Taxable persons established within the EU have more than a few benefits when operating within the common market, and one of those is undoubtedly the possibility of reclaiming paid VAT, leveraging the EU VAT Refund procedure.

This mostly standardized and simplified refund procedure permits the EU-established taxable persons to reclaim the VAT they have paid on their taxable purchases only when the mandatory requirements are met.

The logical question would be, what are these mandatory requirements?

The initial requirement is that both taxable persons have their fixed establishment within the EU. From the connection perspective, the next one is that the claimant Member State of Establishment(MSE) differs from the Member State of the Refund(MSR).

The claimant, to be able to issue a valid refund application, must be aligned with these provisions during the refund period:

- It cannot be established in the MSR or;

- It cannot supply goods or services in the MSR except for → exempt transport and ancillary services and supplies to customers where the reverse-charge system can be leveraged.

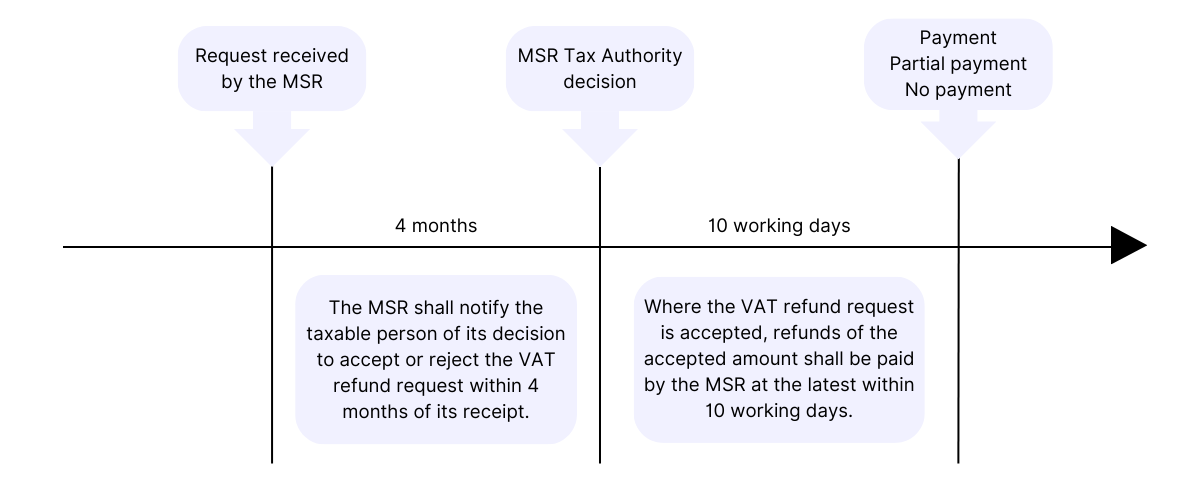

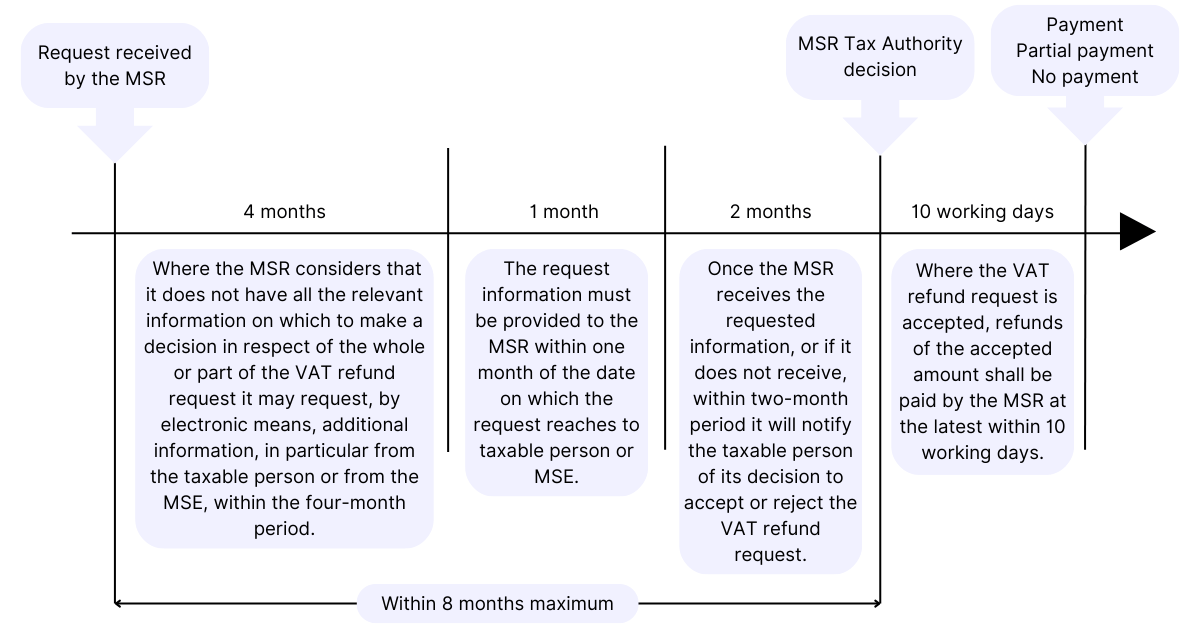

When MSR receives the request for a VAT refund, it should decide following the deadlines defined in the EU-based and national legislation. The decision made by the MSR can be positive or negative; that is, the Member State of Refund can accept, partially accept, or reject the request for a VAT refund.

The Member State of Refund should act within two defined timeframes based on the claimant’s application and related documentation. These deadlines for MSR are entirely related to the specifics of the case put before authority by the claimant.

These two types of deadlines are:

- Deadlines when there is no need for additional information/documentation or;

- Deadlines when the claimant must add additional information to support his refund request.

1.

2.

Aleksandar Delic

1stopVAT Senior Indirect Tax Researcher (Global Content)