Overview: What You Will Learn

In the next ten minutes, you will:

- Identify when and where a tax compliance certificate is mandatory, from Ireland to Nigeria

- Gather the documents tax authorities most often request

- Submit an application that gets accepted the first time

- Monitor validity periods so lapses never catch you off guard

- Rescue a certificate that has been rescinded or rejected.

Use the checklist section by section, or bookmark the whole guide as your new standard operating procedure.

1. Confirm Jurisdictions That Demand Proof of Tax Compliance

Not every country issues the same document. Some label it a tax clearance certificate, others call it a certificate of tax compliance:

- Government contracts: Most EU and African governments require proof before awarding public tenders

- Cross-border dividends or royalties: Banks often withhold payments until a valid certificate is on file

- Business licensing and renewals: Construction, mining, and telecom sectors are frequent examples

- Immigration or work permits: Senior executives moving abroad can be asked for personal tax clearance

Countries That Flag Non-Compliance Fast

Action steps:

- List every country where your business sells, holds assets, or employs staff

- Map the exact document name and legal trigger for each location

- Set reminders six months before any contract bid or license renewal

For a wider look at cross-border requirements and compliance strategies, see Sales Tax Registration and Compliance Guide for Global Sellers.

2. Gather the Prerequisite Filings and Payments

Before your business can confidently apply for new licenses, bid on contracts, or finalize financial agreements, you must prove you are in good standing with all relevant tax authorities. This proof isn't a complex strategy; it's a collection of documents that confirm you have met all your basic obligations.

Core requirements:

- Annual corporate income tax returns filed and paid

- VAT, GST, or sales tax returns lodged up to the latest period

- Payroll withholding remitted, including social security or PAYE

- No outstanding penalties or interest assessments

Pro tips for CFOs:

- Maintain a reconciliation file: one sheet per tax type showing due, filed, and paid amounts

- Keep proof of payment receipts as PDFs; many portals ask for uploads

- Use the same legal entity name and tax ID across all forms to avoid mismatched records

If a liability is under dispute, send the assessment notice and evidence of challenge. Some jurisdictions still grant a provisional certificate while disputes are pending.

To ensure your record-keeping and filing stay organized across all regions, review the Aligning Cross-Border Tax and Accounting Practices for SMEs guide.

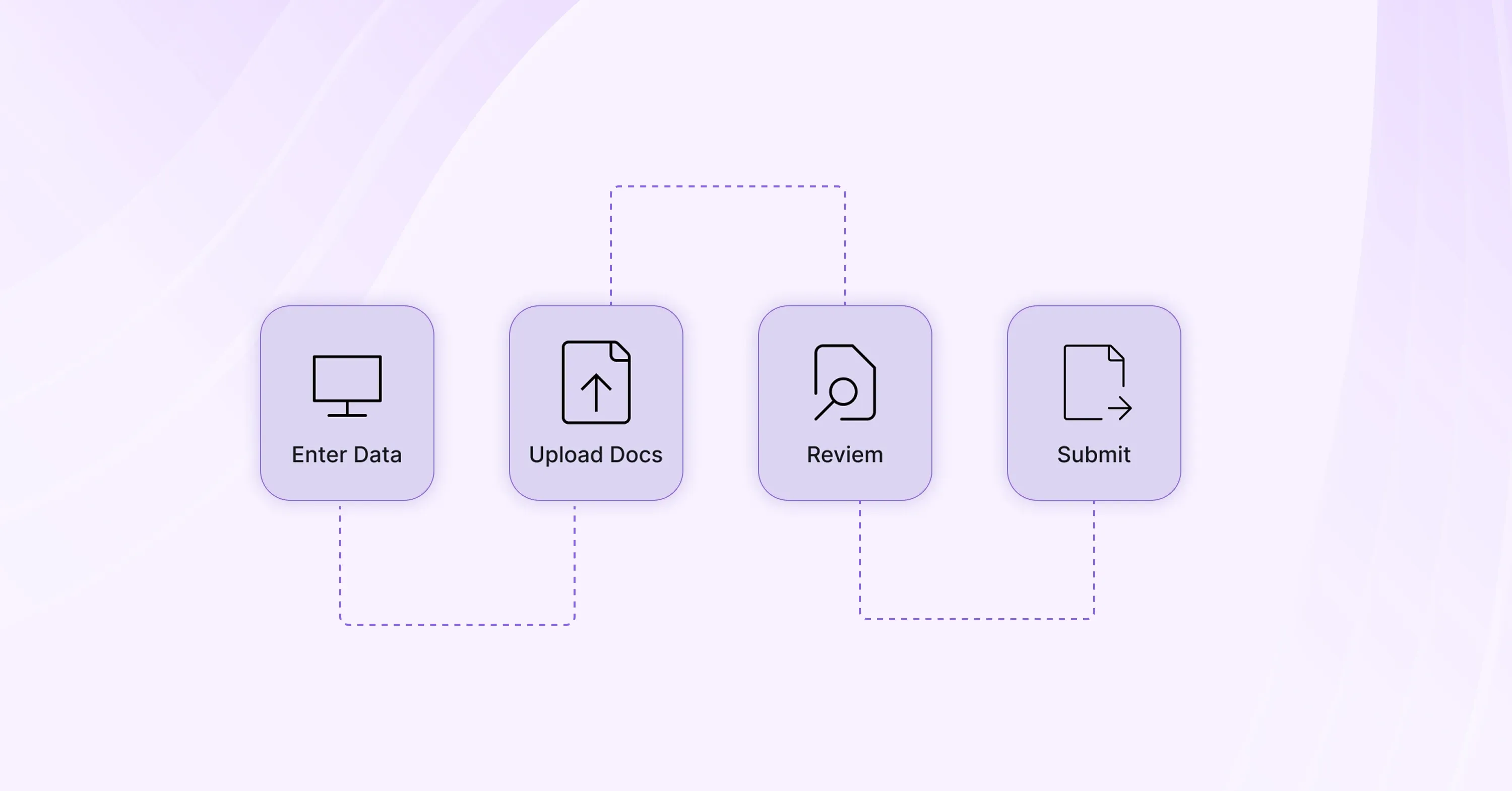

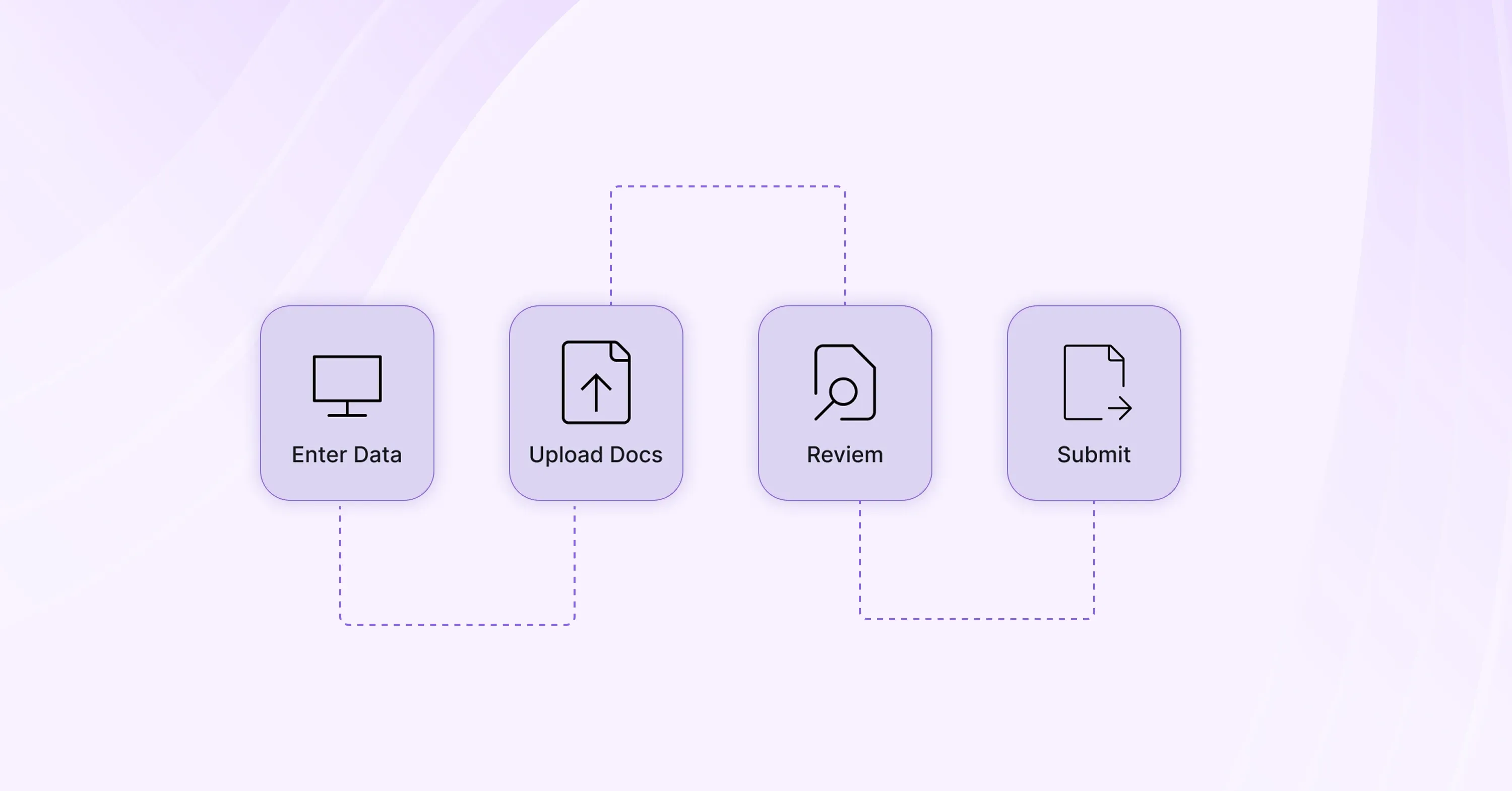

3. Submit the Application Correctly the First Time

The final step in obtaining your tax compliance certificate is ensuring the application is submitted accurately and on time. While your filings and payments prove eligibility, precision in the application itself is critical - even minor errors, outdated forms, or missing documents can cause rejection or serious delays that disrupt your business plans.

This section details the critical checks and balances needed to ensure your submission is flawless, enabling you to secure your TCC without unnecessary bureaucratic friction:

- Online portals: Follow the exact data formats (dd/mm/yyyy vs mm/dd/yyyy)

- Paper forms: Use block letters and blue or black ink; illegible text slows manual review

- Supporting documents: Compress multi-page PDFs to meet file-size limits but keep resolution readable

- Contact info: Provide a monitored email, phone, and even WhatsApp if accepted

Example processing times:

- Nigeria: The upgraded system reduced waiting from two weeks to one click

- Ireland: Paperless filings still face audits, a factor behind the 1,460% year-on-year jump in rescinded certificates

- Poland: Expected to match EU electronic VAT certificate roll-out timelines once live

Tick the “receive notifications” box so you get instant alerts if more data is needed. For step-by-step digital submission guidance, consult How to File VAT Returns Online: Streamlining Digital Submission.

4. Track Approval and Calendar the Validity Period

Securing your tax compliance certificate isn't the final step: it's the beginning of a continuous maintenance process. Once submitted, you must actively monitor the application status and, more importantly, strictly calendar the validity period of the issued certificate. A TCC is not permanent; it has a defined expiration date, and allowing it to lapse subjects your business to the same risks as never applying at all.

A tax compliance certificate rarely lasts forever:

- 6 months: High-risk sectors such as construction

- 12 months: Standard corporate taxpayers

- Continuous: Nigeria’s new one-click version remains valid until the taxpayer lapses again

Action checklist:

- Enter expiry dates in your ERP or compliance software

- Schedule an automatic re-application 30 days before expiration

- Store certificates in a shared folder labeled by country and end date

To go beyond calendar reminders and adopt dashboard-based monitoring, see Global Sales Tax Solutions & VAT Compliance Guide.

5. Troubleshoot a Rescinded or Rejected Certificate

Even with a flawless preparation process, your tax compliance certificate may be rejected upon application or rescinded after it has been issued. The rejection usually points to a data discrepancy in your application or recent missing documentation, while a rescission signals that your continuous compliance has failed: perhaps a tax return was missed or an estimated payment was underpaid.

Warning signals:

- Late VAT return filing

- Unpaid installment agreement

- Data mismatch after a merger or entity name change

What to do next:

- Pull the revocation notice to see the exact reason

- Correct the filing or payment within the stated grace period

- Reapply with proof of rectification

Rescissions are not rare. A clear warning came when 70% of eligible retail investors failed to claim their withholding tax refunds. Complexity leads to missed steps, and authorities use similar data analytics to flag corporate lapses. If you need to recover VAT paid or handle cross-border refund issues, review VAT Refunds & Reclaims: How to Recover Input VAT Costs

6. Bake Certificate Management Into Business Operations

A tax compliance certificate is not a destination; it's a recurring license to operate. The most successful businesses treat the management of TCCs and similar critical licenses (like sales tax permits, foreign registration numbers, and industry-specific certifications) as a core, ongoing operational task, not an accounting-year-end fire drill. Baking certificate management into your business operations means integrating expiration tracking, renewal protocols, and compliance checks directly into your workflow and technology systems:

- Procurement: Require vendors to submit their certificates before the first payment

- Banking: Provide updated certificates to avoid payment blocks on cross-border dividends

- M&A: Add certificate status to due diligence checklists.

Automate where possible

- API connections: Many portals allow direct pulls of certificate status

- Dashboard metrics: Flag days until expiry in red once inside 45 days

- Shared calendar invites: Remind legal, finance, and operations teams simultaneously

For a checklist on deeper operational integration and process automation, refer to Aligning Cross-Border Tax and Accounting Practices for SMEs.

A tax compliance certificate (a tax clearance certificate or certificate of tax compliance) is an official document issued by a tax authority confirming that a company or individual has filed all required returns, settled all taxes due, and currently has no outstanding liabilities. Businesses use it to bid on government projects, receive cross-border payments, renew licenses, and satisfy banks or investors.

Conclusion

Securing and maintaining a current tax compliance certificate is less about paperwork and more about keeping revenue streams open. By confirming jurisdictional rules, cleaning up filings, submitting accurate applications, tracking validity, and reacting swiftly to problems, you stay ahead of audits and tender deadlines. Keep our checklist visible, update it as regulations shift, and Quote a free tax compliance consultation