Expert tax guidance to scale your SaaS business globally

For digital products, global reach is key – but so is compliance. At 1stopVAT, we make indirect tax compliance – VAT, sales tax, digital taxes – seamless across 100+ countries, ensuring your SaaS business stays compliant no matter where you sell.

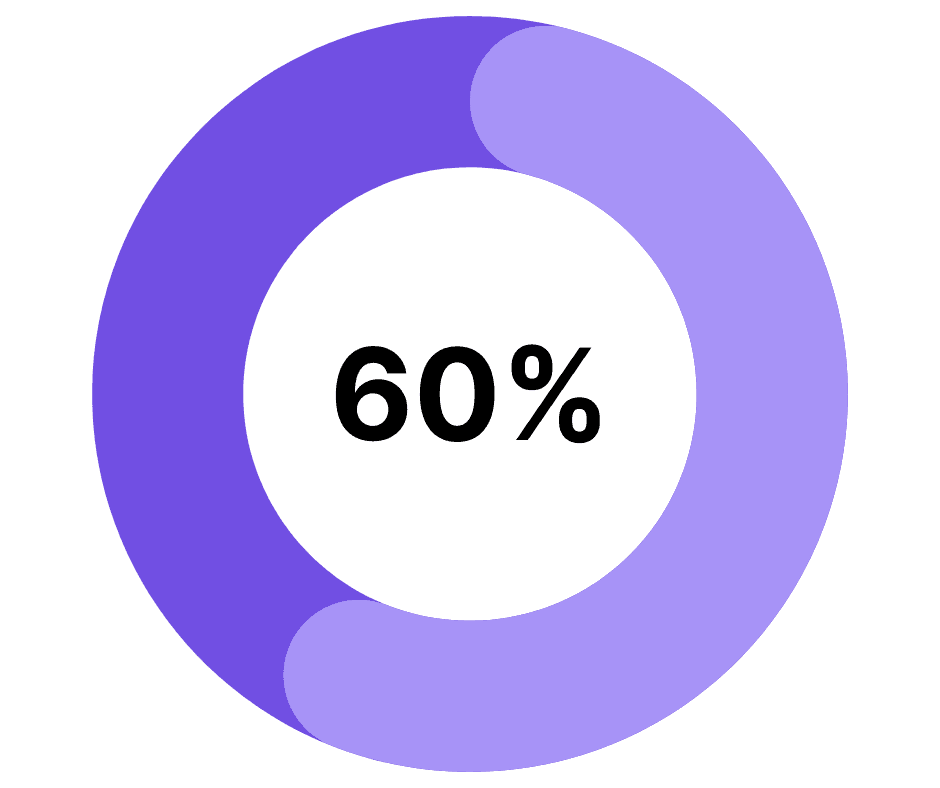

60% of SaaS businesses face delays due to tax complexity. VAT, sales tax, and digital taxes can be a barrier to global expansion. With constantly changing regulations, compliance mistakes can be costly.

PwC’s Global Reframing Tax Survey, 2025

Our key services

- Indirect Tax Strategy & Compliance – We work closely with your team to develop tax strategies that align with your global business model. From registration to reporting, we ensure seamless compliance in every market you operate in.

- Cross-Border Tax Advisory – Our experts guide you through international tax regulations, ensuring you meet the specific requirements of every jurisdiction, whether it’s VAT, sales tax, or digital taxes.

- Audit Prevention & Risk Mitigation – We proactively identify potential tax risks and implement strategies to mitigate them. In cases of past discrepancies, we assist with corrective measures, helping you avoid penalties and costly audits as you scale.

- Ongoing Tax Filing Support – From VAT filings to sales tax reports, our team ensures you meet deadlines and handle the complexities of taxes across multiple countries, without adding strain to your internal resources.

How it works

Tailored Tax Strategy

We begin by assessing your business and understanding your global tax needs. Then, we craft a customized tax strategy to meet your goals and ensure compliance worldwide.

Registration & Filing

Our team handles all your tax registrations and filings, ensuring timely compliance with local tax laws, from VAT to digital sales tax, in every market you sell in.

Monitoring & Support

We continuously monitor tax changes, deadlines, and provide proactive support to mitigate risks, keeping your business compliant and ready for growth.

Why choose us?

Worldwide Coverage

We proudly provide compliance services for VAT, sales tax, and other indirect taxes in 100+ jurisdictions worldwide. With a highly efficient tracking system for filing deadlines, our expert team ensures seamless compliance across markets. We’re continually expanding our global tax compliance services reach.

Compliance Partners

We’ve built a strong network of partners and tax consultants globally to manage local requirements with transparency and efficiency. In many regions, we collaborate with local tax agents to ensure seamless compliance with VAT, sales tax, and other indirect tax obligations for cross-border suppliers.

Reliable Monitoring System

Our Reporting team brings extensive expertise in VAT, sales tax, and indirect tax return services, ensuring your business stays compliant. We provide timely notifications about filing deadlines and tax changes, helping you avoid regulatory breaches.

Certified Experts

Our team consists of more than 40 experts who provide a wide range of services and are certified members of IVA, AITC, and VAT Forum. With over 800 clients, we have deep knowledge of how VAT, sales tax, and other indirect taxes work in 100+ locations.

Client feedback

1stopVAT has been an important partner in supporting NordSecurity’s global growth by offering tailored VAT solutions. They understood our VAT needs from the start and provided the perfect solutions at every step. Whether it was helping us expand into new areas or ensuring we stayed compliant across the board, their quick and expert assistance has been crucial for our continued growth. We are happy to have a partner in our global expansion efforts.

Frequently asked questions

What are indirect taxes for digital products, and how do they apply to my business?

Indirect taxes, such as VAT, sales tax, and digital taxes, are applied to the sale of goods or services, including digital products like software, online subscriptions, e-books, or digital media. These taxes vary by country, and as a digital business, you need to comply with the tax laws in each market you sell to.

How do digital products differ from physical goods when it comes to tax compliance?

Unlike physical goods, digital products are subject to digital sales taxes in many countries. This means that digital goods can be taxed differently depending on the country of the consumer. For example, the EU has specific VAT rules for digital products, and countries like the US have sales tax rates that vary by state. Navigating these different rules can be complex, but 1stopVAT helps you stay compliant across borders.

Do I need to register for tax in every country where I sell digital products?

Yes, digital products are often subject to local tax regulations, which may require registration in each country or region where your business meets certain sales thresholds. 1stopVAT helps assess your sales volume and determine where registration is required, ensuring that you stay compliant without missing any important filing deadlines.

How does 1stopVAT keep my digital product business compliant with evolving tax laws?

Tax laws for digital products are constantly evolving. Countries are frequently updating rules for online sales, digital subscriptions, and software services. 1stopVAT keeps your business informed of the latest tax regulations, ensuring your business stays compliant in all relevant markets so you can focus on growing your product rather than managing complex tax requirements.

How can indirect taxes impact my pricing and profitability?

Indirect taxes like VAT and digital sales taxes can affect your pricing strategy, as you may need to charge different tax rates in various regions. This can also impact your profit margins. 1stopVAT ensures your pricing remains competitive by handling tax calculations and making sure you stay compliant with the appropriate tax rates for each market.

Start your consultation today

Is your SaaS business ready to scale internationally with ease? Let 1stopVAT simplify your tax compliance so you can focus on growth.

Request a free consultation

Security

Data privacy and compliance

Your data stays safe with us. We use top security to protect your information, so you can focus on what matters.