What this comparison covers

In the next few minutes you will learn:

-

How pricing models vary and which hidden costs matter most

-

Why turnaround time is more than a number on a website

-

The support channels seasoned exporters refuse to compromise on

-

Practical advantages and drawbacks of outsourcing VAT registration, illustrated with short real-world examples

Each section builds on the last, so by the end you will have a simple checklist for your own VAT provider comparison.

Pricing: the numbers behind the headline fee

Price is the first filter most businesses apply, yet it is rarely apples to apples. A flat £399 “registration package” may exclude filings, translations, or local fiscal representation.

The core elements that make or break total cost are:

-

Registration fee: one-off cost that ranges from £150 to £800 in the UK, €300–€1,200 in the EU

-

Mandatory documents: translations, notarisation, or apostilles that can add 20%–40 %

-

Fiscal representation: required in some EU states for non-EU companies, often billed as an annual retainer

-

Ongoing compliance: monthly or quarterly filings, Intrastat and SAF-T reports

A UK ecommerce retailer we worked with found a “cheaper” provider at £350, but paid £950 after notarised translations and courier charges surfaced. Had they compared full-year totals, the initial front-runner was actually the costliest.

When scanning price lists, ask for a single figure covering 12 months of service, not just the registration. This avoids the drip-pricing trap and makes best VAT solutions easier to benchmark side by side.

For a granular breakdown of what’s usually included - and hidden costs to watch for - see the VAT Compliance Checklist for Startups and Small Businesses.

The next question is whether a higher fee buys you faster approval.

Registration speed: when “standard” is not fast enough

A listed turnaround of 4–6 weeks may look fine - until you discover HMRC’s rejection rate and realise a delay can mean lost holiday-season revenue. Speed depends on two levers:

-

Provider workflow: automated data capture, pre-submission validation, and direct API links to tax portals

-

Local expertise: familiarity with quirks, for instance Belgium’s preference for original trade licences or Italy’s need for a PEC email

1stopVAT, for example, pairs automated form filling with a team of 40+ certified tax specialists across 100+ countries, reducing the back-and-forth that often drags an application into month two.

Real-world snapshot: A SaaS platform entering Germany needed a DE VAT ID before launching ads. By using a provider with in-country signatories, they received the Steuernummer in 9 days, compared with the typical 4-week queue quoted by rivals.

If expediting approval is mission-critical, follow the steps outlined in the Expedited VAT Registration: Checklist for Fast EU Entry for tactics to avoid hold-ups and common application pitfalls.

When requesting quotes, insist on:

-

Median and worst-case timelines, not just best-case

-

Current backlog data, updated weekly

-

Evidence of direct contacts within tax authorities

Quick approvals are worthless if you cannot get help when a query lands, which brings us to support.

Quality of support: human expertise over chatbots

VAT rules shift constantly. The EU’s e-commerce package alone collected €33 billion in 2024, so auditors scrutinise cross-border sellers. When HMRC or an EU office raises a question, you need a knowledgeable human on the line.

Support quality hinges on three dimensions:

-

Availability: phone, email, and live chat hours - ideally 24 / 5 to cover different time zones

-

Seniority: direct access to VAT lawyers or only first-line agents reading scripts

-

Escalation time: maximum hours before a query reaches a senior specialist

Consider the words of Lubbock Fine’s Jas Dhillon, who notes that swift access to experts is essential for approvals. A provider without tier-one support exposes you to mounting penalties if queries stay unresolved.

For a deeper dive into how professional support reduces delays, errors, and risk, read VAT Compliance & Consultancy: Why Expert Advice Matters.

Checklist when evaluating support:

-

Ask for the name and credentials of the lead consultant on your file

-

Request SLAs in writing: response within 4 hours and resolution within 24 hours is achievable

-

Test them: send a detailed question before signing and measure reply quality

Solid support mitigates risk, but every outsourcing option carries trade-offs. Let us balance the scales.

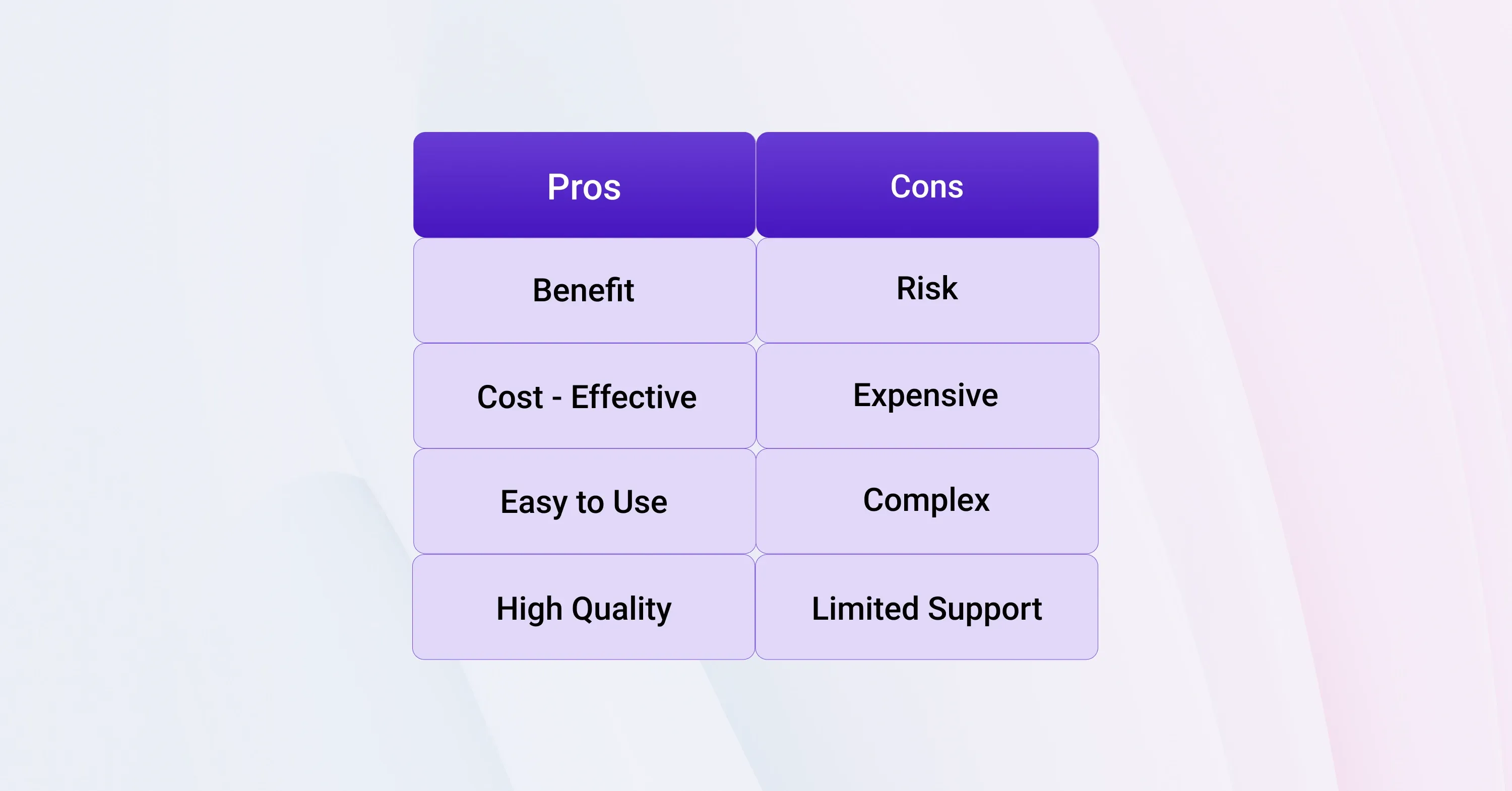

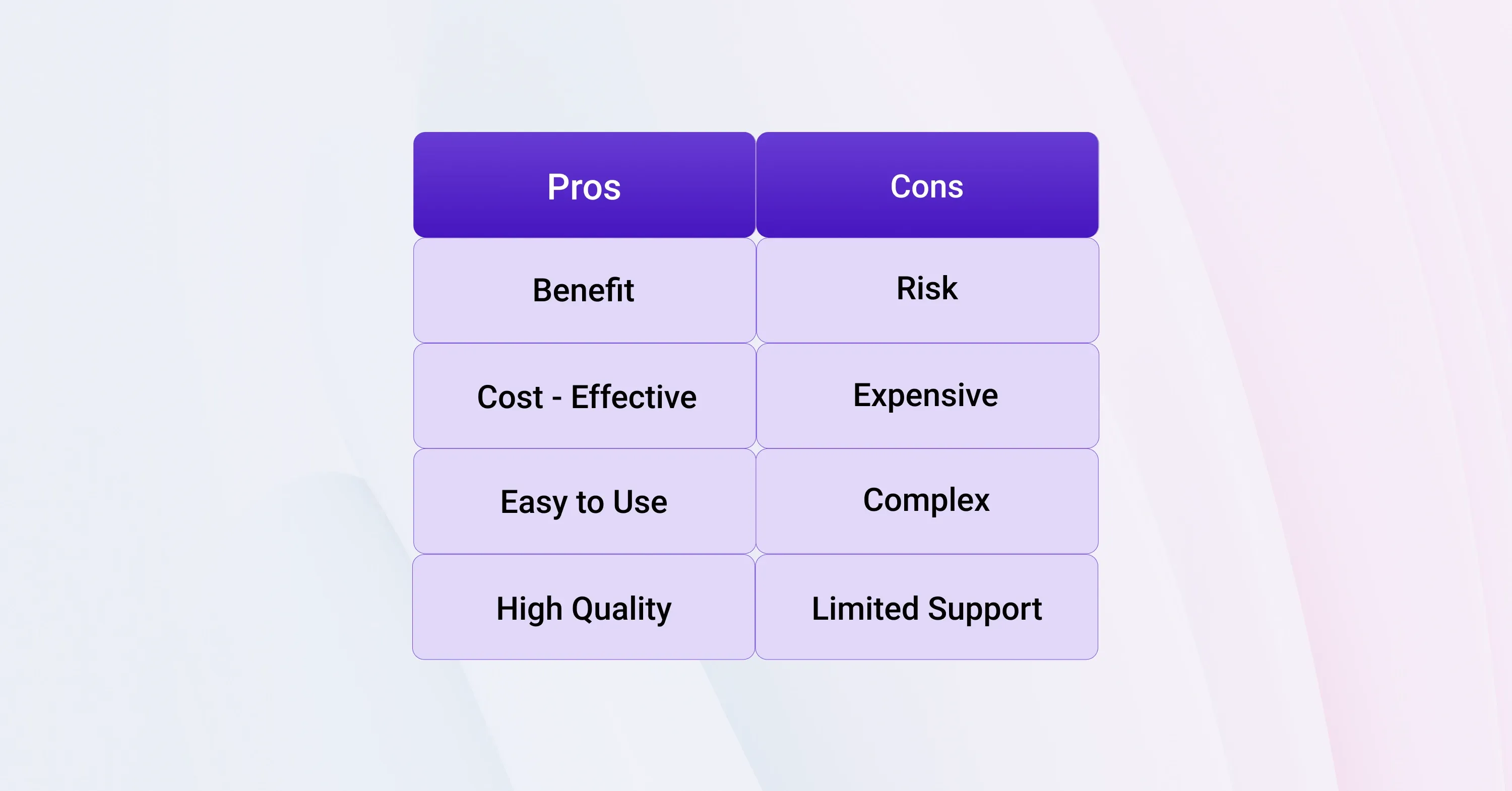

Pros and cons of outsourcing your VAT registration

Outsourcing is rarely all good or all bad. Below is a balanced view drawn from clients ranging from marketplace sellers to mid-size software firms.

Advantages

-

Time savings: finance teams bypass paperwork and avoid 234 000 annual UK registrations queues

-

Reduced error rate: specialist checks prevent omissions that trigger rejections

-

Scalability: multi-country providers like 1stopVAT handle OSS, IOSS, and local filings in one portal

-

Predictable cost: bundled compliance can be budgeted annually

For insight into choosing the right mix of in-house and external VAT support, including a detailed cost and process comparison, see Tax Consultation: Why Businesses Need Professional Guidance.

Drawbacks

-

Less internal knowledge: your team may forget procedural details, risking dependency

-

Data sharing: sensitive turnover figures move outside the company

-

Variable quality: the market is fragmented, and not every agency employs qualified tax lawyers

An online fashion brand initially managed VAT in-house, attracted by OSS simplicity. Growth forced them to register locally in Spain, France, and Italy, each demanding local language filings. Outsourcing freed one full-time employee but added £4 500 in yearly fees. Weighing those numbers against staff costs and late-filing penalties clarified the decision. The trade-off often boils down to control versus certainty. Once you identify your threshold for risk, the final step is to apply the criteria we have discussed to a shortlist.

How to Compare VAT Registration Services

Key factors when comparing VAT registration services are price transparency, realistic registration timelines, expert human support with clear SLAs, and a balanced view of outsourcing pros and cons. Evaluate each point across a 12-month horizon to reveal the true cost and benefit of a provider.

Conclusion

When you compare VAT registration services, resist the urge to look at price alone. Map out total annual cost, verify median approval times, test the depth of human support, and weigh the strategic trade-offs of outsourcing. With those datapoints in hand, the decision moves from guesswork to clear-cut financial logic, letting your team focus on growth instead of red tape.