Overview

In the next ten minutes, you will learn:

- Which taxes most businesses must register for: corporate income tax, VAT or GST, payroll deductions, and local levies.

- The step-by-step process, from choosing a legal structure to filing your first return.

- Typical timelines, required documents, and common pitfalls.

- How recent EU and UK statistics illustrate the growing cost of non-compliance, and why early registration saves money.

By the end, you will have a clear checklist to tackle business tax registration services without sleepless nights.

Step 1: Decide on a Legal Structure and Company Tax Setup

Choosing the right entity sets the foundation for every other tax obligation.

- Sole trader: simplest, but profits are taxed as personal income.

- Partnership: profits flow through to partners’ returns.

- Limited company: pays corporation tax; separates personal and business liabilities.

- Branch vs. subsidiary: matters for cross-border filings.

A limited company must apply for a company tax setup within a short window (often 30 days of incorporation). Registering as a partnership might mean each partner files individually, but the partnership itself submits an information return.

Ending note: Confirm your structure before signing contracts. Changing it later often means re-registering for multiple taxes.

Step 2: Gather Core Information and Forms

You cannot complete corporate tax registration without the right data. Authorities usually ask for:

- Certificate of incorporation or business license

- Articles of association

- Directors’ and shareholders’ IDs

- Expected turnover and activity codes (NAICS, NACE, SIC)

- Bank account details

- Proof of local address

Small example: An e-commerce startup in Germany can upload most documents online via Elster, cutting paperwork time to around 45 minutes.

For a broader look at preparing for international compliance, consult the Sales Tax Registration and Compliance Guide for Global Sellers.

Keep digital copies organized, because the same pack will be reused for VAT and payroll accounts.

Step 3: Register for Corporate Income Tax

When to register

Most jurisdictions require registration within 30–90 days of incorporation or once your first invoice is issued.

- UK: Companies House automatically shares details with HMRC, but you still file form CT41G within three months.

- USA: After receiving your EIN from the IRS, states like California demand a separate franchise tax account.

How to complete the filing

- Fill in the relevant application: CT41G (UK), Form 8832 if you elect S-Corp (US), or local equivalents.

- Provide estimated start-up losses or profits.

- Choose your accounting year end.

Concluding thought: Setting the wrong fiscal year can delay reliefs or refunds for months, so align it with your business cycle.

For a thorough framework on coordinating income tax and international obligations, see Aligning Cross-Border Tax and Accounting Practices for SMEs.

Step 4: Register for Indirect Taxes (VAT, GST, Sales Tax)

Indirect taxes often have lower thresholds, meaning you may need to register long before you earn a profit.

Determine if you need VAT/GST

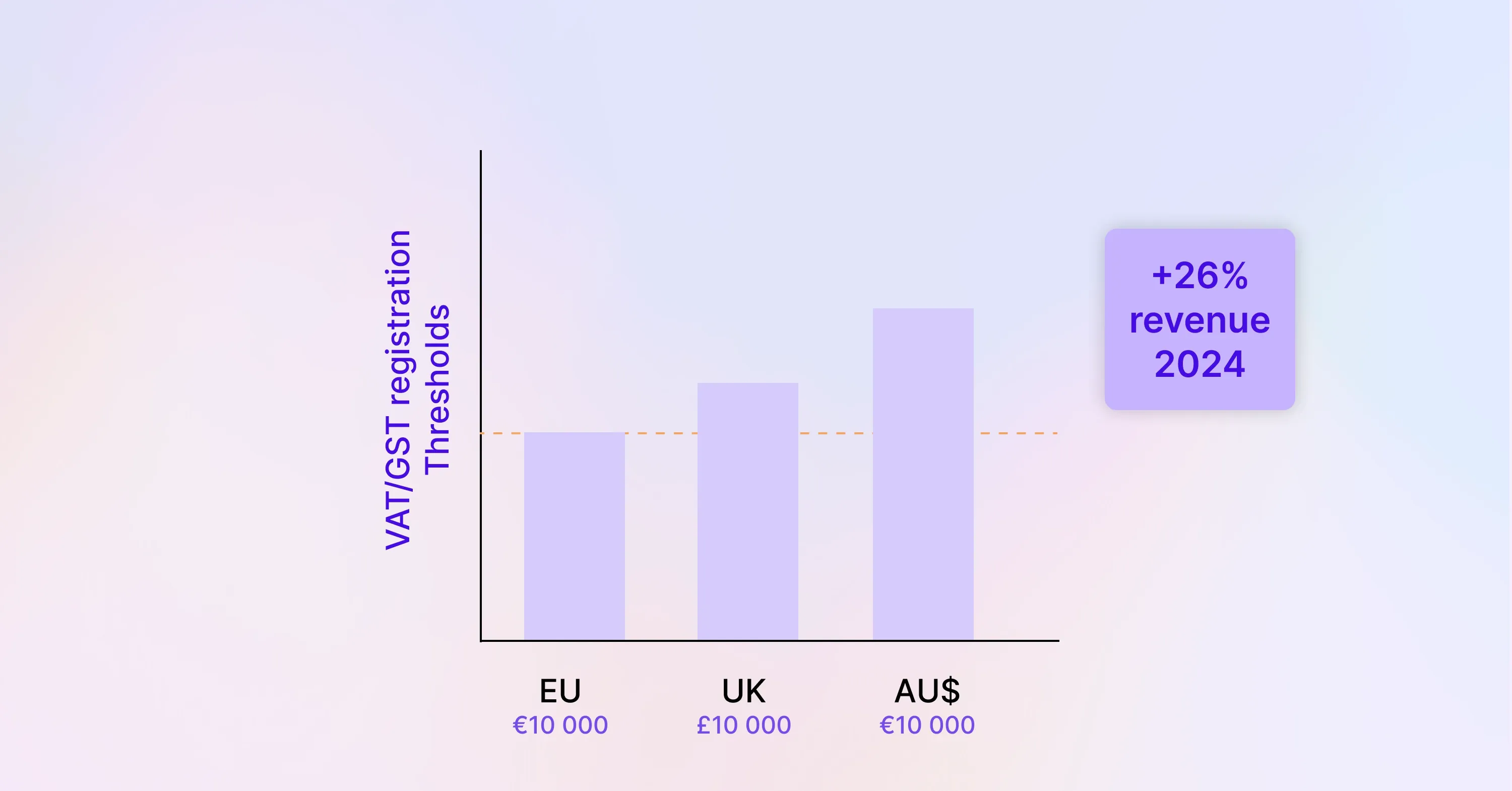

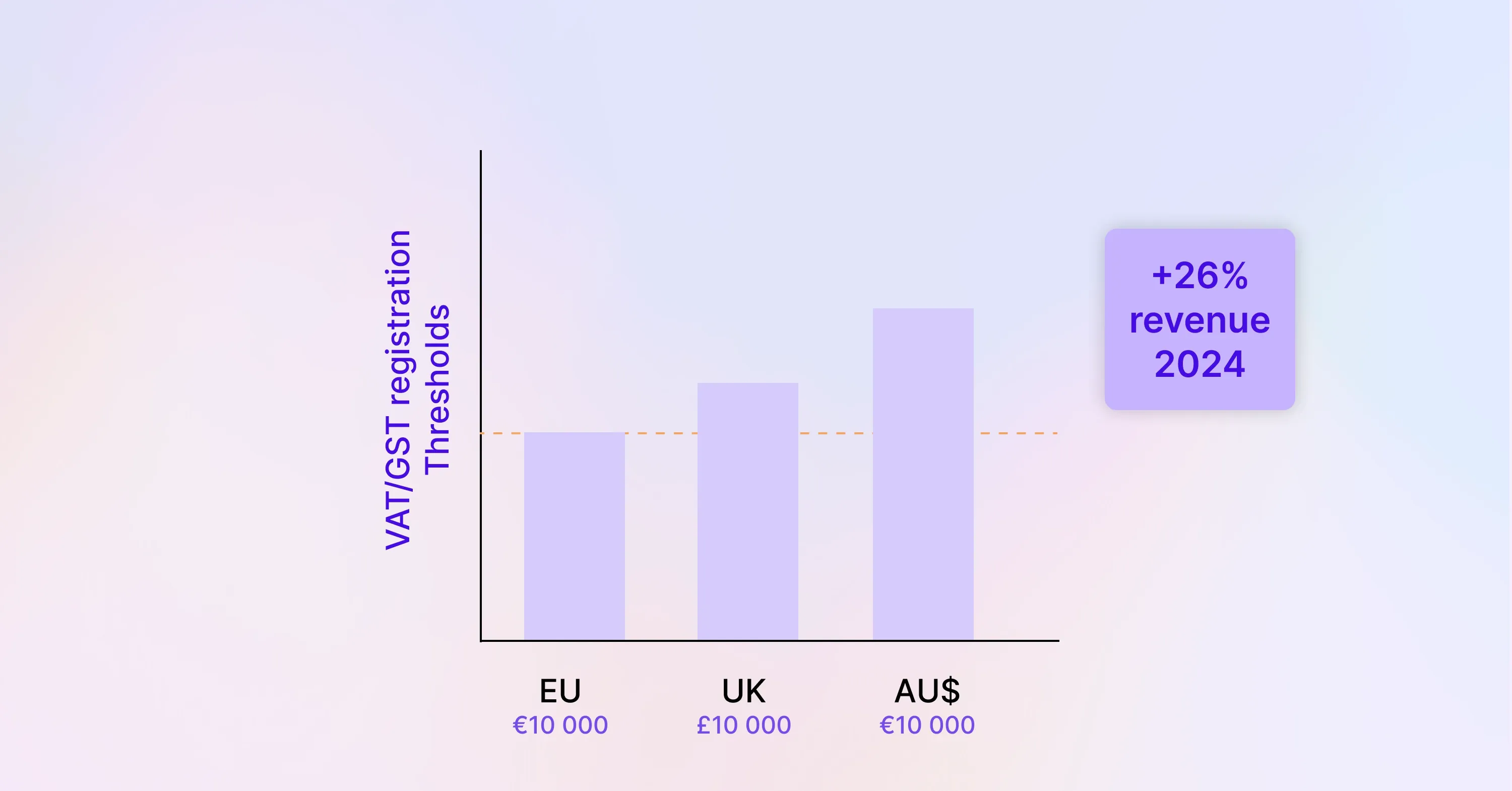

- EU distance-selling threshold: €10 000 across all member states.

- UK VAT threshold: £90 000 turnover in any 12-month period.

- Australia GST: AU$75 000.

Narrative: E-commerce sellers flocking to the EU’s OSS and IOSS schemes generated €33 billion in VAT revenues in 2024, a 26 % increase on the prior year. Over 170 000 businesses had signed up by December 2024, showing how critical timely VAT registration has become.

Wondering where to start? The VAT Compliance Checklist for Startups and Small Businesses breaks down thresholds, schemes, and documentation for new entities.

Apply for VAT/GST numbers

- Submit the VAT1 (UK) or Form RC1 (Ireland) online.

- Select standard, flat-rate, or OSS/IOSS schemes if selling across borders.

- Provide evidence of cross-border sales or intent to trade.

Outsource wisely: Firms like 1stopVAT, whose 40+ specialists cover 100+ countries, can act as a single contact point for international VAT filings, sparing you multiple portals and languages.

Transition: Once your VAT or GST number arrives, display it on invoices and update marketplace dashboards to prevent account suspension.

Step 5: Set Up Payroll and Withholding Taxes

Hiring even one employee triggers new duties.

Key actions

- Register for Pay-As-You-Earn (PAYE) in the UK or Federal/State withholding in the US.

- Obtain unemployment insurance and workers’ compensation numbers.

- Decide on pay frequency and submit Real-Time Information (RTI) or equivalent.

Example: A small café in London that misses its first RTI submission faces an immediate £100 penalty and daily surcharges if the lapse continues.

Takeaway: Accurate payroll registration protects staff morale and avoids spiraling fines.

Step 6: Understand Local and Industry-Specific Levies

Besides national taxes, you may face:

- Business rates or property tax.

- Digital services tax.

- Environmental levies (plastic packaging, carbon credits).

- Tourism or city taxes for hospitality trades.

Tip: Search municipal websites or call the local chamber of commerce early to identify hidden obligations.

Step 7: Build an Ongoing Compliance Calendar

A registration certificate is just the start.

- Record filing deadlines: corporation tax, VAT returns, payroll filings, statutory accounts.

- Map payment due dates and set bank reminders.

- Assign responsibilities between founders, accountants, or external advisers.

For best practices on designing a tax calendar and aligning global reporting periods, see Aligning Cross-Border Tax and Accounting Practices for SMEs.

Why it matters: Compliant companies in the UK still spend at least £15.4 billion a year meeting tax duties, and a further £46.8 billion in unpaid tax forms the UK’s “tax gap.” A clear calendar keeps you out of both groups.

Business tax registration

Business tax registration is the process of officially notifying tax authorities that your new venture exists, obtaining ID numbers for corporate income tax, VAT or GST, payroll, and any local levies, then keeping those accounts active through regular filings and payments.

Conclusion

Registering your venture for taxes is less about ticking boxes and more about building a reliable platform for growth. By confirming your legal structure, gathering the right documents, and sequentially registering for corporation tax, VAT, payroll, and local levies, you sidestep penalties and preserve cash for expansion. Treat tax registration as an investment in credibility and peace of mind, and your business will be ready for whatever opportunities come next.

For more actionable breakdowns and checklists, see the VAT Compliance Checklist for Startups and Small Businesses