What this guide will cover

You will walk through:

- The structure of VAT numbers across the EU and UK

- Free and official EU VAT checker tools plus national databases

- A step-by-step VAT number verification process with screenshots and examples

- Common error messages and how to fix them

- When to bring in a specialist VAT number verification service for peace of mind

By the end, you will confirm any VAT ID in less than a minute and keep a tidy audit trail.

Step 1: Understand what a VAT number really is

A VAT number, often called a VAT ID, is a unique alphanumeric code assigned to a business once it registers for Value Added Tax. It allows tax authorities to track the collection and remittance of VAT along supply chains.

- In the EU, the number always starts with a two-letter country prefix, for example DE123456789.

- In the UK, the prefix is GB or XI for Northern Ireland trade under the NI protocol.

Why the fuss? Because tax gaps are narrowing fast. The EU’s overall compliance gap fell from 11.2 % in 2018 to 7.0 % in 2022 thanks to tighter controls, and authorities now expect businesses to do their part.

Confirming the number protects you from penalties for issuing zero-rated invoices to partners that are not actually registered.

A quick recap: know the format, know the stakes, and you are ready for the next step.

For more on the foundations of VAT, see The Basics of VAT.

Step 2: Collect the information you need

Before opening any VAT ID lookup page, make sure you have:

- The full VAT number including the country prefix

- The legal name of the customer or supplier as it appears on the contract

- The registered address if possible, handy for double checks

- A screenshot tool or printer to save the verification result

Having these details side by side reduces typos and speeds up the check. Once gathered, move on to the official tool.

If you’re unsure about documentation or the process for cross-border compliance, the article VAT services for US companies: How to Stay Compliant When Selling Internationally provides handy checklists and operational tips.

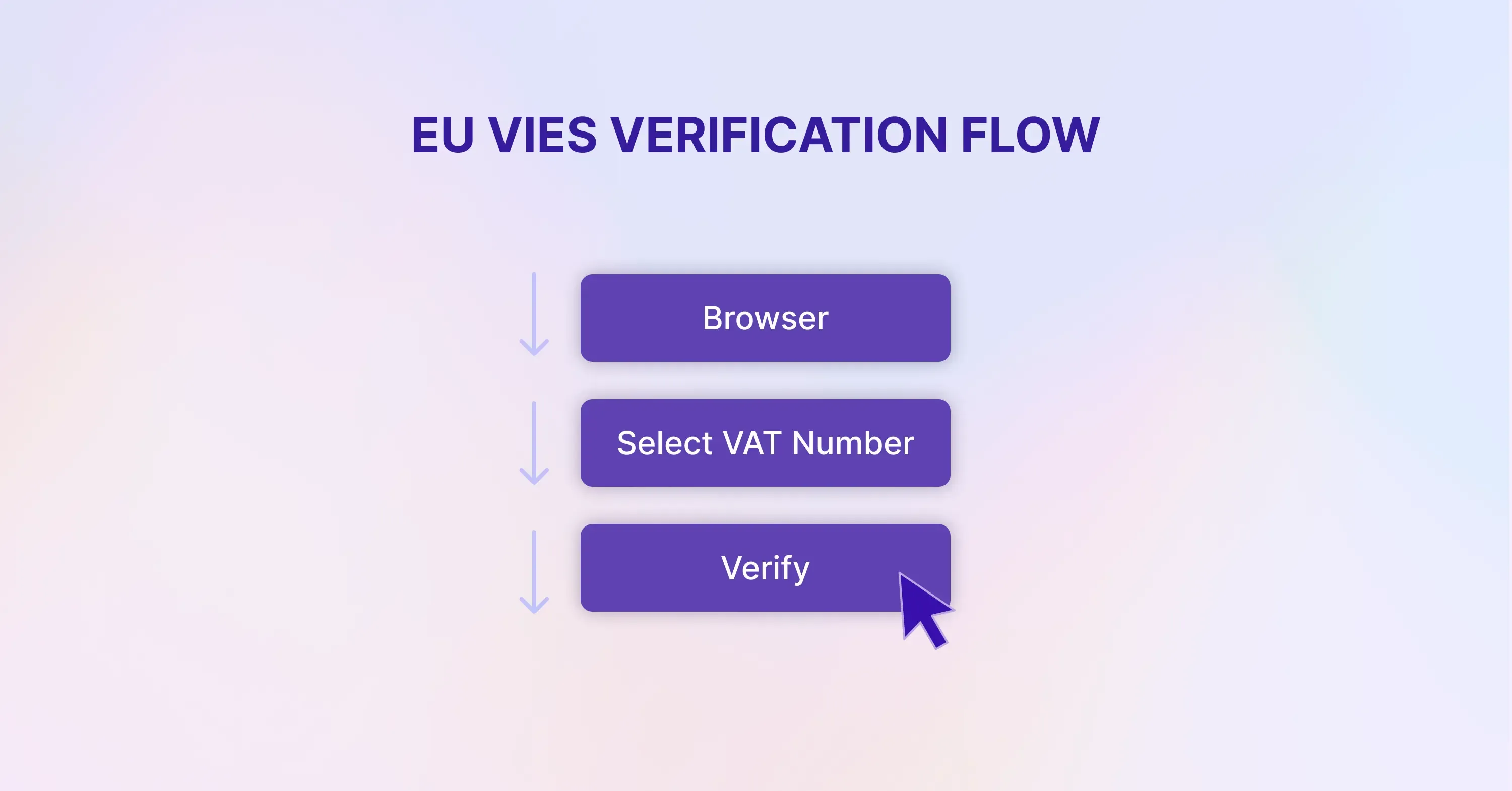

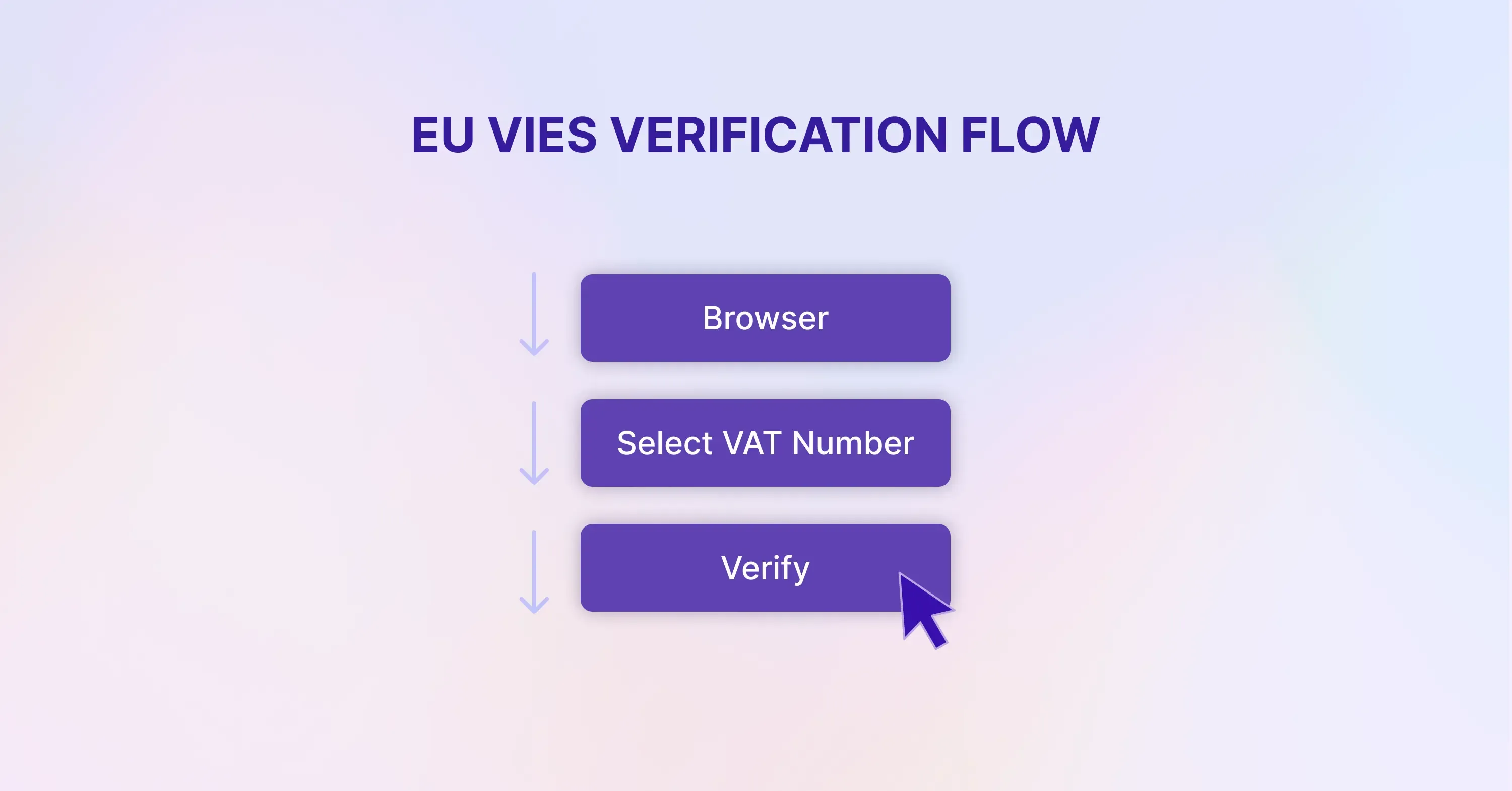

Step 3: Use the official EU VAT checker (VIES)

The European Commission hosts the VIES (VAT Information Exchange System) portal, the most authoritative EU VAT checker available.

- Visit europa.eu and search “VIES VAT”.

- Select country from the dropdown.

- Enter the number without spaces.

- Click “Verify”.

If the number is valid, VIES confirms the business name and address. Save or print the result for your records.

VIES is improving. Only 18% of Member States still skip follow-up checks on new numbers, down from over 30 % in the last review, so reliability keeps rising.

Still, VIES occasionally shows “no information available.” That is where national databases help.

Step 4: Cross-check national or UK databases

When VIES is down or returns “invalid,” go straight to the country’s tax portal.

- Germany: Bundeszentralamt für Steuern

- France: TVA Intra database

- Italy: Agenzia delle Entrate

- UK: HMRC VAT number lookup

For UK partners, HMRC confirms numbers and shows whether the trader is on the Flat Rate Scheme.

If you trade on marketplaces, remember the OSS regime. VAT collected through OSS grew 26% in 2022 with almost 130 000 companies already signed up, so checks on those VAT numbers are more common.

Cross-checking eliminates “false negatives” and keeps your invoices compliant.

For an overview of intra-EU VAT rules and cross-border supply obligations, see How does Intra-Community VAT work in the EU? A simple guide.

Step 5: Interpret the results correctly

Seeing “Valid” on VIES is great, yet you should still match the legal name and address against your contract.

- If the name differs slightly, request a fresh certificate from your partner.

- If VIES is unavailable, but the national database is positive, attach both screenshots.

- For UK numbers, ensure the date of registration covers your invoice date.

Remember, HMRC estimates a 5.0% UK VAT gap worth £8.9 billion, meaning auditors stay alert. Interpretation mistakes can cost you input VAT.

Close each check by saving evidence: PDF, JPG, or cloud capture. Good records are your shield.

If you need further insight into avoiding VAT-related penalties and why recordkeeping matters, read Why should you take VAT compliance seriously? Possible consequences of VAT breaches.

Step 6: Schedule regular rechecks

A VAT number can become invalid overnight if a company deregisters or merges.

- Reverify long-term suppliers every quarter.

- Reverify all numbers before issuing zero-rated intra-EU invoices.

- Automate reminders in your calendar or ERP.

- Archive results by counterparty and date.

Consistent monitoring keeps your compliance gap at zero and reassures auditors that you act diligently.

If you want expert tips for automating compliance, see Tax Technology Tools – VAT Compliance Automation.

Step 7: Troubleshoot common error messages

Sometimes VIES responds with cryptic notices. Here is how to clear them.

“Service unavailable, please try again”

- Wait 10 minutes, then retry.

- Check the European Commission Twitter feed for maintenance alerts.

- Use a national database in the meantime.

“No information available”

- Confirm the number format: letters in capitals, no spaces.

- Run the check on the country’s own portal.

- Ask the supplier for a “VAT registration confirmation letter.”

“Invalid VAT number”

- Double-type the number to rule out typos.

- Cross-reference the company’s legal name.

- If still invalid, do not ship goods or pay invoices until clarified.

When problems persist, consulting a dedicated VAT number verification service such as 1stopVAT, whose 40+ tax specialists support businesses in more than 100 jurisdictions, can save hours of back-and-forth with authorities.

To see a real-world example of tackling VAT registration problems, visit 1stopVAT Case Study: VAT Registration Difficulties in the UK for Foreign Entities.

Step 8: Keep an expert in your contacts

If you expand to several markets, manual checks grow time-consuming.

A global consultancy like 1stopVAT can:

- Verify international VAT numbers swiftly and provide stamped evidence

- Handle VAT registration and ongoing filings in every new country

- Advise on tricky cases, for example mixed supplies or OSS/ IOSS reporting

Using external expertise ensures your team focuses on sales while compliance stays watertight.

For comprehensive support covering VAT compliance, digital filing, and global expansion, see VAT Compliance & Consultancy: Why Expert Advice Matters.

VAT number verification in 30 seconds

To verify a VAT number fast, open the EU VIES portal, choose the country prefix, paste the VAT ID, hit “Verify,” and save the confirmation screen. If VIES is down, repeat the search on the supplier’s national tax website and store both results.

Conclusion

Verifying a VAT number is a two-minute task that can save thousands in denied input tax and penalties. Gather the right details, use the official EU VAT checker or national databases, interpret results carefully, and keep tidy records. When volume grows or cases get complex, calling on a specialist VAT number verification service ensures your compliance never misses a beat.