Major takeaways

Today, you will learn:

- The exact meaning of “tax consultation” and how it complements routine filing

- Tangible benefits of hiring tax advisory services instead of scrambling internally

- A step-by-step framework for selecting a trusted tax consultation firm

- Cost comparisons between outsourcing and an in-house department

- Extra considerations for non-domestic registration, EU VAT, and audits.

At the end, you’ll get a comprehensive checklist to turn taxes into a managed advantage.

Tax consultation is an ongoing advisory relationship where qualified professionals analyze corporate activities, forecast liabilities, and design structures to mitigate tax exposure and align with legal compliance, with a focus on strategy, risk management, and future growth.

Consultation vs. routine filing: the critical difference

Most businesses equate “doing taxes” with submitting annual or quarterly forms.

Key differences:

- Scope: Filing captures past transactions, consultation reviews, plans, expected revenue, and entity structure.

- Timing: Compliance is cyclical, consultation is continuous

- Deliverables: Returns and payments versus memos, scenario models, and risk assessments.

- Skill set: Data entry and statutory knowledge versus industry insight, negotiation with authorities, and strategic planning.

Why it matters:

Benefits of professional tax advisory services

Engaging external experts is a hedge against cash-flow shocks and reputational damage.

- Risk reduction: Better interpretations, documentation, and early detection lower the chance of penalties.

- Cash savings: Optimized reliefs, credits, and group structures relieve working capital.

- Speed to market: Advisers proficient in import VAT, customs codes, and local registration rules shorten launch timelines.

- Resource focus: Finance teams regain bandwidth for forecasting and investor reporting.

- Credibility: Auditors and investors value an independent stamp on tax positions.

Europe offers a cautionary tale: €89.3 billion VAT gap in 2022 represented 7 % of expected revenues. Authorities are tightening digital reporting, meaning businesses without tailored tax advice are at risk of harsher fines and double taxation. Here are our in-depth insights into how expert advice can prevent these pitfalls

Spot check: Are you missing the value?

- Do you claim R&D credits in every eligible jurisdiction?

- Have you optimized supply chains for destination-based VAT?

- Is transfer pricing documented enough to withstand an audit?

- Do you run tax scenario models before entering new markets?

If you are unsure about whether to tick one of the answers, a tax consultation is your best bet

How to choose a tax consultation firm

The UK alone hosts 85,000 firms assisting 12 million taxpayers. A boutique firm that specializes in local business taxes might be a perfect fit for a small startup, but would be ill-equipped to handle the international tax complexities of a multinational corporation.

1. Match expertise to footprint

- Domestic only? Look for niche local specialists.

- Multiple EU countries? Prioritize pan-European teams with multilingual staff.

- Selling digital services worldwide? Seek advisers versed in OSS/IOSS and US sales tax.

Here’s our action-driven guide for SMEs evaluating cross-border tax and accounting solutions with practical considerations for system integration, expert selection, and global compliance. Before hiring a tax firm, verify its credentials and the corporate ethics of its professionals to ensure they have the necessary qualifications and a clean record.

2. Verify credentials and ethics

- Chartered status, bar admission, or similar professional body membership

- Up-to-date continuing education

- Transparent conflict-of-interest policy.

3. Assess technology stack

The efficiency and security of a tax firm are heavily dependent on its technology stack. A modern, well-integrated tech stack is no longer a luxury but a necessity for providing timely and accurate service.

Reputable tax consultation firms offer:

- Secure portals for document exchange

- Automated data pulls from your ERP

- Real-time dashboards of liabilities and refunds.

The effectiveness of any professional relationship hinges on clear and consistent communication. A tax firm's communication style will much determine the quality of your customer experience.

4. Review communication style

- Clear plain-English explanations, not jargon

- Proactive alerts before deadlines

- Senior adviser access, not only junior staff.

5. Compare fee structures

An important step in selecting a tax firm is understanding and comparing its fee structures. While the ultimate cost will depend on the complexity of your situation, knowing the different billing models will help you find a firm that fits your budget.

- Hourly: flexible, but unpredictable

- Fixed-price project: certainty for defined scopes

- Retainer: useful for year-round advisory, typical for growing firms

Request sample engagement letters to gauge what is, and is not, included.

Outsourcing vs. building an in-house tax team

The global tax management market is expected to grow from $24.5 billion in 2025 to $33.2 billion by 2030. Much of that growth owes to the companies shifting compliance and consultation to third parties. Learn more about global advisory trends

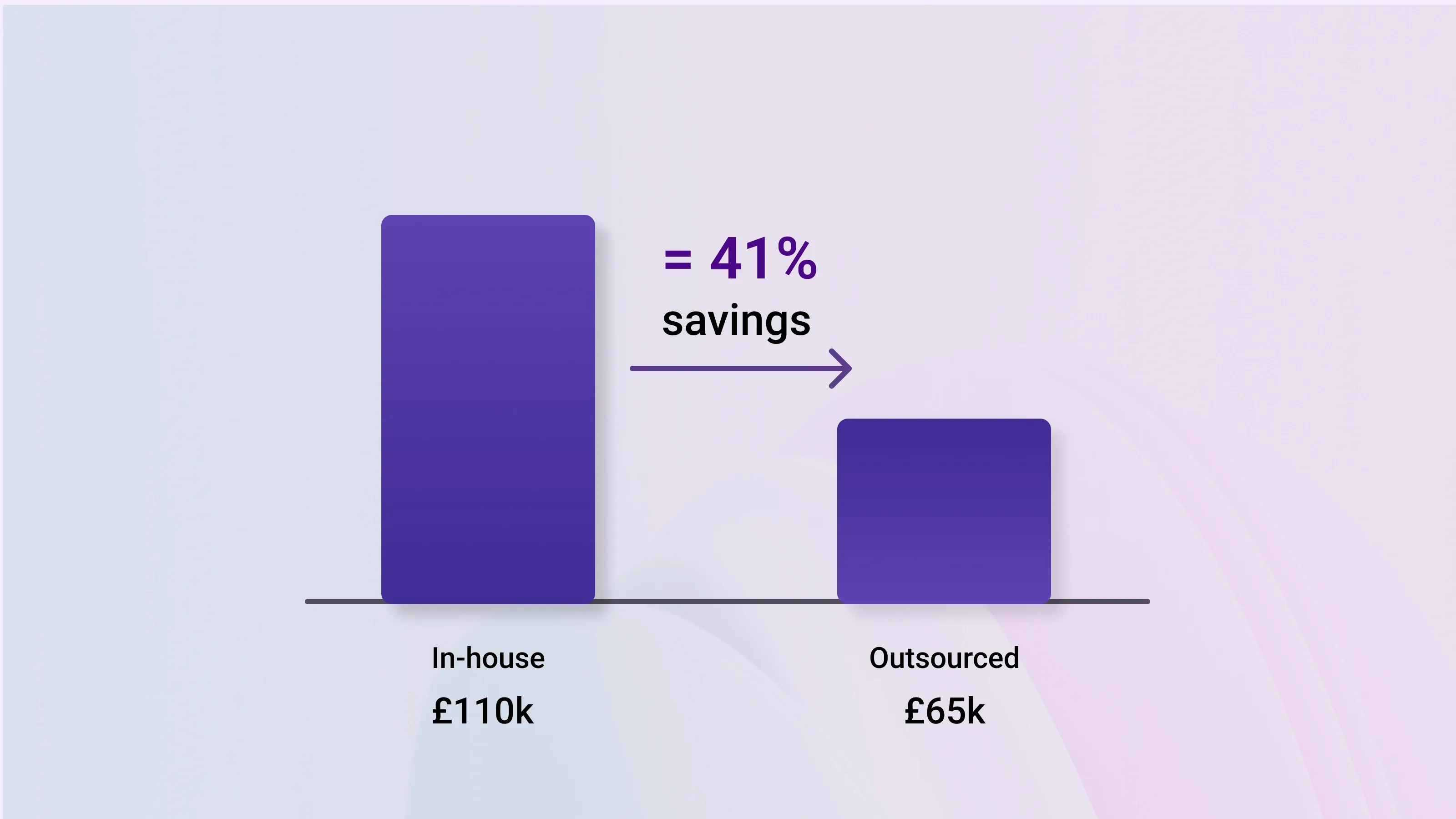

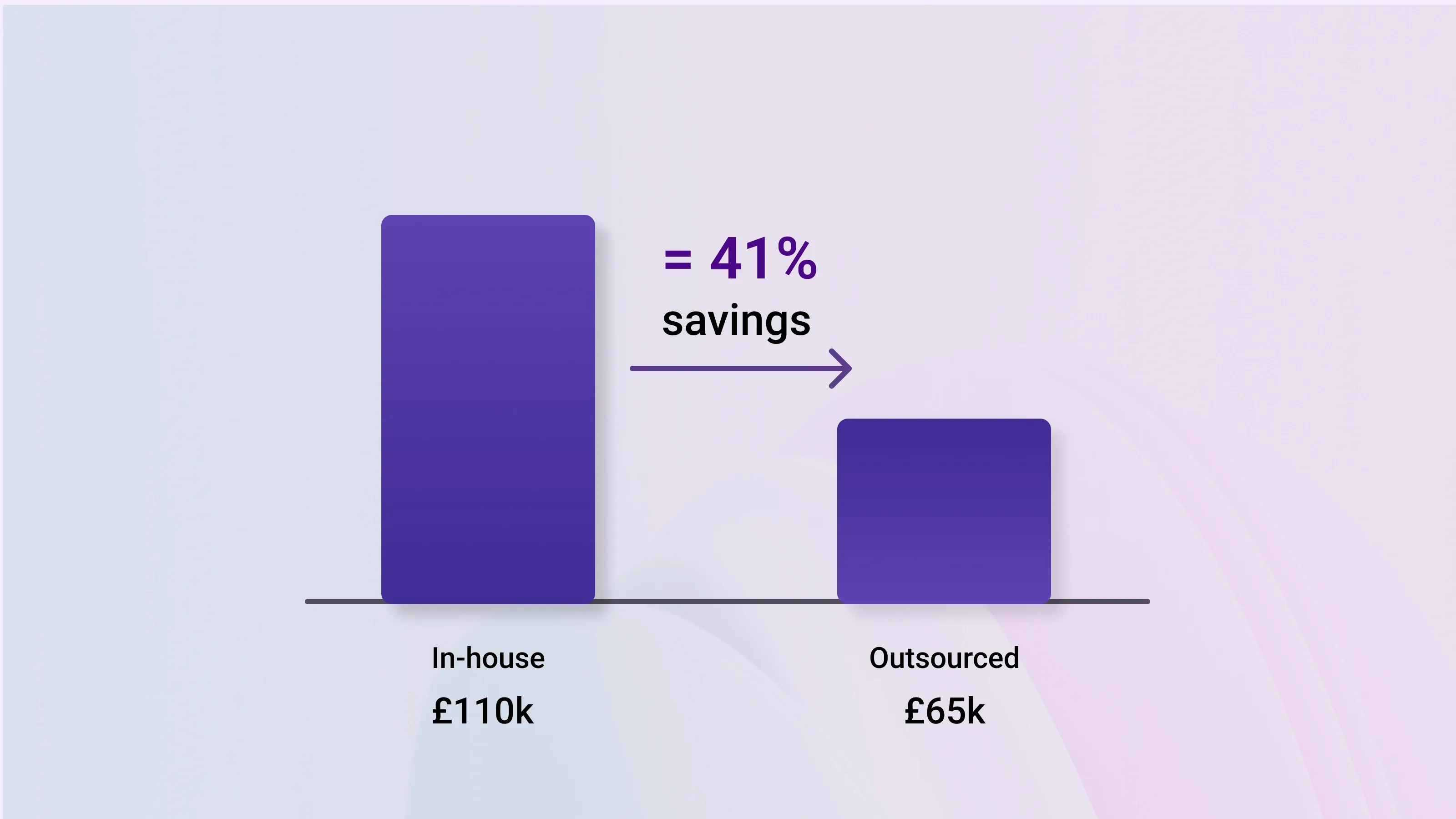

Cost comparison at a glance:

- In-house: salaries, employer taxes, software licenses, training, and possible turnover

- Outsourced: service fee, onboarding time, minor internal liaison costs

For a mid-size exporter:

- One senior tax manager's salary: £90,000 plus benefits

- Compliance software: £15,000 annually

- Training and conferences: £5,000.

Total roughly £110,000 a year. An outsourced package covering returns, consultation sessions, and audit support might land at £65,000. Savings rise if you operate in more than three jurisdictions, because external advisers scale knowledge faster.

When in-house makes sense:

- Large transaction volumes that need instant sign-off

- Proprietary information that cannot leave the building

- A tax profile so complex that keeping both internal and external experts is prudent.

Often, a hybrid works best: a lean internal coordinator plus outsourced specialists.

Special focus: non-domestic registration and VAT filings

When coping with VAT, businesses that operate across borders must navigate a complex web of non-domestic registration and filing obligations.

Registration triggers:

- Distance sales thresholds in the EU OSS regime

- Physical stock held by fulfillment providers abroad

- Hiring remote employees who create a permanent establishment.

How to Stay Compliant When Selling Internationally: VAT services for US companies

Common VAT pitfalls:

- Incorrect use of zero-rating on exports

- Double taxation when goods return under warranty

- Failure to evidence intra-EU dispatch within the required time limits

Professional advisers map these issues early, reducing costly corrections.

Audit preparedness:

Tax authorities increasingly rely on data analytics. This means you should provide clean digital records, a full trail of invoices, and real-time tax position reports. A consultation tax partner sets file formats, retention rules, and mock audits to hold you ready for inspections.

Conclusion

Consultation tax provides more than simple compliance - it equips businesses with strategic insight, proactive risk management, and financial efficiency. Instead of reacting to audits or struggling with cross-border rules, companies that invest in professional guidance gain clarity, reduce costs, and accelerate growth. By partnering with the right advisers, consultation tax becomes a tool to safeguard compliance today and build a stronger competitive edge for the future.