What this guide covers

We start with the big picture: why the EU cares about VAT and how much revenue is at stake. Next come step-by-step instructions for registering, including choosing a Member State, gathering documents, and using online portals. You will also see typical processing times, common pitfalls, and a snapshot of national thresholds. By the end, you will know how to set up European VAT and keep every filing error-free.

1. Confirm that you need an EU VAT number

Many firms register too late or in the wrong country. Spend a minute on these checks first.

- Cross-border sales: If you sell goods into any EU Member State from abroad, you almost always need VAT registration in that destination or through the One-Stop Shop (OSS).

- Domestic sales: Non-resident companies storing stock inside an EU country must register locally even with zero sales.

- Thresholds for local businesses: Resident sellers can wait until their annual turnover hits the national limit, for example GBP 90,000 in the UK (post-Brexit still relevant for Northern Ireland movements).

Missing registration carries real cost. Member States lost €89 billion in VAT revenue in 2022, roughly 7 % of all expected VAT. Auditors are keen to close that gap, so start on the right foot.

For benchmark country thresholds and an actionable checklist tailored to new businesses, see the VAT Compliance Checklist for Startups and Small Businesses.

When this first check is crystal clear, move to choosing the correct scheme.

2. Pick the right registration route

Some companies only need a single EU VAT number. Others benefit from the simplified e-commerce schemes. Deciding now prevents double work later.

Classic local registration

This is required when:

- You hold inventory inside an EU country.

- You run B2B services where reverse charge rules do not apply.

- You breach the local annual sales threshold as an EU-established firm.

Process: Apply directly with the tax office of each country involved.

Union OSS (One-Stop Shop)

Perfect for EU or non-EU businesses shipping B2C goods from one EU warehouse to customers in other Member States.

- Register in only one “Member State of identification.”

- File one quarterly return covering all intra-EU B2C sales.

- Pay VAT to that Member State, which forwards it to the others.

For a more detailed comparison between standard local VAT, OSS, and IOSS—including practical implications for online sellers - see VAT in European Union: EU VAT Rules Explained for International Sellers.

In 2022 traders declared over €17 billion in VAT via the Union OSS.

Import OSS (IOSS)

Use this for low-value goods (≤ €150) shipped from outside the EU directly to consumers.

- Charge VAT at checkout, then declare via monthly IOSS returns.

- Cuts customs delays because the parcel arrives VAT-paid.

By 2024 companies had reported €6.3 billion through IOSS.

Ending this step with certainty saves you from juggling multiple Member States when one OSS account would have done the job.

3. Gather the required documentation

Each tax authority asks for proof that your business exists and is trading. Prepare these items before logging in to any portal.

- Certificate of incorporation or extract from a business registry

- Articles of association

- Passport or ID of the legal representative

- Proof of bank account in the EU or SEPA zone

- Power of attorney if using a tax agent

- Contracts or invoices showing intended EU activity

For practical examples and pro tips to avoid incomplete filings, see Expedited VAT Registration: Checklist for Fast EU Entry.

Scan every document, then create PDF files under 5 MB each. This simple prep prevents upload errors halfway through your application.

Once the paperwork is tidy, you can tackle the forms.

4. Submit the application online

Most Member States now accept electronic applications. Portals vary, yet the workflow is similar.

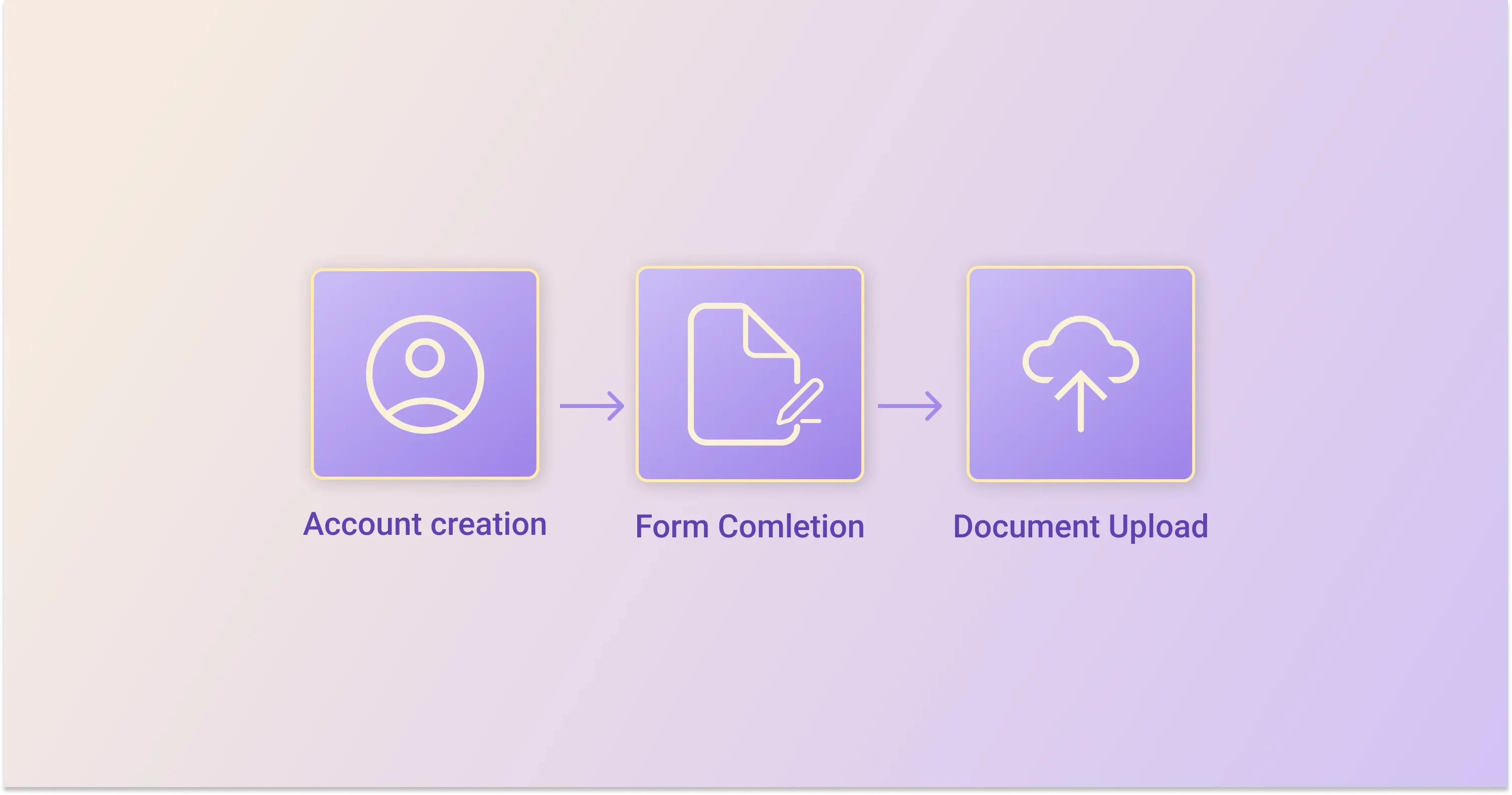

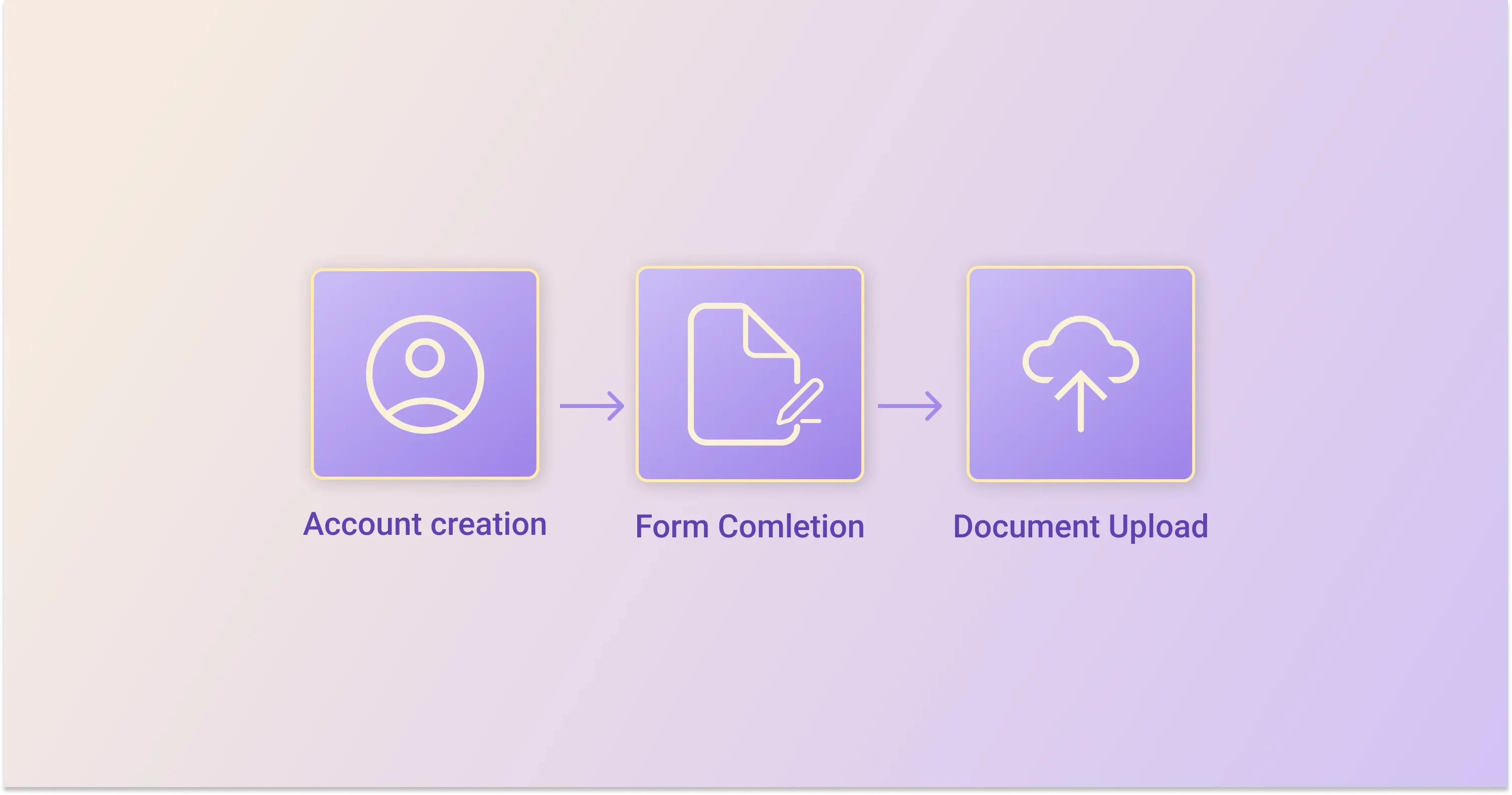

Most Member States now accept electronic applications. Portals vary, yet the workflow is similar.

4.1 Create an account

- Go to the national tax portal, for example France’s impots.gouv.fr or Spain’s sede.agenciatributaria.gob.es.

- Fill in email, phone, and choose credentials.

- Activate via the link sent to your inbox.

4.2 Complete the VAT form

Typical fields include:

- Legal name and trade name

- Activity code (NACE)

- Estimated annual turnover in the EU

- Warehousing locations

- OSS selection if applicable

Use plain numbers with no commas to avoid validation errors.

4.3 Upload documents and submit

Attach your PDFs, click submit, and download the receipt. Processing can take anywhere from 3 days in Estonia to 8 weeks in Italy.

If the tax office requests extra info, respond within the deadline stated in the email. Silence is viewed as abandonment.

After submission, most portals show status updates. When the number is approved, print the certificate for your records.

5. Understand country-specific thresholds and rates

Even with an OSS number, you may still need local VAT registration in certain EU countries. Keep these key thresholds and VAT rates in mind:

Germany

- Local threshold for resident businesses: €25,000

- Standard VAT rate: 19%

France

- Local thresholds: €37.500 for services / €85,000 for goods

- Standard VAT rate: 20%

Netherlands

- Local threshold for resident businesses: €20,000

- Standard VAT rate: 21%

Spain

- Local threshold for resident businesses: none (registration required from the first euro)

- Standard VAT rate: 21%

Remember: non-resident businesses always have a zero threshold, meaning the first sale triggers VAT registration.

6. Activate ongoing EU VAT compliance

A VAT number is only useful when paired with flawless filings. Every Member State expects zero-error returns and prompt payments.

- File OSS returns quarterly by the end of the month following the period.

- File local VAT returns monthly or quarterly depending on national rules.

- Reconcile sales platforms, payment processors, and warehouse data.

- Archive invoices electronically for 10 years in a readable format.

To ensure you stay error-free and penalty-proof, review the best practices outlined in VAT Reporting Made Simple: Best Practices for Businesses.

Given the complexity, many exporters appoint trusted partners like 1stopVAT, whose 40+ tax specialists handle registration, filing, and cross-border consulting in over 100 countries. One contact, fewer headaches.

Maintaining this rhythm of accurate returns guards against audits and secures cash-flow peace of mind.

7. Monitor legislative updates

VAT rules evolve fast. Between 2010 and 2023, Member States lost €13 billion to €33 billion each year to MTIC fraud - pressuring regulators to tighten systems.

Stay ahead by:

- Subscribing to EU Commission tax newsletters.

- Joining local tax webinars.

- Reviewing portal notices every quarter.

Hungary’s Finance Minister recently said new digital VAT rules will “help combat VAT fraud, and ease administrative obligations for small companies.” Change is constant, so a quarterly check-in keeps your process future-proof.

For a deep dive into future developments - like real-time digital filing, e-invoicing, and ViDA reforms - visit VAT in European Union: EU VAT Rules Explained for International Sellers.

With these seven steps complete, you have moved from uncertainty to a fully activated European VAT setup.

How to register for EU VAT in five quick steps

EU VAT registration follows five core steps: confirm the need to register, choose the correct scheme (local, Union OSS, or IOSS), gather key documents (certificate of incorporation, ID, bank proof), submit the online application via the chosen Member State’s portal, and keep filing accurate returns to stay compliant. Completing these steps secures your VAT number and smooth cross-border sales.

Conclusion

EU VAT registration looks daunting only at first glance. With the right EU VAT registration for businesses approach -confirming obligations, choosing the correct route, preparing documents, and using each Member State’s portal -you can secure a VAT number without drama. Stay on top of thresholds and timely filings to maintain EU VAT compliance while expanding across Europe.

Most Member States now accept electronic applications. Portals vary, yet the workflow is similar.

Most Member States now accept electronic applications. Portals vary, yet the workflow is similar.