What you will learn

Below you will find the what, who, when, and how of VAT filing & returns, plus proven tactics to submit VAT reports faster and error-free.

Today, we will help you:

-

Understand why timely VAT filing matters to your bottom line and national budgets

-

Confirm whether your company is required to file, and how often

-

Follow an online filing checklist you can reuse each period

-

Spot common errors that lead to penalties

-

Compare software, automated VAT compliance, and outsourcing options so you can pick the right mix for your finance stack.

1. Why VAT filing matters

Value-added tax (VAT) looks small on each invoice, but it funds schools, roads, and hospitals.

When businesses under-report, treasuries bleed cash. EU member states alone lost around €89 billion in VAT revenue in 2022, roughly 7 % of the tax that should have been collected.

For businesses, accurate returns:

Mistakes can also fuel fraud. Missing Trader Intra-Community schemes cost between €13 billion and €33 billion every year. Regulators respond with tighter rules, so getting returns right is not optional. Here’s how EU businesses lost €159M in penalties.

2. Who should file VAT returns

If your taxable turnover exceeds the local registration threshold, you must register and file. Typical triggers include:

Check special cases:

When unsure, request a written ruling from the tax authority or consult a specialist.

3. Know your filing frequency

Your reporting cadence affects working capital and admin work.

Monthly: Standard in many EU states once turnover tops a set figure. Improves refund speed.

Quarterly: Common for SMEs, balances effort and cash flow.

Annually: Reserved for small businesses or special schemes.

Pro Tip:

If you regularly reclaim VAT, opting for monthly filings can improve liquidity even if you are allowed to file quarterly.

Here’s more on how to prepare and when to file VAT return

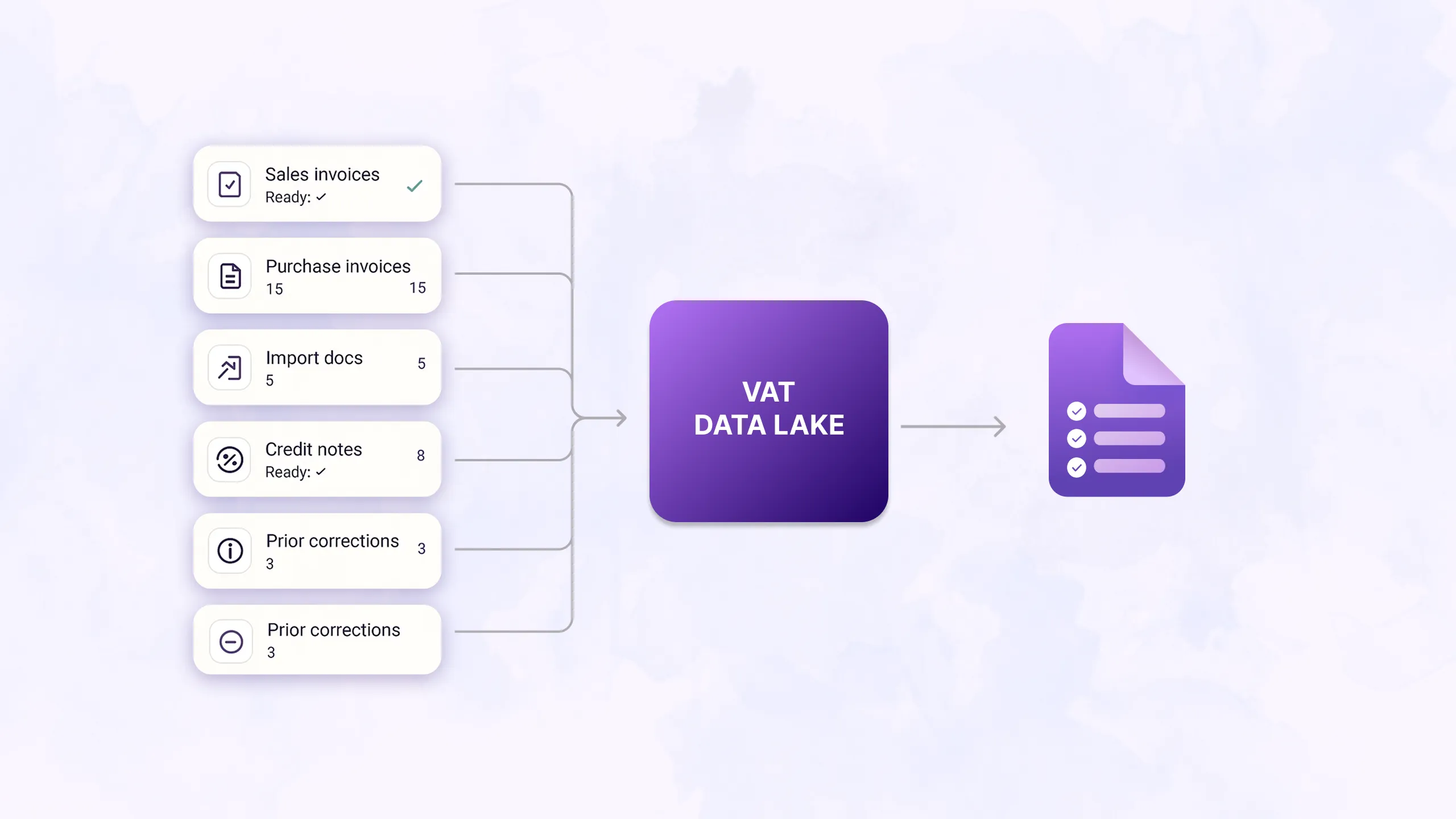

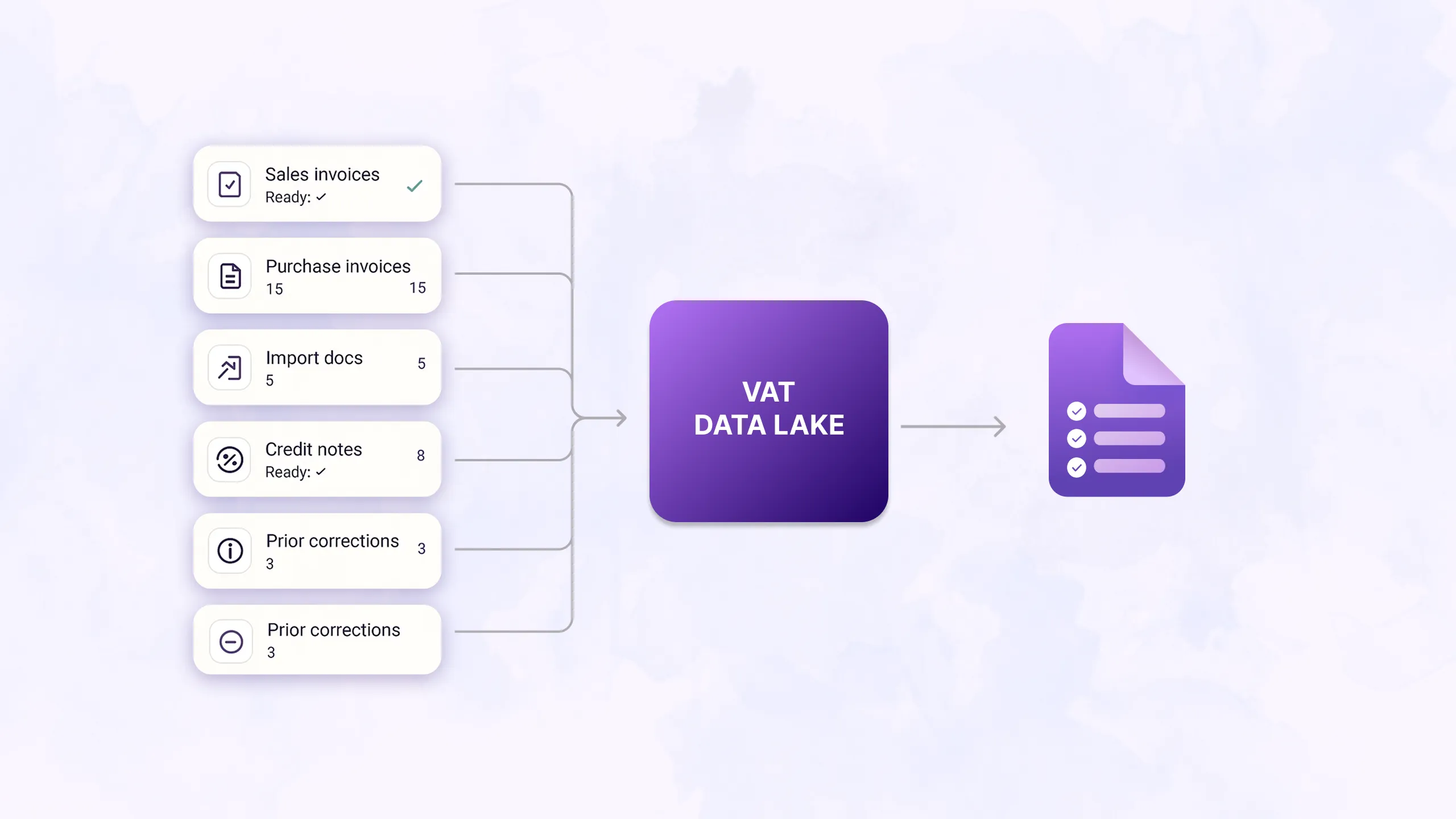

4. Gather data to submit VAT reports

Preparing data is often 70 % of the job:

-

Sales invoices: date, taxable amount, VAT rate, customer VAT ID (for intra-EU supplies)

-

Purchase invoices: VAT amount and reclaim eligibility

-

Imports and customs documents

-

Credit notes, bad-debt relief adjustments

-

Currency conversions at official rates

-

Previous period corrections.

Build a reconciliation routine

Each period, compare:

-

GL revenue vs. VAT ledger

-

Imports declared to customs vs. purchases ledger

-

EC Sales List values vs. zero-rated sales in your return

Automating reconciliation is a quick win. Businesses using the UK’s Making Tax Digital (MTD) platform with fully-functional software saved 26 to 40 hours per year on average and valued the time at £603 million to £915 million.

5. Follow online VAT filing process

The exact portal varies by country, but the workflow is similar.

- Log in tax authority portal with secure credentials or e-ID.

- Choose the period and form type (standard return, nil return, correction)

- Upload data or connect the API/bridging software

- Validate totals: net sales, net purchases, VAT due, VAT recoverable

- Submit and receive the acknowledgement number

- Pay any VAT due by the stated deadline.

Filing VAT Returns Online

Leverage bridging or API software to:

45 % of businesses said MTD software saved them time.

6. Common mistakes that trigger penalties

Finance CEOs know errors are costly. Late filings in many EU countries end up in a fixed fine plus interest, while repeated offenses result in audits:

-

Wrong VAT rate applied to cross-border services

-

Omitting zero-rated intra-EU sales from recapitulative statements

-

Failing to adjust partial exemption calculations

-

Reporting in the wrong currency

-

Missing the payment deadline even if the return was submitted on time

Learn more about how to avoid costly mistakes

7. Penalties for late filing and payment

Each jurisdiction sets its own sanctions, but the pattern is clear:

-

Fixed fines: €100 to €2 000 per return

-

Interest: base rate plus surcharge, often 0.33 % to 1 % per month

-

Reputational hit if public “name and shame” lists are used

-

Criminal liability for intentional evasion.

With the VAT revenue gap shrinking from €121 billion in 2018 to €89 billion in 2022, tax offices are tightening compliance measures, while audits are unlikely to soothe.

8. Tools, automated VAT compliance, and outsourcing

The global tax automation market forecast indicates growth up to 36.37 b. at 12.1 % CAGR by 2030.

That’s because manual VAT filing & returns steal time from higher-value work.

Spreadsheets with manual portal entry: cheap but risky

Bridging software: meets digital-link rules, keeps data in-house

ERP-native tax modules: consistent data, higher licence cost

Specialist platforms: real-time validation, cross-country rules engine, automated VAT compliance alerts

Outsourcing to VAT experts: end-to-end data review, filing, and representation

Dive deeper into how automation streamlines compliance and what to evaluate

Simplify VAT returns with 1stopVAT’s filing services

VAT return explained

A VAT return is a periodic summary sent by registered businesses to the tax authorities stating total sales, purchases, VAT collected, and VAT reclaimable. VAT return triggers payments to and refunds from the treasury.

Conclusion

VAT filing & returns should come as a monthly scramble. Clarify your filing obligations, set the right frequency, prepare clean data, and integrate technology or expert help. Proper VAT practices will save your business from errors, fines, and allow more time for strategic finance. Simplify VAT returns with 1stopVAT’s filing services