What you will learn

This guide explains VAT reporting requirements, shows how technology is reshaping compliance, and profiles the top firms that help multinationals file accurately in dozens of jurisdictions. Expect practical checklists, mini case studies, and a glimpse of what the ViDA reforms will mean for your finance stack.

What it VAT reporting?

VAT reporting means submitting periodic declarations of taxable sales, purchases, and VAT due to national tax authorities. A compliant VAT report:

- uses the correct local format and currency

- reconciles ERP data with invoices and customs docs

- is filed on or before the statutory deadline

- is backed by audit-ready evidence for five to ten years

Failing any of these steps can trigger fines or delayed refunds.

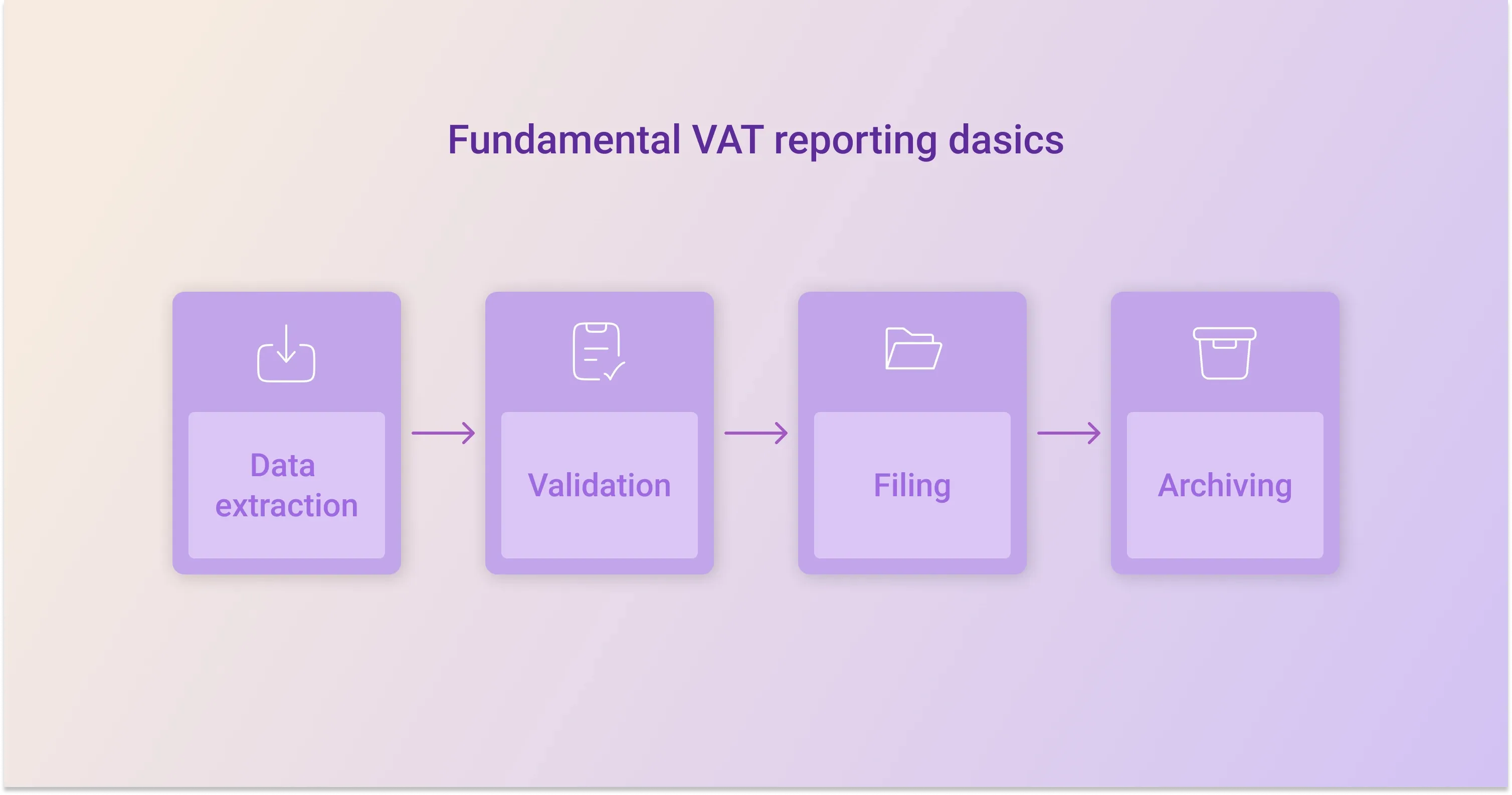

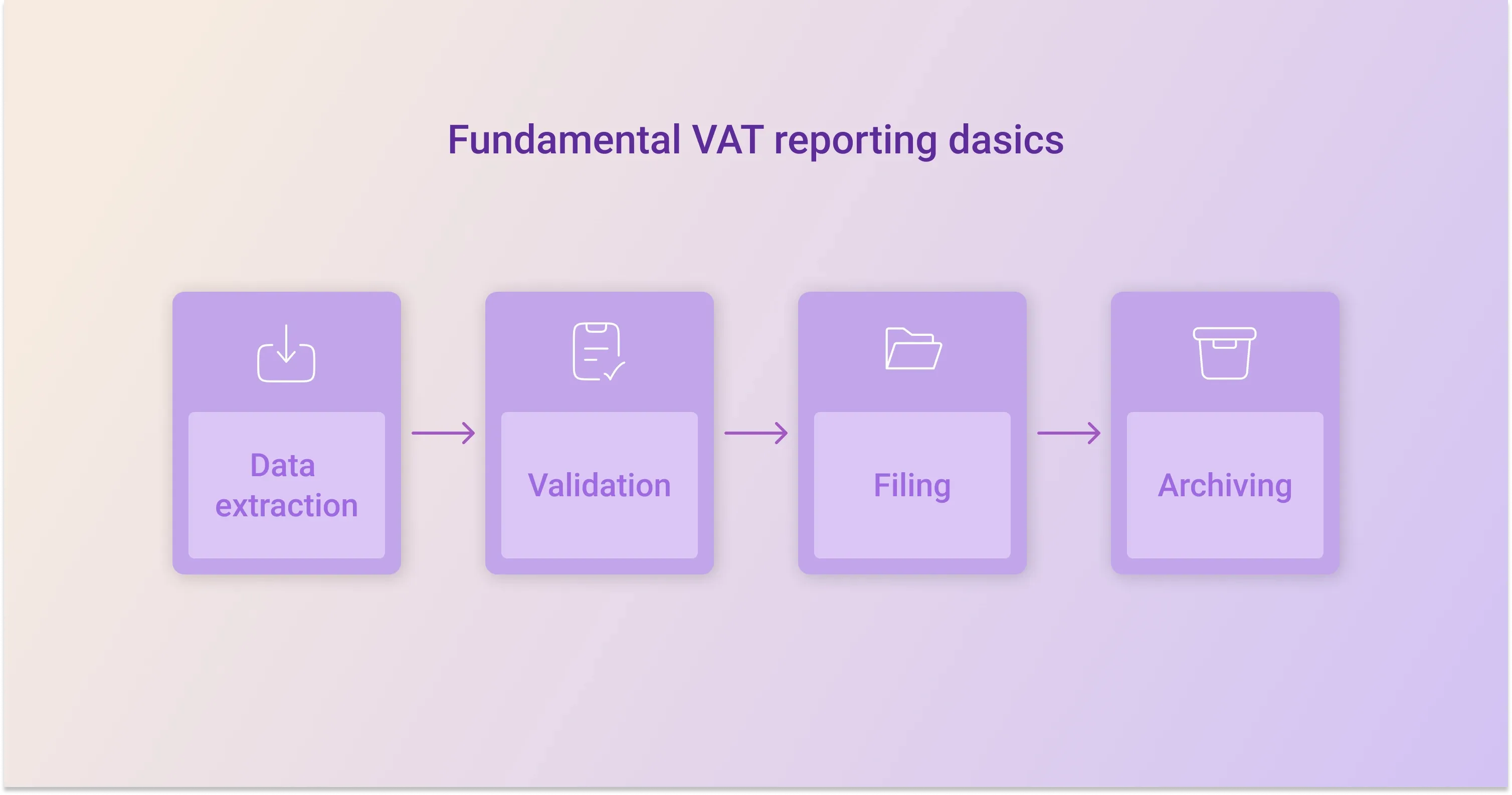

VAT reporting basics every finance team must nail

Getting VAT right sounds simple: collect tax, pay tax. In practice, each country sets different rules for invoice content, exchange rates, and digital filing portals.

- Tax period frequency: monthly in Italy, bi-monthly in Ireland, quarterly in many others

- File formats: XML in Spain, FDF in Denmark, SAF-T in Norway

- Archiving rules: seven years in Germany, ten in France

- Currency rounding and exchange rate policy can change mid-year

A SaaS retailer learned this the hard way. After expanding into Poland, it used the wrong VAT rate on digital services. A €8 000 fine followed. A specialist advisor re-filed the returns, reclaimed part of the penalty, and set up automated rate checks, showing how expert support pays for itself.

For expert guidance on VAT compliance pitfalls and how EU businesses have faced costly consequences, see VAT Compliance: How EU Businesses Lost €159M in Penalties.

The takeaway: consistent data extraction, rules engines, and human review are mandatory before hitting “submit.”

Technology trends reshaping VAT compliance

Software alone does not guarantee accuracy, yet technology reduces manual drudgery and flags risky transactions at scale.

Key advances

- Real-time data validation against domestic schemas

- Pre-mapped SAF-T and e-invoicing templates

- API connections from ERP or web-shop to central compliance hub

- Dashboards showing deadline calendars and outstanding tasks

- AI driven anomaly detection that spots duplicate invoices or negative VAT bases

To better understand how automation can streamline compliance and reduce risks, explore Tax Technology Tools – VAT Compliance Automation.

One manufacturer shaved 15 hours per month off reconciliation by linking its ERP to a cloud VAT portal. That freed the finance manager to focus on strategic KPIs.

Mandatory e-invoicing is the catalyst. Moving to digital invoices could cut VAT fraud by up to €11 billion each year, while trimming €4.1 billion in administrative costs annually. Firms that invest early avoid a scramble when last-minute laws hit.

Top 7 leading firms for VAT reporting services

Below is a snapshot of providers trusted by multinationals. All offer multi-country coverage, specialist knowledge, and technology to simplify filings.

1. EY Global VAT Compliance & Reporting

A network of 140+ countries, local tax teams, and data extraction tools. Strengths: complex supply chains, shared-service center integration.

2. PwC Smart VAT

Combines compliance processes with robotic process automation (RPA) for data collection. Widely praised for out-of-hours support during reporting peaks.

3. 1stopVAT

A one-stop global VAT compliance provider with 40+ certified tax specialists covering 100+ countries. Automated tools handle data collection, while human experts review filings, registrations, and refund claims, giving e-commerce sellers a single point of contact.

To see a rundown of the industry's best, read Best VAT Registration Services in 2025: Top Providers Reviewed.

4. Deloitte Indirect Tax Compliance

Offers end-to-end managed services, SAF-T mapping, and analytics dashboards that benchmark VAT recovery rates.

5. KPMG MyVAT

Focuses on multilingual help-desk support and integrates with SAP S/4HANA and Oracle.

6. Grant Thornton VAT Compliance Hub

Mid-market friendly pricing, real-time deadline tracker, and strong presence in Nordic countries.

7. TMF Group VAT Services

Local accountants in 80 jurisdictions, valuable for businesses adding small entities in multiple markets.

Choosing among these leading firms for VAT reporting services? hinges on scope, internal resources, and IT landscape. The next section offers a selection checklist. For more insights on evaluating cross-border VAT partners and their role in compliance, see Best Cross-Border Tax Compliance Firms: Global VAT Experts.

Evaluation checklist: picking the right partner

Every company has different risk tolerance and data complexity. Use the list below during RFP calls.

- Country coverage: does the provider serve all current and planned markets?

- Technology fit: API, flat-file, or manual upload? Match to your ERP’s export formats.

- Human review: confirm filings are checked by certified tax advisors, not only bots.

- Deadline monitoring: look for automated reminders, escalation paths, and holiday calendars.

- Audit defense: will the firm handle queries, supply evidence, and attend hearings?

- Fee model: fixed fee per return, subscription, or blended hourly rate. Clarity avoids budget shock.

A consumer electronics brand compared three firms. The winner provided a sandbox for testing SAF-T exports, cutting IT integration from six weeks to two. Clear mapping tables can be decisive.

A quick recap: thorough scoping and proof-of-concept trials reduce surprises later. For a deeper dive into tools, checklists, and continuous improvement approaches, don't miss VAT Reporting Made Simple: Best Practices for Businesses.

Future of VAT reporting: ViDA, MTD, and the race to digital

The reform agenda is clear. Cross-border VAT reporting will be fully digital by 2030 with interoperability across the EU by 2035. The UK’s Making Tax Digital initiative already generated an extra £185–£195 million in 2019–2020.

Expect:

- Continuous Transaction Controls (CTCs) rolling out beyond Italy and France

- More granular data requested (purchase order, payment ID, Incoterms)

- Shorter deadlines, even real-time approvals before shipment

- Broader liability rules on platforms facilitating cross-border sales

For a clear explanation of upcoming digital mandates and how to prepare, see EU – Digital Reporting Regime after Parliament Approves Draft Legislation ViDA 2025.

Firms that now adopt scalable data extraction, version control, and central dashboards will glide through the transition. Lagging companies may scramble to retrofit manual spreadsheets with little warning.

Conclusion

VAT laws will only tighten. ViDA, e-invoicing mandates, and real-time reporting shorten the margin for error. By partnering with one of the leading firms for VAT reporting services, finance teams gain proven technology, seasoned advisors, and peace of mind. A structured evaluation, early adoption of digital tools, and continuous process reviews keep your business compliant today and ready for tomorrow.