What you will learn:

Today, we will lay out:

- The main categories that qualify for an exemption include the new EU cross-border SME VAT rules for non-resident businesses, effective from 2025, allowing small enterprises with EU-wide turnover under €100 000 to benefit from simplified VAT exemptions across Member States.

- Documents you need, especially the tax exemption certificate, every auditor asks for.

- Sales tax exemption rules you must follow in different states or countries.

- A practical application checklist that accountants and SMEs can use tomorrow.

Along the way, you will see why tax authorities guard exemptions so closely. For instance, EU countries missed €89.3 billion in VAT revenue in 2022 and are tightening controls.

1. Understand sales tax versus VAT

Most English-speaking jurisdictions refer to sales tax, while more than 170 countries operate a VAT. Both are consumption taxes collected by businesses, but the mechanics differ:

Why this matters: a business may be sales tax exempt in one state yet liable for VAT abroad.

Cross-border sellers need separate strategies. For a deeper dive, see the Sales Tax Registration and Compliance Guide for Global Sellers.

A sales tax-exempt purchase is legally exempt from sales tax because the buyer, the product, or the use meets specific statutory criteria. Proof comes from a valid tax exemption certificate accepted by the seller at the time of sale.

2. Check whether you or your customers qualify

Sales tax exemptions in the U.S. are determined by the state and local tax laws where the sale is sourced. They are rarely based on the financial status of the seller, but rather on who the customer is, what the item is, or how the item will be used.

The key to compliance for a seller is to know when an exemption is legitimate and to get the required proof.

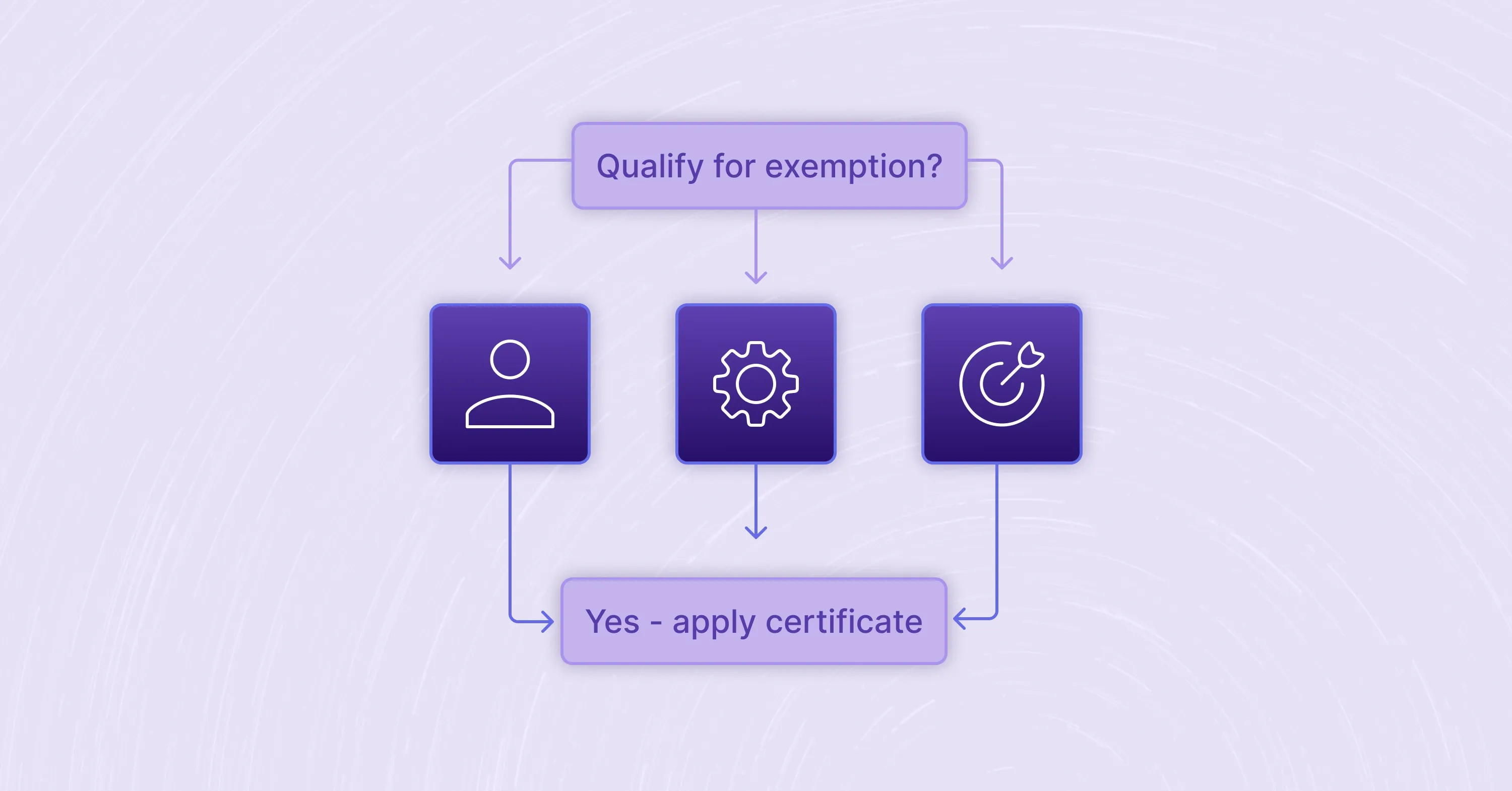

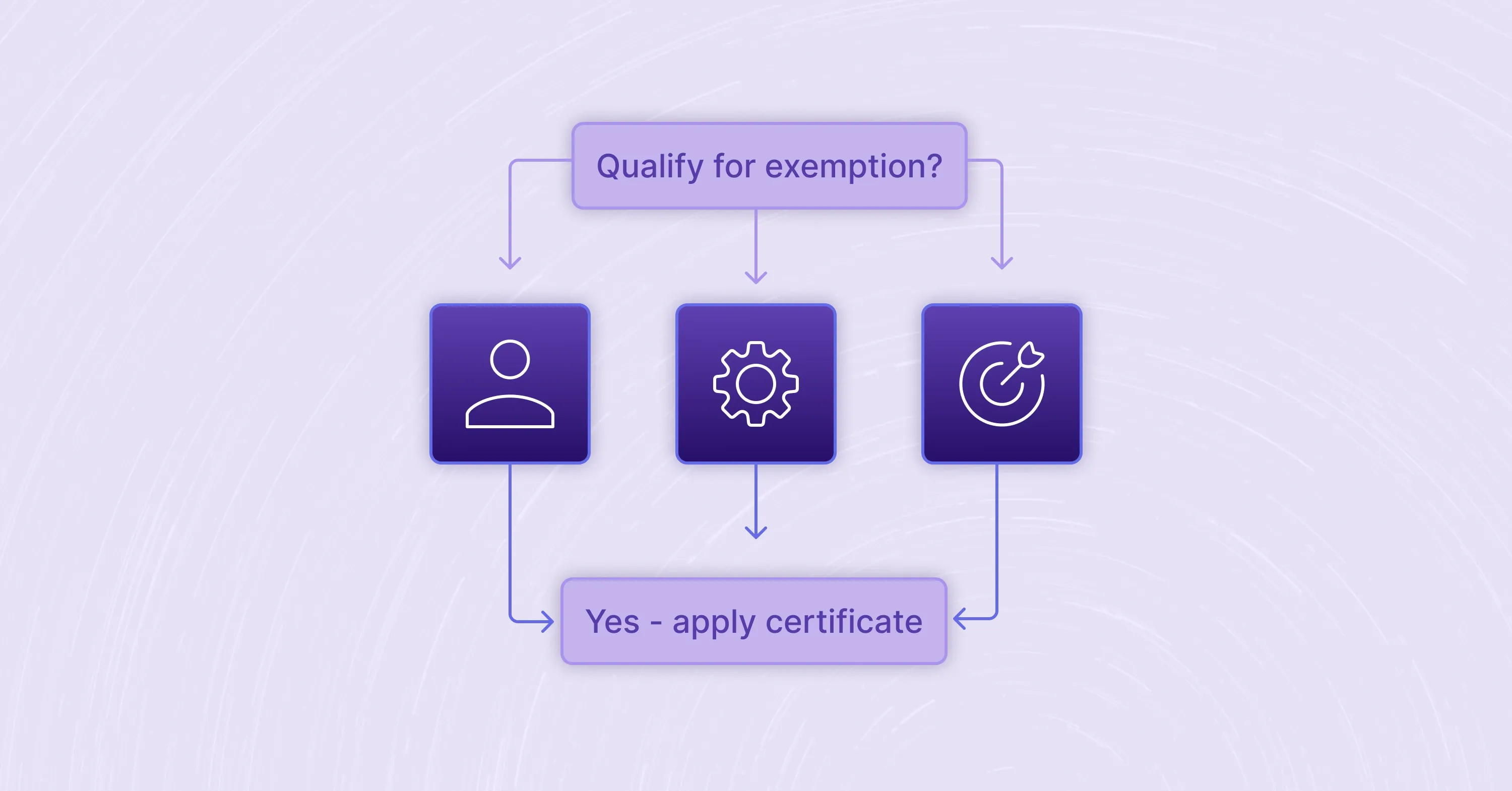

Eligibility, application, business exemptions: the triad you must evaluate before you invoice.

- Entities: nonprofits, government agencies, schools, and resellers often qualify.

- Products: raw materials, manufacturing equipment, food staples, and medicines may be exempt. The UK’s zero-rating of most food alone costs £25.1 billion in lost tax revenue.

- Purpose: resale, export, or direct use in manufacturing frequently triggers an exemption.

Intra-EU Sales

Starting January 1, 2025, EU-based SMEs can leverage the benefits of the newly introduced version of the intra-EU SME scheme. This scheme permits registered EU businesses to maintain VAT-exempt status beyond their country of establishment.

There are two conditions that a person must meet to use this scheme. The first condition is that the business cannot surpass the annual intra-EU-wide threshold of EUR 100,000.

The second precondition allowing EU businesses to remain VAT exempt in other Member States, where they have customers, is that their business volume cannot exceed the national threshold.

US Sales Tax Exemption: Out-of-State Vendors

Remote vendors(one without physical presence) have an option in most US states to remain sales tax exempt if their remote sales are under the State’s threshold. In the US, the threshold is, in most cases, based on two conditions. Meaning it’s turnover-based and/or number of transactions-based. If your business reaches any of these thresholds, it automatically becomes accountable for sales tax.

3. Gather the correct tax exemption certificate

Verbal claims are useless in an audit. You need the right form, signed and dated. To protect your business from sales tax liability on exempt transactions, you must have a valid, correctly completed tax exemption certificate on file for every tax-free sale. This documentation is your defense during a sales tax audit.

-

US: use the Streamlined Sales Tax Form, state-specific resale certificates, or multi-state exemption certificates.

-

Canada: each province issues its own PST or QST exemption form.

-

EU: the buyer’s VAT number and zero-rated supply evidence replace a formal certificate.

-

Cross-border e-commerce: electronic certificates are accepted in most states, but keep originals for seven years.

To avoid certificate-related headaches and keep auditors happy, follow the best practices detailed with our Global Sales Tax Solutions & VAT Compliance Guide.

Common certificate errors

A successful shipment requires meticulous attention to detail, particularly concerning the necessary certificates and documentation.

To ensure a smooth process and avoid costly disruptions, it's crucial to fix these errors, like:

- A missing description of goods

- An expired document on file

- A seller forgetting to sign, or

- The wrong reason code is being checked before the shipment leaves the warehouse.

Be sure to fix these flaws before shipment leaves the warehouse.

4. Follow the sales tax exemption rules in every jurisdiction

Achieving and maintaining sales tax compliance requires businesses to navigate a highly fragmented and constantly changing landscape of exemption rules across various jurisdictions.

- Validity period: Florida certificates expire each 31 December, while Texas resale certificates have no expiry.

- Drop shipments: Some states need certificates from both the retailer and the end customer.

- Digital goods: A handful of states allow exemption if the physical equivalent would qualify.

A robust jurisdiction-specific approach will help you avoid penalties and ensure that every transaction is processed correctly.

Internationally, the OECD found an average 0.58 VAT Revenue Ratio in 2022, meaning around 42 % of potential VAT slipped through. Expect tighter audits and keep meticulous records.

For cross-border sellers and SMEs, getting your accounting and reporting processes aligned is essential.

Here are practical steps to stay audit-ready across jurisdictions

Reconciling mixed sales

Accurate sales tax reporting is complicated by invoices containing a mix of taxable and exempt items, known as mixed sales. To maintain compliance and provide a clear audit trail, you must reconcile these mixed sales by meticulously separating the transaction components. This process involves:

- Taxable section with correct rate.

- Exempt section referencing the certificate number.

- Total with notes for auditors.

If some line items are taxable and others are exempt, split the invoice.

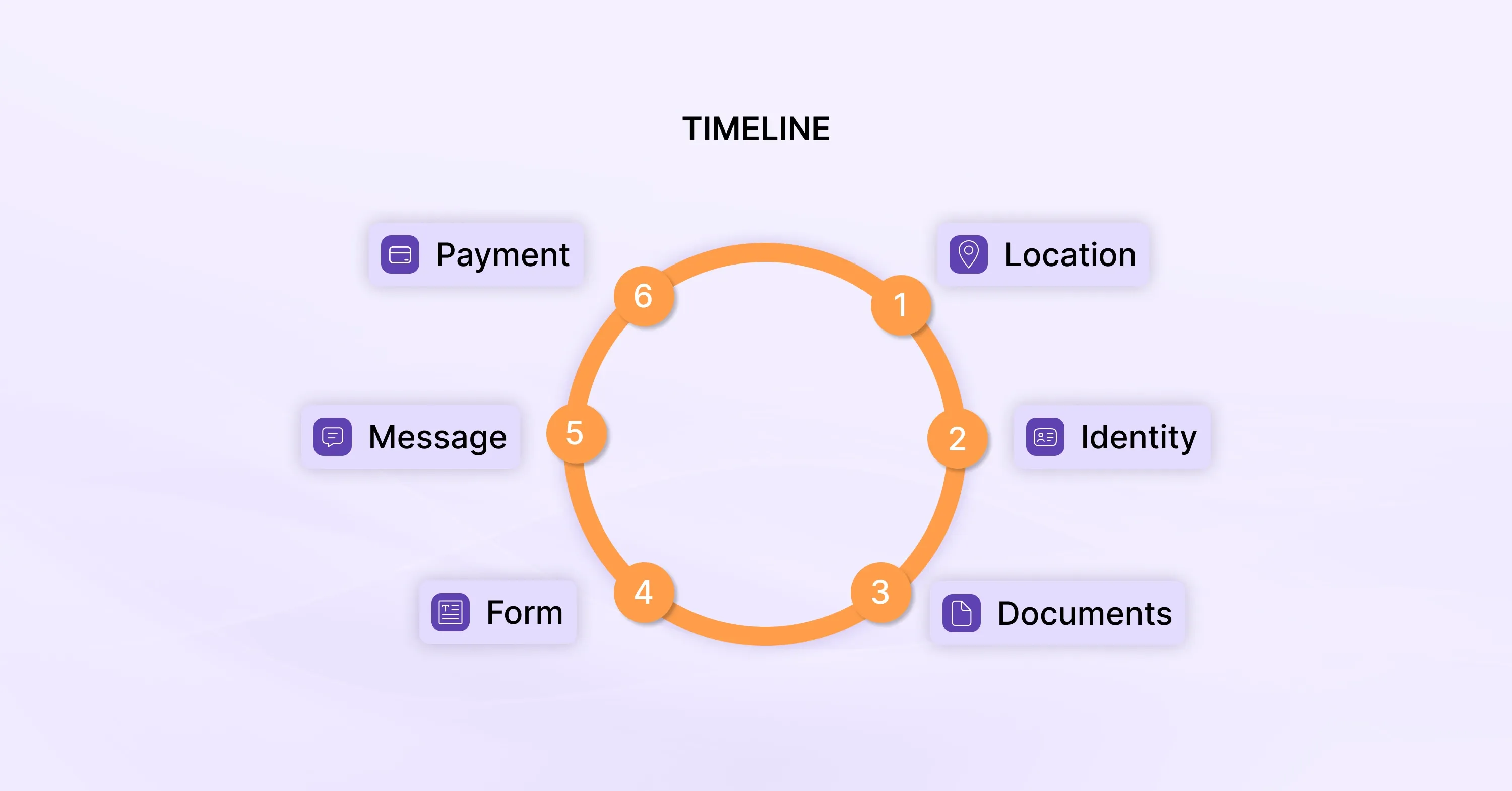

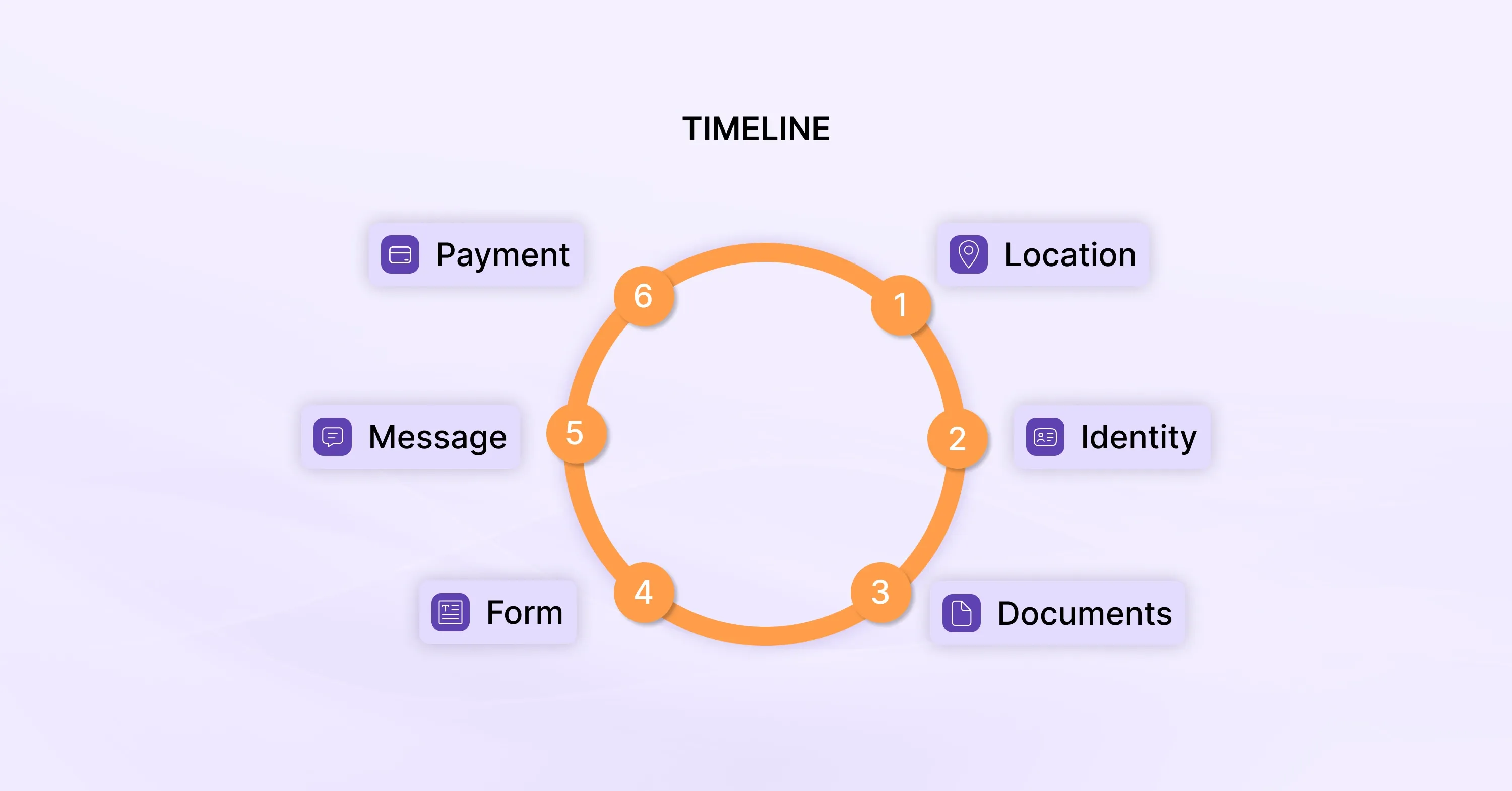

5. File or claim the exemption step by step

Securing a sales tax exemption requires a structured, step-by-step process, whether you are the purchaser applying for an official certificate or the seller accepting one.

To ensure compliance and avoid liability, the process involves first determining eligibility, obtaining the correct state-specific form (or an accepted multi-state certificate), and submitting the certificate.

Use this checklist before clicking “submit” on your application:

- Determine jurisdiction: where does the supply legally take place?

- Confirm eligibility: entity, product, purpose.

- Collect supporting documents: articles of incorporation for nonprofits, supplier invoices, and shipping records.

- Complete forms: state department of revenue portal or EU VIES system.

- Upload or mail originals if required.

- Wait for the approval email or certificate number.

- Update your POS or ERP to ensure that the exemption applies at checkout.

Pro Tip:

SMEs bolt this onto their existing “new customer” workflow, saving manual updates later.

Here’s how to manage VAT compliance as a US-based business with international sales

6. Monitor, renew, and stay compliant

Monitoring, renewing, and staying compliant is the final and most critical step in managing sales tax exemptions. This is an ongoing process essential for preventing penalties, reducing audit risk, and maintaining the validity of your tax-exempt status.

Tax authorities know exemptions are costly. HMRC reports £207 billion in foregone revenue from 107 UK tax reliefs. Expect reviews.

- Schedule renewal reminders 30 days before expiry.

- Revalidate VAT numbers through VIES quarterly.

- Flag customers whose turnover now exceeds exemption thresholds.

- Archive old certificates digitally with searchable tags.

If you import into Israel, note the OECD’s 2025 recommendation to curb VAT exemptions, signaling future rule changes.

7. Common mistakes and how to avoid them

Achieving and maintaining sales tax exemption can be a complex and often misunderstood process, leading businesses into a common set of costly mistakes, from paperwork errors to overlooking crucial use tax obligations:

- Treating exemption as a right, not a privilege: sellers must refuse if the paperwork is wrong.

- Using one certificate across multiple entities.

- Ignoring marketplace rules: Amazon and Shopify still collect tax unless you upload the certificate.

- Forgetting use tax: if you buy an exempt item but later consume the item, self-assess the tax.

Failing to correct these can bump your audit risk score and cancel past exemptions.

Conclusion

Claiming a sales tax-exempt sale is a privilege that saves cash now and headaches later, provided you tick every jurisdiction’s box. Double-check whether your customer or your product qualifies, collect the right certificate, follow the local sales tax exemption rules, and set up a renewal routine. With a clear process in mind, accountants and SMEs can stay compliant even as cross-border rules evolve.