Overview

This guide unpacks:

-

Why error-free VAT reporting is urgent in 2025

-

How to judge a reliable VAT filing service and certified VAT agents

-

A comparative review of seven trusted providers, including features and price signals

-

Actionable tips for choosing and working with specialists

By the end, you will know exactly what to look for, which questions to ask, and which providers consistently deliver accuracy and peace of mind.

Why precision VAT reporting is mission-critical

Governments link digital data, e-invoicing, and real-time reporting to plug revenue gaps. The European Commission estimates member states still lost €89 billion in VAT revenue in 2022 despite recent progress. Closing that gap drives aggressive audits and new rules.

MTD shows the benefits. Close to 67% of UK businesses saw at least one error reduction thanks to the program. Meanwhile, 45 % said approved software saved 26–40 hours per year. Those savings free staff to focus on sales, not spreadsheets.

E-invoicing adds more pressure. It is already mandatory for business-to-government transactions in every EU state and for B2B deals in seven countries, according to the OECD’s 2024 Consumption Tax Trends. Falling behind means more manual corrections and higher fraud risk.

In short, firms that outsource VAT reporting to experts avoid penalties, gain real-time insights, and keep up with rapid policy changes. For more on technology's role, read Tax Technology Tools – VAT Compliance Automation.

What makes a reliable VAT filing service?

Picking a provider is less about slick marketing, more about measurable safeguards. Use the following checklist.

-

Track record: At least five years of filing returns under multiple regimes

-

Breadth: Ability to handle registration, reporting, refund claims, and audit support

-

Technology: Cloud platform, API or ERP connectors, and secure digital record-keeping

-

Certified VAT agents: In-house tax advisers with recognised credentials in target markets

-

Local reach: Native-language support and direct contact with tax authorities

-

Transparency: Clear fee tiers and no hidden charges for submissions or corrections

-

Data security: ISO 27001 or equivalent, two-factor authentication, encryption in transit and at rest

A provider that meets every box minimises missed deadlines and surprise costs. Now let us see who delivers.

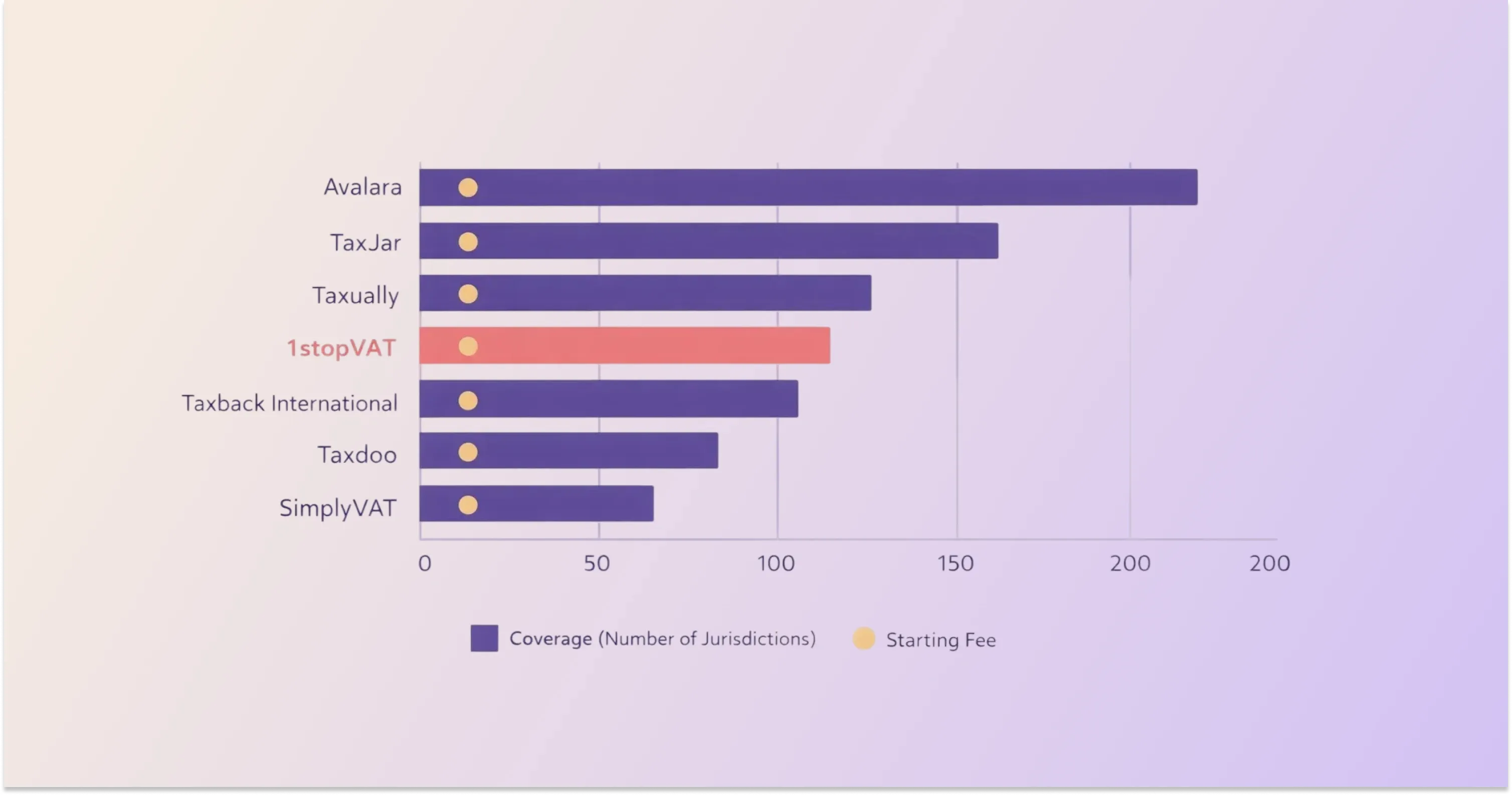

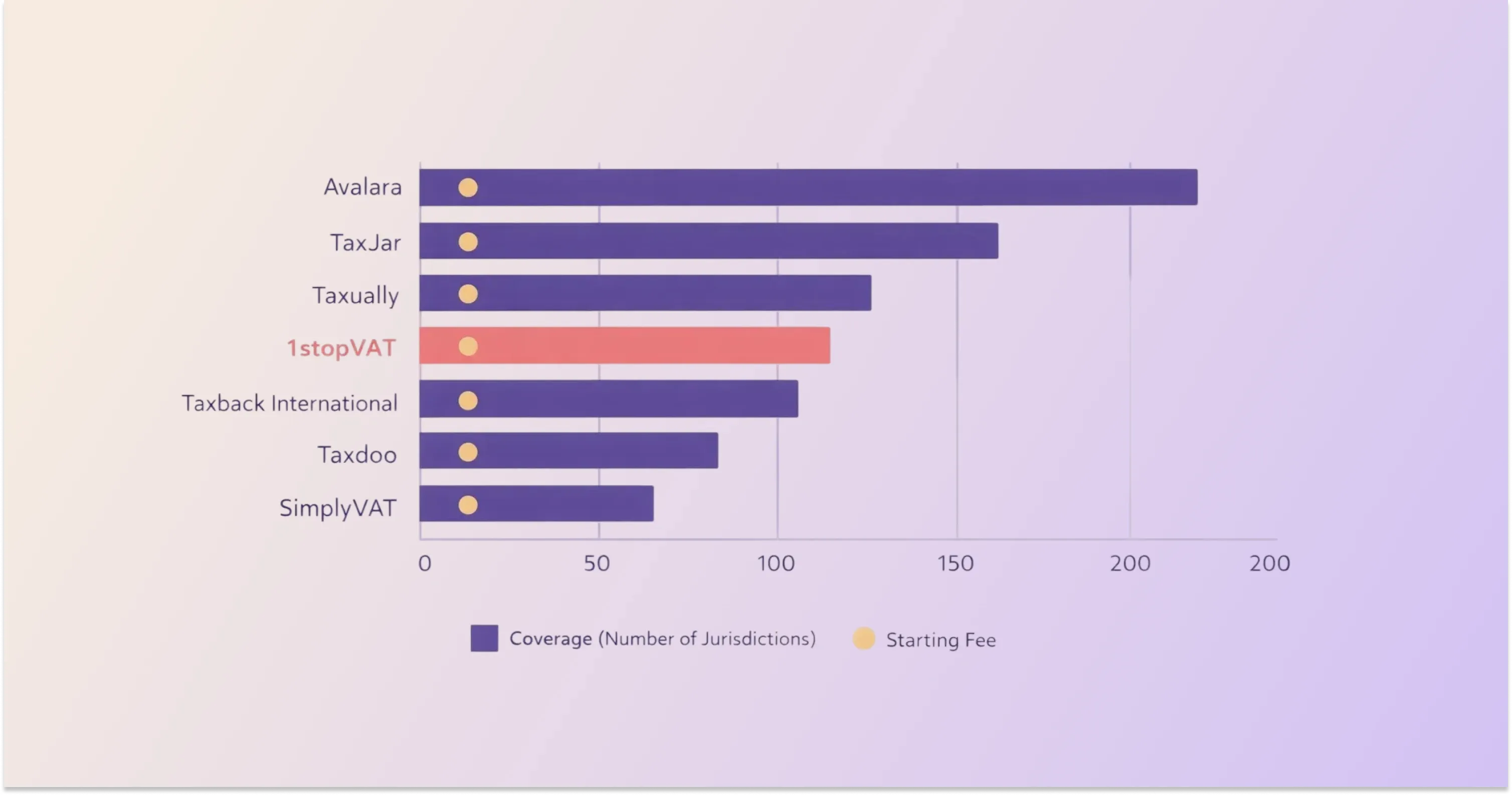

Top 7 trusted VAT reporting providers

The following list covers global networks, specialised boutiques, and hybrid tech-plus-human firms. Prices quoted are entry ranges for a single EU registration and quarterly filings; exact fees vary with transaction volume.

1. Deloitte Indirect Tax

Deloitte’s VAT practice combines Big-Four audit muscle with local compliance centres.

-

Coverage: 150+ jurisdictions

-

Features: Real-time analytics, SAF-T generation, audit simulation

-

Pricing: From £2,000 per year for a single EU entity

Deloitte suits multinationals that need deep advisory and can handle premium fees. Next, we look at a tech-forward boutique.

2. 1stopVAT

1stopVAT acts as a single contact for cross-border sellers needing VAT registration, filings, and consulting in 100+ countries.

-

Certified VAT agents: 40+ specialists handle local queries and exams

-

Hybrid approach: Automated data extraction plus human review for every return

-

Pricing: From €1,200 per country annually, volume discounts above five jurisdictions

1stopVAT fits high-growth e-commerce and digital-service firms that want flexibility without enterprise price tags. For a broader look, see the Best Cross-Border Tax Compliance Firms: Global VAT Experts.

Scaling VAT Compliance Without Extra Headcount

A fast-growing e-commerce business expanding across the EU struggled with multiple advisers and inconsistent VAT filings. By moving to a centralised VAT reporting model that combined automation with expert review, the company standardised data, reduced filing errors, and met local deadlines across all markets.

The finance team expanded into new countries without adding in-house tax staff, keeping compliance efficient as the business scaled.

3. KPMG Global Compliance Management Services

KPMG offers end-to-end indirect tax outsourcing wrapped into broader finance transformation.

-

Technology: Integrates with Thomson Reuters ONESOURCE, SAP, Oracle

-

Coverage: 120+ countries

-

Pricing: Starts near £3,000 per entity per year

KPMG is ideal for corporates embedding VAT processes inside a shared-service centre.

4. PwC VAT Compliance & Reporting

PwC leverages its MyTaxes platform for document upload, status dashboards, and risk scoring.

-

Certified VAT agents across 90 countries

-

Optional e-invoicing plug-ins

-

Pricing: From £1,500 per registration annually

PwC appeals to firms that value global consistency and board-level reporting.

5. TMF Group

TMF Group specialises in back-office outsourcing for mid-caps.

-

On-the-ground offices in 85 jurisdictions

-

Service: VAT registration, ongoing filings, ESL/Intrastat, and representation

-

Pricing: Bundled with accounting packages, typically £950–£1,200 per year

A health-tech exporter reduced late-filing penalties by 80 % after TMF’s country teams set up local bank guarantees.

6. Taxually Core

Taxually offers modular VAT filing with connectors to Shopify, Amazon, and ERP systems.

-

Self-service dashboard plus VAT agent review

-

Coverage: EU, UK, Australia, Canada

-

Pricing: From €29 per month for under 2,000 transactions

Best suited for micro-brands upgrading from spreadsheets. For more options and practical registration checklists by business size, explore Best VAT Registration Services in 2025: Top Providers Reviewed.

7. EY Global Compliance & Reporting

EY pairs multinational templates with country-specific expertise.

-

Features: Data reconciliation, e-archive, anomaly alerts

-

Coverage: 150 jurisdictions

-

Pricing: Custom, usually £3,500+ per entity

A US auto parts maker avoided duplicate import VAT in three states after EY automated cross-checks with customs data.

Quick takeaways

-

Large corporates lean toward Big Four arms for integrated audit defence

-

Digital merchants value hybrid firms such as 1stopVAT for speed and cost

-

Micro-sellers can start with subscription platforms then upgrade to agents as volume spikes

Understanding each profile helps you match risk appetite, budget, and complexity.

Working smoothly with certified VAT agents

Finding a provider is only half the battle. The relationship pays off when internal teams and external agents share timely data and common goals.

-

Kick-off checklist

-

Map every sales channel and revenue flow

-

Provide historical VAT returns, invoices, customs documents

-

Clarify filing frequencies, refund timelines, and power-of-attorney needs

-

Ongoing collaboration

-

Schedule monthly ledger reviews to catch coding errors early

-

Use shared dashboards so finance, logistics, and tax see the same numbers

-

Log queries in a central ticketing system for accountability

-

Continuous improvement

-

Ask for variance reports that flag unusual spikes in VAT payable

-

Review service levels quarterly: missed filings, audit queries, cost overruns

-

Update rules when product lines or supply chains shift

One electronics distributor shaved two weeks off its quarter-end close once its certified VAT agents received item-level data daily instead of monthly. Tiny process tweaks compound into major savings.

For a deeper comparison between VAT agents and in-house approaches - and why expertise matters - visit VAT Compliance & Consultancy: Why Expert Advice Matters.

What Are Trusted VAT Reporting Providers?

Trusted VAT reporting providers are specialist firms or networks that:

-

Register businesses for VAT in relevant jurisdictions

-

Maintain digital VAT records compliant with local rules

-

Prepare and file periodic returns, ESL, and Intrastat reports

-

Act as fiscal representatives and handle tax authority audits

-

Employ certified VAT agents who combine local knowledge with global oversight

Selecting a provider that checks all five boxes safeguards compliance and reduces administrative drag.

Conclusion

Digital tax reforms, shrinking VAT gaps, and mandatory e-invoicing make error-free filing a board-level concern. Trusted VAT reporting providers combine technology, certified VAT agents, and local insight to keep businesses compliant while reclaiming hundreds of staff hours. Whether you partner with a Big Four network or a focused specialist such as 1stopVAT, apply the checklist above, insist on transparent fees, and maintain open data flows. For best practices in reporting and collaboration, see VAT Reporting Made Simple: Best Practices for Businesses. The result is simple: fewer surprises and more time to grow your business.