What you will find below

In the next few minutes you will:

By the end, you should feel confident starting a conversation with any European tax consultants on this list.

How we picked the leading EU VAT agencies

Hiring a VAT partner is more than ticking a box. We scored candidates on six factors:

-

Breadth of EU coverage (number of Member States handled)

-

Expertise: in-house tax lawyers, fiscal reps, and former tax officers

-

Technology: client portals, API feeds, and error filters

-

Pricing transparency: clear schedules or public rate cards

-

Client feedback and case studies

-

Ability to handle One-Stop Shop (OSS/IOSS) returns, which processed €24 billion of Union OSS declarations in 2024

Only firms meeting all six criteria made the cut. For a deeper independent rundown, see the Top EU VAT Registration Agencies: 2025 Guide.

Top EU VAT Registration Firms in 2025: Services & Pricing Explained

The best EU VAT registration firms are 1stopVAT, Deloitte, PwC, TMF Group, EY, KPMG, and VAT Compliance International. They cover all 27 Member States, register businesses for VAT numbers, manage OSS/IOSS filings, prepare periodic returns, liaise with tax offices, and provide strategic consulting. Prices typically start at €400–€900 per country for registration and €80–€150 per return for ongoing compliance.

1. 1stopVAT

1stopVAT positions itself as a one-stop global VAT compliance provider with more than 40 certified tax specialists covering 100+ countries.

-

Services: EU and non-EU VAT registration, OSS/IOSS filings, ongoing compliance, VAT refund claims, advisory

-

Costs: registration from €450, monthly filings from €90; bundles lower unit costs

-

Pros: single point of contact, automated data import, quick response times

-

Cons: smaller than a Big Four network, niche outside indirect tax

Case study: A Nordic SaaS merchant needed 13 VAT numbers in two weeks. 1stopVAT filed all applications and the client started invoicing locally within 12 days.

Smooth coverage makes 1stopVAT a solid choice for firms scaling across several Member States.

2. Deloitte Indirect Tax

Deloitte’s Indirect Tax practice spans all 27 EU jurisdictions and more than 150 countries worldwide.

-

Services: VAT registration, customs duty reviews, e-invoicing readiness, dispute resolution

-

Costs: custom quotes, typically €800–€1 200 per registration, higher for fiscal-rep markets

-

Pros: deep industry specialists, strong SAP/Oracle integration teams

-

Cons: premium pricing, formal project processes can slow smaller companies

Deloitte helped a fashion marketplace reduce penalties by €1.4 million after uncovering missed OSS filings, showing the value of forensic reviews.

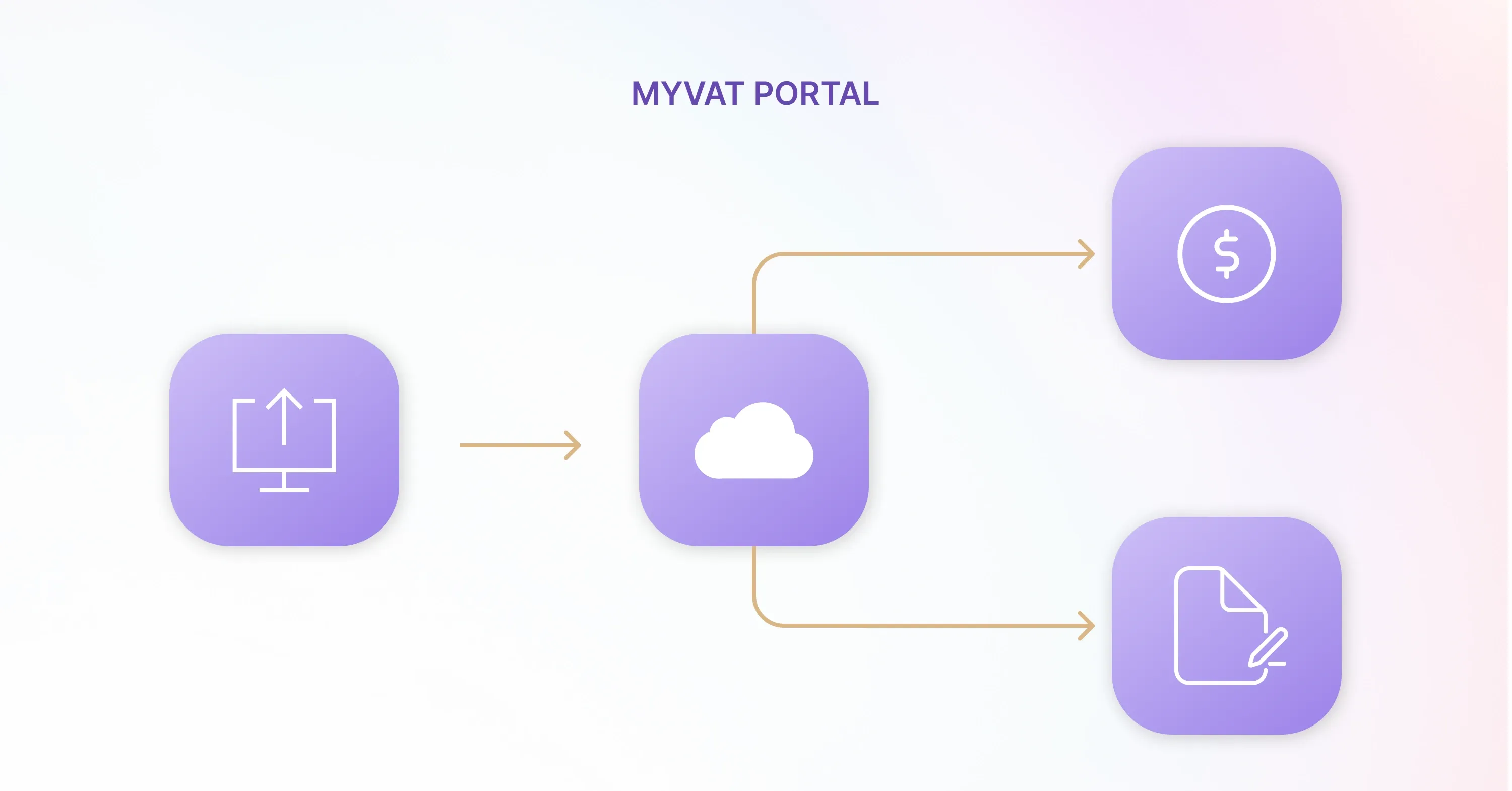

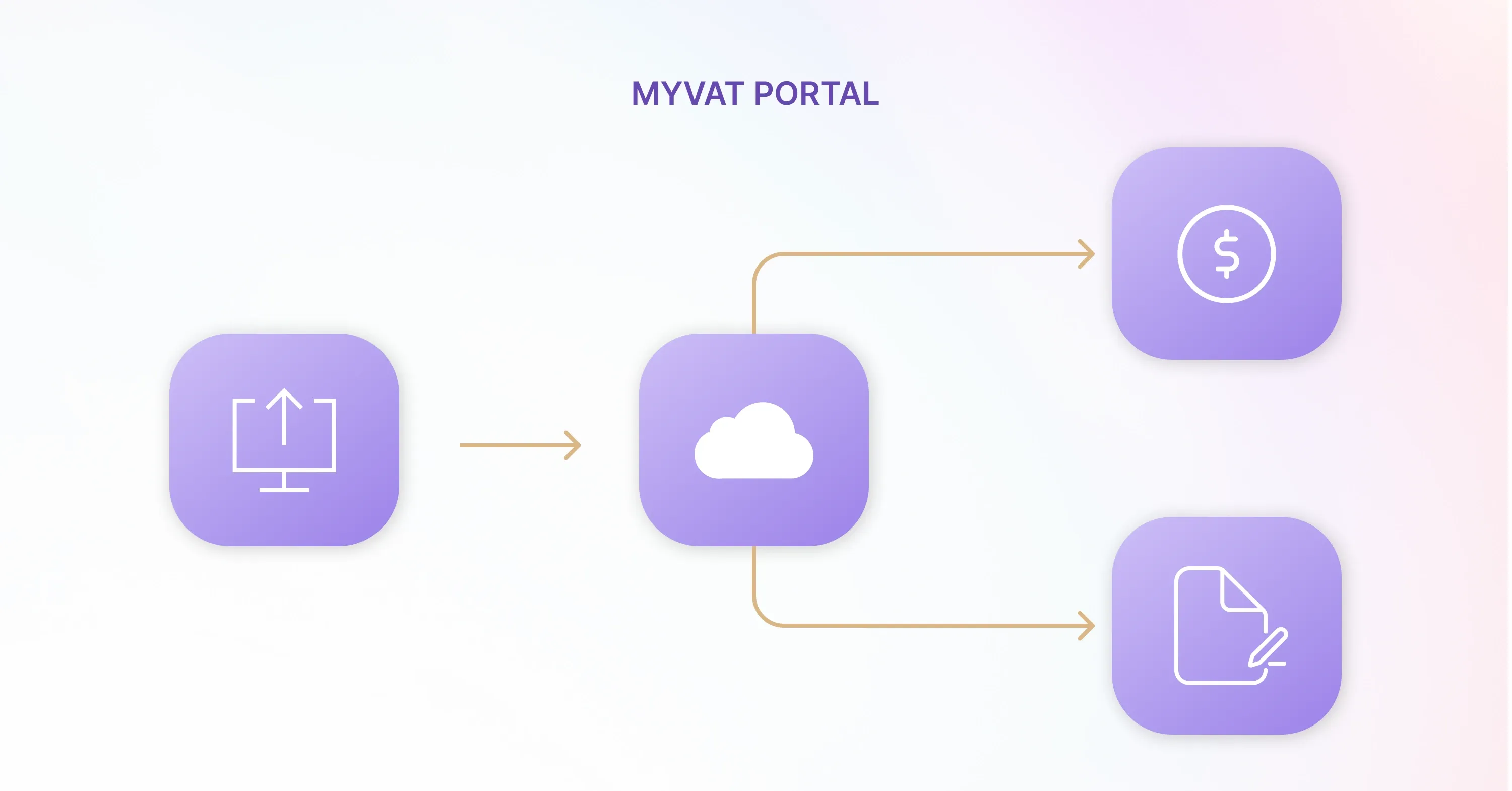

3. PwC’s MyVAT

PwC offers a hybrid solution: local tax lawyers plus the MyVAT portal.

-

Services: VAT numbers, OSS/IOSS, PE risk assessments, Brexit transition support

-

Costs: registration around €700, filings €120–€180 per period

-

Pros: digital portal with near-real-time error flags, global network

-

Cons: portal limited to PwC compliance clients, project fees add up fast

Clients value PwC when audits loom. One Belgian e-retailer recovered €600k of overpaid import VAT after a two-month review.

4. TMF Group

TMF Group focuses on compliance outsourcing, including payroll, accounting, and VAT.

-

Services: VAT registration across 80+ markets, fiscal representation, trade reporting

-

Costs: transparent table - registration €600 average, compliance €100 per filing

-

Pros: bundled accounting and corporate secretarial services

-

Cons: fewer strategic tax consultants, portal UX feels dated

A U.S. electronics brand used TMF to obtain local VAT numbers in Spain and Italy, avoiding local director appointments and saving weeks of paperwork.

5. EY Indirect Tax

EY blends advisory depth with a global footprint.

-

Services: VAT numbers, OSS/IOSS, real-time reporting, litigation support

-

Costs: registration €750–€1 000, compliance €110–€160 per return

-

Pros: strong analytics tools, sector specialists (life sciences, tech)

-

Cons: service silos can mean multiple contacts for one issue

When OSS revenue jumped 26% in 2024 compared with 2023, EY released rapid-response guides to help sellers update processes overnight.

6. KPMG VAT Services

KPMG combines local compliance centers with regional hubs.

-

Services: VAT registrations, e-commerce OSS/IOSS onboarding, SAF-T and live-reporting setup

-

Costs: usually €650 per registration, returns €95 monthly

-

Pros: integrated transfer pricing and customs advice

-

Cons: smaller teams in Baltic and Balkan states, slower onboarding during peak quarters

A German SaaS provider joined the Union OSS through KPMG and cut quarterly compliance costs by 22%.

7. VAT Compliance International (VCI)

VCI is a boutique player focused solely on indirect tax.

-

Services: VAT registrations, fiscal representation, VAT training workshops

-

Costs: competitively priced - registration €400-€500, filings €80–€100

-

Pros: personal account managers, flexible contracts

-

Cons: limited support outside Europe, fewer tech integrations

VCI’s proactive checks helped an Irish drop-shipper detect missing IOSS charges on 7% of orders before audits triggered.

Key Takeaway: Picking the Best EU VAT Registration Firm

Each of these European tax consultants offers the core deliverables - VAT numbers and ongoing filings. Differences lie in price tiers, geographic reach, and extra bells and whistles such as analytics or wider compliance outsourcing. For a more granular break-down, review the Best VAT Registration Services in 2025: Top Providers Reviewed.

Choosing the right partner: 5 simple rules

Even the best EU VAT agencies may not fit every business. Use these guidelines:

-

Map your footprint

-

Estimate volume and complexity

-

Compare total cost of ownership

-

Setup fees, ongoing filings, ad-hoc queries, penalty support

-

Ask for scenarios showing different sales growth models

-

Check service levels

-

Ask for a trial or phased rollout

- Start with two jurisdictions, expand after dashboards and file flows work

For further detail on decision matrices and pricing transparency, see the VAT Compliance & Consultancy: Why Expert Advice Matters.

Follow these steps and you will narrow the field quickly.

Watch numbers that matter

VAT registration is not just a compliance chore. It plugs directly into cash flow. Member States lost €89.3 billion of VAT revenue in 2022, and the tax authorities are closing that gap fast. Union OSS registrations alone jumped by 16% in 2024 to over 153,550 traders. For insight on the mechanics and impact of OSS/IOSS, see VAT in European Union: EU VAT Rules Explained for International Sellers.

A proactive firm not only registers you but also updates processes as rules tighten.

Сonclusion

EU VAT registration is a moving target, yet partnering with the right expert prevents fines, protects reputation, and frees your team to focus on sales. Weigh service scope, cost, and fit, then book a discovery call. For fine-tuned selection criteria and real client examples, visit Finding the Right VAT Consultant for E-commerce. A well-chosen adviser today is cheaper than a compliance scramble tomorrow.