Built for games, backed by experts

Whether you’re selling in-game items, subscriptions, or running a player marketplace – indirect taxes like VAT, sales tax, and digital levies can get in the way of global growth. At 1stopVAT, we’re your hands-on partner in navigating complex tax regulations across 100+ countries.

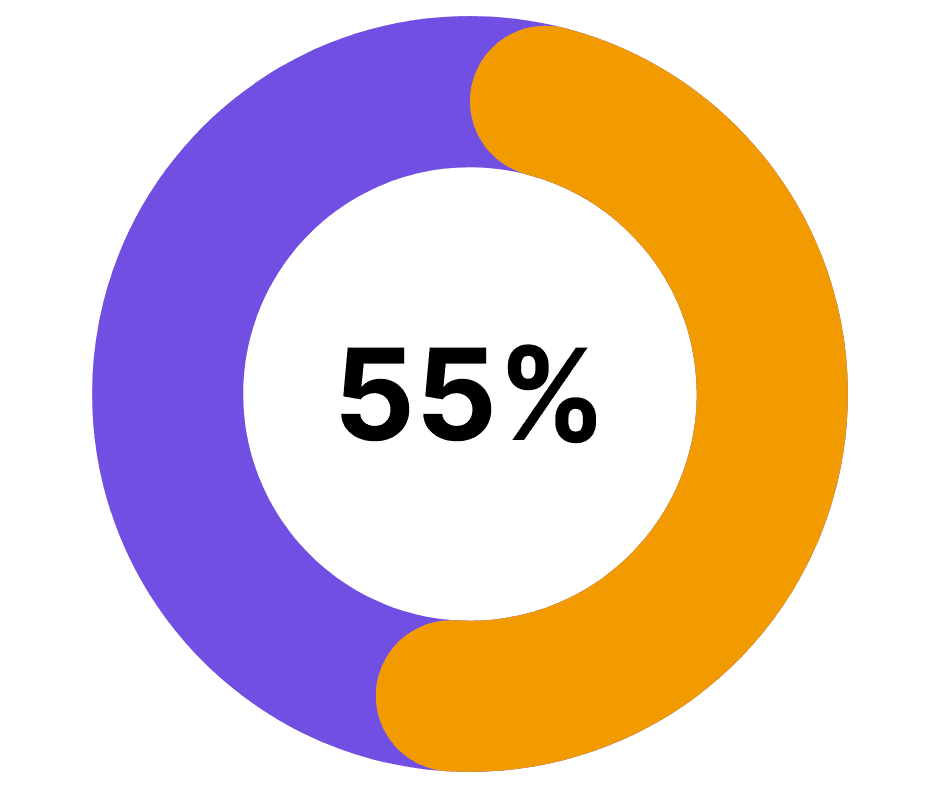

55% of global game software revenue in 2025 is expected to come from mobile platforms, making cross-border microtransactions and indirect tax compliance more critical than ever. Tax complexity and evolving digital regulations are no longer just legal issues – they’re growth blockers.

Our key services

- Indirect Tax Strategy & Compliance – We work closely with your team to develop tax strategies that align with your global business model. From registration to reporting, we ensure seamless compliance in every market you operate in.

- Cross-Border Tax Advisory – Our experts guide you through international tax regulations, ensuring you meet the specific requirements of every jurisdiction, whether it’s VAT, sales tax, or digital taxes.

- Audit Prevention & Risk Mitigation – We proactively identify potential tax risks and implement strategies to mitigate them. In cases of past discrepancies, we assist with corrective measures, helping you avoid penalties and costly audits as you scale.

- Ongoing Tax Filing Support – From VAT filings to sales tax reports, our team ensures you meet deadlines and handle the complexities of taxes across multiple countries, without adding strain to your internal resources.

How it works

Tailored Tax Strategy

We begin by assessing your business and understanding your global tax needs. Then, we craft a customized tax strategy to meet your goals and ensure compliance worldwide.

Registration & Filing

Our team handles all your tax registrations and filings, ensuring timely compliance with local tax laws, from VAT to digital sales tax, in every market you sell in.

Monitoring & Support

We continuously monitor tax changes, deadlines, and provide proactive support to mitigate risks, keeping your business compliant and ready for growth.

Why choose us?

Worldwide Coverage

We proudly provide compliance services for VAT, sales tax, and other indirect taxes in 100+ jurisdictions worldwide. With a highly efficient tracking system for filing deadlines, our expert team ensures seamless compliance across markets. We’re continually expanding our global tax compliance services reach.

Compliance Partners

We’ve built a strong network of partners and tax consultants globally to manage local requirements with transparency and efficiency. In many regions, we collaborate with local tax agents to ensure seamless compliance with VAT, sales tax, and other indirect tax obligations for cross-border suppliers.

Reliable Monitoring System

Our Reporting team brings extensive expertise in VAT, sales tax, and indirect tax return services, ensuring your business stays compliant. We provide timely notifications about filing deadlines and tax changes, helping you avoid regulatory breaches.

Certified Experts

Our team consists of more than 40 experts who provide a wide range of services and are certified members of IVA, AITC, and VAT Forum. With over 800 clients, we have deep knowledge of how VAT, sales tax, and other indirect taxes work in 100+ locations.

Client feedback

Working with 1stopVAT made things so much easier for us at Surfshark. They guided us through the VAT registration process smoothly and even connected us with the right partners when we needed extra help. Their efficiency and support took a lot of stress off our shoulders, boosting our efficiency, reducing costs, and supporting our business expansion while ensuring compliance.

Frequently asked questions

Do gaming companies need to register for VAT or sales tax in every country where they sell?

Not necessarily, but many countries have specific thresholds – either based on revenue or number of transactions – that, once crossed, require tax registration. For example, in the EU, a single threshold applies for digital services sold to consumers, while in the US, economic nexus rules vary by state. Companies expanding globally should regularly monitor their activity in each country to avoid late registrations or compliance issues.

What’s the VAT situation if we sell through Apple’s App Store or Google Play?

In some countries, Apple and Google act as the “deemed supplier,” meaning they collect and remit VAT or sales tax on your behalf. However, this depends on local laws. In regions where platform operators are not deemed suppliers, the developer may still hold tax obligations. It’s also important to consider scenarios where purchases occur outside those platforms – such as on your website – which can trigger separate obligations.

What types of in-game revenue are considered taxable digital products?

Taxable digital products can include:

- Downloadable games;

- Subscriptions (e.g., season passes, game streaming services);

- In-game currencies and digital items (skins, power-ups, etc.);

- Access to digital content or features (e.g., mods, exclusive content);

- NFTs or other blockchain-based game assets.

Each jurisdiction defines these categories differently, and some apply tax even if the item has no real-world equivalent.

If we allow creators or players to sell on our platform, who’s responsible for VAT?

This depends on the structure of the platform. In some countries (e.g., EU, UK), if the platform controls pricing or the transaction flow, it can be considered the “deemed supplier” and become liable for VAT – even if the actual content is made by a third-party seller. Other jurisdictions may place responsibility on the seller directly. Clear documentation, platform terms, and invoicing logic are essential to determine and assign liability correctly.

We already use Stripe or PayPal. Doesn’t that take care of the taxes?

Payment processors like Stripe and PayPal facilitate payments, but they don’t automatically ensure you’re VAT or sales tax compliant. They may provide tools (e.g., location tracking or invoice data fields), but it’s up to your team to interpret tax laws, determine where to register, collect the right amount, and file correctly. Proper setup and oversight are still needed to meet compliance standards.

What if we’re behind on compliance or missed registrations?

Late compliance is common in fast-moving industries like gaming. Most tax authorities offer ways to catch up through voluntary disclosure programs or backdated registration options. These typically reduce penalties if addressed proactively. It’s best to assess exposure early, gather records, and approach the relevant authorities in an organized way.

Ready to grow your game internationally?

Whether you’re launching a new platform, entering a new market, or navigating the rules of in-game monetization, 1stopVAT is your trusted partner for stress-free tax compliance.

Request a free consultation

Security

Data privacy and compliance

Your data stays safe with us. We use top security to protect your information, so you can focus on what matters.