7 Steps to Submit your VAT Return

Every year, thousands of businesses are fined due to inaccuracies in their VAT submissions. This is because most of them do not know how to fill in a VAT return correctly. Today, most VAT-related processes are streamlined through improved record-keeping and digital compliance practices. The 2025 survey shows how businesses saved up to 49 million hours on compliance through digital solutions. To learn more, dive deep into How to File VAT Returns Online: Streamlining Digital Submission.

Here’s a comprehensive Checklist for filling in a VAT Return to help you:

- Safeguard the correct figures

- Prevent potential risks

- Reduce paperwork.

Use our VAT Return Filling Guide for regular reference.

Step 1: Collect All Relevant VAT Records

Gather and organise all current tax period data and documentation before preparing your VAT return. Maintaining all records will streamline the process and prevent mistakes and omissions.

This primary step involves collecting all sales and purchase invoices, credit notes, and any other financial records that have an impact on your VAT calculations:

- Sales invoices from the period, with precise details of VAT charged

- Purchase invoices showing the VAT you can reclaim

- Import-related paperwork and customs charges (if applicable)

- Well-structured summaries of all VAT transactions for the reporting period, maintained in line with MTD requirements.

Why It Matters

Step 2: Verify Compliance with MTD Guidelines

The UK’s Making Tax Digital (MTD) initiative has required all VAT-registered businesses to submit their returns digitally since April 2022. This means your business records and VAT calculations must be maintained in a format that meets MTD standards.

To stay compliant:

-

Ensure your VAT rates and classifications are recorded correctly.

-

Keep complete and accurate digital records for each VAT period.

-

Store backups for at least six years, as required by MTD.

From April 2026, unincorporated enterprises and landlords with annual revenue above £50,000 will also need to follow MTD for Income Tax rules. Starting in April 2027, this will apply to those with income above £50,000.

Quick compliance check

- When it comes to MTD compliance, is your record-keeping method recognised by HMRC?

- Are your processes updated to reflect the latest MTD rules?

- Do you store digital copies for at least six years?

These essential steps mitigate human error and save VAT-registered businesses over 33 hours a year.

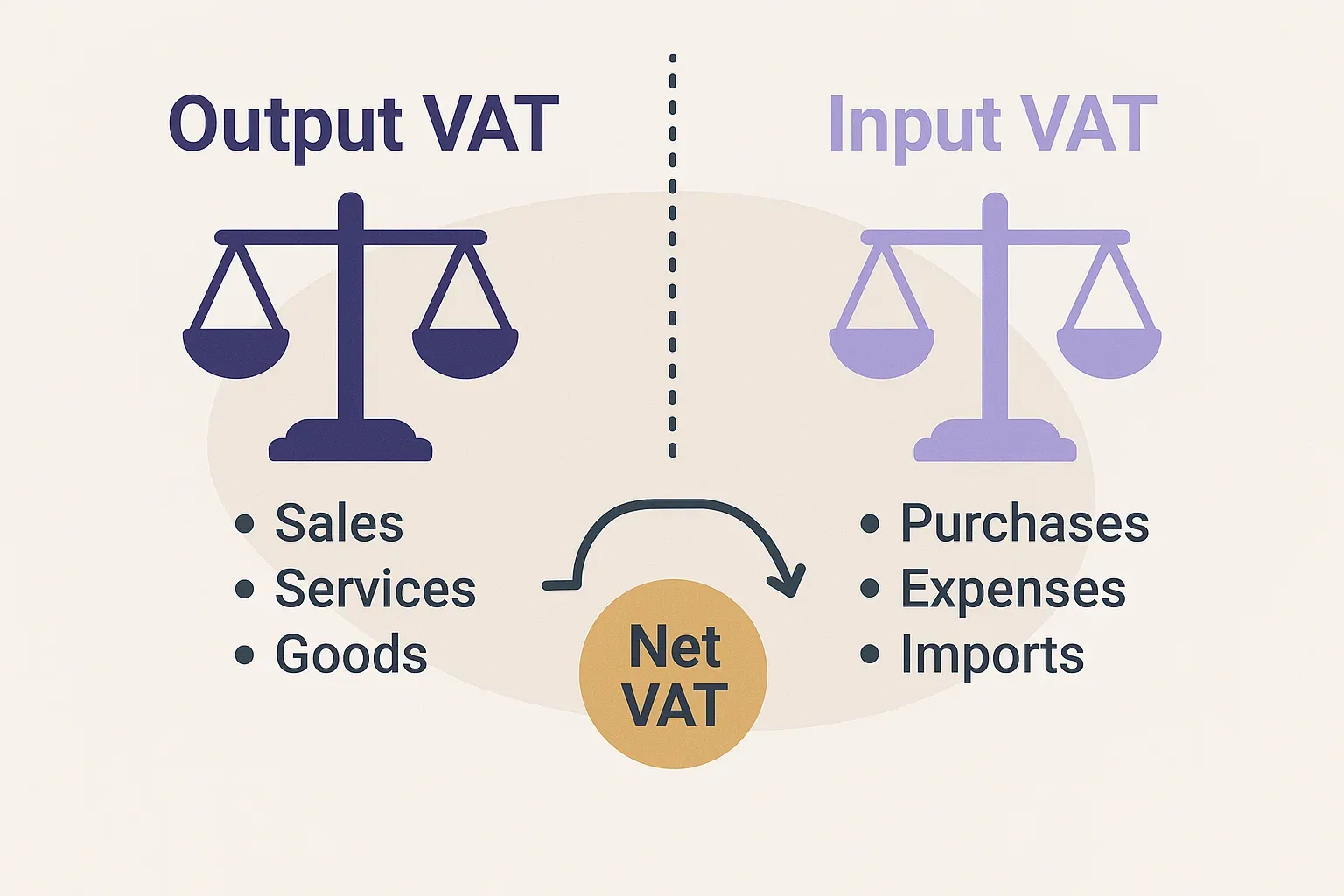

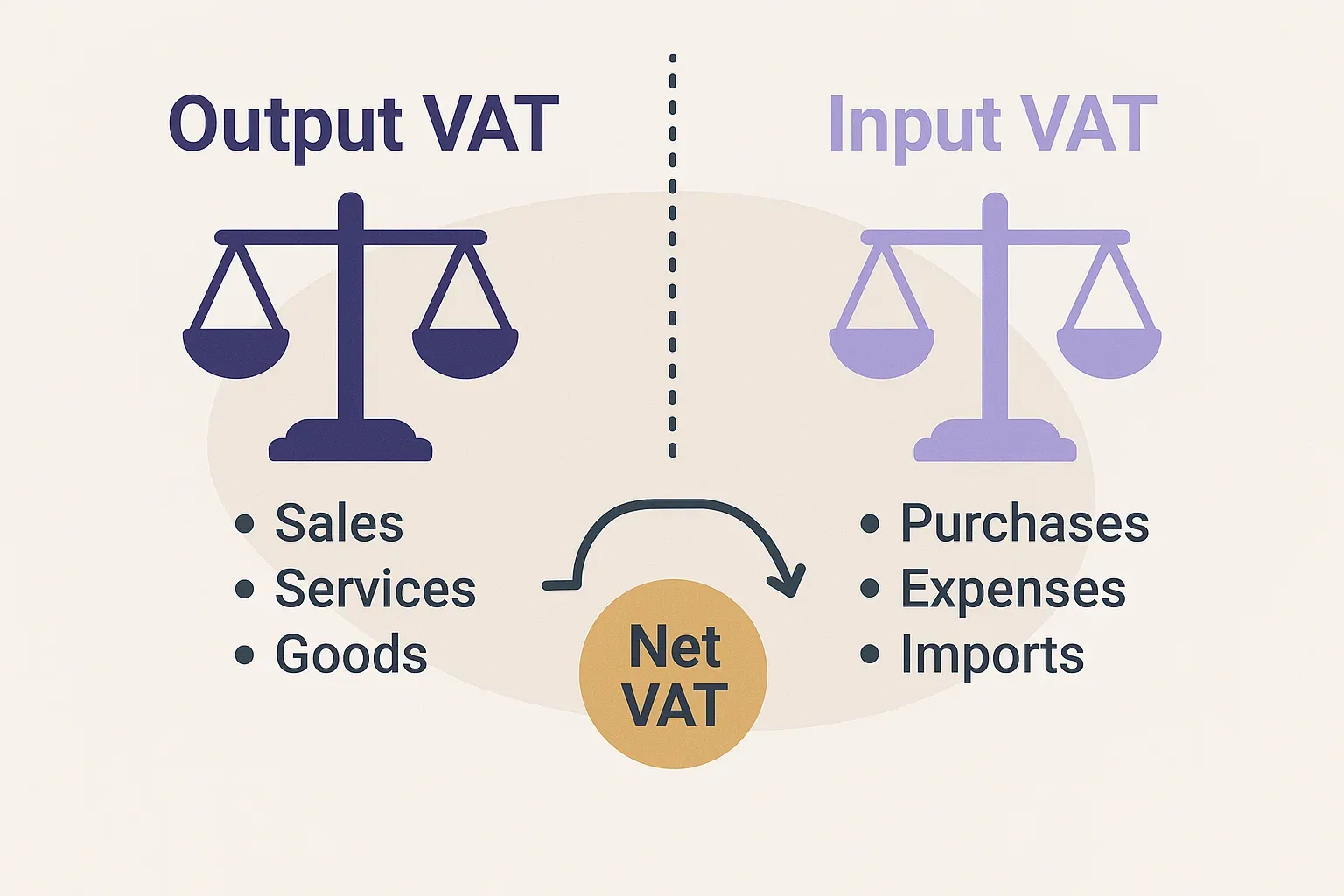

Step 3: Calculate Output VAT and Input VAT

To fill a VAT return accurately, you need to know exactly how much VAT you’ve charged and what you’re allowed to reclaim.

Output VAT

- Check the total amount of VAT you’ve charged on all of the taxable sales.

- Identify and sort out items that are exempt and zero-rated, if applicable.

- Ensure that each invoice includes the appropriate VAT rate.

Input VAT

- Add up the value-added tax you paid on legitimate expenditures.

- Exclude expenses that are not eligible for VAT credits.

- Record all partial exemptions and special schemes.

To determine your net VAT duty, cut out the input VAT from the output VAT after calculating these amounts.

Step 4: Double-Check for Special Transactions

- Reverse charge services (standard in cross-border services)

- Imports and exports that might trigger postponed VAT accounting

- Hire purchase or lease agreements

- Partial exemption methods

Pro Tip

When preparing a VAT return, early review of unusual transactions like imports subject to reverse charge is critical. This will ensure consistent monthly records and save you from confusion over filing time.

Step 5: Complete the Return Fields Carefully

Your VAT return usually includes:

- Total sales and purchases (boxes 6 and 7 on the UK VAT form)

- Output VAT due (box 1)

- Input VAT claimable (box 4)

- Net liability (box 5)

Enter each figure cautiously, especially if you handle multiple currencies:

- Consider any adjustments for errors in previous returns.

- Watch out for the correct decimal places - tiny errors can escalate.

Businesses risk higher penalties once their data is repeatedly inaccurate.

Step 6: Submit Your VAT Return Digitally

Submitting your VAT return digitally each period helps ensure accuracy and compliance with HMRC requirements. Aim to file well before the due date to avoid last-minute issues.

To stay on track:

-

Use an officially recognised digital submission method.

-

File early to prevent surcharges or penalties from late submissions.

-

Keep complete digital transaction records for audit purposes, in line with MTD requirements.

Step 7: Record Your Confirmation and Payment

Once the filing is over, you’ll receive a confirmation. Preserve it in your records.

Prompt payment of any outstanding VAT balance is crucial:

- Arrange a direct debit for regular auto-payments if it suits your setup.

- If you spot an error, alert HMRC quickly to avoid interest charges.

- Plan for each VAT period’s potential liabilities in your cash flow forecast.

This way, you’ll avoid underpayments or late payments and save your business from any extra fees.

Conclusion

Filling in a VAT return with sufficient preparation reduces risks and increases trust in your data. From collecting complete records to verifying special transactions, every step ensures cleaner data and fewer headaches. Investing extra effort in VAT return accuracy helps businesses avoid costly mistakes and overpayments. By following our comprehensive checklist for completing a VAT return and referring to trusted resources, you’ll be ready to file with confidence and accuracy.