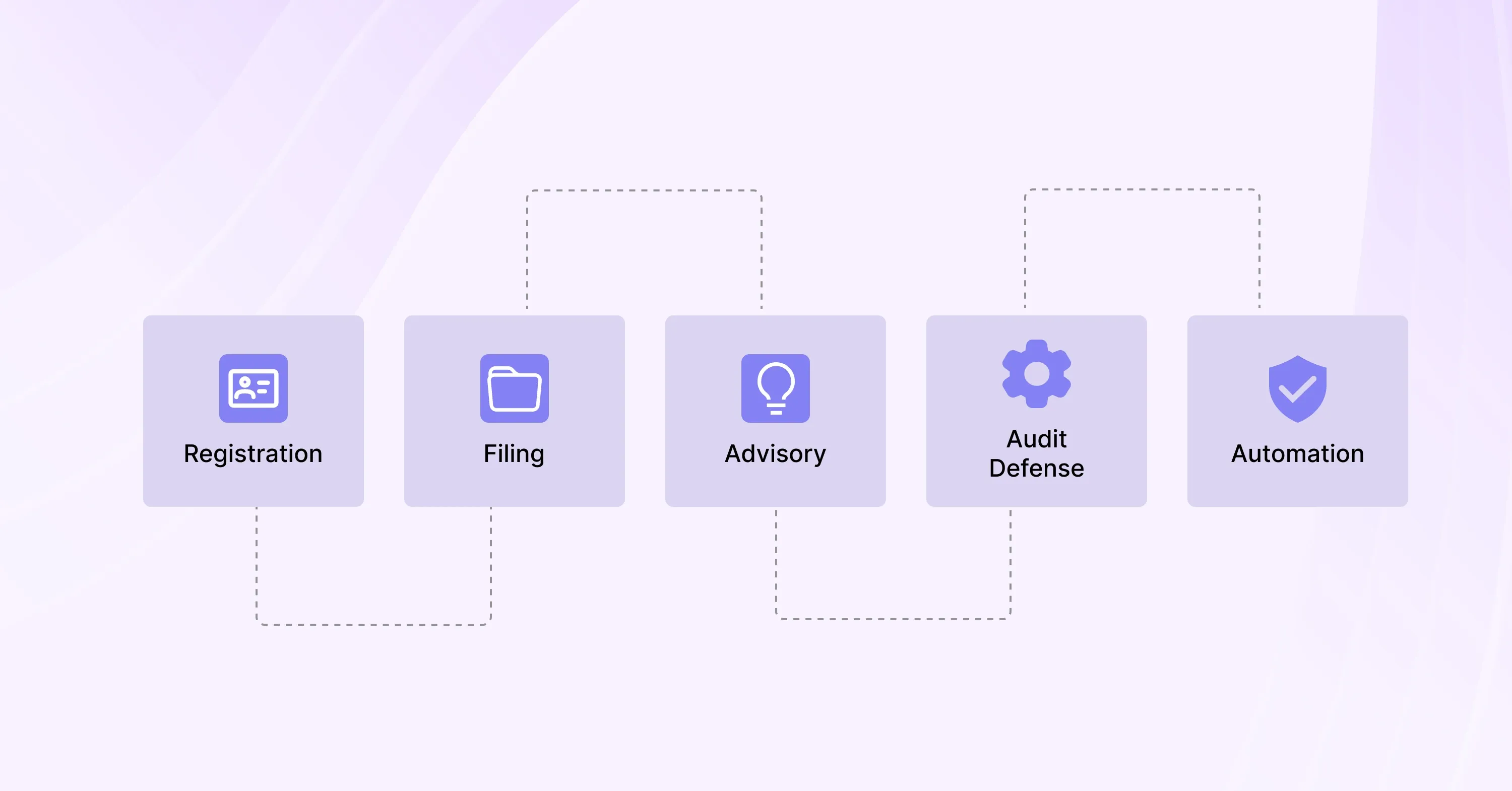

We looked at five dimensions.

- Cost: filing fees, service fees, hidden add-ons

- Speed: days from sign-up to VAT or EIN number

- Coverage: number of jurisdictions, multi-state or multi-country options

- Expertise: certified tax specialists, industry focus, success rate

- Support: live chat, phone, email, and knowledge base quality

We gave each attribute equal weight. You might adjust weights to suit your priorities, for instance, a SaaS company selling globally may give coverage double weight.

That framework now guides the comparisons below.

Side-by-side comparison of popular business tax registration options

Every provider claims to be fastest and cheapest. Here is what we found when we scored them.

1. Government self-service portals

You log in, fill forms, and wait.

Pros:

- Lowest direct cost, often free except statutory fees

- Immediate control of your data

- Works well for single-country, simple structures

Cons:

- No human review, errors can delay approval for weeks

- Limited support, FAQs only

- Unsuitable if you plan cross-border sales in the near term

Average turnaround: 5–20 days once forms are correct.

2. Online registration marketplaces

These websites bundle incorporation, EIN, VAT registration, and templates.

Pros:

- Slick interface, step-by-step guidance

- Transparent pricing tiers

- 24/7 chat support

Cons:

- Call center staff may not be tax professionals

- Extra fees for every additional state or country

- Minimal help with post-registration filings

Average turnaround: 3–10 days, but multi-jurisdiction requests can stretch longer.

3. Local accounting firm

Your neighborhood accountant files on your behalf.

Pros:

- Face-to-face trust

- Can handle bookkeeping too

- Understands local tax incentives

Cons:

- Higher hourly rate

- Limited to one country or state

- Slower if the firm still mails paperwork

Average turnaround: 7–15 days.

4. Global tax consultancy (example: 1stopVAT)

These firms specialise in cross-border VAT and indirect taxes. 1stopVAT, for instance, fields 40+ certified specialists covering 100+ countries.

Pros:

- Single point of contact even for complex international setups

- Humans double-check every form while proprietary tools speed data capture

- Ongoing compliance, filings, and consulting in one place

Cons:

- Premium pricing for small, purely domestic businesses

- May require initial discovery call before quoting

Average turnaround: 2–7 days for standard VAT numbers, faster where portals allow instant issuance.

If your business faces multi-country registration, be sure to read the Sales Tax Registration and Compliance Guide for Global Sellers for practical steps and essential tips.

In short, DIY portals win on cost, online marketplaces on user experience, local accountants on personal touch, while global consultants shine when you sell in multiple regions.

What does it really cost?

Sticker prices can be misleading. Use this rough guide to budget.

- Government fee only: £0–£40 in many UK cases

- Marketplace starter plan: £100–£250 plus state fees

- Accountant package: £300–£600, hourly overruns possible

- Global consultancy starter: £500–£1 200 per jurisdiction, volume discounts common

Remember the earlier stat: 41% of UK VAT traders earn below the £85 000 threshold. For small sellers, a low fee matters. For high-growth companies, faster market entry may outweigh price.

For founders weighing different VAT schemes and more cost-efficient compliance choices, see the VAT Compliance Checklist for Startups and Small Businesses.

Customer satisfaction snapshots

Survey data is patchy, so we looked at Trustpilot averages, response time metrics published by the providers, and anecdotal founder interviews.

Highlights:

- DIY portals get criticized mainly for confusing error messages rather than outright failure

- Marketplaces score 4.1–4.5/5 when customers only need one jurisdiction, scores dip once they expand

- Local accountants vary widely, from perfect NPS to horror stories tied to individual staff

- Global consultancies average 4.7/5 among exporters who need multiple VAT numbers in Europe, North America, and APAC

Across the board, live human chat and proactive status updates correlate with higher ratings.

Learn more about how ongoing compliance, digital filing, and automation support smooth registration and high satisfaction in the Global Sales Tax Solutions & VAT Compliance Guide.

Checklist: choosing the right service

Use this quick list before you pay anyone.

- Confirm whether you need domestic only or multi-country registration

- Ask for an itemised quote, including any translation or notary fees

- Check professional credentials: chartered accountant, tax attorney, or certified consultant

- Request a timeline with milestones and escalation contacts

- Verify post-registration support: filings, reminders, deregistration help

- Read at least five third-party reviews dated within the last six months

- Ensure data security compliance if you will upload passports or bank statements

For further advice on aligning compliance with international growth and keeping up with changing rules, refer to Aligning Cross-Border Tax and Accounting Practices for SMEs.

Tick every box and your odds of a smooth registration rise sharply.

Business tax registration services are third-party providers that prepare, submit, and monitor all paperwork needed to obtain a tax ID, VAT number, or similar certificate for a new or expanding company. They differ mainly in cost, speed, geographic reach, and human support levels.

Conclusion

Choosing between DIY portals, online marketplaces, local accountants, and global consultancies comes down to cost, complexity, and growth plans. Match the provider’s strengths to your roadmap, use the checklist above, and you will register quickly and avoid costly missteps.

More than

More than