What you will learn

In the next few minutes, you will discover:

- How VAT rules became so complex that even finance teams struggle to keep up

- The exact services multi-country VAT advisors provide

- Tangible benefits, from lower costs to reduced audit risk

- Typical mistakes a specialist prevents

- Tips for choosing an advisor that fits your business model and budget

By the end, you will have a clear roadmap for staying compliant while you expand internationally.

The rising tide of VAT complexity

Global e-commerce, marketplace rules, and real-time reporting mandates have multiplied VAT touchpoints. Consider just a few headlines:

These figures highlight not only the money at stake but also the scale of the challenge. Each new reporting scheme adds forms, data fields, and deadlines that differ by country. Without a seasoned guide, the risk of errors grows daily.

For a real-world look at the costs of noncompliance, see VAT Compliance: How EU Businesses Lost €159M in Penalties.

Complexity is unlikely to ease any time soon. Understanding how a multi-country VAT advisor mitigates that complexity is the first step toward peace of mind.

What does a multi-country VAT advisor actually do?

Multi-country VAT advisors combine technical tax knowledge, local language skills, and technology to act as an outsourced indirect tax department.

- Registration management: Assess nexus, secure VAT numbers, and keep certificates current.

- Return preparation and filing: Gather sales data, apply the right rates, submit returns on time, and reconcile payments.

- Advisory support: Analyze supply chains, marketplace rules, and distance-selling thresholds to minimize exposure.

- Audit defense: Handle queries, prepare documentation, and represent you before tax offices.

- Process automation: Implement tools that collect transaction data and feed it into compliant reporting formats.

If you want to understand how global sales tax platforms and expert-driven solutions smooth out these challenges, check out the Global Sales Tax Solutions & VAT Compliance Guide.

Behind-the-scenes coordination

An advisor coordinates with customs brokers, logistics partners, and ERP teams so that VAT flows match physical flows. They translate legal texts into practical steps for order processing and invoicing.

Think of your advisor as both strategist and operator. They build the compliance blueprint and then execute it month after month.

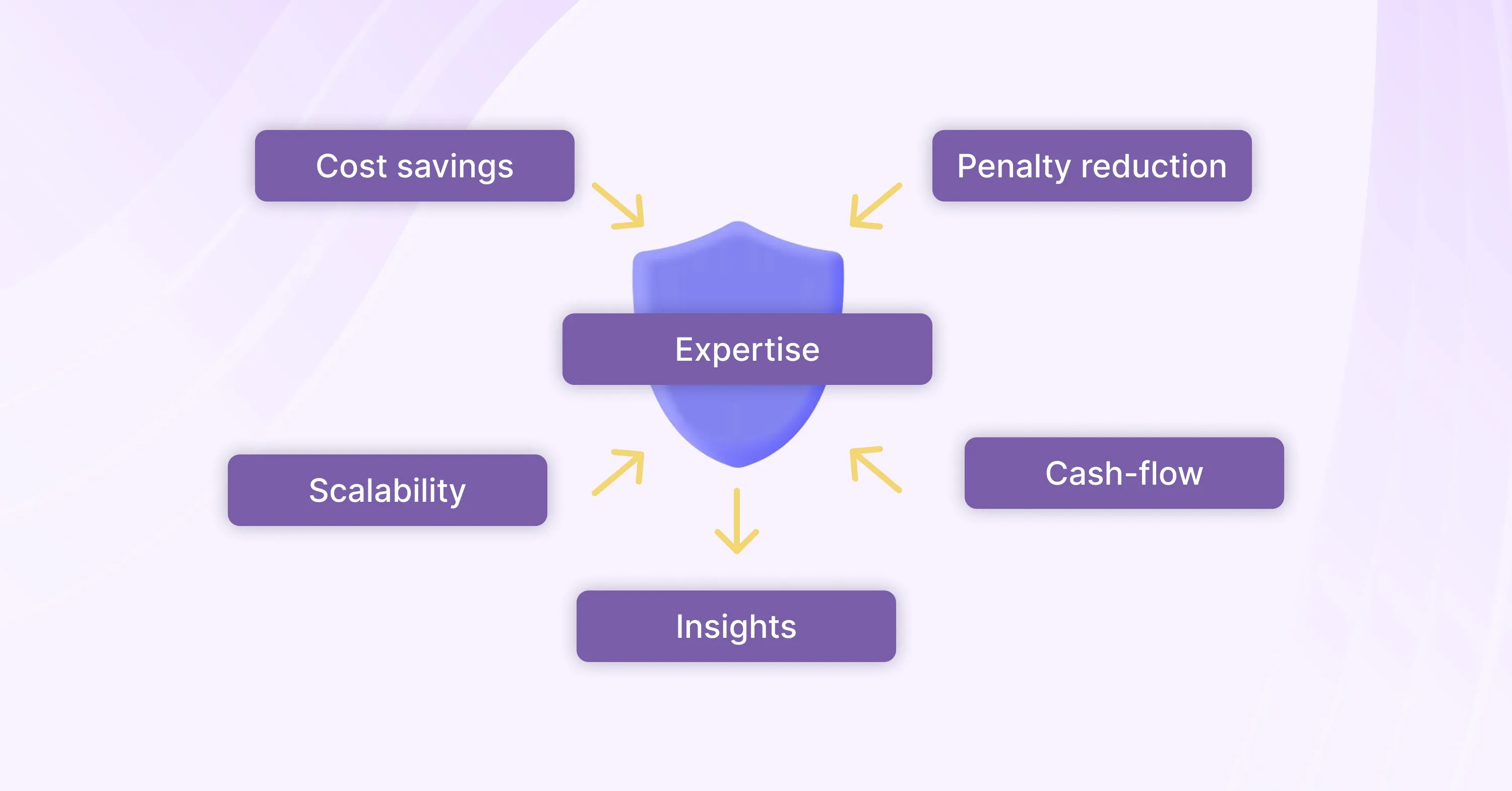

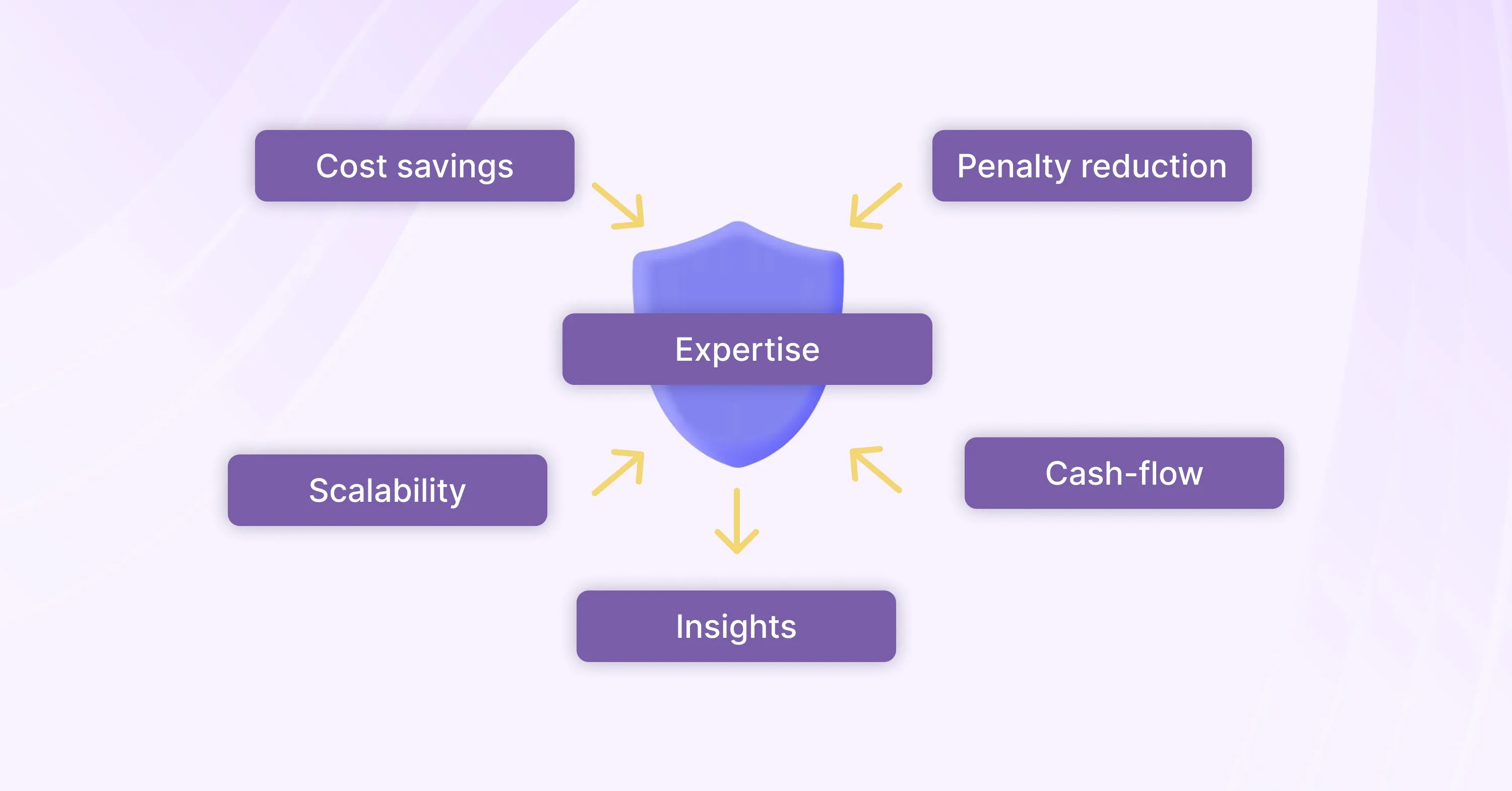

The benefits of hiring multi-country VAT advisors

The value of an expert shows up in several measurable ways.

The value of an expert shows up in several measurable ways.

- Lower compliance costs: SMEs that self-manage VAT spend 2.5% of turnover on tax compliance. Outsourcing portions of the workload can cut that figure sharply.

- Fewer penalties and interest: Correct filings reduce the chance of surprise assessments.

- Cash-flow savings: Optimized VAT recovery shortens the time between paying input tax and receiving refunds.

- Strategic insights: Advisors highlight profitable markets or schemes such as the non-Union OSS that let you serve EU customers from abroad.

- Scalable expansion: When sales spike in a new region, your advisor already knows the local rules and can register you within days.

To dive further into the advantages brought by experts versus the DIY route, read VAT Compliance & Consultancy: Why Expert Advice Matters.

These benefits stack up quickly, turning compliance from a burden into a competitive edge.

Common VAT pitfalls and how experts prevent them

Even well-run finance teams stumble over recurring traps. Global VAT specialists catch them early.

Missing local thresholds

Countries like the EU apply a single €10,000 distance-selling threshold for intra-EU consumer sales, yet many merchants still charge the wrong VAT rate.

- An advisor tracks thresholds for every market.

- They set alerts in your order system so you switch rates as soon as the limit is reached.

For a list of typical missteps and how to avoid them, see Determining VAT: mistakes to avoid.

Late or incorrect registrations

Securing a VAT number abroad costs about €1,200 upfront, and annual maintenance can run to €8,000 for a midsize business. Failing to register on time can multiply those numbers in fines.

- Multi-country VAT advisors time registrations precisely.

- They handle document translations, notarization, and direct tax office queries.

Misreporting marketplace sales

Marketplaces often collect VAT on your behalf. Declaring those sales again creates double taxation.

- Advisors reconcile marketplace statements with your own records.

- They adjust filings to avoid overpaying.

For a deeper look at real penalties stemming from compliance gaps, learn from case studies in VAT Compliance Lessons from the €200,000 Mistake.

Closing paragraph: Each trap seems small until it triggers an audit. Expertise turns those traps into routine tasks finished correctly on the first pass.

Choosing the right multi-country VAT advisor

Not all advisors are equal. Here is a framework to pick one that fits your growth plans.

- Geographic reach: Confirm coverage of every country on your expansion roadmap.

- Service scope: Some firms focus on filings only, while others add strategic consulting and audit support.

- Technology stack: Look for secure data portals, real-time dashboards, and APIs that link to your ERP.

- Team credentials: Prioritise certified tax professionals who speak local languages.

- Pricing model: Compare flat fees to transaction-based pricing, factoring in future sales growth.

If you’re evaluating outsourcing or professional advisory for the first time, the article VAT Consulting for International Businesses walks through scenarios, features, and what to expect from a reputable service.

Closing paragraph: A provider such as 1stopVAT, which acts as a single point of contact with 40+ certified specialists across 100+ countries, shows how a true partner can replace a patchwork of local agents with one cohesive service.

Cost versus value

At first glance, outsourcing VAT may seem expensive. Contrast that with the numbers:

- Average annual compliance abroad: €8,000 per country

- Potential audit assessments: easily six figures

- Internal staff time diverted: months per year

A seasoned advisor can often cut compliance spend by double-digit percentages while freeing staff to focus on revenue-generating work. The result is a positive return on investment that scales with your sales.

When weighed against the tangible and hidden costs of going it alone, specialist guidance is not a luxury but a necessity.

What is a multi-country VAT advisor?

A multi-country VAT advisor is a tax professional or firm that manages VAT registrations, filings, and strategic planning for businesses operating in more than one jurisdiction, ensuring correct rates, timely returns, and audit defense while reducing compliance costs and risk.

Conclusion

Selling across borders unlocks new revenue yet exposes businesses to a patchwork of VAT rules. Multi-country VAT advisors - also known as international VAT consultants - provide the expertise, technology, and local presence needed to stay compliant, cut costs, and expand with confidence. By choosing the right partner, you transform VAT from a hurdle into a strategic lever for growth.

The value of an expert shows up in several measurable ways.

The value of an expert shows up in several measurable ways.