The European Union E-Commerce package introduced many significant changes to electronic commerce transactions. One of those novelties was the introduction of the deemed supplier provision.

The deemed supplier provision was introduced to enhance VAT compliance within the e-commerce sector. It transfers the VAT liability from the supplier/seller to the taxable person, facilitating the supply of goods via the digital marketplace.

So, based on these provisions, the facilitator – the taxable connector between the supplier and customer- is held as the liable person from the VAT perspective.

From the moment the amendment of the EU VAT Directive became effective for specific types of supply of goods and under mandated requirements, the VAT liability should be transferred from the underlying supplier to the digital marketplace.

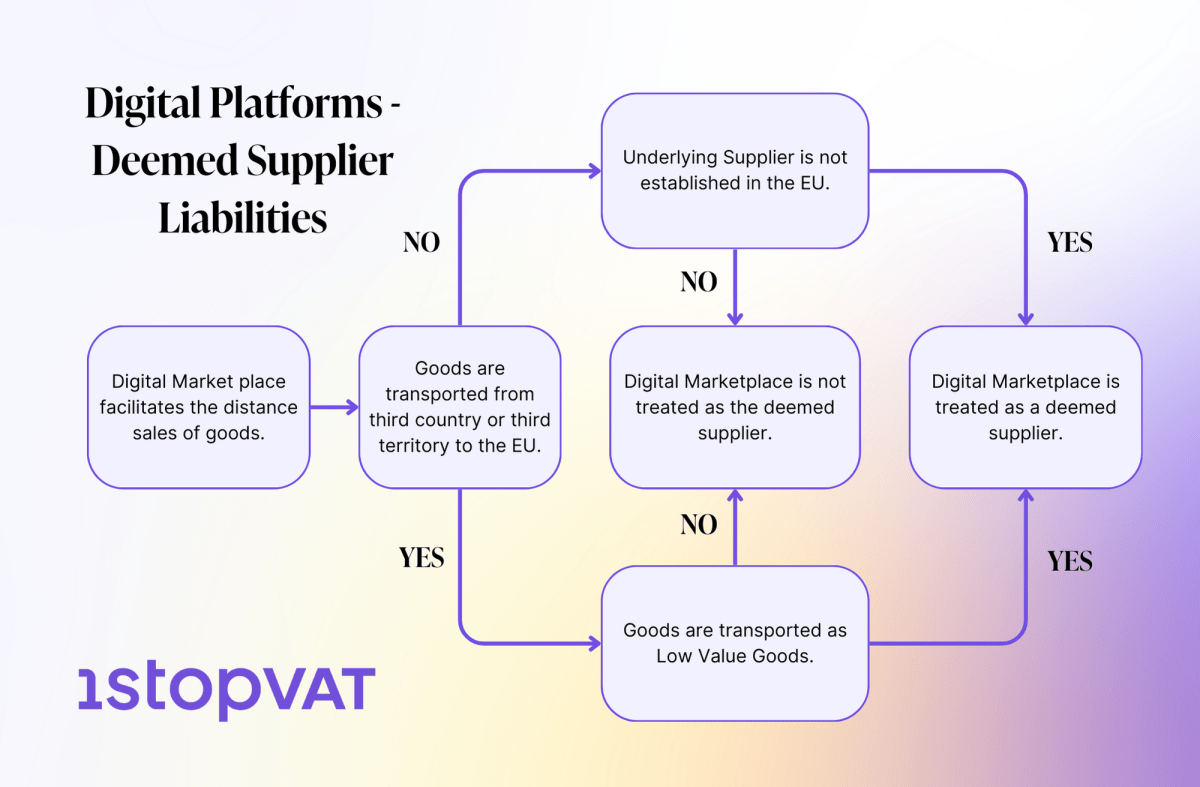

The digital marketplace is treated as a deemed supplier for the following types of supplies where mandatory conditions are met:

- Distance sales of Low-value goods(goods in consignment with the intrinsic value of less than EUR 150) imported from third countries or third territories by the underlying supplier(EU/non-EU established);

- Domestic and intra-community distance supply of goods where the underlying supplier is non-EU established, no matter the value of goods.

The E-commerce package is applicable from July 1, 2021 onwards.