On February 12, 2025, the EU parliament approved the draft version of the VAT in the Digital Age (ViDA) initiative. Before this event, last November, the agreement by the Ministers of Finance was reached on this three-pillar-based reform.

The approval by the Parliament of the VAT in the Digital Age reform is a milestone of significant progress towards one of the most important reforms of the EU VAT regimes in the last decades. The approved draft legislation that will amend the EU VAT Directive has been passed to the EU Council for review as the mandatory step for adopting these types of legislation.

The adopted three-pillar-based ViDA package culminates more than three years of dedicated work by various stakeholders. One of the main goals for introducing a reform of this magnitude is reducing the EU VAT gap.

The three pillars upon which the reform is based cover the introduction of mandatory intra-EU B2B digital reporting requirements based on e-invoicing; enhancement as well as reinforcement of the legislative framework for platform economy; and implementation of the single VAT registration system to reduce bureaucratic challenges for SME’s that operate in more than one Member State.

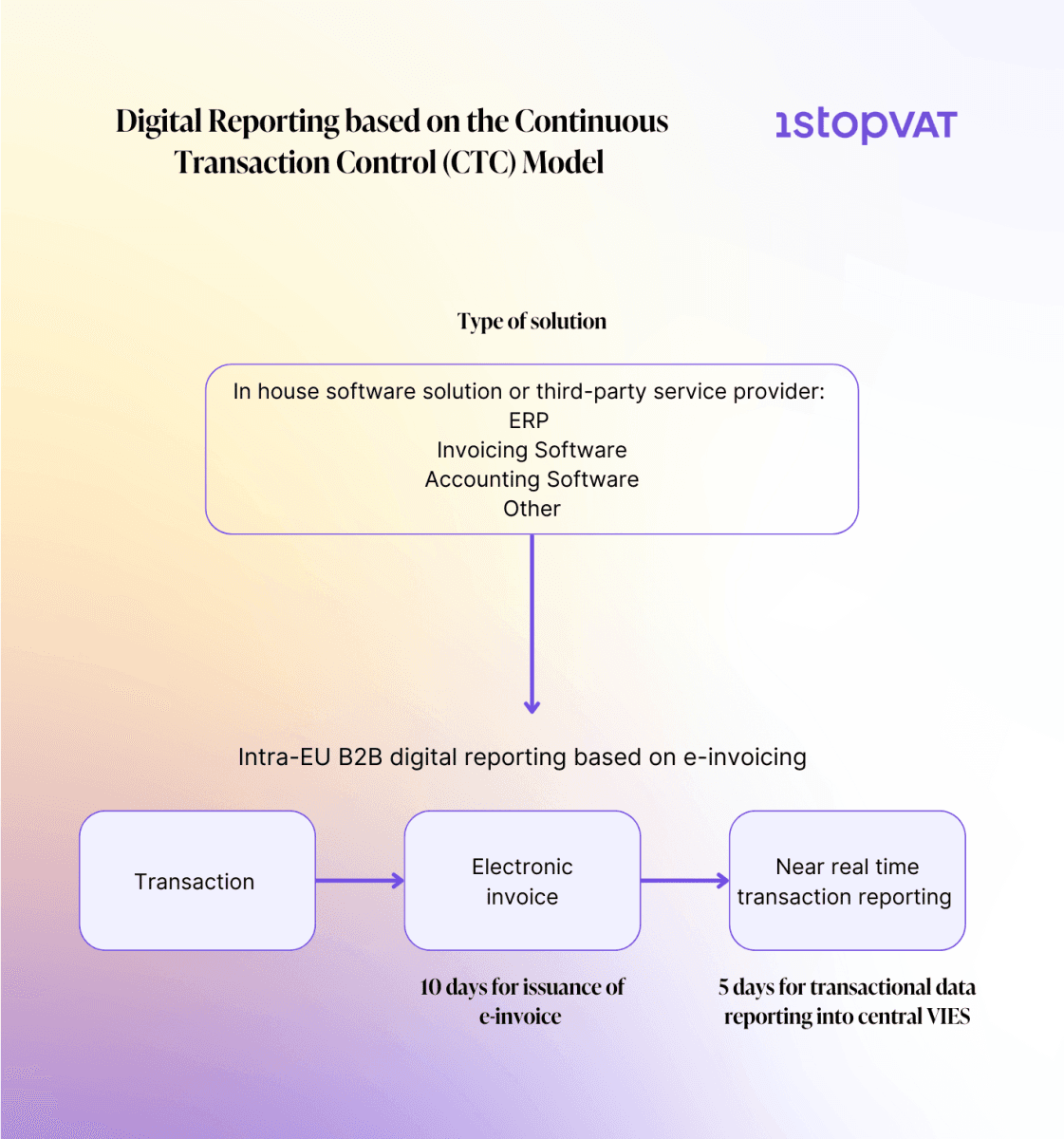

Introducing a digital reporting system that should cover all intra-EU B2B transactions is, technically and from the investment perspective, a most demanding part of the ViDA puzzle. It encompasses a shift to digital VAT reporting and structured e-invoicing across the entire EU by July 2030. In the scheme below, you can get familiar with the basic overview of how the proposed DRR regime should work:

The EU legislators and connected stakeholders undoubtedly see the adoption of digital reporting based on transaction-by-transaction metrics as a powerful tool to combat VAT fraud and add needed transparency in intra-EU B2B supplies.

Introducing transactional reporting instead of recapitulative statements will inevitably lead to higher costs for all parties involved. This is one of the reasons(behind the technical ones) why this pillar of the ViDA reform is left as the last one for the full implementation.

Aleksandar Delic

1stopVAT Indirect Tax Manager – E-Commerce