What you will learn

By the end of this guide you will be able to:

-

Identify seven advisory teams widely regarded as the best cross-border VAT experts for international businesses

-

Spot the most common VAT traps before they trigger penalties

-

Understand the services a true vat specialist accountant should deliver, from registrations to audits

-

Ask the right questions so every piece of vat expert advice you buy produces measurable savings

Along the way, we weave in fresh data, real-world examples, and clear action points so you can move from research to engagement with confidence.

Top cross-border VAT advisors in 2024

The seven firms most praised for global VAT compliance support are 1) EY Global Indirect Tax, 2) PwC Global VAT & IPT, 3) Deloitte Global Tax & Legal, 4) KPMG Indirect Tax Network, 5) Ryan International VAT Consulting, 6) 1stopVAT, and 7) TMF Group Indirect Tax. Each covers registrations, periodic filings, controversy support, and technology-enabled monitoring in 80-plus countries. For additional benchmarks and comparisons, review the Best Cross-Border Tax Compliance Firms: Global VAT Experts.

The rising stakes of cross-border VAT compliance

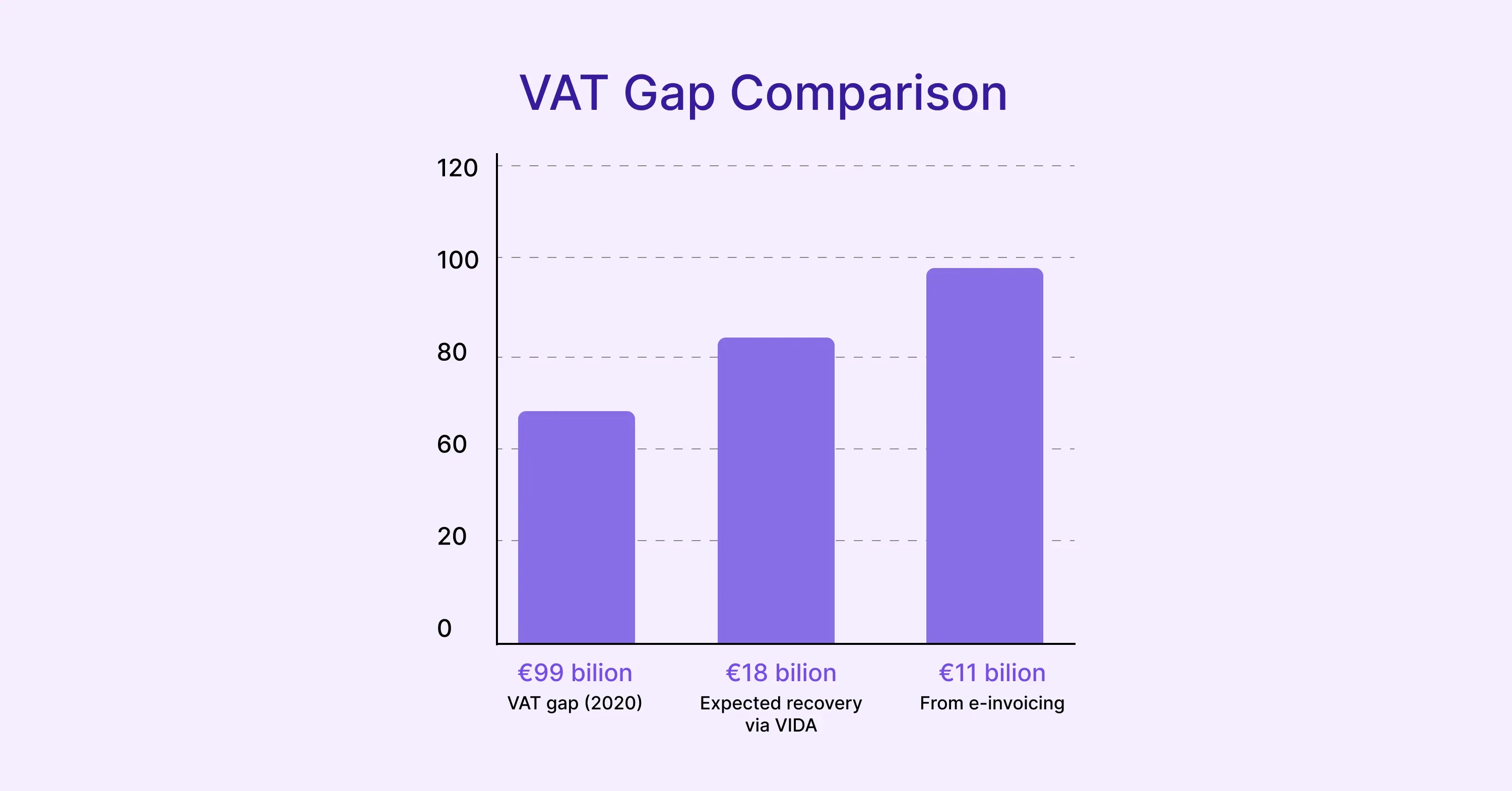

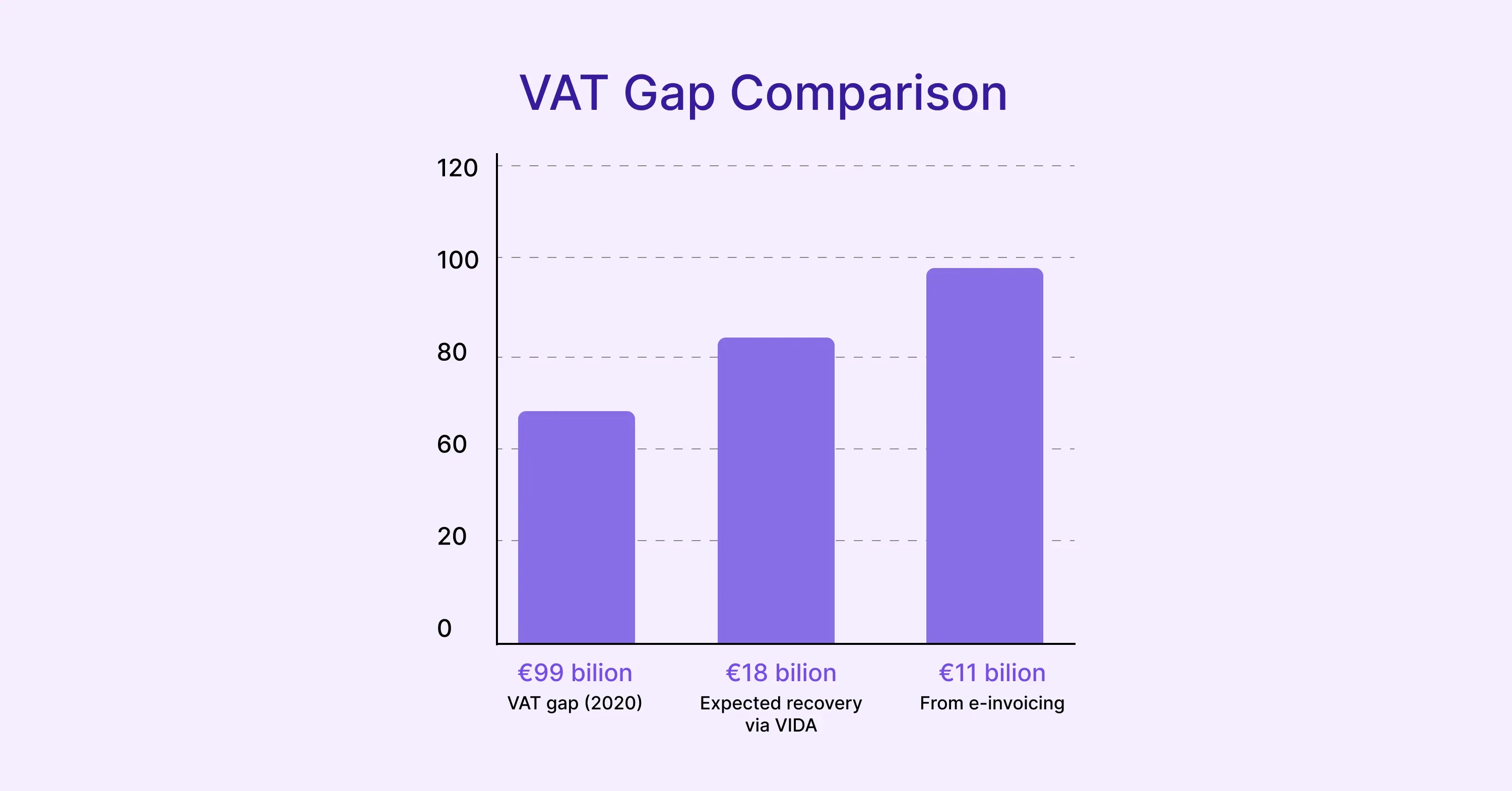

Member States lost €99 billion in VAT revenues in 2020, and roughly a quarter of that gap came from intra-EU fraud. Those missing funds explain why the EU’s VAT in the Digital Age (ViDA) reforms aim to secure an extra €18 billion each year. E-invoicing alone could curb fraud by €11 billion annually.

For businesses, these reforms translate into stricter real-time reporting, wider taxable events (think gig-economy platforms), and stiffer fines. Mariana Príncipe of Ryan warned that “even small mistakes” in multi-country filings can trigger penalties, a statement echoed by many vat specialist accountants.

If you’re seeking clarity on how these EU reforms could impact your operations, VAT in the Digital Age: How Could it Affect Your Business? explores ViDA’s timeline, new e-invoicing mandates, and best-practice adaptation strategies.

That reality makes choosing a seasoned advisor a strategic decision, not mere outsourcing.

The 7 best cross-border VAT experts for international businesses

Below are the teams that global controllers, CFOs, and e-commerce founders name most often when asked who saved them from a VAT nightmare. Each H3 details why the firm stands out, what services you can expect, and an example that shows its impact.

1. EY Global Indirect Tax

EY’s 7 000-strong indirect tax practice spans 150 countries. The firm combines deep legislative contacts with technology platforms such as EY Global Tax Platform.

-

Registrations, fiscal representation, OSS/IOSS setup

-

Real-time e-invoicing integration in Italy, Spain, and soon ViDA mandates

-

Litigation support plus expert testimony if disputes escalate

Example: A Scandinavian SaaS provider faced multiple VAT audits after shifting from perpetual licenses to subscriptions. EY re-engineered its billing flows, recovered over €3 million in overpaid VAT, and eliminated retroactive fines.

EY is a solid pick when you need global reach and peerless technical depth.

2. PwC Global VAT & IPT

PwC’s network of vat specialist accountants couples compliance outsourcing with strategic advisory. The team publishes respected thought leadership such as the annual “VAT Compass”.

-

Country screening to identify permanent establishment triggers

-

Margin schemes, especially for travel and second-hand goods

-

Data analytics to compare your effective VAT rate against peers

Example: A UK cosmetics retailer using drop-shipping into 12 EU markets saved 4 percentage points on landed costs after PwC restructured supply chains through the Union OSS.

PwC offers iterative, data-driven advice ideal for complex supply chains.

3. Deloitte Global Tax & Legal

Deloitte blends legal, accounting, and digital capabilities under one roof. Its indirect tax group often works alongside the firm’s Customs & Global Trade team.

-

ViDA-ready e-invoice validation gateways

-

Integrated VAT and customs duty optimisation

-

Industry solutions for fintech, digital platforms, and renewables

Example: A US fintech processing B2C micro-payments in 27 EU states risked being treated as an electronic service provider. Deloitte secured a simplified VAT treatment, cutting compliance costs by 60 %.

Choose Deloitte when overlapping tax and regulatory risks demand a multidisciplinary approach.

4. KPMG Indirect Tax Network

KPMG excels at controversy work and tax technology selection.

-

Mock audits simulating tax authority queries

-

ERP VAT logic reviews before system migrations

-

Negotiating advance rulings to lock in treatment certainty

Example: A Japanese electronics brand moving its EU distribution hub to the Netherlands asked KPMG to secure advance licentie-verlegging. The ruling deferred €25 million in import VAT per year, improving cash flow.

KPMG is compelling for businesses expecting scrutiny or planning system overhauls.

5. Ryan International VAT Consulting

Ryan, the world’s largest tax specialty firm, is known for aggressive recovery of overpaid tax and contingency-based fees.

-

VAT recovery reviews, including historical error correction

-

Rapid response teams for cross-border audits

-

Training workshops for in-house finance teams

Example: An Irish hospitality chain unknowingly overstated VAT on bundled room-service packages. Ryan recovered €1.2 million and implemented templates that continue to generate six-figure savings yearly.

Ryan fits companies seeking a pay-for-performance model backed by robust expertise.

6. 1stopVAT

1stopVAT positions itself as a one-stop global VAT compliance provider. Its 40-plus certified tax specialists handle obligations in 100+ countries while proprietary tools track rate and rule changes.

-

Single point of contact for registrations, periodic filings, and consulting

-

Automated dashboards paired with human review to catch anomalies early

-

Flat-fee plans that simplify budgeting for scale-ups

Example: A Silicon Valley SaaS startup expanded to 38 markets within 18 months. 1stopVAT handled every new registration and ensured that the firm’s invoices met local digital signature requirements, allowing the finance team to stay lean.

If you want streamlined processes without juggling multiple advisors, 1stopVAT offers clear value. For deeper insight, see VAT Consulting for International Businesses.

7. TMF Group Indirect Tax

TMF Group focuses on compliance outsourcing for mid-market multinationals that favor central coordination.

-

VAT registrations, SAF-T filings, and e-invoicing clearance

-

Corporate secretarial and payroll services bundled under one contract

-

Local language support in 85 jurisdictions

Example: A Canadian machinery maker opened subsidiaries across Central Europe. TMF Group combined VAT, payroll, and entity management, cutting onboarding time by half.

TMF suits firms seeking one vendor for multiple back-office functions, VAT included.

Each advisor above marries regional presence with sector know-how. In the next section we explore the pitfalls they solve daily. Further strategies for narrowing your shortlist are given in Leading VAT Consultants for E-commerce: Who to Trust.

How vat specialist accountants neutralize common international VAT pitfalls

Cross-border VAT errors cluster around a handful of themes. Knowing them clarifies what services to prioritise.

-

Incorrect place-of-supply rules: Digital services, events, and B2C goods each follow distinct logic.

-

Missed registration thresholds: Sales through marketplaces can push you over local limits overnight.

-

E-invoicing and live reporting deadlines: Spain’s SII requires submission within four days, while planned ViDA rules will shorten windows further.

-

Import VAT and customs interplay: Poorly coded HS classifications inflate VAT.

-

OSS/IOSS misuse: Filing the wrong scheme or omitting zero-rated exports causes assessments.

For a practical workflow on identifying and preventing typical VAT pitfalls, see VAT Compliance & Consultancy: Why Expert Advice Matters.

A sharp vat specialist accountant will:

-

Map your transaction flows against country rules and flag mismatches early.

-

Monitor sales in real time so new registrations happen before authorities notice.

-

Configure ERP or marketplace feeds to output compliant e-invoices automatically.

-

Optimise incoterms and warehouse locations to defer or eliminate import VAT.

-

Reconcile OSS returns with local GL data, ensuring nothing is double-declared.

Real-world example: When EU OSS went live, Member States collected over €17 billion via the Union OSS. Companies that set up OSS incorrectly received assessment letters within months, while those guided by experts filed cleanly from day one.

For more operational insights, you might explore advice in How to Register for VAT: A Complete Guide.

The takeaway: specialists turn reactive firefighting into structured prevention.

Five questions that secure the best vat expert advice

You now have a short-list. Use these questions to select the perfect fit.

-

What is your track record with my industry’s unique supply chain? Ask for a case study, not generic statements.

-

Which country offices will work on my account and how do they share information? Coordination beats isolated filings.

-

How do you stay ahead of rule changes such as ViDA’s upcoming e-reporting? Look for named experts on EU working groups.

-

Can you explain your fee model line by line? Hidden “consulting hours” inflate budgets.

-

How will you measure success in year one? The answer should include KPIs like error rates, refunds secured, or time saved.

A firm that answers transparently is more likely to provide dependable results.

Conclusion

VAT complexity will only intensify as governments close the compliance gap. Whether you pick a Big Four powerhouse, a recovery specialist like Ryan, or a focused provider such as 1stopVAT, the firms above have proven they can keep businesses selling internationally without missteps. Match their strengths to your risk profile, ask targeted questions, and cross-border VAT will shift from a looming threat to a managed routine.

For further help in selecting a provider, read Finding the Right VAT Consultant for E-commerce.