Overview

This guide breaks down tax and compliance into manageable steps for CFOs and compliance leaders. You’ll learn how to identify the rules that apply to your business, build a repeatable compliance framework, and stay prepared for audits. We also highlight international reporting obligations and the penalties that often catch non-local businesses off guard.

Step 1: Know Your Regulatory Landscape

Crafting an effective tax and compliance program begins with a fundamental, yet often overlooked, first step: a comprehensive understanding of your regulatory landscape.

It's not enough to simply pay your taxes; you must know exactly which taxes apply to your business, what triggers those obligations, and when they are due.

This initial mapping phase is your blueprint for building a robust and resilient compliance framework:

- Identify direct taxes (corporate income tax, withholding) and indirect taxes (VAT, GST, sales taxes).

- Flag special regimes: digital services taxes, environmental levies, customs duties.

- Log statutory thresholds, registration triggers, and filing schedules.

By mapping all direct and indirect taxes, special regimes, and deadlines, you shift from a reactive approach to a proactive, strategic compliance foundation.

Local rules still matter

Even global corporate groups stumble on simple local issues, like city-level payroll taxes.

To safeguard your tax standing, build a domestic matrix to track:

- Registration numbers and certificates

- Monthly, quarterly, or annual returns due

- Payment cut-off times and formats.

Cross-border web

For businesses expanding internationally, tax compliance has grown far more complex. It’s no longer tied only to physical offices - digital presence, online transactions, and shifting rules can trigger tax obligations in countries where you have no local entity. From managing permanent establishment risks to defending transfer pricing across multiple jurisdictions, international tax regulations remain in constant flux.

- Permanent establishment thresholds

- Transfer pricing documentation

- Double tax treaty relief procedures

- Country-by-country reporting.

Across the European Union, total business tax compliance costs jumped by 114% from 2014 to 2019. A sharp rise is mostly caused by expanding cross-border disclosure rules, so map them early.

Here is further reading and action-driven checklist for international tax compliance.

Step 2: Build a Tax Compliance Management Framework

Tax compliance management framework turns scattered tasks into a living system.

- Assign ownership: finance to lead filings, legal to review positions, IT to secure data

- Document each process in a standard operating procedure (SOP)

- Set materiality limits that trigger extra review

- Add controls to catch errors: dual approvals, variance checks, automated validations.

Tech enablers

- Central dashboard to track filing calendars

- Secure document repository with audit trails

- Alert system for law changes.

43% of companies view coping with evolving tax laws as their top challenge

Tips for implementing effective technology for compliance

Step 3: Streamline Data Collection and Documentation

To streamline your data collection and documentation for regulatory tax compliance, it's crucial to adopt a systematic approach that treats data as the core of your operation.

Bad data leads to bad filings, resulting in inaccurate reports and potential penalties. By establishing a robust process for gathering and managing your source data, you can ensure accuracy, improve efficiency, and build a strong foundation for your entire compliance program:

- Map data owners for sales, purchasing, payroll, and treasury.

- Adopt a standard chart of accounts and consistent tax codes.

- Use validation rules at the point of entry to prevent coding errors.

Documentation checklist

- Tax return workpapers and reconciliations

- Contracts supporting withholding or PE positions

- Transfer pricing files and comparables

- Proof of payment receipts

Small and medium-sized enterprises already spend about 2.5% of their turnover on tax compliance.

Global SMEs are successfully handling cross-border tax and accounting through structured frameworks

Step 4: Prepare for Audits Before They Start

Don’t wait for a tax auditor to come knocking - get your records in order well in advance. While you can’t predict when an audit will occur, early preparation reduces stress, minimizes risk, and protects your business from costly setbacks. With consistent record-keeping and organized processes, a potential audit turns from a threat into a manageable review.

- Keep backup for every line item on filed returns.

- Store correspondence with tax authorities in one folder.

- Maintain an audit log noting who prepared and who reviewed each filing.

Mock audits

- Run an annual internal review that mirrors authority questionnaires.

- Score findings by risk and remediate within 30 days.

- Update SOPs to lock in improvements.

How to minimize audit risks through robust compliance and documentation

Step 5: Report Accurately and On Time

Don't let tax deadlines catch you by surprise. While the tax world might seem like a predictable calendar of April 15ths, the reality is far more complex.

Depending on where you operate, the type of tax you're dealing with, and even the volume of your business transactions, a multitude of deadlines could be lurking just around the corner. Missing even one can lead to significant financial penalties and headaches.

- Use a master calendar with color-coded urgency levels.

- Automate reminders escalating to senior management at minus five days.

- File electronically where possible to gain instant confirmation.

Penalty matrix for non-local businesses

For non-local businesses, tax compliance can feel like a high-stakes game of chess—one wrong move triggers costly consequences. Rules vary widely across jurisdictions, where a small oversight in one country may result in severe penalties in another. Our Penalty Matrix for Non-Local Businesses highlights the key financial risks to help you stay ahead and protect your bottom line.

-

Late filings: percentage of tax due or flat daily amounts

-

Underpayments: interest plus surcharges up to 50%

-

Non-registration: trading bans, customs holds, reputational damage

Here’s how global sellers benefit from a step-by-step approach to registration, reporting, and compliance.

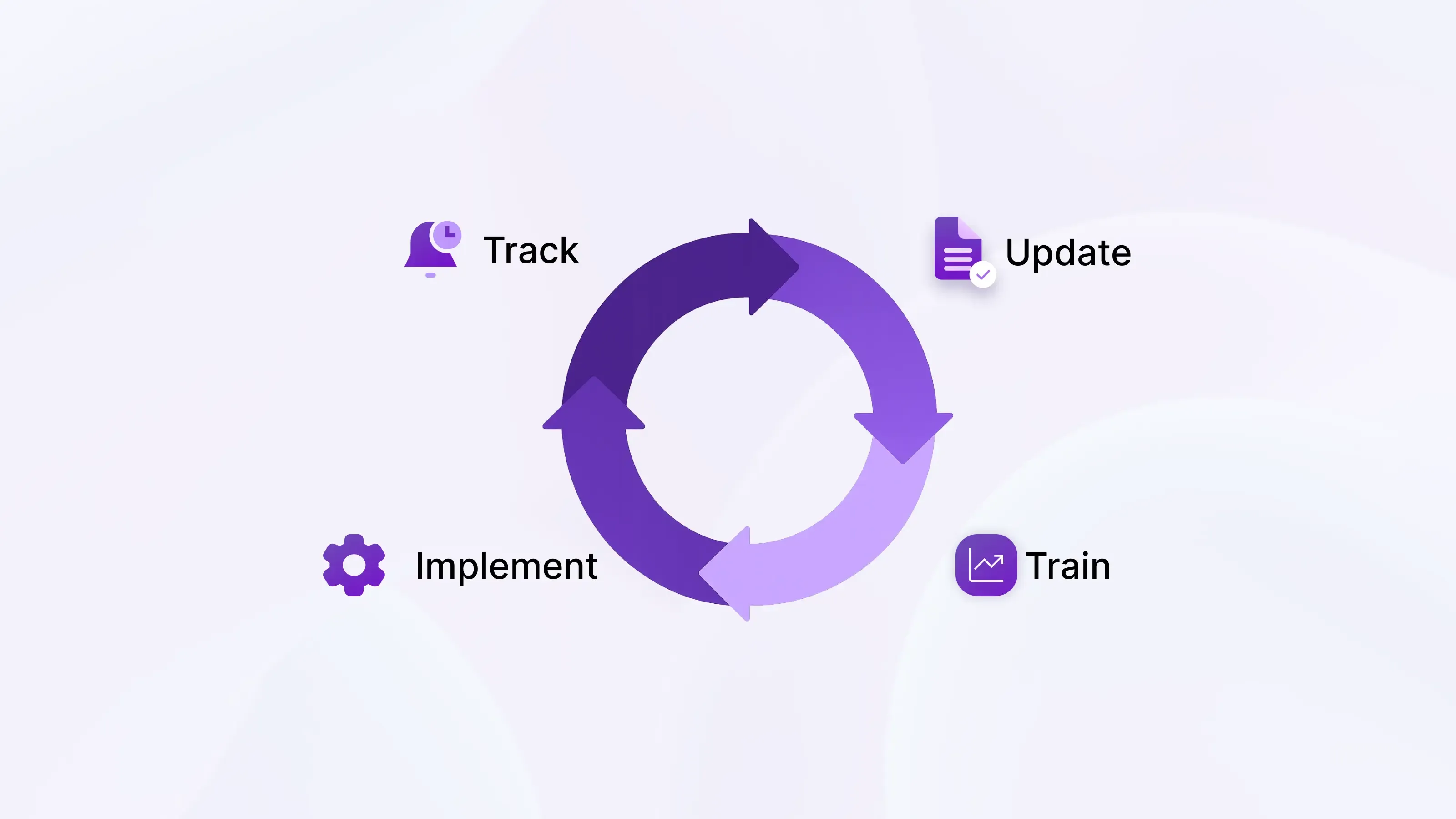

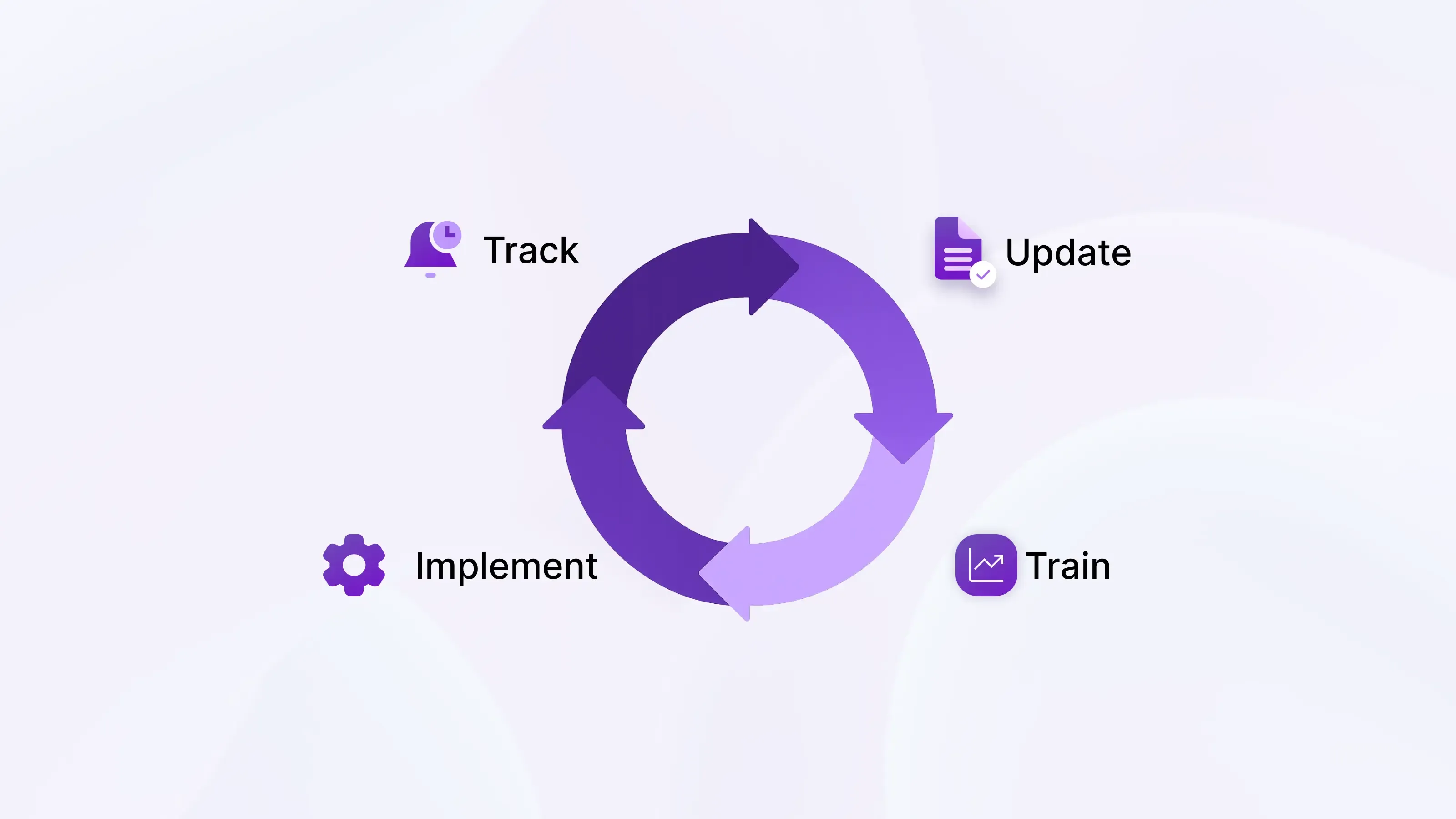

Step 6: Monitor Changes and Train Your Team

In the ever-changing world of tax compliance, tax laws, regulations, and reporting requirements are constantly evolving, and a failure to keep up can expose your business to significant risks.

The final and ongoing step in any robust tax compliance program is to actively monitor changes and ensure your team is properly trained to adapt.

- Subscribe to official gazettes and industry newsletters.

- Hold monthly knowledge sessions summarizing rule changes.

- Update your process maps within 48 hours of a new obligation.

Staying Ahead Internationally

For a global perspective on changes in e-invoicing, real-time reporting, and compliance requirements, check out Global Trend – Electronic Invoicing and Digital Tax Reporting.

Quick Checklist Recap

Before wrapping up, let's take a moment to recap the essential steps for building a resilient tax compliance program.

This isn't just a list of tasks; it's a strategic framework for protecting your business from the costly risks of non-compliance. By following these steps, you’ll transform a reactive, stressful process into a proactive, systematic approach

- Map all tax rules affecting each entity

- Document a repeatable framework with clear owners

- Clean and validate source data

- Store airtight documentation for audits

- Meet every filing deadline

- Monitor legislation and train staff continuously

Conclusion

Regulatory tax compliance protects businesses from financial loss and reputational harm. By building a strong framework and staying audit-ready, finance leaders can navigate complex obligations with confidence. A proactive tax and compliance approach secures long-term stability and trust.