Overview

We will untangle VAT obligations for software-as-a-service (SaaS), apps, e-books, and other electronic services sold to consumers.

You will learn:

- How VAT works for digital products and why SaaS VAT rules differ from physical goods

- The €10,000 single EU threshold that triggers registration

- How the One-Stop Shop (OSS) and Import OSS schemes simplify cross-border reporting

- Mandatory invoice elements, record-keeping tactics, and filing timelines

- Tips for avoiding common electronic service tax compliance errors and when to call in outside expertise

By the end, you will know your next concrete steps to stay compliant and keep revenue flowing.

Step 1: Grasp the VAT Basics for Digital Services

Every solid tax strategy starts with fundamentals. VAT is a consumption tax collected where the customer consumes the service, not where your company is based.

Digital services cover:

- SaaS subscriptions, cloud storage, and platform fees

- Streaming music and video, gaming add-ons, e-books

- Downloadable software, mobile apps, and online courses

If you supply any of these to non-business customers in another country, VAT usually applies in that customer’s location. That principle sits at the heart of both EU and many non-EU regimes.

SaaS VAT rules depart from those for tangible goods. You rarely need a warehouse or customs broker, but you do need:

- Correct place-of-supply determination through IP, billing address, or bank location

- Local tax rates, which in the EU range from 17% to 27%

- Evidence files proving the customer’s country for 10 years

Understanding these cornerstones now saves painful corrections later. For a deep dive on these essentials and region-specific cases, see VAT Compliance for SaaS and Digital Services in the EU.

Step 2: Check Thresholds and the Place-of-Supply Test

Before you rush to register, confirm whether your sales volume passes each jurisdiction’s threshold. In the EU, the VAT e-commerce reform set a €10,000 single threshold. Once your total annual B2C digital sales to all EU countries exceed that figure, you must charge VAT at the customer’s local rate.

Outside the EU, thresholds vary:

- United Kingdom: no threshold, VAT applies from the first sale

- Australia: AUD 75,000 in 12 months

- New Zealand: NZD 60,000 in 12 months

- Norway: NOK 50,000 in 12 months

In parallel, apply the place-of-supply test:

- Collect at least two pieces of non-conflicting evidence of customer location (IP, billing, bank).

- If evidence clashes, seek a third data point to break the tie.

- Archive all proof for audit review.

A clear understanding of thresholds and location rules lets you register on time and avoid late-filing surcharges.

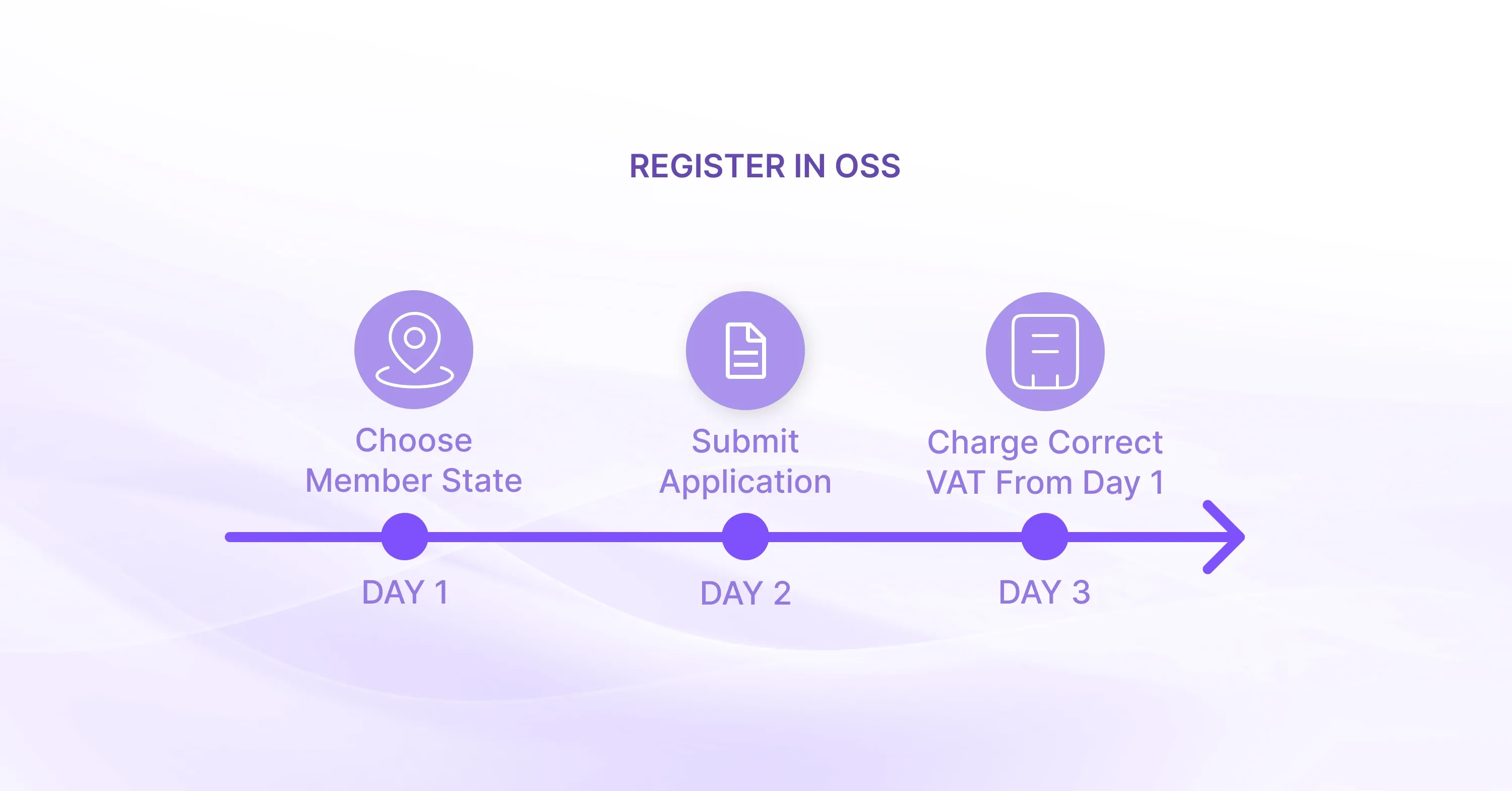

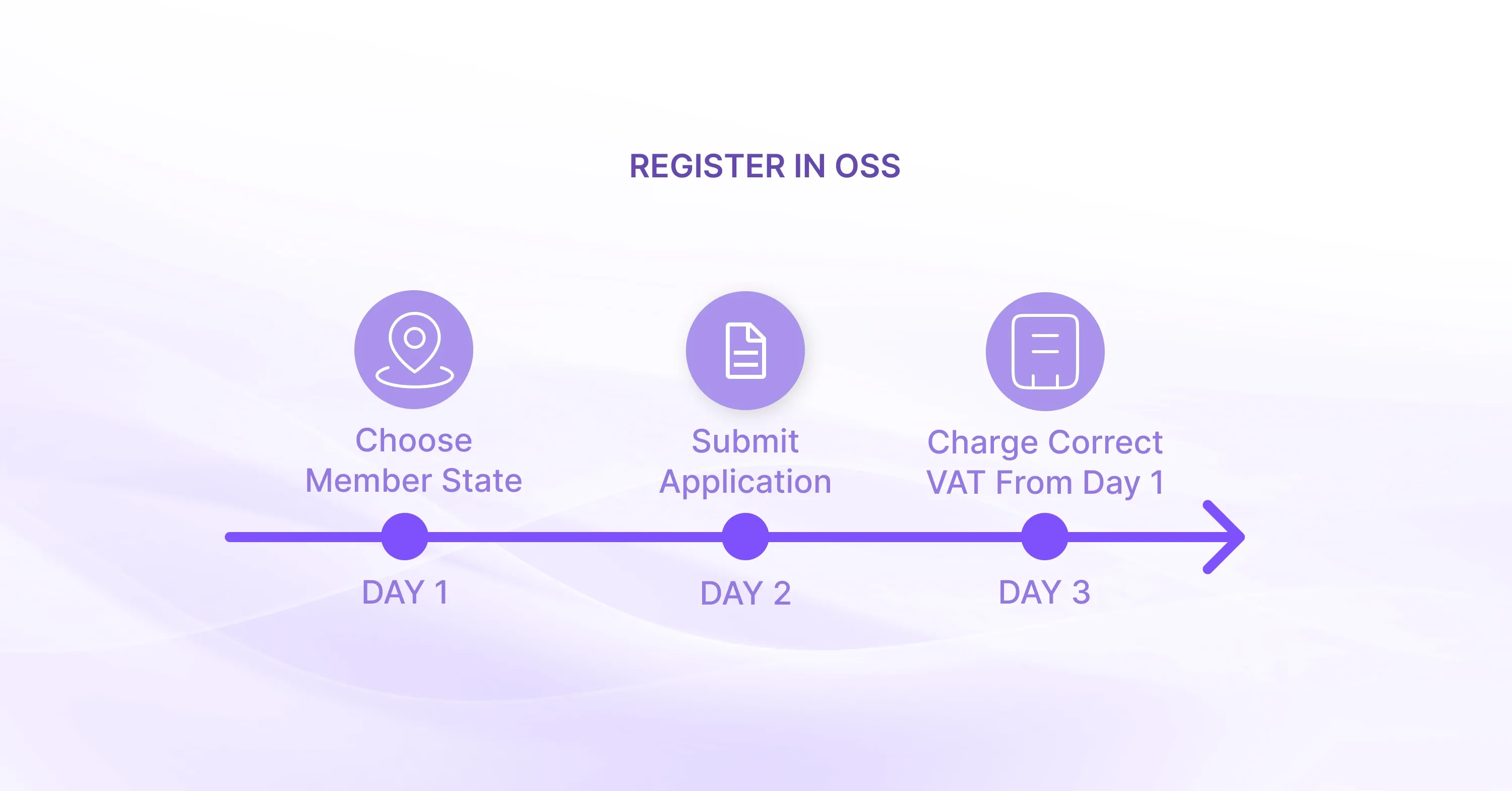

Step 3: Register Through the EU OSS or IOSS

Once you exceed the EU threshold or decide to charge VAT voluntarily, the OSS scheme becomes your best friend. You register once in a single EU Member State, file one quarterly return, and authorities distribute the tax to each country.

Once you exceed the EU threshold or decide to charge VAT voluntarily, the OSS scheme becomes your best friend. You register once in a single EU Member State, file one quarterly return, and authorities distribute the tax to each country.

Key steps:

- Choose a “Member State of identification,” usually your home base or a country where you have a fixed establishment.

- Submit an electronic application on that state’s portal. Registration is typically approved within 10 days.

- Collect and charge VAT at the correct rate on every B2C invoice from day 1 of registration.

Why bother? Member States collected over €33 billion in VAT through OSS/IOSS in 2024. More than 170,000 businesses now rely on the system, proving its value for SaaS providers that sell across borders. Explore how OSS/IOSS changes the practical steps for sellers with Marketplace VAT Obligations for Online Sellers: What You Need to Know.

Conclude this step by adding OSS filing dates - last day of the month after each quarter - to your finance calendar. For scenarios where expert help might improve efficiency or decision-making, read VAT Compliance & Consultancy: Why Expert Advice Matters.

Step 4: Issue Compliant Invoices

Most Member States don’t require digital service providers to issue structured tax invoices with mandatory content for B2C transactions. In most cases, providers of digital services issue a PDF or another form of e-sales receipt as proof of the transaction. This primarily serves as confirmation of the successful conclusion of the e-contract.

The EU VAT Directive mandates minimum content requirements for tax invoices and sales receipts. However, Member States may modify these requirements within the permitted framework. In some countries, e-invoicing may be mandatory for B2B transactions - and in certain cases, for B2C transactions as well.

Generic sales receipt content for EU B2C ESS sales:

- Supplier’s full legal name, address, and VAT number

- Customer information

- Invoice date and sequential number

- Description of the digital service supplied

- VAT rate applied and the VAT amount

- Total amount

- OSS reference if issued under the special scheme

Finish each billing cycle by reconciling invoice totals with payment processor reports to quickly detect any rate miscalculations.

Step 5: File and Pay VAT Accurately

Electronic service tax compliance hinges on timely returns. Missing a deadline can bring interest and reputational damage.

Filing frequency and deadlines

- OSS: quarterly, due by the end of the month following the reporting quarter

- Union Member States outside OSS: monthly or quarterly

- Non-EU countries:

- Japan: monthly, quarterly, or yearly

- South Africa: bimonthly or monthly

Learn more about digital filing, automation, and country-specific requirements in How to File VAT Returns Online: Streamlining Digital Submission.

Practical reporting tips

- Automate data extraction from payment gateways into a VAT report template.

- Double-check the currency conversion rate used on the day of supply.

- Pay via SEPA or local tax authority’s portal to avoid bank fees.

EU Member States lost about €89 billion in VAT in 2022, roughly 7% of revenue. Closing that gap is a political priority, so expect stricter audits. Getting your returns right the first time keeps you off the radar.

Step 6: Maintain Records and Stay Audit Ready

Auditors can request transaction evidence up to ten years after the sale. Prepare now rather than scramble later.

- Store invoices, payment receipts, and location evidence in a secure archive.

- Use a consistent file naming convention: YYYY-MM client-name invoice-number.

- Review VAT codes in your billing system quarterly to catch rate changes.

- Document your place-of-supply logic and any manual overrides.

Keep an eye on rate updates and legislative changes. Globally, 101 countries now tax cross-border online sales. A quick internal checklist review every six months prevents surprises.

Step 7: Know When to Seek Expert Help

Rapid expansion can stretch an in-house finance team thin. A specialist firm such as 1stopVAT, with over 40 certified tax advisers covering 100-plus countries, can handle VAT registration, ongoing compliance, and complex advisory while you focus on product growth. Whether you need a second opinion on OSS filings or a full outsourced solution, external guidance often costs less than one major penalty.

For tips on weighing in-house work vs. outsourcing - and the specific value a VAT specialist can deliver - refer to VAT Compliance & Consultancy: Why Expert Advice Matters.

A final thought before moving on: Engage experts early if you plan to enter multiple new markets in one quarter, launch marketplace sales, or change your business model from licensing to subscription.

Digital services VAT compliance means charging the correct VAT rate where the customer is located, registering through schemes like the EU One-Stop Shop once you pass the €10 000 threshold, issuing invoices with mandatory details, filing returns on time, and storing records for up to ten years.

Conclusion

VAT rules for digital services evolve quickly, but a structured approach keeps you compliant. Confirm thresholds, register through schemes like OSS, issue accurate invoices, file on time, and archive everything. When resources tighten, consider partnering with experienced advisers such as 1stopVAT. Follow these steps and you can expand globally while keeping VAT headaches to a minimum.

Once you exceed the EU threshold or decide to charge VAT voluntarily, the OSS scheme becomes your best friend. You register once in a single EU Member State, file one quarterly return, and authorities distribute the tax to each country.

Once you exceed the EU threshold or decide to charge VAT voluntarily, the OSS scheme becomes your best friend. You register once in a single EU Member State, file one quarterly return, and authorities distribute the tax to each country.