Overview

Today, you’ll discover a seven-step process that covers domestic rules, corporate tax compliance for groups, and international tax compliance for cross-border flows.

We’ll dive deep into why compliance matters, the hidden costs and risks, and the documentation authorities expect to see. CFOs, founders, and tax managers will have a clear playbook they can roll out in Q4 2025.

Tax compliance encompasses legal tax obligations: registering, calculating liabilities, filing returns, remitting payments, and maintaining evidence in case of audits.

1. Map Your Tax Footprint

Tax compliance is a critical, and often complex, requirement for any business.

Before diving into the specifics of filing and payment, the foundational first step is to map your tax footprint. This involves identifying precisely where your business activities create a nexus, the legal term for a sufficient presence to obligate you to register, collect, or pay taxes in a particular jurisdiction.

Before you can fix a gap, you need to know it exists:

- List every country where you make sales, hold inventory, own IP, or employ staff, even contractors.

- For each location, capture all possible tax types: VAT, GST, payroll, corporate income, customs duties, digital services, withholding.

- Flag nexus thresholds: sales, headcount, or days in-country, triggering the registration.

Why start here?

Regulators have become data-driven. EU authorities collected 10 million audits, raising €105 billion in extra revenue in 2022 alone. Here’s our CFO-friendly exploration of entity mapping, pitfalls, and practical steps for cross-border tax and accounting practices for SMEs.

2. Nail Domestic & Corporate Tax Compliance Basics

With your tax footprint firmly mapped, the next step is to understand and rigorously apply the fundamental rules of domestic and corporate tax compliance. This is the core engine of your tax strategy, involving a deep dive into the types of taxes your business must pay, the essential deadlines, and the non-negotiable record-keeping requirements.

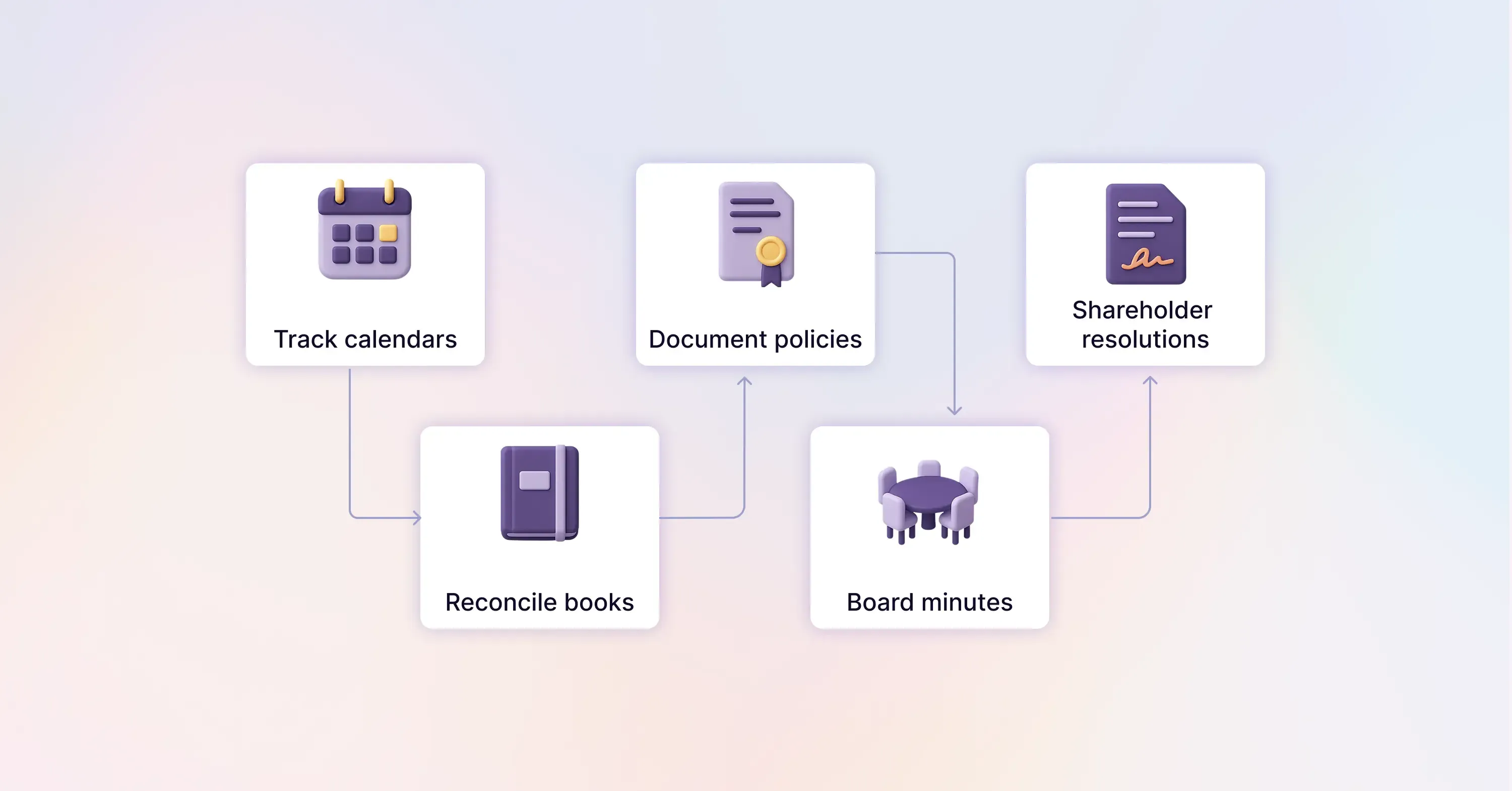

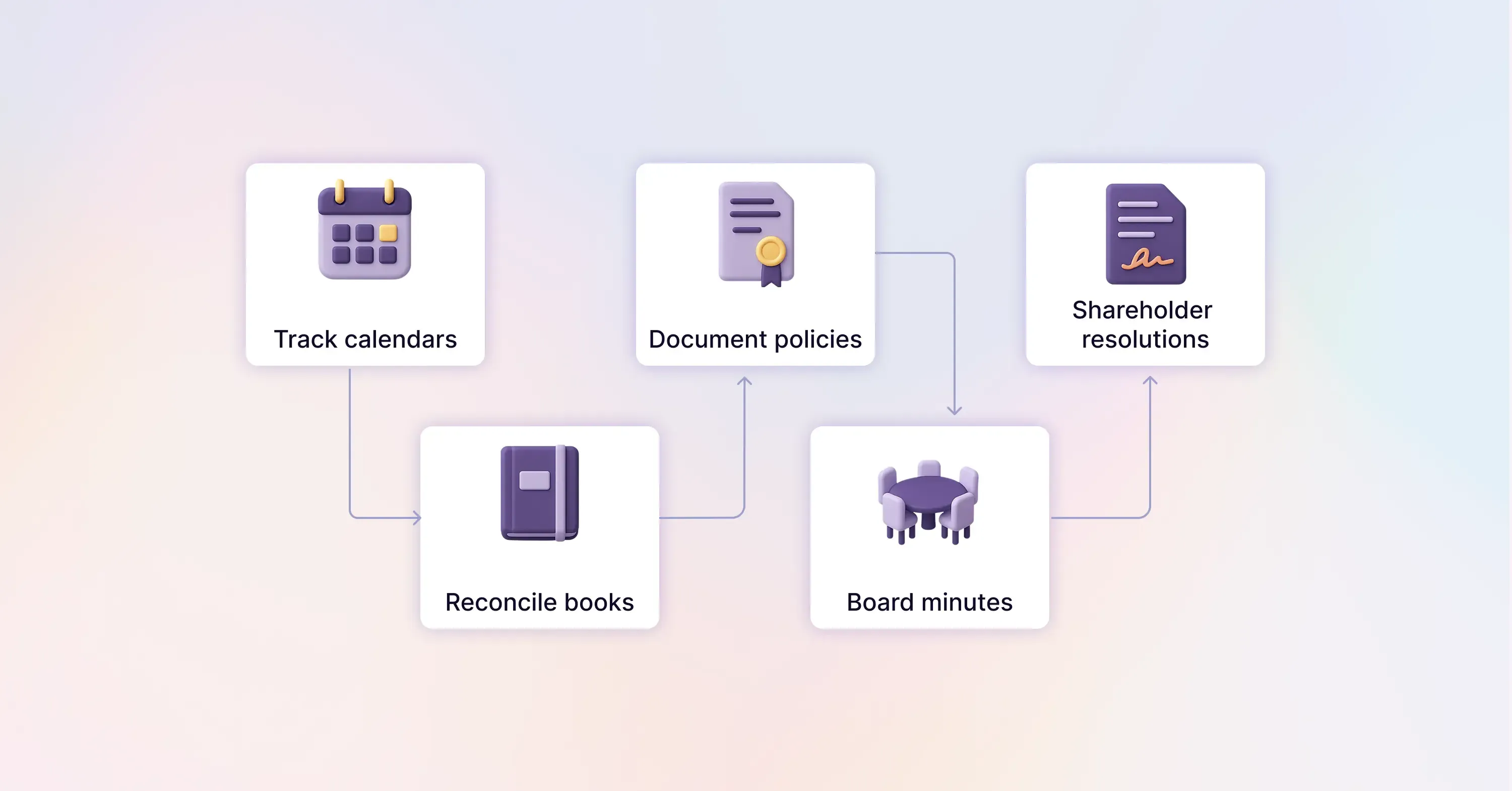

Corporate tax compliance is not only about filing an annual return:

- Track filing calendars: corporate income tax, VAT, payroll, local levies, and statutory accounts often have different filing dates

- Reconcile books monthly to minimize year-end adjustments

- Document transfer pricing policies, board minutes, and shareholder resolutions that support deductions and intercompany charges.

Precisely, UK companies have already shouldered £15.4 billion in annual tax compliance costs.

3. Tackle International Tax Compliance for Cross-Border Operations

For businesses with customers, suppliers, or operations extending beyond domestic borders, international tax compliance is the highest tier of complexity and risk.

The global landscape is governed by a patchwork of treaties, regulations, and reporting requirements that can differ drastically from what you encounter domestically.

Failing to navigate this intricate environment can expose your business to double taxation, hefty foreign penalties, and intense scrutiny from tax authorities worldwide.

This section is dedicated to de-risking your cross-border operations by focusing on three critical areas:

- Understanding Tax Treaties: How bilateral agreements between countries work to prevent double taxation on income and determine taxing rights.

- Transfer Pricing: The critical rules governing the pricing of transactions between related entities (e.g., a U.S. parent and a German subsidiary) to ensure profits are taxed where the economic activity occurs, not simply where the business chooses.

- Foreign Reporting Obligations: The non-negotiable requirements, like specific IRS forms (e.g., Form 5471 for foreign corporations or FBAR/Form 8938 for foreign financial assets), that dictate disclosure of foreign income, ownership, and assets, even if no additional tax is due.

Effectively managing international tax compliance requires specialized expertise and proactive planning. By mastering these three elements, you can ensure your global operations remain compliant, efficient, and strategically sound.

Running sales in more than one jurisdiction adds layers of complexity.

3.1 Register for non-resident VAT and GST

Once your international tax footprint is mapped, one of the most immediate and urgent compliance tasks for any business selling digital services or goods across borders is registering for Value-Added Tax (VAT) and Goods and Services Tax (GST) in foreign jurisdictions.

Unlike corporate income tax, which often has higher revenue thresholds or treaty protection, VAT/GST obligations are typically triggered by the first sale to a consumer or a very low revenue threshold in a foreign country.

Failing to register can result in your business being liable for the tax plus heavy fines and penalties, sometimes dating back to the first transaction.

- Check distance-selling thresholds or marketplace rules.

- Use a single EU registration, such as OSS or IOS, when possible.

- Align invoicing systems with local e-invoice or SAF-T standards.

If your company is US-based and expanding overseas, understanding international VAT registration and local rules is crucial.

Here’s a step-by-step walkthrough of VAT services for US companies, breaking down obligations, registration, and supporting documentation needed across jurisdictions.

Managing international tax compliance effectively requires specialized expertise and proactive planning. By mastering these three elements, you can ensure your global operations remain compliant, efficient, and strategically sound.

3.2 Understand withholding and PE risks

As your business engages in cross-border transactions, two critical and interconnected concepts dramatically increase your compliance risk: withholding tax and permanent establishment (PE).

These are not merely administrative hurdles; they represent a potential shift in taxing rights from your home country to a foreign jurisdiction, often resulting in unexpected tax liabilities and significant financial exposure.

A PE is the legal threshold that creates a foreign country's right to tax a portion of your business profits as if you were a resident entity.

Understanding and proactively mitigating PE risk is essential to prevent being unexpectedly subjected to corporate income tax in a foreign jurisdiction.

3.3 Handle treaty relief

Tax treaties are the critical mechanisms that save businesses from the nightmare of double taxation, being taxed on the same income by both their home country and a foreign country.

Without them, international business would be prohibitively expensive and complex. Therefore, the ability to effectively handle treaty relief is a cornerstone of sophisticated international tax compliance.

This step involves proactively assessing your business activities against relevant tax treaties to strategically reduce your tax burden and ensure you are only taxed where legally required:

- Confirm residency certificates are valid before applying reduced rates.

- Keep digital copies; some countries require them to be attached to e-returns.

Ignoring international requirements multiplies risk. Across the EU and UK, businesses burn 1.9 % of turnover: €204 billion a year on tax compliance. Streamlined processes free cash for growth.

For practical checklists and global insights on VAT and sales tax registration, see Global Sales Tax Solutions & VAT Compliance Guide.

4. Build a Reliable Audit Trail

In the complex world of tax compliance - especially with international and digital reporting requirements - the quality of your audit trail is just as important as the strategy itself. Tax authorities operate on evidence, not assumptions. If you cannot quickly and accurately substantiate every deduction, revenue source, or cross-border transaction with reliable, well-organized audit records, your compliance efforts remain at risk of challenge and penalty.

Authorities expect real-time or near-real-time visibility into your audit trail:

- Centralize all transactional records in a unified audit system or secure ledger.

- Tag each entry with tax codes, customer location, and supporting documentation.

- Keep audit evidence for at least the statutory retention period - usually six to seven years.

The stakes keep rising. EU Member States still lost €89.3 billion in VAT revenues in 2022, roughly 7 % of expected VAT. As gaps close, scrutiny shifts to individual companies.

5. Automate Deadlines and Filings

Manual tracking of hundreds of federal, state, and international deadlines are prone to human error. Missing a single filing or payment deadline, particularly at the state or international level, can trigger immediate and costly penalties, interest charges, and the potential loss of compliance good standing:

- Deploy compliance software or a robust Excel-plus-calendar workflow.

- Set reminders at least two weeks before each deadline.

- Integrate ERP and payroll feeds to auto-populate returns, reducing keystrokes and errors.

For more on leveraging technology to strengthen compliance, read Tax Technology Tools: VAT Compliance Automation.

6. Monitor Regulatory Change

The regulatory environment surrounding tax compliance is not static; it is in a state of constant, often rapid, evolution.

New digital economy taxes are emerging globally, the IRS is continually updating its enforcement priorities, states are altering their nexus laws, and international bodies like the OECD are driving sweeping changes (e.g., the global minimum tax known as Pillar Two).

For any business committed to sustained compliance, the final, crucial step is establishing a reliable system to monitor regulatory change. Failure to keep pace with new laws, forms, and deadlines can quickly render a previously compliant strategy obsolete, leading to unexpected penalties or missed opportunities:

- Subscribe to official gazettes and tax agency newsletters.

- Join industry associations that lobby and provide alerts.

- Assign each update an owner responsible for scoping impact and rolling out changes.

Between 2014 and 2019, business tax compliance costs in Europe more than doubled by 114 %. For staying ahead amid global digitization and reporting mandates, see Global Trend: Electronic Invoicing and Digital Tax Reporting.

7. Prepare for Audits and Disputes

Even the most meticulously compliant business will, at some point, face an inquiry, a notice, or a full-scale tax audit.

Tax audits are a reality of operating a business, and the way you prepare for and manage them is critical to minimizing financial penalties and operational disruption.

An audit is fundamentally a test of your data trail, documentation, and procedures. If you wait until the audit notice arrives to organize your records, you are already behind.

7.1 Create an audit file

- Copy the final version of each return.

- Add the working papers that bridge books to tax.

- Include correspondence, rulings, and advance pricing agreements.

7.2 Run mock audits

- Select random periods and have an internal or external reviewer test the evidence.

- Grade findings by severity and fix root causes.

Small enterprises with less than ten employees carry about 90 % of the EU’s corporate tax compliance costs. Large groups can borrow a page from their lean playbook: prepare early, keep files light, and resolve issues fast.

For SME-specific record-keeping and cross-border audit prep, visit Aligning Cross-Border Tax and Accounting Practices for SMEs.

7.3 Keep an eye on reform

A single set of EU corporate tax rules, BEFIT, could cut costs for multinationals by up to 65 %. Knowing where reform is headed helps during negotiations and when setting reserves.

Conclusion

Tax compliance is a moving target, yet the steps are clear: map exposure, master domestic rules, manage international filings, safeguard data, automate, stay current, and rehearse for audits.Want to cut costs, reduce risk, and give finance teams room to focus on growth!

Follow our best tax compliance advice