The introduction of the simplified triangulation concept for VAT purposes under the EU VAT Directive simplifies compliance and trade within the EU. The possibility of adhering to and benefiting from this simplified reporting mechanism allows EU-taxable persons to reduce their compliance burden significantly.

Logically, the precisely designed requirements should be met to leverage the simplified triangulation reporting and invoicing mechanism for VAT purposes. Let’s dive into a practical, concise, and well-rounded explanatory guide.

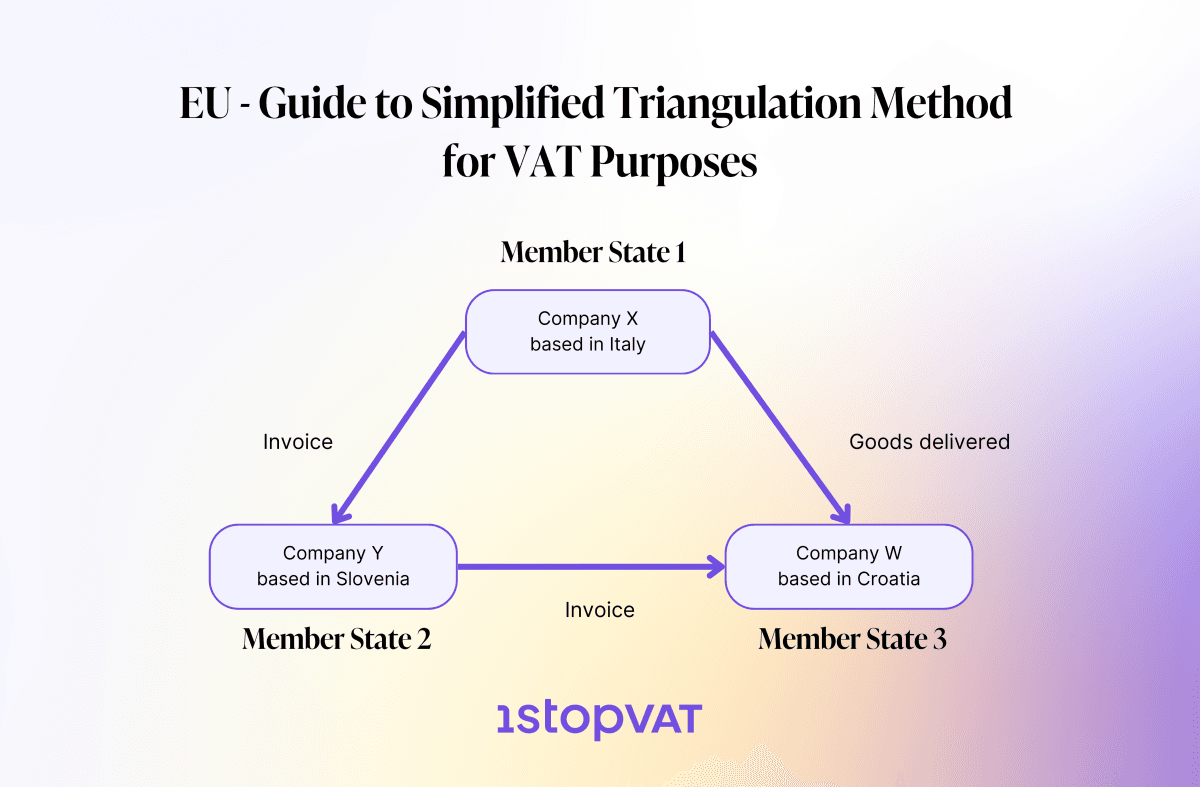

In this supply chain transactions scenario, two EU VAT-registered taxable persons consecutively supply the same goods. Those goods are transported directly from the first supplier in one Member State to the end customer(third party) in the other Member State.

So, to put it more plainly, in the EU VAT triangular transaction, we have three EU VAT-registered taxable persons whose places of business are in different EU countries. The goods are directly transported from the first supplier to the end customer(taxable person based in the third MS).

If the second supplier(intermediary) in this transaction chain can leverage the simplified triangulation in the MS of destination(MS of the end customer), it doesn’t need to register for VAT in the destination country. Without the possibility of adhering to this simplified reporting procedure, the intermediary will need to register for destination country VAT to be able to report intra-community acquisition in that country via ESL report and to make a subsequent domestic supply to the end customer.

Suppose the second supplier(intermediary) can use the simplified triangulation method for VAT purposes and choose to do so.

In that case, we have(following the picture) the following flow of transactions:

- There is a zero-rated supply intra-community supply from Company X based in Italy to Company Y based in Slovenia

- Company Y is making a VAT-exempt supply to Company W based in Croatia

Reporting and Invoicing obligations:

- For the first zero-rate supply, Company X issues an invoice to Company Y(intermediary) 1.1. Company X reports this transaction as an intra-EU supply in domestic return, and its ESL report

- Company X reports this transaction as an intra-EU supply in domestic return, and its ESL report

- Company Y issues a VAT-exempt invoice to Company W for the simplified triangular intra-EU supply under the reverse charge mechanism.

- Company Y reports this transaction into the ESL report as the simplified triangular intra-EU supply to the end customer in the MS of identification

- End customer(taxable person in Croatia) accounts for this transaction and reports it in this local VAT return on the self-billing basis, as the domestic supply on the reverse-charge mechanism basis.

Aleksandar Delic

1stopVAT Senior Indirect Tax Researcher (Global Content)