What you will learn

You will see why checking a supplier’s VAT status is non-negotiable, what data to collect, how to run a fast supplier VAT check in multiple databases, and how to store proof that satisfies auditors. Mini case studies show each rule in action, and an FAQ answers the most common questions at the end.

Why validating VAT partners matters

EU governments still lose eye-watering sums to missing VAT. In 2022 the VAT compliance gap was €89.3 billion, or 7.0% of theoretical revenue. Revenue shortfalls have narrowed, but they still slid from €121 billion in 2018 to €89 billion in 2022.

Tax authorities are therefore laser-focused on validation evidence. Failing to check can mean:

-

Rejected zero-rate sales and retroactive VAT due

-

Fines for issuing invoices with an incorrect VAT ID

-

Input VAT reclaims denied when the supplier turns out fraudulent

Mini case study: A Dutch electronics wholesaler sold €400k of laptops intra-EU, relying on a VAT number copied from a pro-forma invoice. An audit proved the number belonged to a defunct entity, which cost the wholesaler €84k in unpaid VAT plus interest.

For more cautionary tales about compliance gaps and penalties, see VAT Compliance: How EU Businesses Lost €159M in Penalties.

Knowing the risks, let us jump into the practical steps.

Step 1: Collect the right vendor data

Before you can run a reliable VAT partner lookup, gather a minimum dataset.

-

Legal name of the entity (spelling counts)

-

Full address, including postal code

-

VAT identification number exactly as presented

-

Company registration or tax ID for non-EU suppliers, if relevant

-

Contact person details for follow-up questions

Keep copies of original documents (e.g., certificate of incorporation) in your vendor master file. This baseline stops simple typos from triggering false negatives and makes later audits smoother.

For a more detailed checklist of data to gather and onboarding best practices, consult VAT Certificate Verification: Ensuring Compliance.

Good data in, good validation out.

Step 2: Run the primary VAT vendor search and validation

The official first port of call inside the EU is the VIES (VAT Information Exchange System) database.

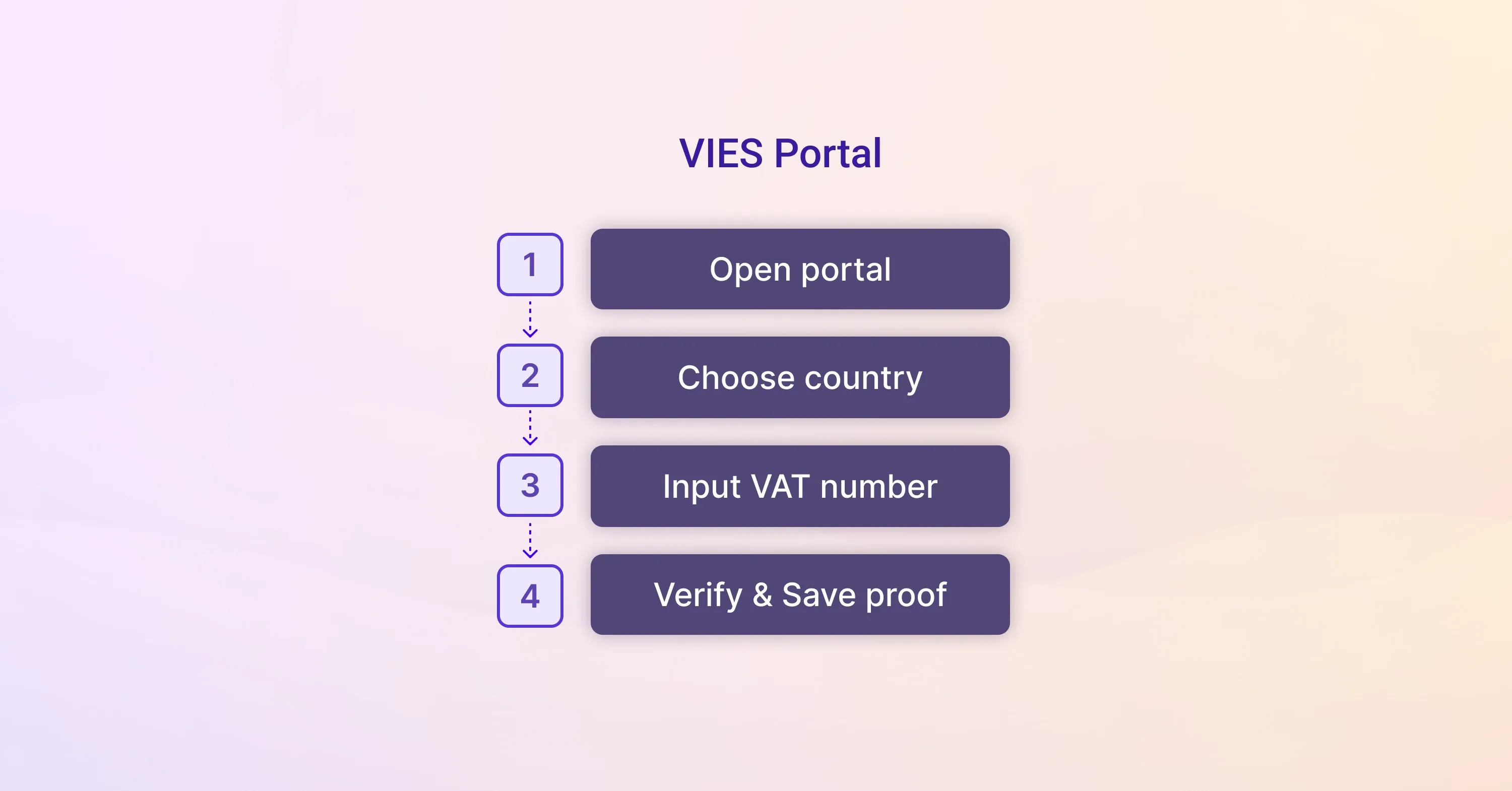

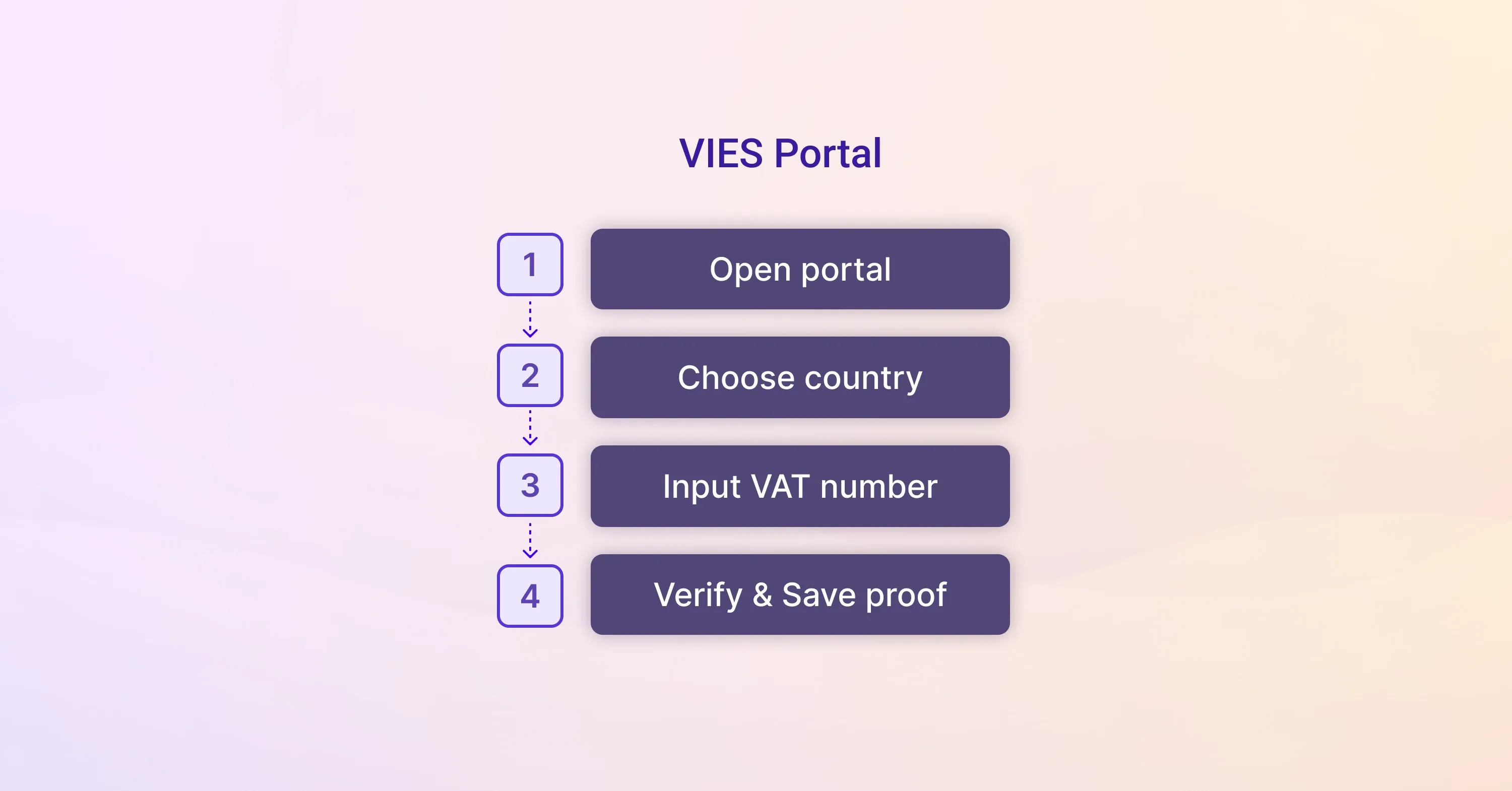

How to use VIES

-

Open the VIES portal.

-

Select the supplier’s Member State.

-

Enter the VAT number without spaces.

-

Hit “Verify” and review the status message.

If the number is valid, a confirmation page appears. Download or print it, date-stamp, and store the PDF.

If you need a detailed step-by-step walkthrough with tips and pitfalls, refer to How to Perform an EU VAT ID Check (VIES Guide).

What if VIES shows “Invalid”?

-

Double-check the number for typos.

-

Confirm you selected the correct country.

-

Ask the supplier to re-send their VAT certificate.

-

If still “Invalid”, withhold zero-rating until clarified.

VIES is indispensable, but not foolproof, so a layered approach follows next.

Step 3: Cross-check with supplementary databases

While VIES covers EU VAT numbers, you may trade with UK, Norwegian, or non-EU partners where other databases apply. VAT Certificate Verification: Ensuring Compliance provides a practical overview of this process and explains how to supplement official checks with robust documentation.

National tax portals

-

UK: HMRC’s “Check a VAT number” service

-

Norway: Brønnøysund Register Centre

-

Switzerland: UID Register

Cross-reference the name and address to catch “number hijacking”, where fraudsters use an active VAT ID belonging to someone else.

Commercial validation tools

Modern platforms can validate VAT data across 150+ jurisdictions instantly. They typically:

-

Ping multiple registries at once

-

Flag mismatches in spelling or address

-

Provide an audit trail export

For practical advice on VAT automation and tech solutions, see VAT Reporting Made Simple: Best Practices for Businesses.

Although automation helps, remember you remain responsible for the final decision.

Bank and credit checks

A multi-source approach protects against single-point failure and raises your comfort level before shipping goods.

Step 4: Keep evidence and monitor changes

A one-off validation is not enough; VAT numbers can be revoked at any time.

-

Store PDF or CSV evidence of each check, labelled with invoice number and date

-

Re-validate long-term customers at least quarterly

-

Use alerts where a VAT number status changes to “Invalid”

-

Record internal notes: who performed the check and when

Mini case study: A Polish SaaS provider ran quarterly validations and spotted a lapsed Czech customer number within 10 days, saving €18k in potential adjustments.

For concrete tips on digital archiving and maintaining a compliant audit trail, visit VAT Reporting Made Simple: Best Practices for Businesses.

Documentation turns a quick online lookup into defendable audit evidence.

Step 5: Troubleshoot common validation issues

Even diligent teams face edge cases. Here is how to handle them.

VAT number not yet on the database

-

New registrations can take days to propagate

-

Ask for the tax office acknowledgment letter

-

Re-check after one week before shipping goods

Branch versus head-office VAT numbers

Format errors

-

Some systems ignore spaces, others do not

-

Validate the expected length (e.g., Italy always 11 digits)

To see how to troubleshoot these validation issues in depth, take a look at How to Perform an EU VAT ID Check (VIES Guide).

Consistent internal rules prevent these glitches from escalating.

Step 6: When to involve external specialists

If a vendor supplies contradictory documents, operates in multiple jurisdictions, or red flags appear, professional advice pays for itself. A firm such as 1stopVAT, with 40+ certified tax specialists covering 100+ countries, can perform enhanced supplier VAT checks, draft compliance procedures, and liaise with foreign tax offices on your behalf.

To see what value expert consultancies add - and how they can de-risk global expansion - review VAT Compliance & Consultancy: Why Expert Advice Matters.

External insight turns uncertainty into clear action steps.

The Clear, No-Nonsense Definition of VAT Vendor Validation

VAT vendor validation is the process of confirming that a supplier’s VAT identification number is active, correctly linked to the supplier’s legal details, and suitable for zero-rate or input tax recovery purposes. Businesses typically validate via official tax databases, retain dated evidence, and repeat the check regularly to stay audit-safe.

Conclusion

Running a robust VAT partner lookup is not complex, yet the stakes are high. Collect clean data, validate through VIES and supplementary sources, archive evidence, and revisit regularly. These simple habits close the compliance gap and let you trade across borders with peace of mind.