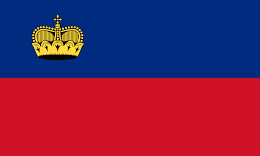

International VAT Guides – Liechtenstein

VAT rates in Liechtenstein

How much is VAT in Liechtenstein?

The VAT Liechtenstein system is mainly based on the Liechtenstein VAT Act and Regulation. Following the treaties signed between Switzerland and Liechtenstein, the territories of both states form a common “VAT territory.”

The domestic VAT framework is almost identical to the one implemented in Switzerland. The taxability regime is based on two central VAT rates: the standard and reduced VAT rate.

Various supplies of goods or services are under the countries’ VAT rules and are treated as tax-exempt.

| Liechtenstein VAT Rate | Rate Type | Coverage and imposition |

| 8.1% | Standard Rate | The general VAT rate applies to all supplies of goods and services that are taxable and on which the reduced or special rate cannot be imposed. |

| 2.6% | Reduced Rate | Particular food; newspapers, magazines, books in paper format; electronic newspapers, magazines, and books of non-advertising nature. |

| 3.8% | Special Rate | Accommodation services (B&B, hotels). |

Business owners or individuals with significant knowledge of the Swiss VAT landscape will probably not experience many difficulties when shifting their attention to the Liechtenstein VAT requirements. However, there are still differences between the two systems that in a combined manner, form a “common” VAT territory.

Liechtenstein authorities have adopted all the latest amendments to the VAT regulations previously adopted by the Swiss assembly when it comes to the VAT rules for the digital economy. New rules have come into force on January 1, 2025.

VAT threshold in Liechtenstein

The VAT Liechtenstein Act and implementing Ordinance represent the two most significant types of legislation upon which the VAT regime of the country is defined. The rules for VAT threshold in Liechtenstein follow the same logic as the ones adopted by the Swiss VAT Act.

VAT registration threshold for resident businesses: CHF 100,000 global.

VAT registration threshold for non-resident businesses: CHF 100,000 worldwide + local turnover.

VAT registration threshold for foreign providers of digital services: CHF 100,000 worldwide + local turnover.

VAT Taxable Activities in Liechtenstein

Types of taxable activities that mandate the VAT registration:

- Supply of goods and services for consideration;

- Exports;

- Imports of goods and services;

- Supply of warehousing services;

- Hosting of events and payments of entry fees.

Tax Representative in Liechtenstein

Non-resident providers of digital services should appoint a local tax representative for VAT compliance activities.

Tax registration

Standard Registration

Local taxable persons or foreign businesses with a place of business in the country should follow the steps designed by the VAT Act concerning standard registration procedures.

Simplified tax registration

There is no specifically designated registration procedure for digital services providers. Non-resident digital service providers should register online, following the standard registration procedure.

The registration is handled online, using the services of the Liechtenstein Revenue Authority.

VAT on Electronically Supplied Services in Liechtenstein

Digital Services

Non-resident providers of digital services should register for Liechtenstein VAT upon reaching the threshold. The threshold for VAT registration is CHF 100,000, covering the worldwide sales of the service provider or seller.

Upon reaching the threshold, the non-resident must register, charge, collect, and report local VAT through a VAT representative.

Non-resident suppliers of digital services should charge VAT for both B2C and B2B transactions.

How much is VAT in Liechtenstein for Electronically Supplied Services?

The Liechtenstein VAT rate for most digital goods and services supply is 8.1%.

Taxable Digital Services in Liechtenstein

The following types of digital services trigger mandatory VAT registration of non-resident providers:

- Audio and video streaming services;

- SaaS services;

- Web and cloud hosting services;

- Supply of downloadable or remotely accessible digital content;

- E-books and publications;

- Intermediation between third parties offering goods or services and those seeking them;

- Online clubs and dating sites;

- Distance learning or teaching.

Marketplace and Digital Platform Operators Rules

The non-resident operator of a digital marketplace or platform(foreign intermediary) that intermediates in the distant supply of goods or taxable digital services is mandated to register for Liechtenstein VAT number when reaching the mandatory threshold.

When the foreign digital service provider is registered under Swiss VAT law, under specific conditions, there is no obligation to register also for Liechtenstein VAT. The collected tax should be reported to the Federal Tax Administration in Switzerland.

Invoicing Rules

Under general rules for B2B transactions, the invoice should be issued, but when it comes to B2C transactions, the invoice should be issued when the customer demands it. In most cases, for B2C transactions, simplified invoices or sales receipts are issued.

Invoice Requirements in Liechtenstein

The pdf invoice should at least contain the following:

General information:

- Date of invoice issuance;

- Date and time of supply;

- Unique invoice number from consecutive series.

Seller information:

- Company name;

- Full address (head office);

- Billing address if different from company address;

- VAT number.

Customer information:

- Name;

- Full address;

- VAT number (if applicable).

Fiscal Information:

- Tax amount for each type of goods or services supplied;

- The Tax Rate;

- Type of the transaction by reference to the categories indicated in the VAT Act;

- Total tax amount;

- Invoice Total tax exclusive;

- Rate of any discount;

- Total invoice amount.

Foreign Currency Invoice in Liechtenstein

In most cases, issuing an invoice in foreign currency is permitted. However, VAT reporting should be processed exclusively in local currency.

VAT Return in Liechtenstein

Standard Return

There is no differentiation between the format and procedure for submitting returns regarding non-resident providers of digital services compared to local taxable persons. The return should be submitted online.

VAT Liechtenstein return

| VAT Return Name | Online Return |

| Filling frequency | Quarterly |

| Online Filling | Mandatory |

| Annual Return | No |

| Filing deadline | 60 days from the end of the reporting period |

| Payment deadline | 60 days from the end of the reporting period |

| Payment currency | CHF |

| Language | German |

| Local VAT acronym | VAT |

Penalties for late reporting and omitted declarations

As previously mentioned, the bilateral tax treaties have established a common framework for the applicability of most tax provisions between Switzerland and Liechtenstein. The scope and the content of tax penalties for non-compliance are also highly similar.

Fines and penalties according to VAT Liechtenstein:

A fine of up to CHF 10,000 shall be imposed, unless the offense is punishable by a higher penalty under another provision, on taxable persons who intentionally or negligently:

- Fails to register as a taxable person;

- Fails to submit a tax return on time despite a reminder;

- The tax is not declared on an accrual basis;

- Fails to provide adequate security;

- Fails to properly maintain, prepare, store, or present business books, receipts, business papers, and other records;

- Indicates in invoices VAT which is not due or not due in the amount owing;

- Simulates an entry in the register of taxable persons by indicating a registration number;

- Despite a warning, the proper conduct of an inspection is complex, hindered, or impossible.

Economic operators that have negligently or intentionally skipped the mandatory registration can also be prosecuted for tax evasion, regardless of previously receiving a fine for missing the registration upon establishing the mandated grounds for it.

Need assistance with VAT in Liechtenstein?

We can help!

Dedicated account manager

As our client, you will be assigned to a multilingual account manager who can address all your tax-related inquiries and resolve any issues you may have at any time.

Single point of contact

We serve as single point of contact, simplifying the process and ensuring that your VAT compliance is handled efficiently and effectively within single stop.

Exclusive customer service

We support our clients, ensure fast response time and always go beyond by offering tailored assistance and individual attention.

Certified experts

Our team is combined of more than 40 experts, who can provide wide range of services and are certified members of IVA, AITC and VAT Forum. Currently we have more than 800 clients and knowledge how VAT works in 100 locations.