What you will learn and why it matters

By the end of this guide you will be able to:

-

Explain why VAT number verification is critical for both your tax position and cash flow.

-

Identify the five most reliable verification tools, from free government databases to commercial APIs and full-service providers.

-

Follow a click-by-click or API call-by-API call walkthrough for each solution.

-

Spot common pitfalls that cause €93 billion in lost VAT revenue across the EU each year, a figure highlighted by the European Commission’s VAT Gap report.

-

Put in place a repeatable checklist so your accounts payable team never accepts an invalid VAT ID again.

Let us start with the stakes.

Why VAT number verification is the silent hero of B2B trade

Every B2B transaction inside the EU relies on the customer’s VAT Identification Number. Input tax recovery, zero-rated intra-community supplies, and your EC Sales List all hinge on that string of digits.

A single invalid number can:

-

Trigger denied deductions during a tax audit, wiping out your margin.

-

Generate reverse charge errors that create double-tax situations.

-

Force time-consuming corrective invoices and credit notes.

-

Set off cross-border audit cooperation, lengthening the disruption.

This is why an automated yet trustworthy verification step is now standard in modern finance stacks. For a practical overview of the stakes and compliance essentials, see How to Perform an EU VAT ID Check (VIES Guide).

One Wrong VAT Number. Six Months of Frozen Cash Flow.

A German SaaS vendor shipped €120,000 in annual renewals to a French customer whose VAT number contained one incorrect digit. During a routine audit, French tax authorities flagged the mismatch. The vendor had to pay €24,000 in back VAT plus late-payment interest before reclaiming it, freezing cash flow for six months.

How to judge a VAT verification tool before you subscribe

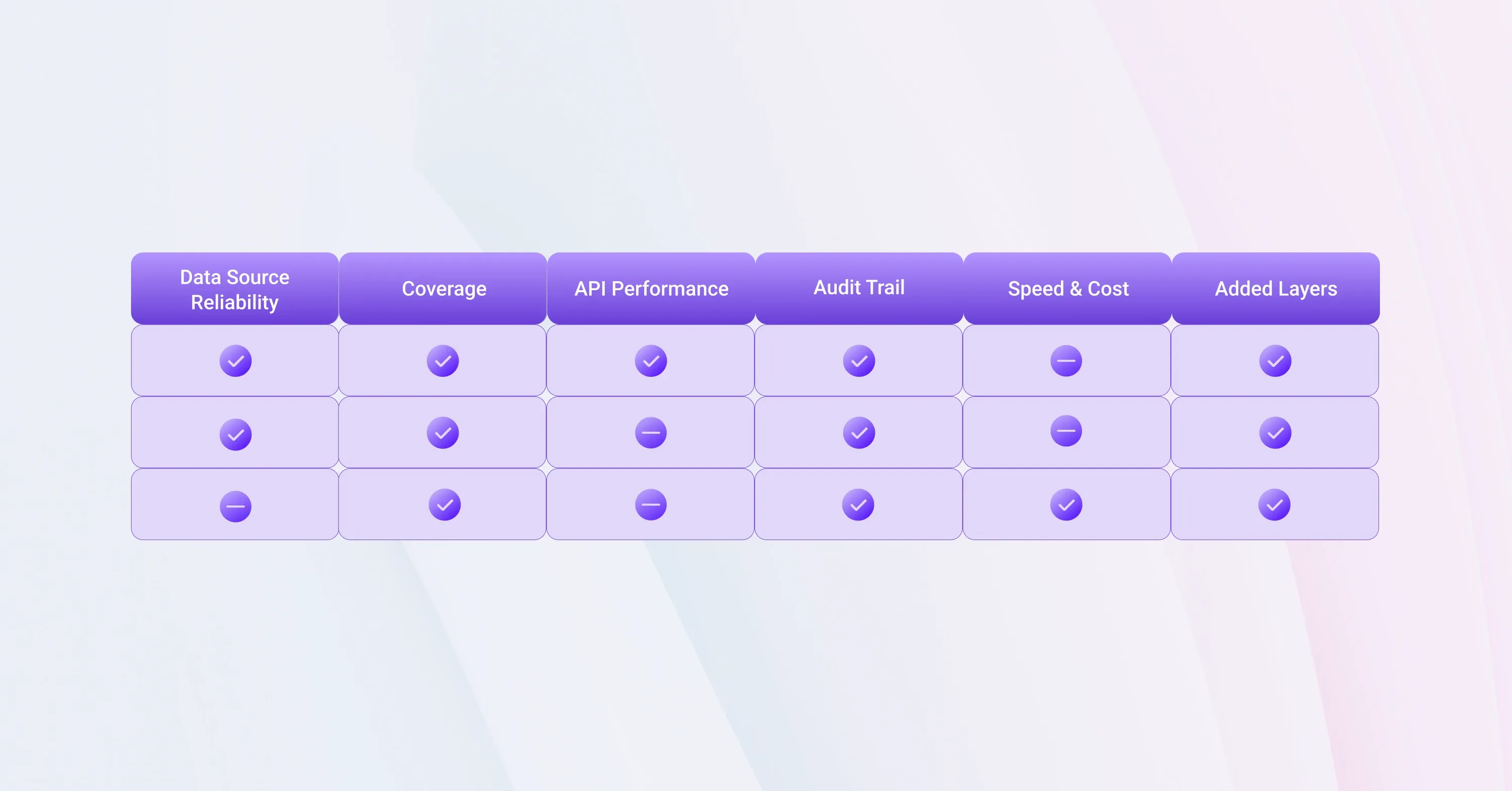

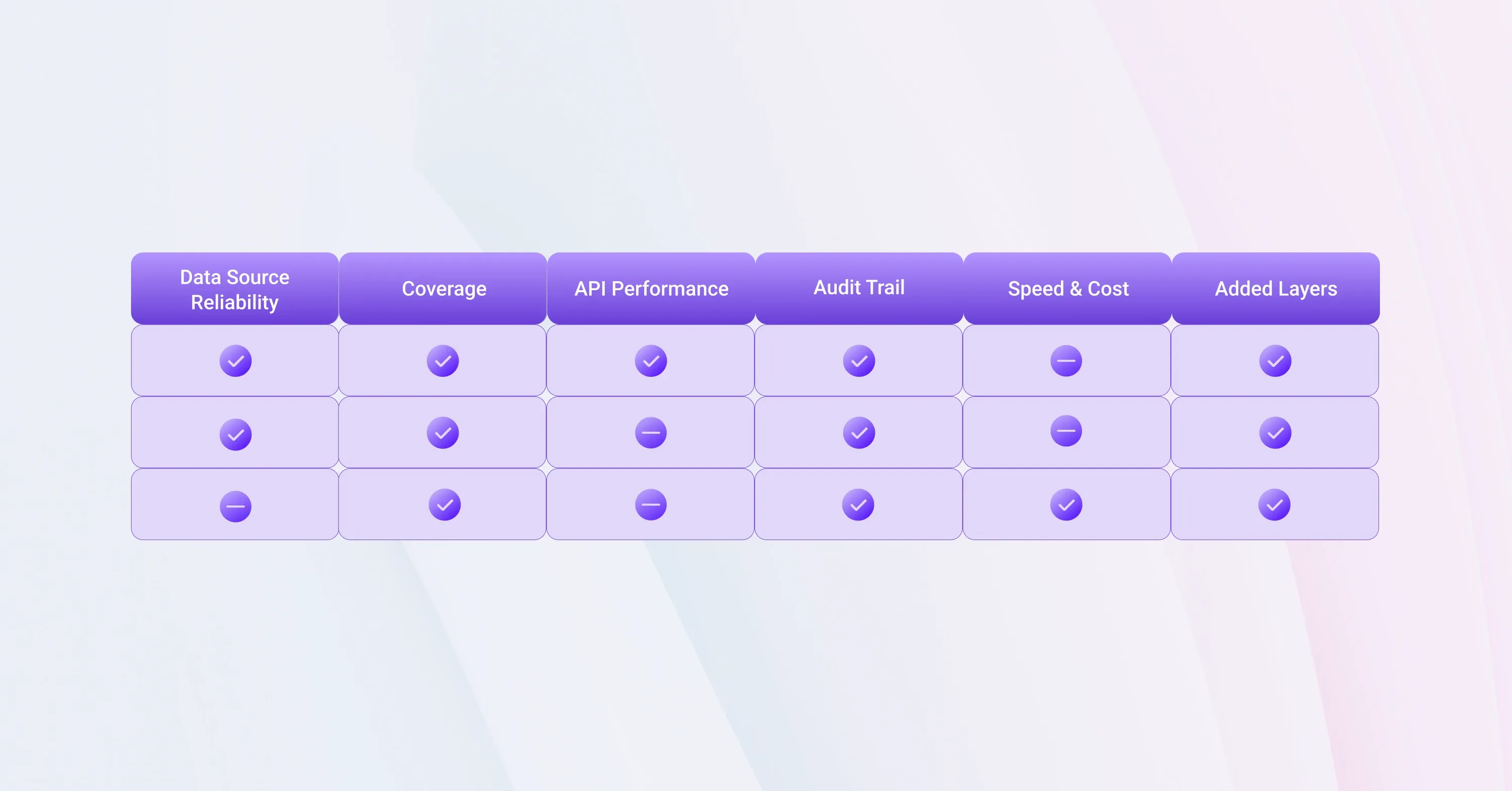

Before we compare individual services, establish the evaluation yardstick. The right tool will depend on your transaction volume, IT resources, and countries covered.

-

Data source reliability: Direct government databases reduce latency and risk.

-

Coverage breadth: Does the tool validate EU only, or also UK, Norway, Switzerland, and emerging e-commerce markets?

-

API performance: Look for high uptime, JSON/XML responses, and asynchronous batch options if you process thousands of invoices a day.

-

Audit trail: Screenshots or logs with timestamped responses help during inspections.

-

Speed and cost: Free portals are fine for low volume, but paid APIs usually drop per-check costs below €0.003 once you scale.

-

Added compliance layers: Some services, like 1stopVAT, pair number checks with advisory support when a result is ambiguous.

Having criteria in place prevents shiny-tool syndrome and keeps focus on your actual risk.

Top VAT number verification services compared

The services below are arranged from public portals to commercial APIs and full-service compliance partners. Each subsection starts with a snapshot, walks through usage, then notes pros and cons.

VIES (EU Commission)

The EU’s VAT Information Exchange System is the gold standard for intra-community verification.

-

Navigate to the official VIES website.

-

Enter the member state and VAT number.

-

Click “Verify,” then save or print the confirmation.

Pros:

- Zero cost, direct data source, instant printable audit proof.

Cons:

- Manual entry only, limited to EU numbers, periodic downtime.

For a more detailed walk-through of VIES usage, batch processing, and documentation best practices, visit How to Perform an EU VAT ID Check (VIES Guide).

HMRC VAT Number Checker (United Kingdom)

Post-Brexit, UK numbers are no longer in VIES. HMRC hosts a separate checker.

-

Visit the “Check a UK VAT number” page on GOV.UK.

-

Type the nine-digit VAT number.

-

Receive confirmation plus the registered business name.

Pros:

- Official government data, includes entity name for fraud checks.

Cons:

- UK only, no API, recent data updated overnight rather than real time.

VATlayer API

A popular RESTful API for businesses that need machine-to-machine validation.

-

Sign up for a free key, then read the straightforward API docs.

-

Format a request: https://api.vatlayer.com/validate?access_key=YOUR_KEY&vat_number=NL123456789B01.

-

Parse the JSON response, which includes validity, country code, and request date.

Pros:

- Supports EU, UK, and some non-EU numbers, fast JSON, 256-bit encryption.

Cons:

- Freemium limits, no built-in business name match for every country.

Real-world example: An Italian drop-shipper pipes its Shopify orders through a VATlayer webhook, slashing manual checks from 30 minutes to under 30 seconds each morning.

Vatin.io

A newer entrant focused on a developer-first experience.

-

Register, obtain your API token, and consult the Swagger UI for live testing.

-

Post a batch of comma-separated numbers, then receive a status array.

Pros:

- Bulk validation up to 10,000 numbers per call, robust uptime metrics posted publicly.

Cons:

- Limited documentation on non-EU IDs, higher tier needed for SLA.

1stopVAT Verification Service

1stopVAT offers VAT number validation as part of its broader compliance suite that spans 100+ jurisdictions.

-

Contact the onboarding team to map your transaction flow.

-

Choose between a secure web portal or API integration.

-

Receive a flag on any uncertain result along with a tax specialist’s recommendation, not just a pass/fail code.

Pros:

-

Combines automated lookup with human review, helpful when VIES returns “service unavailable.”

-

Creates a permanent audit trail aligned with EC Sales List filings.

Cons:

- Strong fit for companies that also need registration, filing, or consulting, less ideal for hobby-scale merchants.

These five options cover almost every use case, from occasional checks to enterprise-grade throughput. Next, let us see how to weave them into your daily process.

Step-by-step: verifying a VAT number without missing a beat

Start small with the manual method, then graduate to automation.

For expert guidance and practical automation tips, read Tax Technology Tools – VAT Compliance Automation.

By following this progression you preserve control, then scale safely.

Pitfalls that cause VAT errors and how to steer clear

Even with good tools, errors creep in. The most common pitfalls are surprisingly mundane.

-

Copy-paste mistakes: Staff may trim leading zeros. Counteract this with input masks on your forms.

-

Stale data: A number can become invalid if a business changes legal form. Quarterly reverification solves this.

-

Mismatched entity names: Fraudsters sometimes use a valid VAT number that belongs to another company. Cross-checking with the HMRC or VIES “trader name” field is cheap insurance.

-

Service downtime: VIES is notorious for weekend maintenance windows. Keep a fallback API or perform checks outside batching windows.

-

Overreliance on a single system: Make sure at least two team members understand the verification flow, so vacations do not freeze accounts payable.

To protect yourself against classic documentation mistakes, see VAT Certificate Verification: Ensuring Compliance.

An Austrian wholesaler learned this the hard way when VIES went offline during the last week of the quarter. Invoices piled up, cash application stalled, and suppliers threatened late-payment charges. A simple secondary API would have avoided the scramble.

What Is VAT Number Verification and Why It Matters for EU Businesses

VAT number verification is the process of confirming that the VAT Identification Number supplied by a business partner is both structurally correct and currently active in the tax authority’s database. A valid check protects your right to zero-rated intra-EU supplies, input tax deductions, and shields you from penalties if the counterparty’s status later changes.

Conclusion

Choosing a reliable VAT number verification service is less about bells and whistles and more about uninterrupted compliance. By weighing data source reliability, coverage, and audit-ready records, you can match the right tool to your risk profile. Start with manual checks, automate cautiously, and keep a fallback for the inevitable outage. For more actionable compliance insights and checklists, see How to Verify a VAT Number: A Simple Guide. Follow these steps and you will keep your cash flow, audit posture, and supplier relationships healthy - one verified VAT number at a time.