What you will learn

This guide first explains why VAT registration has grown more complex yet more digital at the same time. It then walks through the criteria seasoned finance teams use when reviewing top VAT agencies and introduces the eight trusted VAT providers that consistently score highest on coverage, speed, and cost clarity. Real-world numbers - from refusal rates to One-Stop Shop volumes - anchor the narrative so you can benchmark providers against hard data.

Why reliable VAT registration matters

A competent intermediary is not a luxury, it is insurance that your trading can start on time. In the EU, the share of refused VAT registration requests plunged from 14.5% to just 2.2% between 2016 and 2019. Most businesses now meet the tighter documentation standards, but rejections still cluster in certain states, swinging from 0% in Italy to over 20% in Latvia and Lithuania. Parallel to stricter checks, registration volumes are exploding. By 2024, firms declared €33 billion through the three EU One-Stop Shop schemes, up from €20 billion in 2022, as shown in the European Commission’s revenue trackers. Close to 130 000 companies have opted in. Add 2.33 million VAT-registered UK traders and you get a hyper-crowded field where mistakes trigger audits.

For a detailed background on the complexity and evolution of cross-border VAT, see VAT in European Union: EU VAT Rules Explained for International Sellers.

That context explains why the following selection criteria matter.

How we judged the top VAT agencies

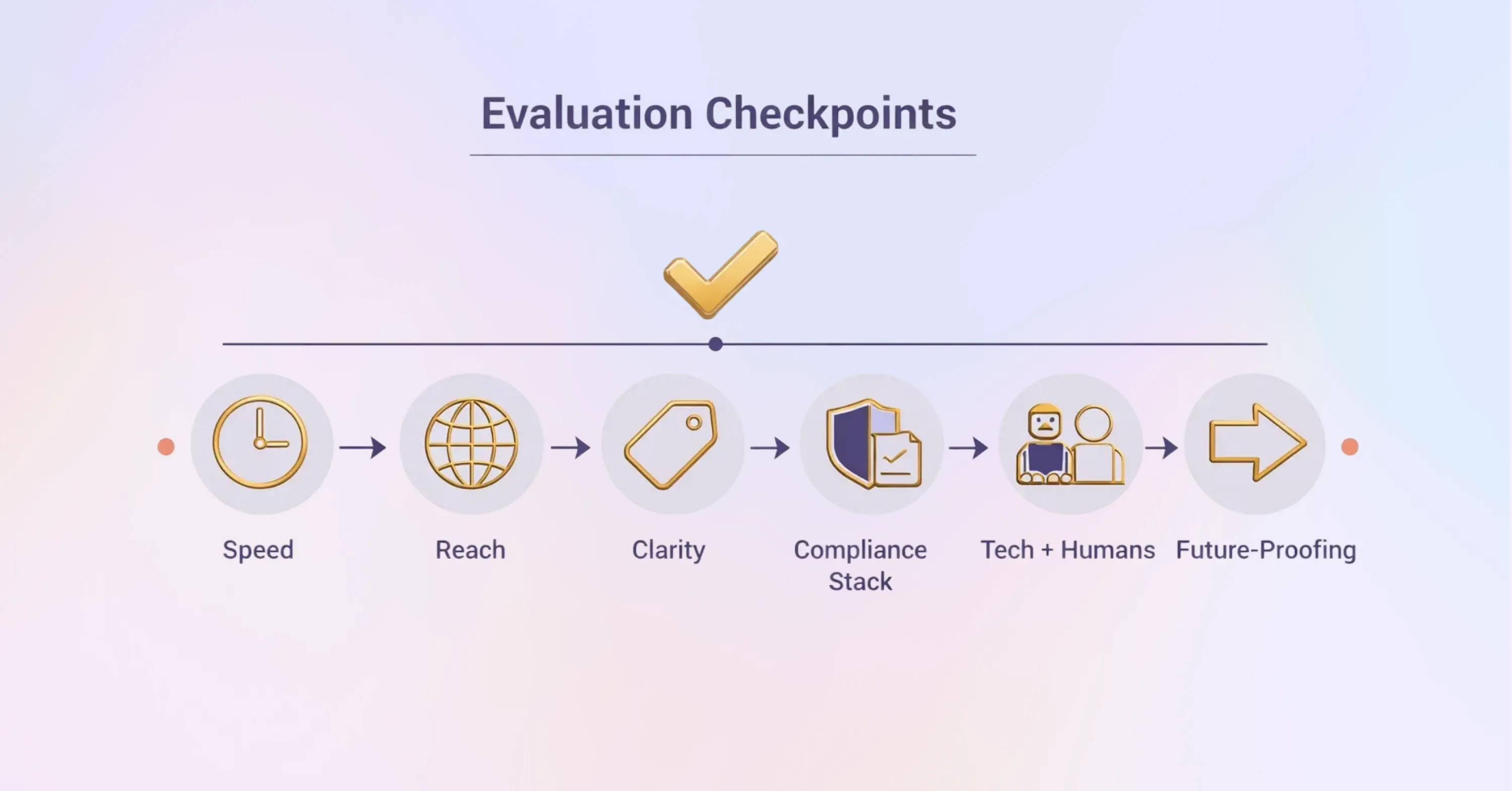

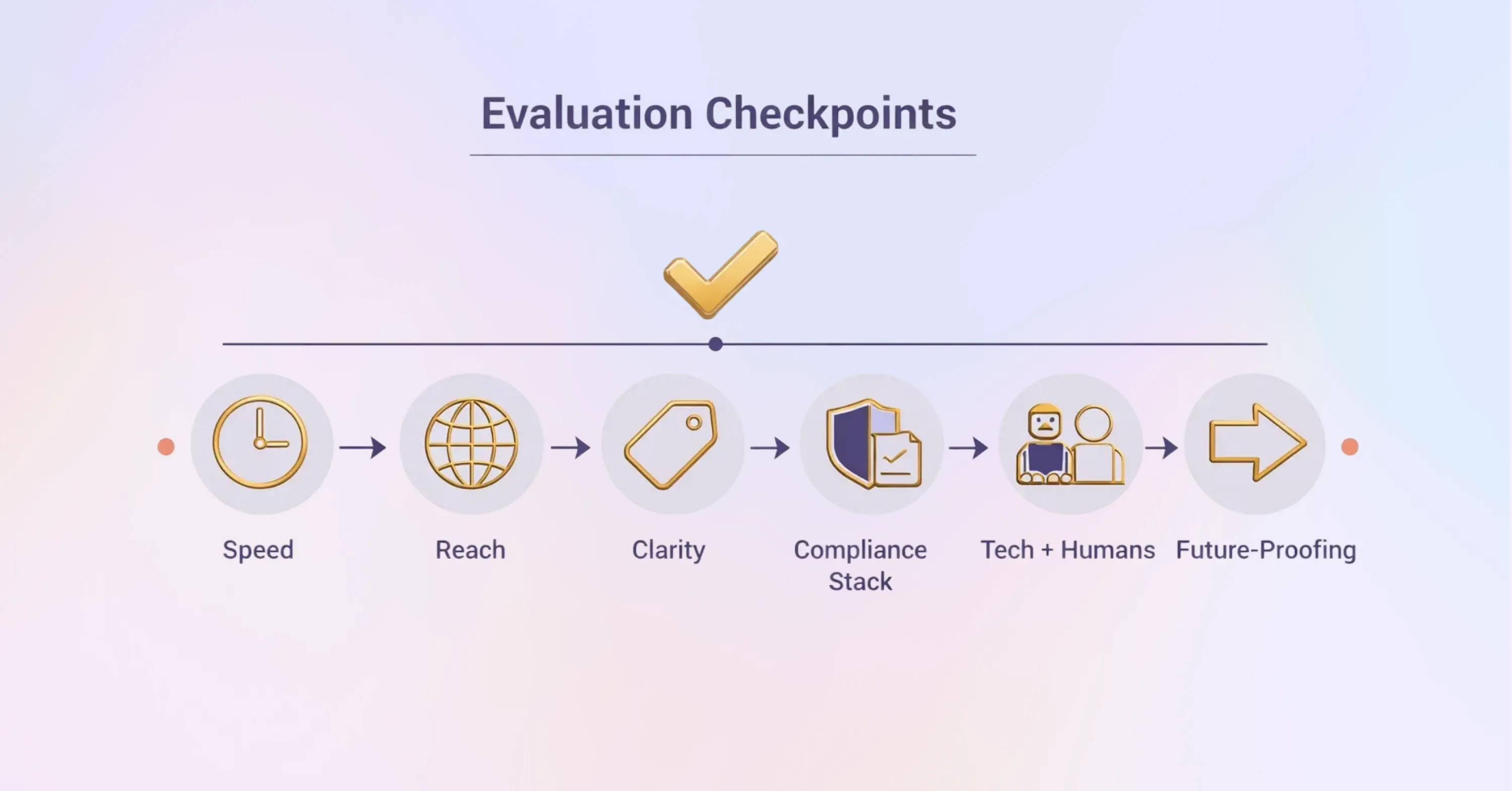

Choosing a provider is about more than price. Finance managers we interviewed highlighted six recurring checkpoints.

-

Speed: typical lead times, power of pre-filled forms, experience with local tax portals

-

Geographic reach: number of countries handled directly rather than through affiliates

-

Pricing clarity: fixed fees for registration versus success fees or hidden charges

-

Compliance stack: ability to maintain filings and communicate audits after the VAT number arrives

-

Tech plus humans: does the firm automate uploads, yet keep certified tax experts on call?

-

Future-proofing: preparations for the EU-wide digital reporting mandate due by 2030

When a provider ticks at least five of these six boxes we call it “trusted.” The eight providers below all meet that bar.

The best VAT registration companies in 2025

Below you will find concise profiles, each with a short real-world example that shows how the service performs.

1. 1stopVAT

Operating across 100+ countries, 1stopVAT combines proprietary dashboards with a 40-person tax desk. A consumer-electronics seller from Sweden expanded to the Gulf Cooperation Council states and received local VAT IDs in under five weeks, relying on a single 1stopVAT case manager instead of six separate advisors.

-

Registration fee: €450 to €900 per country

-

Ongoing compliance: €89 per monthly return

-

Stand-out: unified contact point and swift Gulf approvals

For an independent review of multi-country capabilities, automation, and how agencies stack up for different business sizes, check out Best VAT Registration Services in 2025: Top Providers Reviewed.

2. Taxually

Taxually brings an API-heavy approach, plugging ecommerce sales data straight into its filing engine. A Polish marketplace merchant cut manual spreadsheet work by 80 percent after switching.

3. TMF Group

Known for legal entity management, TMF Group leverages its on-the-ground offices in 85 jurisdictions. A US medical device firm entering France valued the bilingual support during tax audits.

-

Registration: custom quotes, often €1 200+

-

Filing bundles: from €250 per quarter

-

Bonus: corporate secretarial add-ons

4. Marosa

Marosa, a Spanish boutique, focuses on the EU. Its filing portal compares sales records with EU OSS limits in real time. An Irish SaaS provider avoided a €10 000 penalty when Marosa flagged that Italian thresholds would reset mid-year.

5. SimplyVAT.com

SimplyVAT.com champions solo sellers and SMEs. A UK craft brand secured German and French VAT numbers in eight weeks and saved 15 percent versus its previous accountant.

6. Taxback International

With 30 years of reclaim experience, Taxback International now runs a VAT registration wing. A Japanese game studio enjoyed “follow-the-sun” support from Dublin, Melbourne, and New York hubs.

7. EuroVAT

Paris-based EuroVAT specialises in non-EU companies selling digital goods. A Canadian app publisher raved about EuroVAT’s fast France, Spain, and Italy setup despite zero local presence.

8. Osome

Osome, a Singapore fintech, integrates bookkeeping with VAT. A Latvian drop-shipper gained a VAT number and weekly P&L without adding staff.

Taken together, these firms cover every business model, from Amazon FBA merchants to SaaS scale-ups.

For a data-rich overview comparing top VAT registration agencies - including timelines, fee structures, and scope - review Top EU VAT Registration Agencies: 2025 Guide.

Quick side-by-side summary

-

Fastest average approval: 1stopVAT and Marosa at roughly four to six weeks

-

Lowest entry cost: SimplyVAT.com, €380 average

-

Widest country spread: 1stopVAT and TMF Group, 100+ and 85 respectively

-

Best for SMEs: SimplyVAT.com and EuroVAT

-

Audit-season support leaders: Marosa, TMF Group

If cost is your only filter, EuroVAT and SimplyVAT.com win. If unified dashboards and worldwide reach matter more, 1stopVAT or TMF Group make more sense.

How to pick your trusted VAT provider

Start with a needs map, then line up shortlists.

-

List every market where you will exceed the distance-sales threshold within 12 months

-

Note languages you can handle internally: outsource the rest

-

Check if the provider can file through OSS so you avoid multi-country registrations

-

Demand total cost of ownership: registration, translation, bank liaison, fiscal rep fees

-

Probe tech: ask for a demo of pre-filled returns, helpful since about 40 percent of tax administrations can already prefill VAT returns.

-

Request client references from your sector

For guidance on speeding up the process and avoiding pitfalls, see Expedited VAT Registration: Checklist for Fast EU Entry. After you compare those answers, the best match usually becomes obvious.

Best VAT Registration Companies in 2025: Top Providers Compared

The best VAT registration companies in 2025 are 1stopVAT, Taxually, TMF Group, Marosa, SimplyVAT.com, Taxback International, EuroVAT, and Osome: all offer fast cross-border VAT numbers, filing automation, and audit-season human support at prices ranging from €325 to €1,200 per country.

Conclusion

VAT registration is no longer a routine formality - it is a critical step in cross-border growth. The right provider helps businesses register faster, avoid costly errors, and stay compliant as tax rules become more digital and tightly enforced. By prioritising speed, pricing transparency, geographic coverage, and long-term compliance support, companies can confidently choose a partner that fits their expansion plans.

From cost-efficient options like SimplyVAT.com to global providers such as 1stopVAT, the eight firms in this guide offer reliable, scalable paths to compliant international growth in 2025.